Wealth Building Strategies

You probably haven’t heard about precision medicine. That’s fine, it wasn’t even possible ten years ago.

But now we’re entering the new Gilded Age — and suddenly researchers are using it to fight many deadly diseases, including brain cancer in kids.

Scientists at Dana Farber, a Harvard-affiliated research group, and the Boston Children’s Blood Disorders and Cancer Center, recently sequenced tumor samples from 200 children with brain cancer, Forbes reported.

What they found was astounding: More than half the children exhibited genetic abnormalities that could influence how the disease was treated.

What they found was astounding: More than half the children exhibited genetic abnormalities that could influence how the disease was treated.

“The reason we did this trial was that brain tumors are a leading cause of death in children, and the treatments that we and everyone else use are decades old – radiation and chemo,” writes Pratiti Bandopadhayay, a pediatric neuro-oncologist at Dana-Farber/Boston Children’s in the medical journal Neuro-Oncology. “Our approach to try to improve on that is to target the individual tumors of each child.”

That’s the key. Precision medicine promises to change health sciences by using data analytics and what we know about ourselves to tailor personal therapies and treatments.

In this way, precision medicine is the perfect symbol of the New Gilded Age. It grew out of the awesome advances in cloud computing. It touched medicine and changed what researchers thought to be possible. Without that, neither genome sequencing nor bespoke drug discovery would be possible. Certainly it would not have been possible for doctors to dream about developing treatments based on the patient’s individual biology.

In theory, it all seems simple enough, even logical. Getting to this point has been a bit more complex.

It started with the sequencing of the human genome. At an initial cost of $3 billion and 13 long years of research, the outlay of monetary and human capital was extreme. Yet the project was bountiful. It allowed scientists to learn about illness at the cellular level, determine what precisely went wrong, and — at least in theory — determine a treatment for the mutation.

For example, most patients currently diagnosed with cancer undergo a battery of oncology tests and usually end up with chemotherapy. That one-size-fits-all treatment carpet bombs everything, killing good and bad cells indiscriminately.

Precision medicine is more of a smart bomb. Doctors locate the mutation at the cellular level, find the specific drug treatment to correct the abnormality. Then they calibrate the dosage based on personal genetics.

The theory is great, and there has been a lot of promising work. The only holdback is cost.

Sensor data from wearables like FitBit, smartwatches and phones will help, too. It will be true personalized medicine.

In January 2015, President Obama announced he would be adding $215 million to his annual budget for a comprehensive precision medicine plan. The National Institutes of Health will help build a 1 million volunteer sample group to draw more data; its National Cancer Institute will research the genomic drivers of cancer; the Food and Drug Administration will develop new testing techniques to expedite the drug approval process; and a consortium of privacy groups is being consulted to maintain strict privacy standards.

More recently, 21 Chinese hospitals reached an agreement to use IBM’s cognitive platform Watson for Oncology to help tailor personalized, precision medicine. Cancer is the leading cause of death in China. In 2015, more than 4.3 million people were diagnosed and 2.8 million died. Watson for Oncology draws data from 300 medical journals, 200 textbooks and more than 15 million pages of text and peer-reviewed work to make recommendations.

It also has a working relationship with the world renowned, Memorial Sloan Kettering Cancer Center in New York.

In 2013, the center made news when a breast cancer patient, who had been battling the disease for the better part of 30 years, made remarkable progress following an experimental precision medicine treatment developed by AstraZeneca.

Tumors, which had become visible on her skull and face, completely receded.

Pharmaceutical companies are gearing up. In 2015, Roche promised as much as $1 billion to Blueprint Medicines for five small molecule projects in development. Then, in January 2016, Roche announced it would spend more than $1 billion on a 56% stake in Foundation Medicine, a molecular and genomic diagnostic company. Illumina, another diagnostic service provider, has formed similar alliances with Germany’s Merck KGaA , AstraZeneca and Sanofi.

Each of us is unique, a product of our own chemistry and environmental factors. It makes sense to build healthcare treatments tailored to that uniqueness. Ultimately it could be less costly and more effective.

