Personal Finance

Most readers of this column own (or plan to own) physical precious metals – gold and silver, perhaps even some platinum or palladium. They may also own mining stocks.

But which category is “best”? It’s like asking, “What’s the most efficient exercise?” or “What’s the best fishing lure?” Truth be known, it’s really about what you wish to accomplish! Here is my considered opinion…

Precious Metals Offer Insurance First – Profit Second

One should strongly consider holding physical precious metals for “investment first, profit potential second.”

The primary function of “metals in hand” is to help offset the possible loss of purchasing power that inflation or a changing business/regulatory climate might visit on a person’s other asset classes, such as the broad stock market, real estate, collectibles, and certainly, bonds.

“The One-Ring” – Gold and Silver

This last category appears to be ending a literal 30-year bull market, during which time interest rates declined (and bonds rose) to levels not seen in many decades.

This last category appears to be ending a literal 30-year bull market, during which time interest rates declined (and bonds rose) to levels not seen in many decades.

(A change in the secular trend, to rising interest rates, would have severe ramifications for the value of bonds, whether or not they are held to maturity.)

A side advantage, common in India but not discussed in this country, is that gold and silver can be easily be “pawned” when a person might not have other options for a loan. Just like any item left in the pawn shop owner’s care, precious metals can be redeemed when the loan has been paid off.

Indians have a much more nuanced – and relaxed – view about metals’ ownership. Outlookindia.com takes the pulse about how its citizens deal with the idea of buying gold and silver, noting, “If you bought gold today and its price falls tomorrow, you don’t say, oh, wish I had not bought gold, I lost money. You just look at your gold and say, I have got 200 grams of gold. That’s it.”

Mining Stocks Are Speculations

Mining stocks are an entirely different “investment animal.” You’re buying shares in companies who explore for and/or produce precious and base metals. Miners have many inherent risks to overcome, which the metal held in your hand, by virtue of having being refined, has already put behind it.

A miner’s profit can be adversely affected by all sorts of variables – operational factors like oil prices, the cost of labor, local community support or lack thereof, government regulations, and even nationalization (theft) of a company’s assets – which often takes place without compensation to the owners, let alone shareholders. A tailings dam collapse or accidental worker deaths can also affect the share price. Over the years, several such companies have seen theirs drop from multiple dollars each, to a fraction of that… or to zero.

Some companies bill themselves as “pure silver producers.” The “purest” of these usually produce a fair amount of base metals – lead, copper and zinc – which are added to the profit mix to yield “equivalent silver ounces.” Even the best known examples may list 30-40% of their annual production in this non-silver category. A geologic fact is that silver veins tend to “pinch and swell,” causing ore head grades, and hence the company’s share price, to unexpectedly rise or fall.

Some companies bill themselves as “pure silver producers.” The “purest” of these usually produce a fair amount of base metals – lead, copper and zinc – which are added to the profit mix to yield “equivalent silver ounces.” Even the best known examples may list 30-40% of their annual production in this non-silver category. A geologic fact is that silver veins tend to “pinch and swell,” causing ore head grades, and hence the company’s share price, to unexpectedly rise or fall.

