Real Estate

The time and effort it takes to build up a real estate portfolio can test your will, but when you stick with it, the benefits are worthwhile.

The time and effort it takes to build up a real estate portfolio can test your will, but when you stick with it, the benefits are worthwhile.

Here is my list of the six benefits of investing in real estate:

1. The courage to walk away

….related: Canada 6-City Housing Prices Slide Off Their Highs

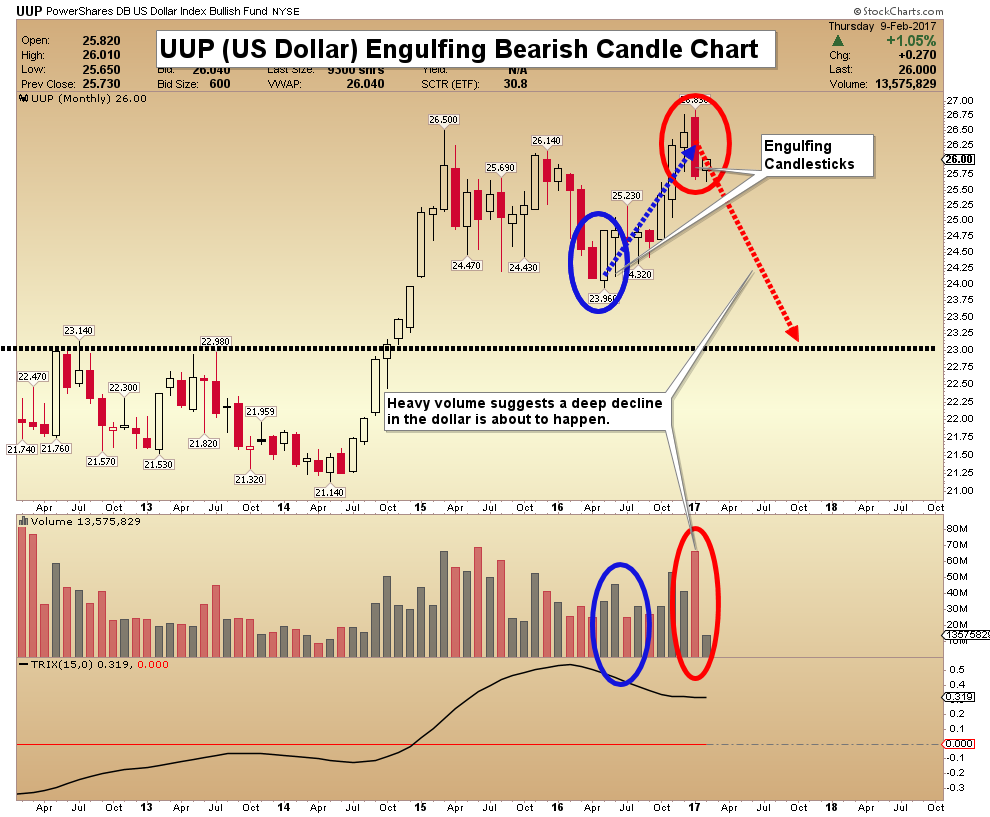

China has called all Bitcoin exchanges to a closed door meeting looking to shut down the flight of capital from China. China is looking to deal with the expected trade confrontation with Trump and looking to shut down the flow of capital that has been putting a downward pressure on their currency. We can see that the US dollar has risen for 35 months and this will be seen as a currency war by Trump for his advisers from Goldman Sachs are clueless assuming markets can simply be bullied or manipulated with power.

China has called all Bitcoin exchanges to a closed door meeting looking to shut down the flight of capital from China. China is looking to deal with the expected trade confrontation with Trump and looking to shut down the flow of capital that has been putting a downward pressure on their currency. We can see that the US dollar has risen for 35 months and this will be seen as a currency war by Trump for his advisers from Goldman Sachs are clueless assuming markets can simply be bullied or manipulated with power.

Our sources are also hinting China may tighten the quotas on importing gold even more since their actions last November (see FT). China is trying to curb the flight of capital which has contributed to the greenback’s rise for 35 months. However, with Europe tottering on the edge, the next country to withdraw from the EU may set off a collapse of the euro and that will only cause a surge higher yet in the dollar impacting China negatively with regard to trade disputes.

Yellen’s Last Hike and the Next Fed Chair

Yellen’s Last Hike and the Next Fed Chair

Janet Yellen, you’re fired!

For the past 20-30 years, the Federal Reserve has been dominated by academics largely out of MIT. Jim Bianco at Bianco Research says that’s all going to change under Trump, starting with Fed chair Janet Yellen.

Here’s what he recently told FS Insider:

Yellen’s Last Hike

“I’ve jokingly said that when it comes to the story with the Fed this year, it’s that the Fed will raise rates in June and then Janet Yellen will be fired by Trump right after that. Her term is up in January 2018. What we’ve learned about Trump is what he says he means and what he means he says, and he has said repeatedly during the campaign that he doesn’t like Janet Yellen, doesn’t think she’s done a good job. She’s done, she’s out. And she’s got another year to go…so that’s what I mean when I say the Fed will raise rates the middle of the year and then Trump will fire Yellen.”

….continue reading more of what Bianco has to say HERE

…related:

Wolf Richter: Central Banks Quietly Backing Out of Negative Interest Rate Policies (NIRP)

Despite the near record increase in U.S. oil inventories last week – an increase of 13.8 million barrels – oil prices traded up on February 8 and 9 as traders pinned their hopes on a surprise drawdown in gasoline stocks, which provided some evidence of stronger-than-expected demand.

Despite the near record increase in U.S. oil inventories last week – an increase of 13.8 million barrels – oil prices traded up on February 8 and 9 as traders pinned their hopes on a surprise drawdown in gasoline stocks, which provided some evidence of stronger-than-expected demand.