Until recently, it was impossible. Cloud-computing advances in the New Gilded Age are changing everything.

Best wishes,

Jon Markman – Pivotal Point Trader and Tech Trend Trader.

Conclusion: full article HERE

Conclusion: full article HERE

Lesson #1. Trade disruptions. Global trade and currency markets are heart muscles of the world economy with connecting tissues that extend to interest rates, bond markets, banking, insurance and more. If, for example, Trump initiatives reset trade patterns and exchange rates, you could see a cycle of global actions and reactions that includes some key features of the 1970s and 1980s.

Lesson #2. Powerful forces. Once that kind of megacycle is set into motion, it can continue for decades, and no one can stop it. Our colleague Larry Edelson says it’s the cycle itself that drives government policy, not the other way around. But disruptive policy changes from Washington can certainly play an important role in precipitating a major turn of events.

Lesson #3. Rising prices. One of those major turns could bring back inflation. It may start slowly and may take time to hit with full force. But any major changes that make foreign imports more expensive or weaken the U.S. dollar could be catalysts.

Lesson #4. Gold. Even without much inflation, gold is bound to be among the leading beneficiaries. I repeat: After the Nixon Shock, it surged from $43 to $850 per ounce. An equivalent rise from today’s gold price would take one ounce of the yellow metal to over $24,000. Certainly, no one is predicting anything that extreme. But it just goes to show the power behind the cycle that fueled — and was fueled by — the Nixon Shock.

….read the entire article HERE

1. Hang Onto Your Hat – Trump Rally Nowhere Near Over

1. Hang Onto Your Hat – Trump Rally Nowhere Near Over

Things are not good in Europe and investors there are flooding into the North American Stock Markets. Much higher numbers in the next 4-5 years. What about the Free Trade agreement with Europe?

