Asset protection

Marc Faber says the World Economy Grinding to a Halt and strongly advises to not Trade With Leverage. Still people are buying stocks with no earnings. They aren’t buying value, they are buying because stocks are expected to move higher. In other words, “a Mania”

…also from Marc: Trump will soon be begging the Fed for QE4

In yesterday’s alert we emphasized that the breakdown in the USD Index should not be trusted as it was not confirmed and there were several good reasons to think that it would not be confirmed. The breakdown is already invalidated and – again, as discussed yesterday – this is actually a strong bullish sign. Is the decline in the USD Index over and is the big slide in the precious metals sector just around the corner?

In short, that seems quite likely. Naturally, there’s much more to the precious metals market than just the USD Index and it’s prudent to analyze more factors than just this specific index. In other words, it is of utmost importance especially at this time, but there are many other important signs to keep in mind. Still, let’s start today’s analysis with the U.S. currency (charts courtesy of http://stockcharts.com).

In yesterday’s alert, we commented on the above chart in the following way:

Today’s move to 99 is a small breakdown below the previous lows. Because the move is relatively small and the session in the U.S. is far from being over, it is definitely not confirmed. In fact, it could be quickly erased and the supposedly bearish event could turn into an invalidation of the breakdown, which would be a very bullish sign. For now, today’s move is not something that changes the short-term outlook.

Based on the above chart, the USD Index reversed and closed the session at 98.97 – there reversal is visible, but the breakdown was not really invalidated. However, if we take the closing price from Bloomberg – 99.166, we see that the USD Index closed extremely close to its February low (99.19). Still, no invalidation of the breakdown, but we now see that the breakdown was indeed very tiny. How much does it matter as of this moment? At this moment, the USD Index is trading at 99.21, having earlier moved to 99.347. This means that however one chooses to interpret yesterday’s breakdown or the daily reversal, the breakdown was still invalidated today and the bullish implications are in place anyway.

Additionally, if we focus on daily closing prices alone, then one can argue that there was actually no breakdown at all – the USD Index closed above the declining support line based on the daily closing prices (marked in blue). Either way, the implications of yesterday’s session are not bearish, but bullish.

The RSI indicator has just flashed / is about to flash a major buy signal as it moved to the 30 level. It didn’t move below it, but its proximity seems to be enough to be viewed as a buying opportunity. As you can see on the above chart, the last time when we saw this signal, the USD Index formed a major bottom in early May 2016. This signal also corresponded to a few local bottoms earlier that year.

The outlook for the USD Index is bullish, which has bearish implications for the precious metals market, especially that the latter is responding to the USD’s signals with much smaller strength than one might expect – the USD Index is well below its February monthly close, while gold and silver are relatively close to their own respective February closes. The USD Index’s long-term outlook and its implications for precious metals are even more important than the short-term one and our recent alerts include details. Having said that, let’s move to gold.

