Personal Finance

It’s been roughly 20 months since borrowing costs were slashed drastically at the onset of the COVID-19 pandemic, but a newly released poll is providing fresh evidence that Canadians are still binging on cheap money.

According to the latest MNP Consumer Debt Index, 58 per cent of Canadians are likely to take on more consumer debt before the end of the year. And the insolvency firm is concerned about the “riskier ways” consumers may pile it on.

Among survey respondents who intend to increase their debt load, 37 per cent said their credit card is already carrying a balance. Twenty-two per cent are planning to use Buy Now Pay Later options, which, according to MNP, have increased in popularity during the pandemic. Another 22 per cent of respondents are looking at purchase finance options. Fifteen per cent said they are likely to apply for a new credit card, while nine per cent said they are considering a pay day loan…read more.

Major stock indices drop to 10-week lows – then bounce

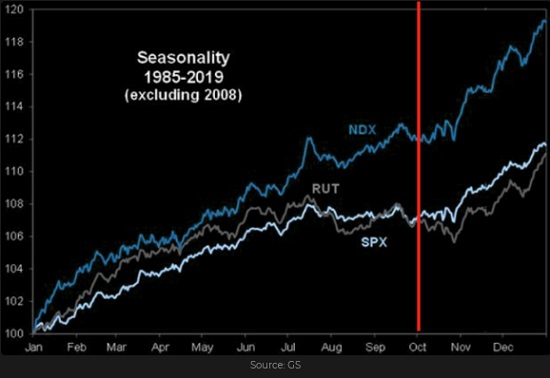

The most significant broad market decline since Biden’s election (S+P and DJIA down ~6%, Nasdaq 100 down ~7.5%) happened right on schedule. For the previous 35 years, September (especially the 2nd half) has typically been the weakest month of the year – followed by the best quarterly returns in Q4. Is the Merck covid pill kicking off another strong fall rally?

A sharp fall in bond prices accelerated the late September weakness in stocks

Bond yields spiked higher after the Fed signalled that they would soon begin tapering their $120 billion a month QE program. With Central Banks around the world likely to reduce their respective QE programs (totalling ~$300 billion a month), who will buy bonds? Is “persistent” rather than “transitory” the new CB watch-word for inflation?

Stalled stimulus programs in dysfunctional DC add to bearish stock market sentiment

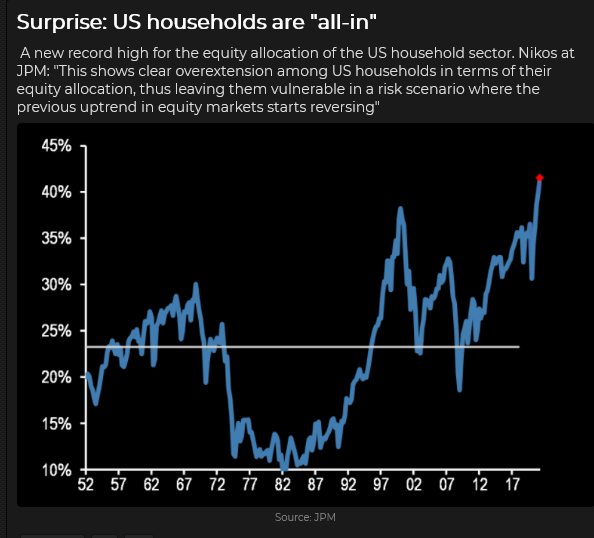

Massive QE and massive government stimulus were the two significant drivers behind the 100% stock market rally off the 2020 lows. With Biden struggling to unite Democrats (let alone soliciting Republicans) to support his key proposals, it looks like much less-than-expected stimulus will be coming from DC. As Joe Manchin (Democratic Senator from W. Virginia) says, “We’ve spent more than $5-Trillion since March 2020. How much is enough?”

