Real Estate

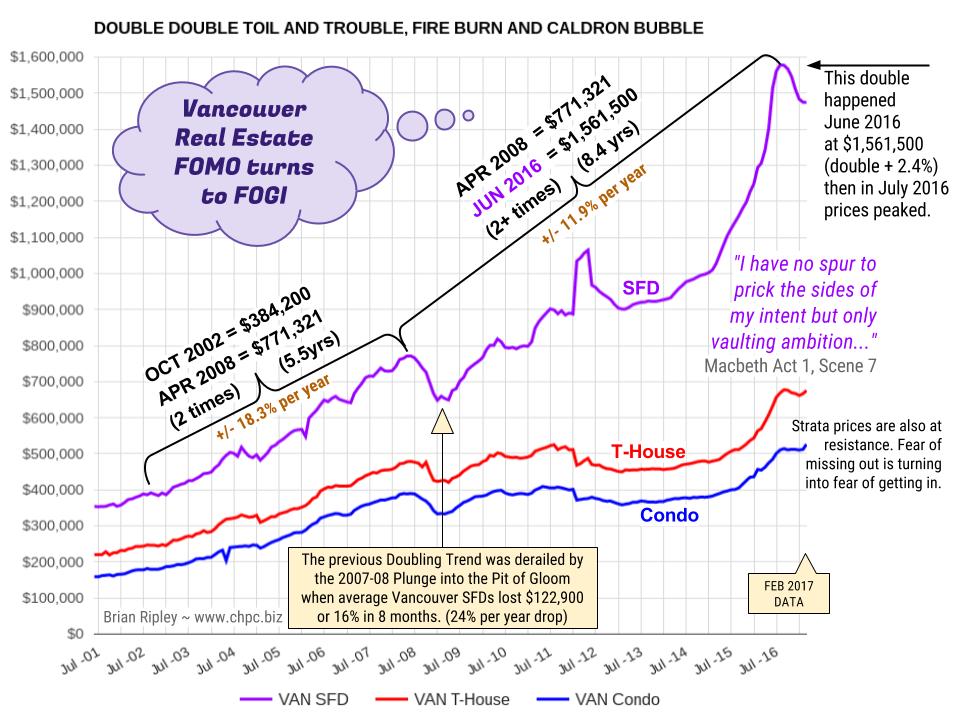

The chart shows the bulls in charge prior to the 2007-2008 plunge that took the average Vancouver SFD price down $122,900, or 15.9% in 8 months (24% per year drop). The crash derailed the exponential doubling trend but after reignition prices doubled again in June of 2016 at $1,542,642 + $18,858. The next double was scheduled for around December 2021, but it is now unlikely that buyers are as fearful of missing out as they were in 1H 2016.

…also:

In February 2017, Vancouver detached house prices added very little drama to the slump from the July peak under the heavy weight of sentiment change and sales that are 53% below their March 2016 peak. The manic detached buying spree moved prices up 21.5% per year since the JAN 2013 low. Prices now are deflating at 11.4% since the peak in July 2016.

A Los Angeles spec house is on the market. It has seven bedrooms and 20,000 square feet of living space.

A Los Angeles spec house is on the market. It has seven bedrooms and 20,000 square feet of living space.

It comes with a gold Lamborghini Aventador and a gold Rolls-Royce Dawn.

You also get a wine cellar, a pool, and the usual claptrap amenities to which rich people are easy prey.

The price? A hundred million dollars.

Oh, and it comes with some of Damien Hirst’s oeuvres, considered by some to be “art.”

The builder says he has another one under construction in Bel-Air that he plans to offer for $500 million.

Bombastic Extravagance

What do we make of this?

Who knows? But you don’t get this kind of bombastic extravagance at the bottom of a boom/bust cycle. You get it at the top.

The risk of a crash and/or recession has been with us for years. But it seems to be intensifying.

Real estate indexes show prices back to their 2006 all-time highs. House flipping, too, is almost back where it was at the peak, with about 6% of sales attributed to flippers compared to about 7% in 2006.

For old commercial space, the picture is darkening fast. Bloomberg:

A tidal wave of store closures is about to hit the U.S., and the result could be catastrophic for hundreds of lower-tier shopping malls.

J.C. Penney announced Friday that it would close up to 140 stores in the next couple months.

That follows decisions by Macy’s and Sears to close a collective 218 stores in the first half of the year. Other mall-based stores including American Apparel, The Limited, Bebe, BCBG, and Payless have also recently announced that they are shutting down all or most of their stores.

Or take a look at the CAPE ratio for the S&P 500. It looks at stock prices relative to the average of the past 10 years of inflation-adjusted earnings to “smooth out” year-to-year fluctuations in earnings.