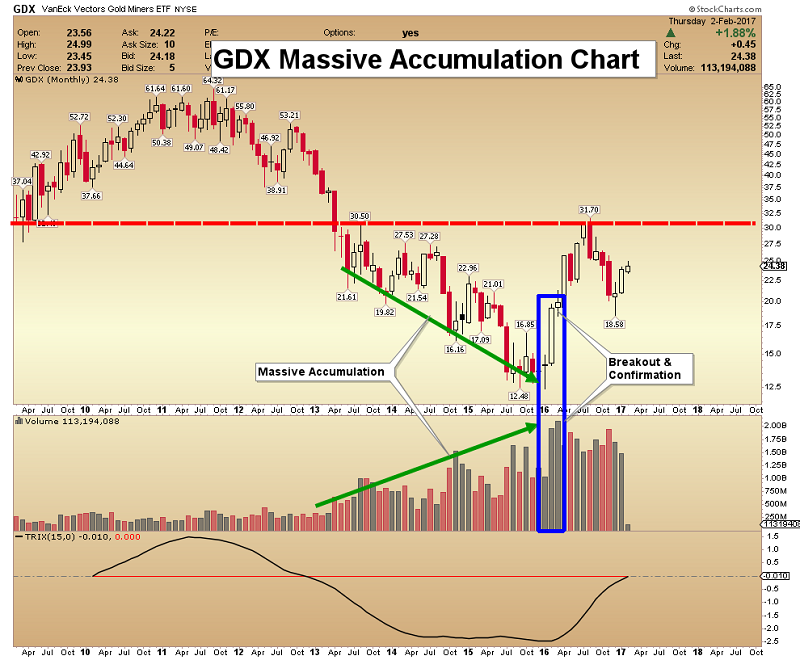

A big argument for holding mining stocks is that because of their increased risk profile, they can be expected to gain at a greater percentage rate – perhaps several times as much – as do gold and silver. For a number of miners in 2016, that was certainly the case. Yet several of the best ones on the board also declined over 50% during last fall’s inevitable correction to the strong uptrend… which you may have noticed was not the case with the price of the metals they produced.

For much of the last 20 years, during which time, precious metals rose by multiples of their early bull market price, mining stocks as a group actually underperformed. So what’s the point of taking on additional risk and doing considerably more work, just to find that you could have made a single metals’ buy-and-hold decision – which performed better with less downside?

You should also answer these fundamental questions before deciding whether or not to include miners and metals in your investment mix. What are your financial goals? How much risk are you willing to take? How much time can you spend on the “care and maintenance” of your “garden” of stocks?

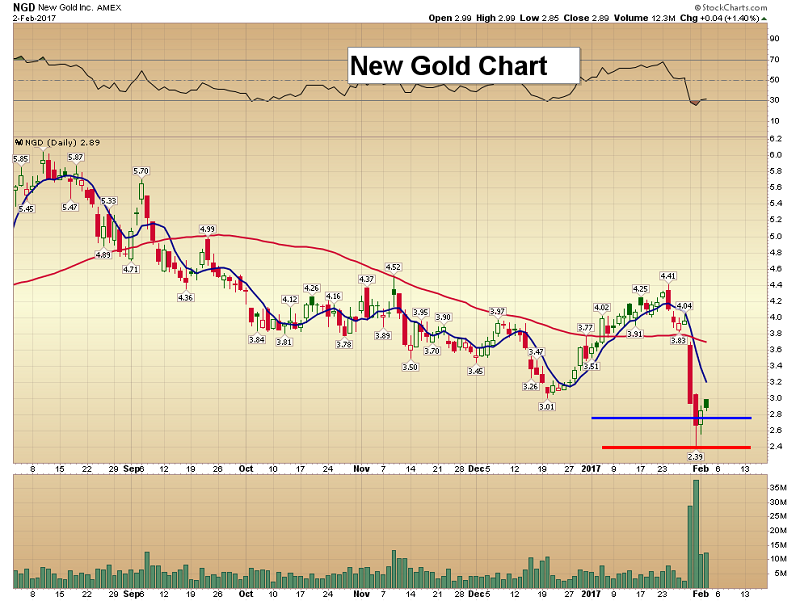

They can’t simply be purchased and placed in a drawer somewhere. Here are just a few of real-life, high-to-low ranges, stated in U.S. dollars, of share prices for several well-run, profitable miners during the cyclical bear market lasting from mid-2011 to late-2015 – $19 down to $7; $10.30 to $0.28; $43 to $5.38; $13 to $1; $36 fell to $3.30.

And did I mention that scores of other companies either reverse-split 20 (or 100):1… or simply went bankrupt?