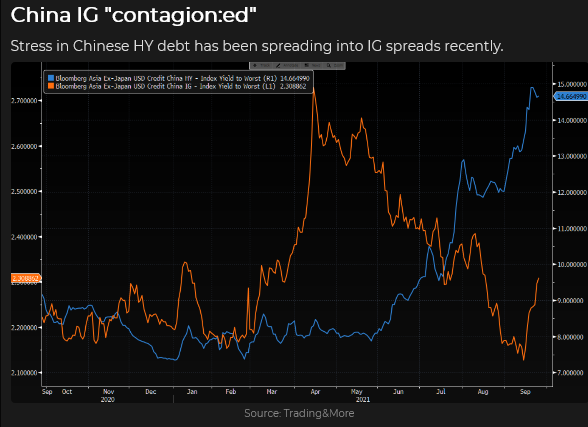

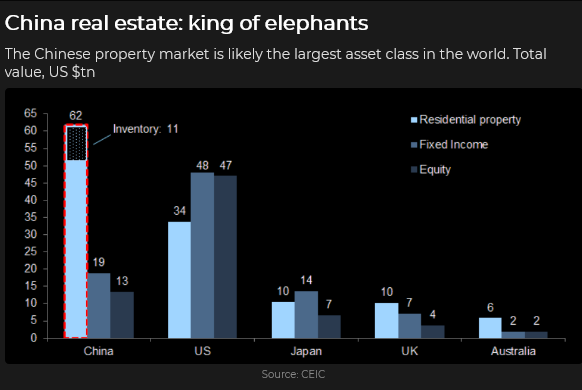

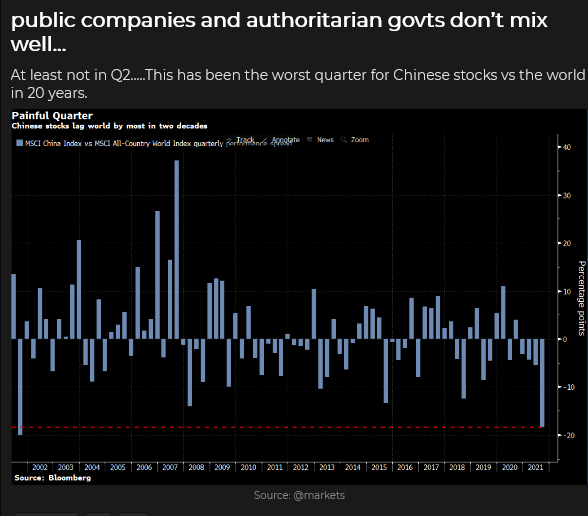

Dramatic changes in Chinese government policies have added to bearish stock market sentiment

Under the banner of “Common prosperity for all,” Xi Jinping is reshaping the social order in China and (please forgive my cynicism) ensuring his position as the Great Leader. Tech shares have tumbled, property shares have wobbled, but the government seems intent on policy compliance.

Widespread energy shortages in China are dampening economic growth to the point where the government this week ordered energy providers to “secure supplies at all costs.”

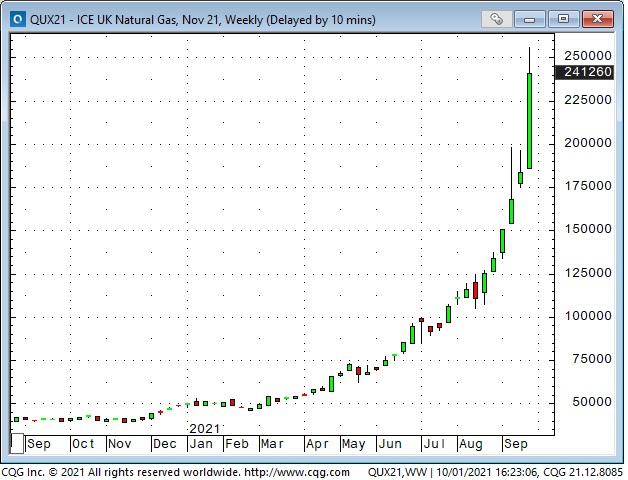

Transitioning to Green Energy will be bumpy

Nat Gas prices in the UK and Europe have been soaring. Inventories are low ahead of the upcoming winter heating season. Electricity prices across Europe are at record highs.

New York Nat gas registered the highest monthly close in September since November 2008.

The uranium ETF traded at a 7-year high.

Brent crude traded above $80 for the first time in three years.

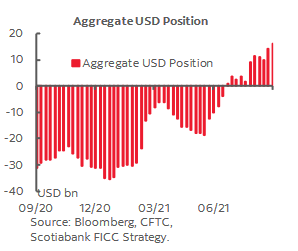

The US Dollar ended September at a 15-month high

I’ve (generally) been bullish on the USD since its “inflection point” the first week of January when the mob stormed the Capitol Building. The USD has rallied ~6% since those January lows and is now near the mid-point of its 20-year trading range.

The USD has been trending higher in September as the stock market has been falling. These are two sides of the same risk-off coin.

Over the past 12 weeks, speculators have gone from (marginally) net short the USD to long ~$16Billlion as of Sept 28. This is the largest spec net long position since the Covid panic of Feb/March 2020.

The broad commodity indices have had a great run from last year’s lows

The leading commodity indices hit 20-year lows in April 2020 following a brutal bear market from the 2011 highs. Since last year’s lows, the energy sector has been the best performing sector, but all sectors have had a substantial advance driven by supply/demand imbalances.

The Goldman Sacs broad commodity index (with a heavy energy weighting) is up ~160% from last year’s lows, while the CRB Index is up ~120%.

My short term trading

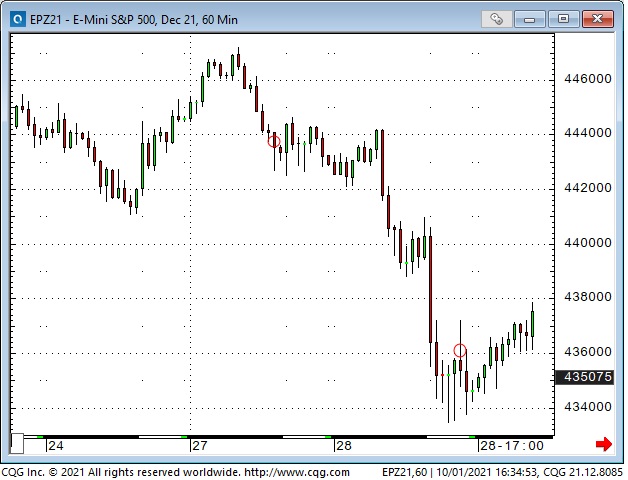

I started this week flat. Last week, in the On My Radar section, I wrote that I thought the bounce in the stock indices might have been “reflexive” and that if the rally rolled over, “I would be looking for opportunities to short stock indices, buy the USD, and I might even buy bonds!“

The S+P initially traded higher Sunday night but rolled over such that the Monday day session opened slightly lower than Friday’s strong close. I shorted the market at 4432 (circled) during the Monday day session with a stop just above Friday’s high. The market fell overnight and tumbled hard on the opening of the Tuesday day session. With little follow-through to the weak opening, I covered my short at 4355 (circled) for a gain of ~80 points.

I did not buy the USD, and I did not buy bonds.

On Monday, I bought 74 cent strike long-dated Australian Dollar calls with the AUD trading near 73 cents. The AUD trade was counter to the bearish thinking that got me short of the S+P, so I saw it as a bit of a hedge. The AUD calls had much less net risk than the S+P futures, so I was heavy “net” risk-off.

Since early summer, speculators have been aggressively building their net bearish AUD position and are currently holding a record-sized short position. My thinking was that if the AUD rallied above 7325-50 (without first taking out the August lows) that some of those spec shorts might start to cover their positions and drive AUD higher.

Note the low pivot point (circled) on August 19. That date was a Key Turn Date for several markets, including an interim high for the USD. Early September, the next circled date, was a temporary low for the USD and a high for the S+P. For the past few months, the AUD has traded in line with the S+P and opposite to the USD.

The long AUD calls were my only position at the end of the week, and they were slightly underwater. My P+L was up ~0.8% on the week.

My trading was subdued this week because I knew I would be away from my desk and unable to monitor markets for about 14 hours mid-week. My wife and I visited a small remote town to pick a puppy from a newborn litter. Barney will come to live with us in mid-November after spending eight weeks with his mother. Photo below.

On my radar

As noted above, Q4 has typically been the strongest quarter of the year for the major stock market indices for the past 35 years. After making new lows, the strong rebound on Friday may be the start of another leg in the rally. I may be a buyer if the strength continues into next week.

Biden will have to soon decide about re-appointing Powell. If he does not re-appoint Powell, then the next Fed Chair will be even more dovish, which will not be good news for the USD but will be good news for gold. The stock market will probably embrace an even more dovish Fed Chair.

The drama around the energy markets “feels” overdone, short-term, but is probably only a taste of the difficulties that will be encountered during the multi-year government-inspired transition from fossil fuels to green energy.

The surge in the commodity indices also “feels” overdone, short-term. The supply-chain dislocations and shortages are undoubtedly real, but, as always, the question is, “How much is in the price?”