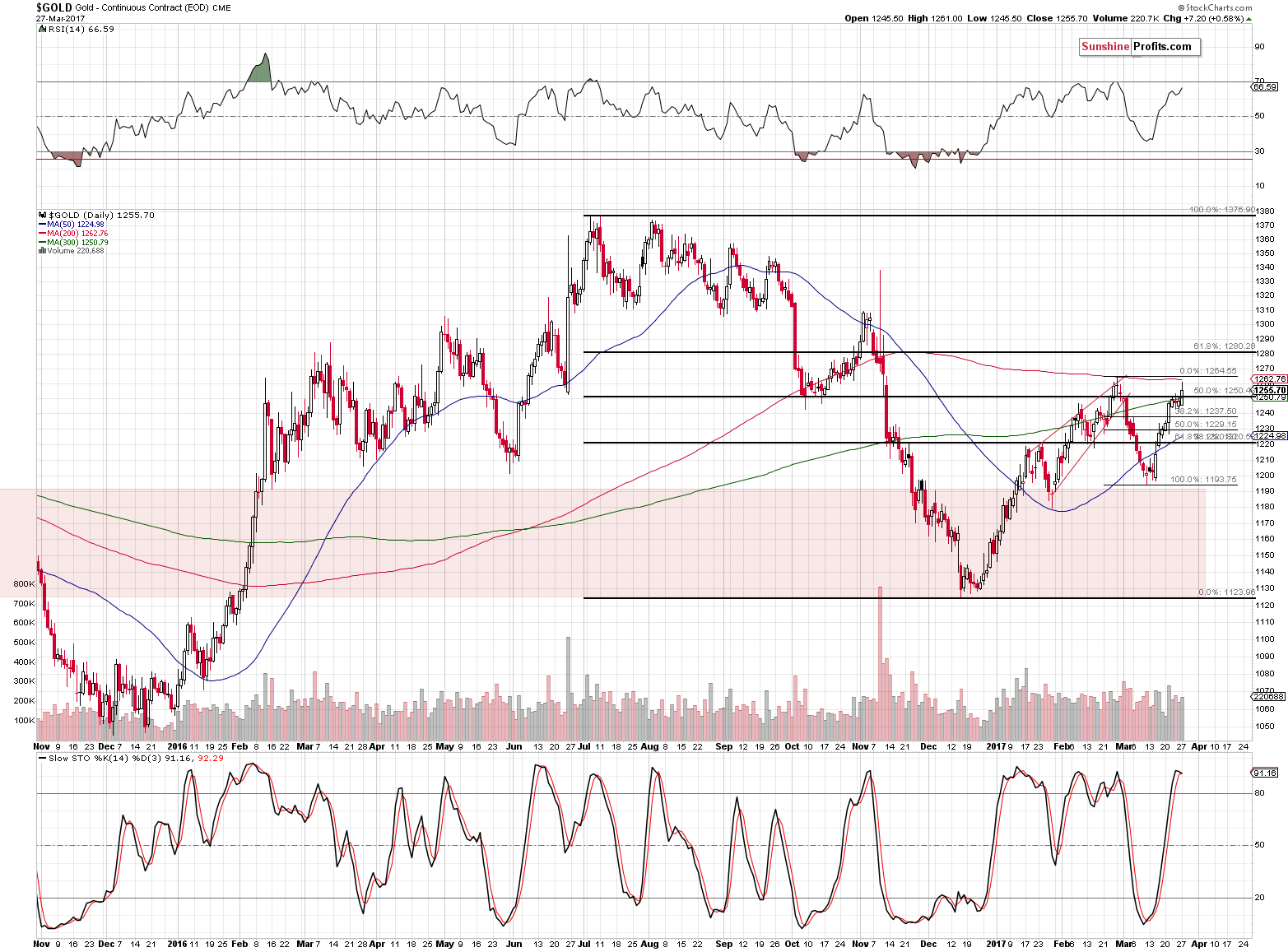

Just as the USD Index reversed yesterday, before the end of the session, gold did the same thing. As we discussed yesterday, gold moved to its February high and the 200-day moving average. Both are strong resistance levels and their combination is even stronger. Will it be enough to stop gold’s rally? It’s quite likely, especially that the volume on which gold moved higher on Friday was relatively low and this move was accompanied by silver’s outperformance (the white metal tends to outperform in the final parts of an upswing).

Gold’s volume that we saw yesterday wasn’t low, but that’s not what’s expected during reversals and thus it’s not necessarily a bullish phenomenon. Gold touched, but didn’t break the mentioned combination of resistance levels and – given the situation in the USD Index and also other factors – it’s not likely to break it or confirm such a breakout. There is a small sell signal from the Stochastic indicator, but it’s not one of the most important signals.