By this measure, stocks have only been more expensive in 1929, 1999, and 2007 – all before major crashes.

There is particular extravagance in the tech market, where Fortune magazine counted 175 “unicorns” – unproven new companies said to be worth more than $1 billion – in 2016.

One of them is appropriately named Farfetch. It is a London-based website hosting, well, clothes.

According to The Economist, “Farfetch emphasises its bricks and mortar boutique roots,” allowing independent retailers to “keep their identity, while boosting their position in the market.”

It has never earned a dime…

Bad Outlook

Meanwhile… S&P 500 profits have been going down for the last five consecutive quarters and are now lower than they were four years ago.

And the outlook is bad. Whatever gains might be anticipated by lower business taxes will almost surely be overshadowed by higher labor costs and squeezed margins.

In some industries – like agriculture and construction – undocumented immigrants do more than 10% of the work.

Farmers will be especially hard hit. Their exports will be trimmed by a stronger dollar and retaliatory trade barriers. And their costs will rise as the lowest-cost labor disappears.

The number of hours worked is going down, too. So are real wages.

Half of Americans are already living paycheck to paycheck. With smaller paychecks, they will have to cut back spending fast.

Auto loan delinquencies are higher than they’ve been since 2008. Used car prices are 10% below their level three years ago.

New car sales are stalled. Dealers have increased discounts by more than 20% in the last year.

Desperation Sign

Another sign of desperation: People with bad credit are signing up for more credit cards. This from the Fed:

Nearly half of all card closures in 2010 and 2011 belonged to borrowers with credit scores of 660 and below [with anything below 660 raising red flags], although they comprise only 33% of card borrowers. Reversing the sharp net decline in the number of credit cards during 2008-10… in recent years, the level of new card issuance to this group has been strong and is now approaching pre-recession levels.

And for the first time in 10 years, Federal Housing Administration mortgage delinquencies are rising.

Student debt passed the $1.3 trillion mark.

Consumer bankruptcies rose last month.

The trade deficit is back to 2008 levels.

And finally, inflation is rising. Officially, it is 2.5% for the last 12 months. Other measures put it much higher. Remember, the whole system depends on low interest rates… which depend on low inflation rates.

Panic? Not yet. But here at the Diary, this is Crash Awareness Week.

Regards,

Bill

….also the latest: Ozzie Jurock’s Hot Properties

This year will prove decisive for the eurozone. Between March and September, the Netherlands, France, and Germany will hold general elections whose outcomes will help determine the future of Europe’s common currency. Italy, too, may hold a vote by the end of the year. In light of the uncertainty that awaits, the eurozone’s major players are making moves to brace themselves for whatever the future brings.

This year will prove decisive for the eurozone. Between March and September, the Netherlands, France, and Germany will hold general elections whose outcomes will help determine the future of Europe’s common currency. Italy, too, may hold a vote by the end of the year. In light of the uncertainty that awaits, the eurozone’s major players are making moves to brace themselves for whatever the future brings.

…continue reading this fascinating Strafor analysis HERE

…related from Michael Campbell:

T he rumors are flying in France and the conservative candidate Fillon denounces a probe now into corruption. Fillon now vows to fight on to the end – not good for he has placed himself above the country making this personal. His top aide just resigned and Fillon was summoned to appear before investigators on March 15 to be placed under formal investigation over allegations that he paid his wife hundreds of thousands of euros of public money to do very little work if any at all.

he rumors are flying in France and the conservative candidate Fillon denounces a probe now into corruption. Fillon now vows to fight on to the end – not good for he has placed himself above the country making this personal. His top aide just resigned and Fillon was summoned to appear before investigators on March 15 to be placed under formal investigation over allegations that he paid his wife hundreds of thousands of euros of public money to do very little work if any at all.

This corruption scandal of career politicians in France is opening the door for Le Pen and now we have France, Netherlands, Spain, Italy, and Greece all moving toward exiting the EU. With the ECB holding 40% of the national debts of the Eurozone countries, it looks like the Euro is on borrowed time. The outcome is simply inevitable.

This corruption scandal of career politicians in France is opening the door for Le Pen and now we have France, Netherlands, Spain, Italy, and Greece all moving toward exiting the EU. With the ECB holding 40% of the national debts of the Eurozone countries, it looks like the Euro is on borrowed time. The outcome is simply inevitable.

This European crisis is pushing up the Dow and capital flows from smart money is starting to vacate Europe headed into the Dow for that is where “big money” always hides. Of course, domestically, they are attributing this as always to just local issues now praising Trump’s speech as optimistic. Trump’s speech was widely praised for its positive tone outside of mainstream media, which is increasingly becoming irrelevant in the real world.