Thoughts on trading

For the past 20 years or so I’ve jotted down brief notes or quotes about trading in a special notebook. The Denise Shull quote that I used in last week’s Notes is the latest entry in my notebook.

I’ve probably got enough “material” in my notebook to write a book, so I’ll start sharing some of those nuggets in this space every week. The point in doing that will be to inspire my readers to think twice about some of the ideas – and maybe they will be better traders as a result. So here we go:

“Wall Street’s job is to sell people things they should not buy. Like “short volatility.” Michael Lewitt – the Credit Strategist – February 2018

“Volatility will remain low as long as interest rates remain low. I can’t argue with that.” JMP Clarke 2018 (Jim and I had been discussing how option vol was lower than it otherwise would be – because so many people were selling vol to “earn income” in a low-interest rate, reaching-for-yield world. We agreed that few of those people had any idea of their risk exposure.)

“Nobody gets paid for originality – you get paid for making money.” Christan Siva-Jothy – Prop Trader – Inside the House of Money 2005

“Every day, I assume every position I have is wrong.” PT Jones Market Wizards 1989

“When a market is going down, you have no idea how far down is.” Dennis Gartman, 1990’s

“I’ve never thought in terms of beating a benchmark. If I used a benchmark, and I was down, but not as much as my benchmark, I would not see that as a “win.” I know most money managers use benchmarks, but, for me, Absolute Returns are the only real measure of performance.” Victor Adair, 2005

“Nobody ever thanks you for not taking a holiday.” Peter Appleby 2008

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

Immigration to Canada is improving from pandemic lows, but it’s still weak. A BMO economics analysis shows the net flow of non-permanent residents was minimal in Q2 2021. It’s better than the beginning of the pandemic when the flows were negative, but not by much. The bank sees this as a big contributor to the rising job vacancies, and will potentially force wages to rise to attract domestic labor.

Canada Is Seeing A Lot Fewer Non-Permanent Residents

Canada’s inflow of non-permanent residents is still much lower than normal. During the beginning of the pandemic, there were net outflows, but those have since reversed. Positive flows are better than contractions, but they’re still fairly close to nil, especially in contrast to pre-2020 numbers.

The lack of non-permanent residents has put a major drag on the labor supply. “This is likely adding to the labor shortage situation in Canada, as it appears difficult to pull domestic labor into jobs normally filled by foreign workers. Or it might take more significant wage increases to do so,” said BMO.

El Salvador has mined 0.00599179 bitcoin, or about $269, with power harnessed from a volcano.

President Nayib Bukele – who has banked his political future on a nationwide bitcoin experiment – tweeted early Friday morning that this is the country’s maiden voyage into volcano-powered bitcoin mining.

On Tuesday, the president posted a flashy 25-second teaser video, which includes shots of a government-branded shipping container full of bitcoin mining rigs, technicians installing and plugging in ASIC miners, as well as sweeping landscape aerials of an energy factory in the thick of a forest, bordering a volcano.

The video, which has since gone viral with more than 2.3 million views, is captioned simply with “First steps…”

If the Central American country is, indeed, minting new coin, it will mean that Bukele has made good on a promise first announced in June, when he said that he had instructed state-owned geothermal electric company, LaGeo SA de CV to “put up a plan to offer facilities for #Bitcoin mining with very cheap, 100% clean, 100% renewable, 0 emissions energy from our volcanos.”…read more.

Affirm Holdings Inc. is joining the ranks of fintech companies vying for “super-app” status as the company plans a series of feature introductions that will broaden its platform beyond buy-now pay-later capabilities.

Fintech companies in the U.S. are increasingly trying to follow in the footsteps of Chinese players like Alipay, combining payments with a host of other financial features in so-called super-apps. PayPal Holdings Inc. has been vocal about its super-app ambitions, and Square Inc. has also been looking to beef up its Cash App mobile wallet with a deal for Affirm-rival Afterpay Ltd.

Through an investor presentation late Tuesday, Affirm AFRM outlined similar aims as it rolled through a series of feature enhancements in the works. Chief Executive Max Levchin said Affirm has nearly 1 million people on the waitlist for its debit card that will make it easier for people to split in-store payments into installments, and the company sees opportunity to add other functions to the card over time.

The company is also piloting a cash-back program that will offer rewards to customers, and it’s planning a crypto product that will let people own digital assets in Affirm savings account. The Affirm super-app will combine the “best of Affirm’s commerce, payments and financial services,” Levchin said in the presentation…read more.