BGMI index vs. Gold

Why I Hold Mining Stocks and Why, Perhaps, You Should Not

Trading the mining sector is quite literally a job. I write reports, take mining tours, read hundreds of articles and evaluations on scores of companies – and trade mining stocks. But that’s my choice. It’s great when shares are rising to the sky, as was the case this past January to August. But it was NOT great when the bottom fell out into December.

I am willing to put up with these swings for the possibility of a few home runs, while often settling for base hits, along with the occasional “strike-out.” Do you have the temperament, are you willing to put in the research, can you handle the risk, do you want to give up a lot of the time you could spend doing something else?

Perhaps you can answer “yes” to these questions. If not, or the questions aren’t relevant to what you’re trying to accomplish, then you should seriously consider keeping decision-making about the metals, relevant to your needs and goals.

David Smith is Senior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com. For the past 15 years he has investigated precious metals’ mines and exploration sites in Argentina, Chile, Mexico, Bolivia, China, Canada, and the U.S. He shares his resource sector observations with readers, the media, and North American investment conference attendees.

….related: Gold and Reflation

Here are today’s videos and charts (double-click to enlarge):

Gold, Silver, US Dollar, & T-Bonds Video Analysis

SFS Key Charts & Tactics Video Analysis

SF60 Key Charts & Tactics Video Analysis

SF Juniors Key Charts Video Analysis

********

Unique Introduction For Gold-Eagle Readers: Send me an emailtoalerts@superforcesignals.com and I’ll send you 3 of my next

Super Force Surge Signals free of charge, as I send them to paid subscribers. Thank you!

Stay alert for our Super Force alerts, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Super Force signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successful business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

Email:

trading@superforcesignals.com

trading@superforce60.com

Mail:

SFS Web Services

1170 Bay Street, Suite #143

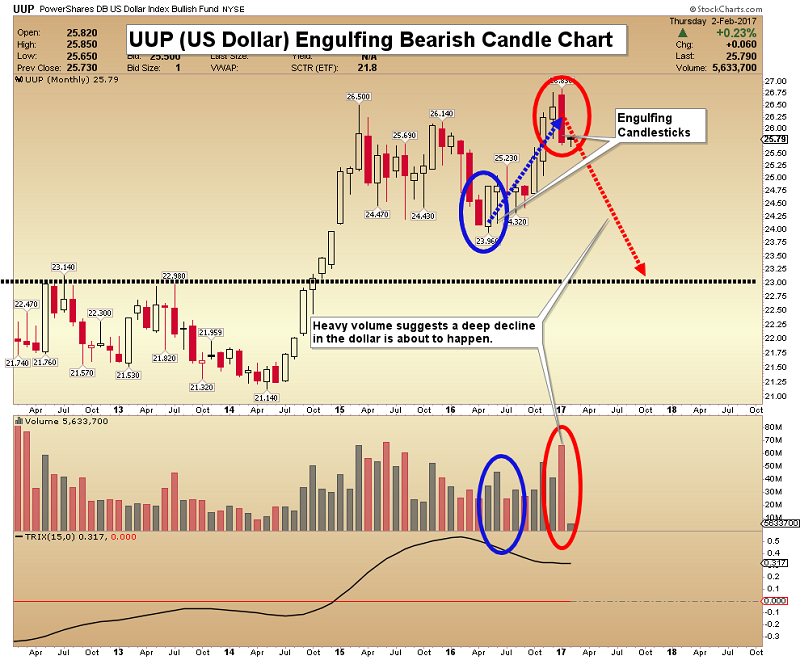

As we have repeatedly warning, anyone who is betting on the Trump Presidency unleashing a massive $USD bull market in the near future is going to get taken to the cleaners.

This has already begun…

One of the single most dangerous traps for traders to avoid is a “False Breakout.”