Meanwhile, if gold closes above 1242 today, it can also rally again, but it avoided the Monthly Bullish Reversal so it is still showing there is inherent risk just yet.

With seemingly everyone from the blogosphere to the Tweeter-in-chief chiming in on fake news, have investors considered their risk/return profile may also be “fake”? When it comes to investing, who or what can we trust, is the market rigged, and why does it matter?

For eight years in a row now, an investment in the S&P 500 has yielded positive returns.1 In recent years, expressions like “investors buy the dips” and “low volatility” have become associated with this rally.

In the “old days”, investors used to construct portfolios that, at least in theory, provided a risk/return profile that they were comfortable with. For better or worse, I allege those “old days” are over. To be prepared for what’s ahead, let’s debunk some myths.

The system is rigged

For those that say the system is rigged, I concur. In my assessment, central banks are largely responsible for a compression of “risk premia.” All else equal, quantitative easing and its variants around the globe have made assets from equities to bonds appear less risky than they are. This is at the very core of central banks efforts to entice investors to take risks, as risk taking is key to making an economy grow. In practice, central banks have foremost pushed up financial assets, but have largely disappointed in generating real investments. As a result, those holding financial assets have disproportionally benefited.

Hidden risks: liquidity

When I look at market risks, I feel like investors are in ‘la la land,’ ignoring the moonlight. Pardon the pun, I believe investors completely underappreciate hidden risks in the markets, notably the risk of liquidity evaporating. In today’s ETF driven world, to make ETFs track underlying indices, there are so-called market makers providing liquidity. Exchanges are providing incentives to these market makers; ever look at those exchange fees on your trade ticket? The exchange pays market makers from these fees for each share they buy or sell (ranging from fractions of a cent to multiple cents); such a “rebate” gives market makers a better price than you can possibly get, so they can cost effectively hedge their own risk, thus incentivizing them to provide liquidity. Each ETF has a so-called lead market maker that, by arrangement, gets a better deal than the other market makers. Through that, all the other market makers know they can always offload their risk to the lead market maker. Everyone is happy, including the investor. Except when the lead market maker has a glitch. Suddenly, just about everyone withdraws liquidity because something appears wrong. In addition, Dodd Frank discourages traditional market makers to provide liquidity. Flash crashes can then occur when investors place market orders in the wrong belief that the system will take care of them. As a result, in our opinion, the current design of the system makes the periodic flash crash a near certainty.

Risk is merely masked

In the past, I have compared central bank efforts to suppress risk akin to putting a lid on a pressure cooker. It should come as no surprise that taking the lid off might cause a spike a volatility, e.g., a taper tantrum. In the meantime, while the European Central Bank (ECB) and Bank of Japan (BoJ) are still ‘printing money’, the Fed is trying to raise rates.

Investors desperate for insurance?

We talk to a lot of investors who go along for the ride as the market is rising, but are rather concerned the party could come to an end. Instead of rebalancing their portfolios or taking chips off the table, however, they are looking for ways to have their cake and eat it too by buying insurance. One way to buy insurance on equities is to buy put options on equities. Another is to buy volatility, i.e. take a speculative position that volatility in the market is going to rise. Through ETFs, such strategies are available to retail investors. It turns out that buying insurance can be very expensive (at times more than 10% a month in case of buying volatility), making this not a prudent long-term investment. As with anything else in this analysis, we are observing what we see in the market, we not making an investment recommendation.

Selling volatility: a risky proposition?

It wouldn’t be Wall Street, if there weren’t investors on the other side of the trade of those trying to buy insurance: selling volatility has become a very fashionable trade. The idea is that so long as volatility stays low, one collects the equivalent of an insurance premium; when volatility surges, one loses money, those writing insurance might believe that those surges and associated losses are always temporary (buy the dips, remember!); over the medium term, so the logic goes, such a strategy promises to be profitable. To be clear: we do not recommend investors pursue this strategy even as such strategies have become increasingly popular. Amongst others, a single mutual fund pursuing a strategy building on that concept had amassed over four billion in assets. After all, what could possibly go wrong? What has gone wrong is that a few weeks ago, the fund experienced substantial loses in the absence of a surge in volatility. What appears to have happened is that a too-good-to-be-true strategy became victim of its own success. In our analysis, the fund encountered a particular constellation where their derivatives position was inherently difficult to manage, with difficulties exacerbated because of their size. Differently said, they were cornered. More than a few investors appear to have concluded that they didn’t sign up for the risks that materialized and have withdrawn their investments.