2. Is the Gold Silver Ratio Predictive?

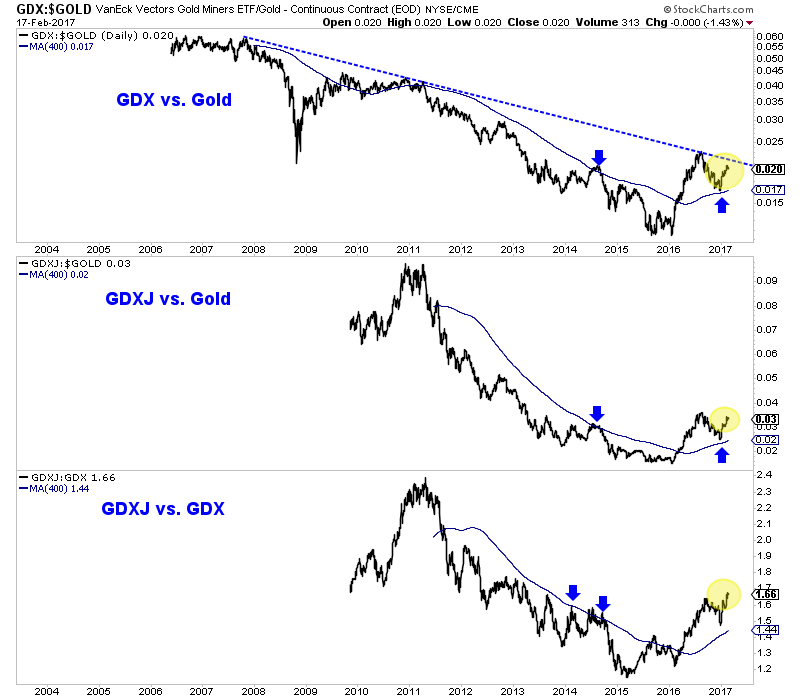

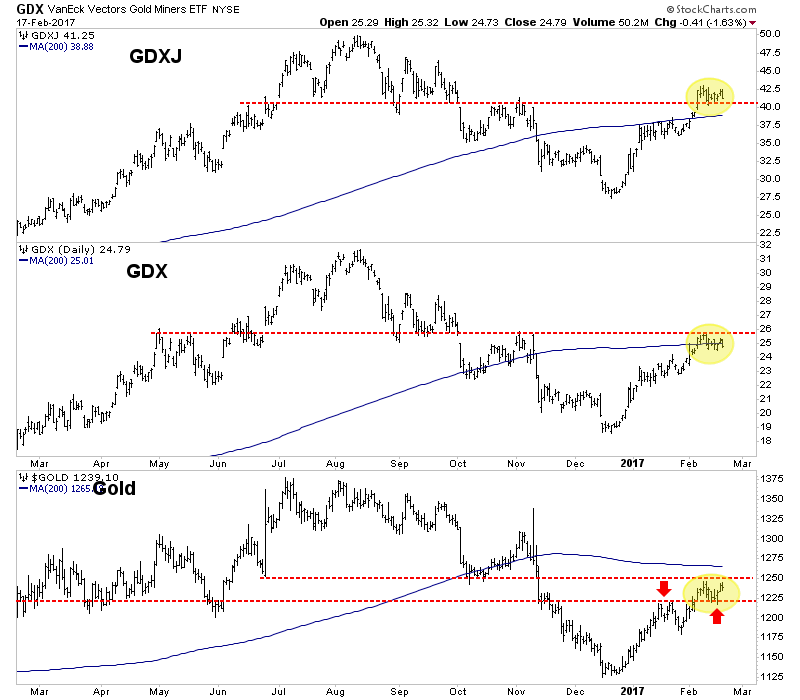

Precious metals bear markets always hit silver hard, while bull markets always see Silver outperform gold. As a result, the Gold Silver Ratio rises during bear markets and then falls during bull markets.

3. Is This What They Mean By “Crack-Up Boom”?

In the past year, stock prices have risen from “near-record, overvalued-by-every-historical-measure” levels, to “new-record, grossly-overvalued” levels – and show no signs of slowing down

It’s happening on cue: Over the last few days, some of the world’s most volatile nations are provoking the Trump administration big-time. Consider what’s happened …

Test #1. North Korea test-launched a new ballistic missile into the East Sea. The U.N. Security Council and Japanese Prime Minister Abe strongly condemned the act. President Trump says the U.S. has Japan’s back — but we both know that’s not going to deter North Korea’s military ambitions. It failed to stop the previous four launches.

What we know: North Korea is making great strides in advancing their nuclear arsenal, with a new mobile launching system and the use of solid (nuclear) fuel. The ultimate goal: Attacking the U.S. and its allies. This new arsenal is harder to detect and increases its range — both providing a greater threat to national security.

Test #2. Russia spy ship spotted cruising along the Eastern U.S. seaboard. The ship is armed with surface-to-air missiles and is used to intercept communications.

Test #3. Four Russian jets fly within 200 yards of U.S. Navy destroyer USS Porter in the Black Sea. Interestingly, the Russian jets had transponders off and unable to acknowledge multiple radio calls from the American warship.

Test #4. There were reports this week that Russia deployed a new type of nuclear cruise missile that’s in direct conflict with the 1987 Intermediate-Range Nuclear Forces Treaty with the U.S.

Just Coincidence?

Just Coincidence?

It’s interesting how all these events are developing like a carefully orchestrated mission – in line with my war cycle forecasts.

Perhaps that’s why U.S. Defense Chief “Mad dog” Mattis prodded NATO member countries to pony up more capital into the defense fund. In fact, he’s looked for 2% of their GDP.

Officials from Germany and the U.K. agree, seeing the writing on the wall: It’s going to cost more to defend Western values in a challenging global environment.

But that’s exactly what I’ve been warning about since debuting forecasts of my war cycle research in December 2013. I said back then that the world would experience an environment of rising domestic and international unrest until at least 2020.

And that’s coming true in spades.

This geo-political hotbed could cause all kinds of economic and financial repercussions that could strip you of your wealth in the months and years ahead OR present once-in-a-lifetime opportunities to protect you and yours.

But it all depends on the quality of your guidance — and your ability to think for yourself, especially in times like these.

I know which way I’m headed … and which way I’m taking my subscribers and members.

Do you?

Best wishes, Larry @ https://edelsonwave.com