False breakouts are moves in which an asset “breaks out” of a formation, leading many to believe that the move is legitimate… then suddenly KA-BLAM, the move reverses violently.

See the $USD today. This looks more and more like a false breakout, which means YES, the $USD is going to sub 90s if not lower within 12 months.

Those who believe Trump wants the $USD above 100 are not paying attention. Similarly, those who believe that the Fed can and will raise rates three times in 2017 are missing the big picture.

NEITHER OF THOSE IS GOING TO HAPPEN. And if you’re investing based on them, you’re in for a LOT of pain.

Originally posted on http://gainspainscapital.com

Best Regards

Graham Summers

Forex Trading Alert originally published on Feb 2, 2017, 8:14 AM

Earlier today, the USD Index extended losses against the basket of the major currencies as yesterday’s Fed statement didn’t give clear signal on the timing of its next rate hike. How did this drop affect the technical picture of EUR/USD, USD/CAD and AUD/USD?

In our opinion, the following forex trading positions are justified – summary:

EUR/USD: none

GBP/USD: none

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

EUR/USD

Quoting our previous alert:

(…) EUR/USD reached the yellow resistance zone, approaching the 50% Fibonacci retracement. What’s next? Taking into account the fact that the proximity to this resistance area was enough to trigger a pullback in the previous week, it seems that we’ll see a similar price action and a verification of a breakout above the lower border of the blue rising trend channel in the very near future.

Looking at the daily chart, we see that the situation developed in tune with the above scenario and EUR/USD verified the earlier breakout above the lower border of the blue rising trend channel. What does it mean for the exchange rate? We believe that the best answer to this question will be the quote from our yesterday’s commentary:

(…) we should keep in mind that as long as there is no drop below this support another upswing and a test of the upper border of the yellow resistance zone is likely – especially when we factor in the fact that the buy signals generated by the weekly and daily indicators are still in play.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

USD/CAD

On Friday, we wrote the following:

(…)Although the pair rebounded in recent days, the exchange rate still remains under the previously-broken lower purple resistance line, which suggests that the current upswing could be nothing more than a verification of the earlier breakdown. Additionally, (…) the sell signals generated by the weekly indicators remain in place suggesting lower values of USD/CAD in the coming days. If this is the case and the exchange rate declines from here, (…), it seems that the exchange rate will move lower once again and test the lower border of the blue rising tend channel (seen on the daily chart) in the coming days.

On the daily chart, we see that currency bears pushed USD/CAD lower (as we had expected) and the pair slipped to our downside target. Although the exchange rate rebounded yesterday, the previously-broken lower border of the purple declining trend channel encouraged currency bears to act, which resulted in a pullback. Earlier today USD/CAD extended losses, which suggests a re-test of the blue support line. At this point it is worth noting that the Stochastic Oscillator generated a sell signal, which suggests that the bears could try to push the pair even lower. If this is the case and the exchange rate drops under this support line, the next downside target for the sellers will be around 1.2893, where the 61.8% Fibonacci retracement based on the entire May-December upward move is.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

Looking at the daily chart, we see that AUD/USD broke above the upper border of the blue consolidation earlier today, which means that our Tuesday’s commentary on this currency pair is up-to-date also today:

(…) taking into account the buy signal generated by the Stochastic Oscillator, it seems that currency bulls will try to push the pair higher in the coming days. If this is the case, and the exchange rate breaks above the upper border of the consolidation, we’ll see not only a test of the recent highs, but also an increase to the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels (around 0.7629-0.7643). If this area is broken, the next target will be around 0.7677, where the size of the upward move will correspond to the height of the blue consolidation.

Finishing today’s commentary please keep in mind that as long as there are no sell signals further improvement is likely. Therefore if AUD/USD climbs above 0.7677, the next upside target will be the yellow resistance zone marked on the weekly chart.

Very short-term outlook: bullish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

….related: Weaker US$ Could Send Gold & Gold Stocks to Higher Targets