Market melt-up?

Above, we discuss a mutual fund being cornered. While the fund management brushed off that they would impact the market as a whole, our internal analysis suggests otherwise. As the fund is liquidating its position, the net effect on the market that we have observed is upward pressure on equities and downward pressure on volatility (this is due to how market makers hedge their books as they mitigate their own risk of helping the fund to unwind its position). While one can observe the stress in the market in characteristics of specific options, the casual observer might think everything is normal. The management of the fund indicated its troubles are over, but as of this writing, our assessment suggests they continue to be cornered as they liquidate positions to cater to redemptions. It isn’t just one mutual fund that tried to harvest carry from low volatility, we have seen the growth of an entire cottage industry. There’s a host of other strategies, including some of the so-called risk-parity strategies, that could similarly create market distortions if and when unwound. We believe it is plausible that much of the upward pressure in equity markets on the backdrop of low volatility may well be due to the unwinding of some of these strategies.

Fed being fooled?

If much of the feel-good-rally in the markets is due to internal market technicalities, is it possible that the Fed is being fooled? We have long argued that the Fed will raise rates if the market allows it to, meaning that they would love to have higher rates, but are most concerned about causing asset prices to deflate. That’s because we believe much of the recovery since the financial crisis has been based on asset price inflation. Moreover, we believe the Fed wants to avoid putting the economy into recession at just about any cost as they don’t want to revert to 0% interest rates and quantitative easing. They are emboldened by an economy that appears to be humming along, a market that appears robust and thinking that if they induce inflation, well, that’s a problem they know how to fight.

If, however, asset prices floating higher is actually an expression of stress due to exotic strategies being unwound, the Fed might well be emboldened to hike rates more aggressively.

Market crash?

The logical next question is whether investors are being fooled. If higher asset prices are more due to a short-squeeze than fundamentals, and if on top of that, the Fed is more aggressive, are we setting ourselves up for trouble? The stock market crash of 1987 comes to mind.

Does that mean investors should liquidate their positions? Does it mean investors should buy insurance? Regarding the latter, we’ve already pointed out that “insurance” might be very expensive. If you know the market is going to crash tomorrow, by all means, seek protection. That said, we have been cautious on the markets for some time and we have to be aware of the risk that our concern is misplaced.

Underperforming in bull markets

In my experience, investors swallow losing money in bear markets, but are furious if they don’t keep up with the averages during bull markets. When the smartest strategy is to buy the index, bright minds are leaving the industry. What you get is an obsession with indexing.

Beating the average is impossible

Not a week goes by that we aren’t told the merits of index based investing. The average active manager is failing to beat the index. Well, duh, that’s by definition: the average cannot beat the average once fees are included. But does that mean investors should stop thinking?

Buying the dips can be irresponsible

When markets are in a panic, the pundits tell us to buy the dips. As proof, they show the recovery we had from the market bottom in the financial crisis; or any other dip we have had since. With due respect, that too is the wrong way to look at the issue. Investors ought to invest according to how much risk they can stomach. If they had properly rebalanced, they would have taken chips off the table ahead of the financial crisis and then had the resources to deploy cash at the bottom. Yes, in that case, absolutely, buy when prices are cheap.

But that’s not how many portfolios look. Many investors go along for the ride during the good times, and are over-exposed to risk assets. They chase returns because they don’t have enough money to retire. Then, when the market plunges, they lose a great deal of their net worth. Are you telling me that the appropriate way to react in that situation is to double down and put a now disproportionally larger portion of your net worth at risk? If you cannot stomach the risk of an investment, stay away from it. When you lose money, you can afford to take less risk, not more risk. Any pundit suggesting otherwise is, in my opinion, irresponsible.

Don’t confuse indexing with lifestyle investing

If you are a pure index investor w.r.t. equities, you hold the S&P 500 Index and little else; unless you embrace a global view and invest pro-rata in global equities. Very few investors pursue that; instead, we have become what I call lifestyle investors: if you like green tech, you buy a green tech ETF. If you like biotech, you buy a biotech ETF. If you like,…, you get the picture. Sure, you aren’t picking stocks anymore, but you are picking winners and losers. Such a strategy may have worked quite beautifully in recent years because, well, because just about everything has gone up. As a result, if you work with a broker, he or she will have tailored your portfolio to what you feel good about. That’s fantastic, except if feeling good is all you are looking for, just take your kids to the ball game.

Fees matter

The one thing the indexing community has gotten right is that fees do matter. Again, this is math. If you pay less in fees, all else equal, your returns are higher if your fees are lower. As such, if you buy a popular market index through an ETF fees are very low. It’s not surprising that competitive market pressures have pushed prices lower. But it doesn’t mean investors should shy away from a more expensive product, if the segment it is in hasn’t been commoditized, i.e. when it provides value.