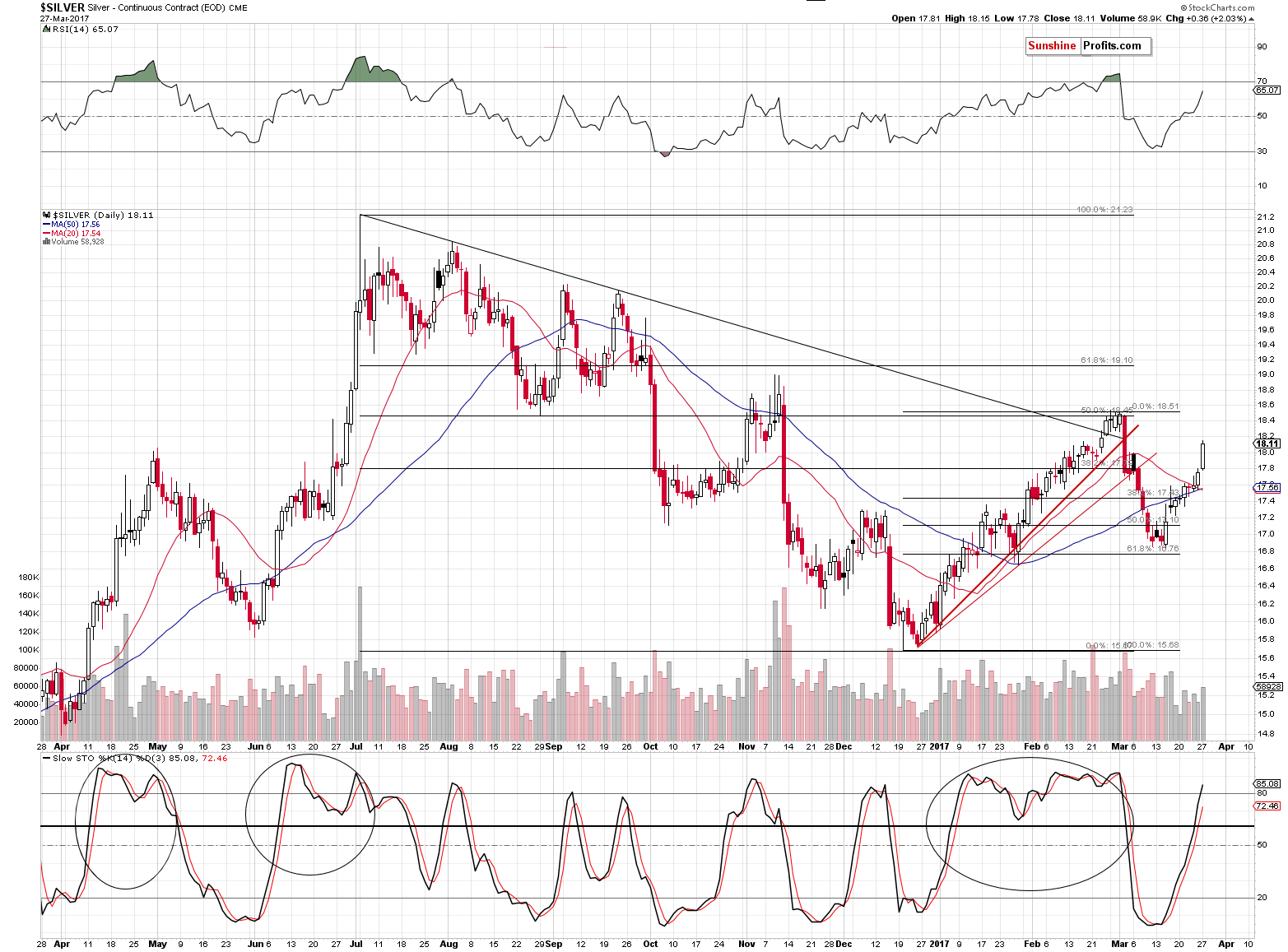

The mentioned outperformance of the white metal is.

In the past years, there were numerous times when silver faked a rally, breakout or even outperformed just on an intra-day basis right before turning south. Why is this the case? There is no way to say with 100% certainty why a given move has really happened, but it’s quite likely related to the fact that the silver market is much smaller than the one for gold and thus the share of individual investors compared to the share of big, institutional (professional) investors is much bigger.

One of the lesser known gold trading tips is that the general public is usually most eager to buy close to tops and thus we see that silver (to a bigger extent driven by these investors) outperforms gold right before tops. This is not always the case and doesn’t have to be the case, but it very often is – often enough to view silver’s outperformance (especially when accompanied by mining stocks’ underperformance) as something important and bearish.

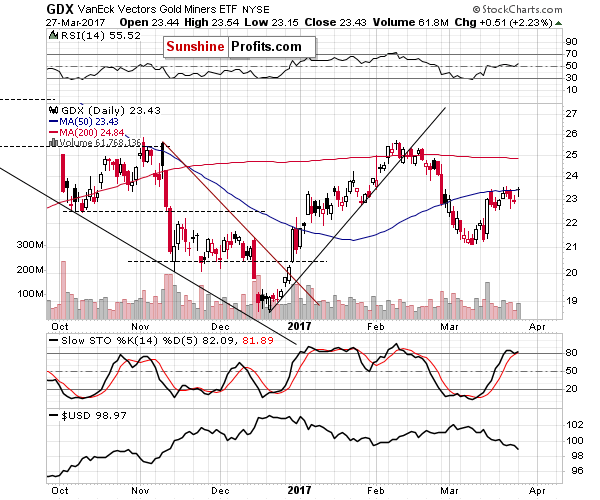

Speaking of mining stocks’ underperformance, let’s take a look at the GDX.

Mining stocks are not following gold higher. GDX closed at its 50-day moving average, unable to generate a visible rally even though gold and silver moved visibly higher. Miners simply moved to last week’s high – not above it. Moreover, please note that mining stocks are not even close to their February highs, which proves that their underperformance is not only a one-day event.

Summing up, the move to the February high in gold might highlight this rally’s end just as the USD’s temporary breakdown below 99 and its invalidation could mark the end of the decline in the U.S. dollar. Moving back to the title of today’s alert, please note that we have a strong bullish case for the USD in the short term, gold reaching strong resistance levels and its underperformance relative to the signals from the USD Index, silver’s visible short-term outperformance and general underperformance of the mining stocks sector (both short-term and medium-term). The buy signal from the RSI indicator (in case of the USD Index) and sell signal from Stochastic in gold supplement the already-bearish picture. Still, it is not the multitude of short-term signals that’s most important – it is the long-term outlook for the USD Index and the critical moment in it. If you enjoyed reading our analysis, we encourage you to subscribe to our daily Gold & Silver Trading Alerts.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

When interest rates climb, investors should pay closer attention to the sectors they own

When interest rates climb, investors should pay closer attention to the sectors they own

Think of investment sectors as neighbourhoods. If you own the best house in the worst neighbourhood, the market will assign a discount on your home’s value. Own the worst house in the best neighbourhood and you’ll enjoy a premium valuation. That’s how Barometer Capital describes its approach to investing, and investors may want to follow suit, especially if your portfolio lives in the financial district.

“The vast majority of your return comes from being in the right sector,” says Diana Avigdor, vice-president head of trading and portfolio manager at Barometer Capital, a Toronto-based wealth management firm. With interest rates climbing in the U.S. this is an important time for investors to make sure they understand which neighbourhoods they’re in.

The current rise in rates in the U.S. Is more about a normalization, after a lot of intervention to boost the economy. It’s not about an expected surge in inflation. Regardless….

…relatedL

Two Trends That Will Force The Fed To Start Buying Stocks

“Reader, I wish thee Health, Wealth, Happiness, And may kind Heaven thy Year’s Industry bless.“

– Ben Franklin

I originally thought it would be an easy task to write this week’s article since I only had to come up with one thing; the single most important lesson I learned in my 30 years in business. However, I soon learned how hard a task that really was, as there are so many important lessons I have learned during my own journey.

I originally thought it would be an easy task to write this week’s article since I only had to come up with one thing; the single most important lesson I learned in my 30 years in business. However, I soon learned how hard a task that really was, as there are so many important lessons I have learned during my own journey.

I know that persistence, the unwavering dedication to a task, is critical in achieving anything of note. Character development is key to building the traits necessary to persevere. Education, both formal and informal, is absolutely paramount in building a foundation from which all other skills can be developed. Communications, which is the one most important skill that helped me build a great career in business. All of those are worthy candidates for the most important lesson learned.

However, none of them can come close to what I believe is the single most important lesson I learned; that is the importance of making COURAGE in making decisions and taking actions. If I am 100% truthful with myself, the only times I really massively excelled in my career was when I ventured far outside my comfort zone. It was the time I was most frightened, anixous and filled with fear about the outcome of a venture, but pressed ahead against the obstacles anyways. For instance, I quit a high paying job as a young manager one time when newly married with a child along the way, only to get recruited within one week to a much, much better position. I turned down the recruiters first offer, even though I had given up our apartment and was living in my inlaws basement suite, only to get a much better offer. Another time, I took my first executive job with 50% of the salary paid in shares wondering if I would make it, only to have the shares accelerate significantly in value. Most times I pushed the envelope of my personal appetite for fear, I seem to come out ahead. Not always, but more often than not. It was courage that made the difference.

While business has many known and proven rules, it is the bold action-taking the separates the winners from the losers, or from the mere survivors. Taking bold action requires faith in yourself that you will overcome any difficulty, that you are bigger than your problems, that you have powers beyond the natural, and finally, that if you do fail temporarily, you will come back stronger than every. Courage is not being reckless since it still requires planning, risk mitigation and the application of proven business principles. However, there comes a time when all the planning is done, the risks are mitigated and you know the principles are sound, the only thing left to do is act. The bolder the action the bigger the courage required!

Step out of your comfort zone and start taking the action necessary today to make a bigger difference in your life. Seize opportunities around you, don’t hold back and wait for circumstances to be just right. Focus on whatever resources you have in front of you now and build the type of life, business and wealth you know you can build and would be proud to accomplish.

By Eamonn Percy http://www.percygroup.ca