Robo-advisors do some good – and bad

In my assessment, the good news about robo advisors is that they have a rigid process to rebalance portfolios. I do not have a problem with anyone “buying the dips” if it is part of an otherwise comprehensive investment program. As I indicated earlier, I only have a problem with it if buying the dips is done for the wrong reasons, i.e. when it violates the risk tolerance of investors and when it is done in already lopsided portfolios.

What robo advisors can’t do is to fully assess the risk tolerance of investors when accounts are opened. I say that because I don’t think anyone or any machine can do that. Sure, we all fill in our risk tolerance when we open a brokerage account, but for most of us, these are abstract questions. We associate risk with upside risk, not downside risk. And let a portfolio really dive 25% or more, are you still comfortable with the risk tolerance parameters provided? This is a human weakness, but it doesn’t mean one can ignore it. I tell investors: if you get sleepless nights because of your investments, you are over-exposed. An investor should look at the most volatile periods and try to assess: would I really be comfortable holding x% of my portfolio in this security/fund if it went down as much as it did in 2008, or some other bad period? Such mind games are ever more difficult the further one is from the most recent crisis; with 2008 being far in the rear-view mirror, I allege there are millions of investors that have not properly assessed their own risk tolerance.

The bad of the early generation of robo advisors is that, in my view, they are too limited. They follow the most classic way of investing in stocks and bonds; that’s wonderful for normal times. But I question whether, after eight years of stock prices rising, we are in normal times. That said, because such model portfolios have done great, their sales argument is compelling.

In my humble opinion, investors may want to take advantage of the good while trying to mitigate the bad. That is, investors may want to have a rigorous investment process that includes rebalancing; they also should look at fees, although they should look at them in the context of what they are buying. If a robo advisor helps in terms of the “good” they may provide, great. However, so long as such investment strategies focus only on the basics, I would caution anyone not to deploy all their assets into such a strategy.

What shall investors do?

During extended bull markets, and the current market qualifies as such, I believe investors lose sight of what investing is all about. Call me old school, but I do not think investing is about chasing indices. Similarly, investing is not about lifestyle investing.

At any time, imagine what were to happen if markets were to crumble. How would you be able to pursue your investment goals?

If you have savings, you don’t need to chase investments; you can pursue your investment goals by looking for value; it’s okay not to participate in each and every market rally. If, however, you don’t have savings, you feel like you have to chase returns to catch up; in doing so, you are quite likely never to achieve your goals as you’ll invest at the top, then realize you are too exposed when prices tumble. In the opinion of yours truly, the irony is that even with modest savings, the more cautious approach should pay off more in the long run.

What do I do?

As a registered investment adviser myself, I am not allowed to give specific investment advice in a general analysis such as this one. But I can tell you that for myself: I seek to get my returns with as little equity risk as possible. My current view (which is subject to change at any moment) is that even as I believe equity prices are at risk of a severe correction, buying insurance is too costly given that I know as little about when the next bear market will come as anyone (I do have a hard time believing we’ll never have a bear market or financial crisis again). As such, I try to get my returns elsewhere. To the extent that I like specific equities, I hedge out equity risk (this is not an encouragement to use derivatives, as those come with their own set of risks that may not be suitable for many investors). Then, I look to generate return streams that are not correlated with equities. Those that have followed our work for some time know that I try to achieve at least some of that by investing in currencies and precious metals. Those are but two ways of trying to achieve uncorrelated returns.

We spend a lot of time on both macro and systematic work. While the heavy hand of policy intervention might be shifting from monetary to fiscal policy, I believe it is nonetheless important to gauge their impact on portfolios. With what I believe are distorted asset prices due to policy makers, we also spend a lot of time using other gauges, such as shifting risk sentiment in the markets.

The short of it is that there are many ways I believe one can weather the storm that may lie ahead in the markets. However, what may have been one of the more profitable approaches in recent years, namely to invest and forget, might be hazardous to your wealth in what’s ahead.

Please make sure you subscribe to our free Merk Insights, if you haven’t already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

Merk Investments, Manager of the Merk Funds

1 The S&P 500 return with dividends reinvested has been positive in each year since 2009. If dividends had not been reinvested, the return for 2015 would have been slightly negative. While one can generally not invest directly in an index, there are index funds tracking the S&P 500. Returns for investors are lower than those of the index because of fees charged by the index fund, as well as taxes that may be payable. Source for analysis: Bloomberg, Merk Investments LLC.

…also: