Timing & trends

1. All major economies, USA, China, Japan, Europe and Emerging markets have debt which have grown exponentially and will never be repaid.

1. All major economies, USA, China, Japan, Europe and Emerging markets have debt which have grown exponentially and will never be repaid.

2. The financial system has a gross exposure of over $2 quadrillion. This will all collapse when counterparty fails.

3. With the Trump administration leading, the world will soon enter the final spending spree which will accelerate the velocity of money and lead to hyperinflation. This will in turn finish off the value of most major currencies until they reach zero.

4. 1-3 above will result in a deflationary implosion of the financial system. This will get rid of all debt and reduce the value of most assets by at least 90%.

5. This total debt destruction is the only way to put a world on a sound footing for future growth and prosperity.

….read more including the antidote HERE

also:

“We have enough history now to distinguish the clear divergence between Vancouver (down) and Toronto (still straight up),” BMO chief economist Douglas Porter wrote in a January 24 client note, as quoted by BuzzBuzzHome.

“We have enough history now to distinguish the clear divergence between Vancouver (down) and Toronto (still straight up),” BMO chief economist Douglas Porter wrote in a January 24 client note, as quoted by BuzzBuzzHome.

Porter stated that sufficient time has passed to make a proper evaluation of these leading markets…

…related:

Sure, the oil markets have responded to the OPEC and Non-OPEC agreement to cut production. But perhaps not quite like the cartel anticipated!

Sure, the oil markets have responded to the OPEC and Non-OPEC agreement to cut production. But perhaps not quite like the cartel anticipated!

While media headlines are chock-full of reports that parties to the agreement are complying with the cuts, this time it’s different.

And that’s because they’ve underestimated the supply coming out of a new swing producer: The United States.

And that’s going to drive oil prices down in a big way. Consider …

<1> Cumbersome U.S. inventory and surging production. U.S. oil inventories are at their highest seasonal level in 30 years and production is running at its fastest clip in nine months.

And I think this is just the start. Especially on a surge in U.S. oil drilling rig activity, which last week saw the biggest one-week jump in nearly four years.

<2> Surge in corporate spending and oil-patch investment. A recent poll of more than a dozen U.S. players showed an average 60% increase in capital expenditures for oil exploration and production planned for this year! This view was echoed by global investment bank Barclay’s calling for a 50% increase in American E&P spending.

There’s also a flurry of investment activity in the shale-rich Permian Basin.

And don’t forget: U.S. drillers have become nimble and well-funded with some shale producers generating a handsome profit at $45 per barrel. When they’re making money like that, the last thing on their minds is cutting production.

<3> Worrisome Speculator Positioning in the oil market. Initial excitement surrounding the OPEC production cut sparked aggressive buying interest into the oil market. In fact, figures compiled by the Commodity Futures Trading Commission (CFTC) show small speculators holding their largest long position on record …

These traders are considered the weak hands — generally underfunded and the last to enter the market. In fact, I use them as a contrarian indicator — what not to do.

As you can see from this chart, these weak hands are all in.

And that tells me to stay away.

In addition, given the current extreme reading, when these weak hands move to cover — in this case, sell their positions — oil will get hammered.

This is similar to late 2014 when oil topped $100 and small speculators held record net-long positions. They were forced to cover and kicked off a crash in oil prices.

Not surprisingly, this view is supported by my AI model: Oil prices should move sharply lower into late February.

I have advised members to strategically position themselves for lower oil prices at various points in recent weeks: Putting them in positions to take full advantage of a looming decline.

Don’t be left behind: Take a look at my Real Wealth Report and other trading services today.

Best wishes,

Larry

January 27, 2017

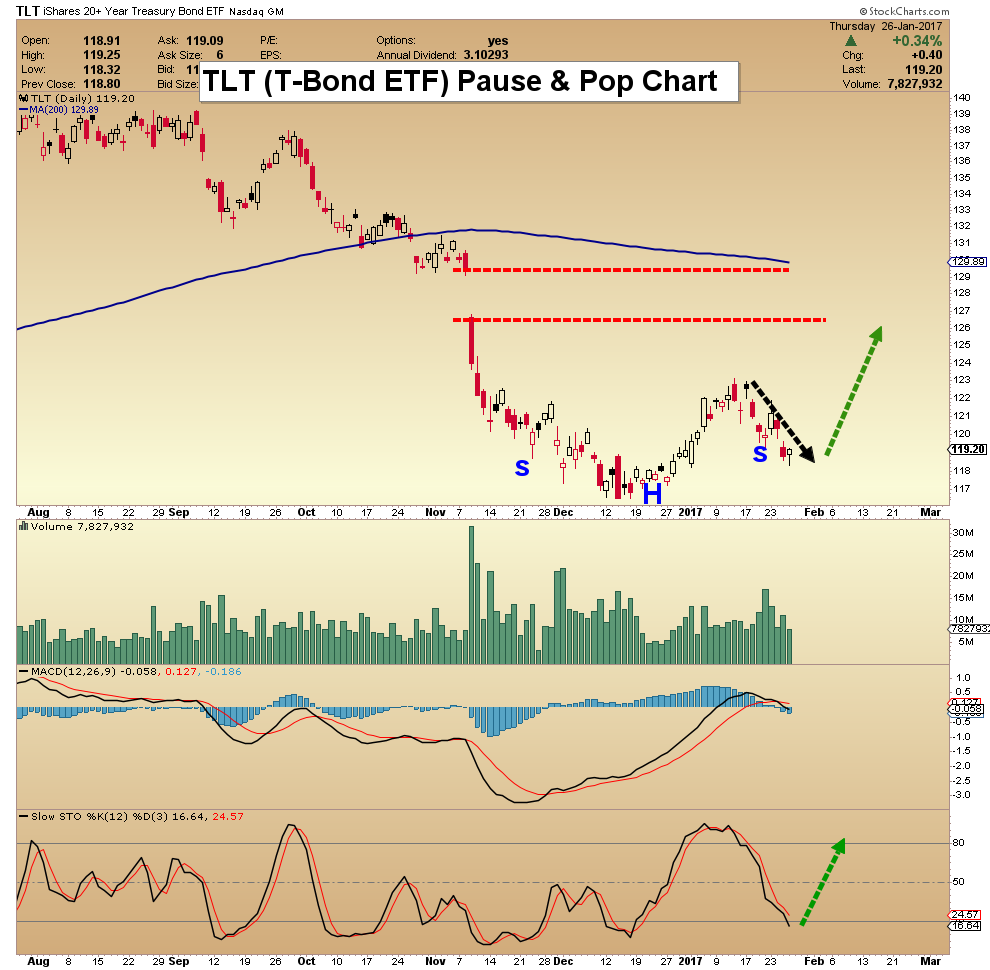

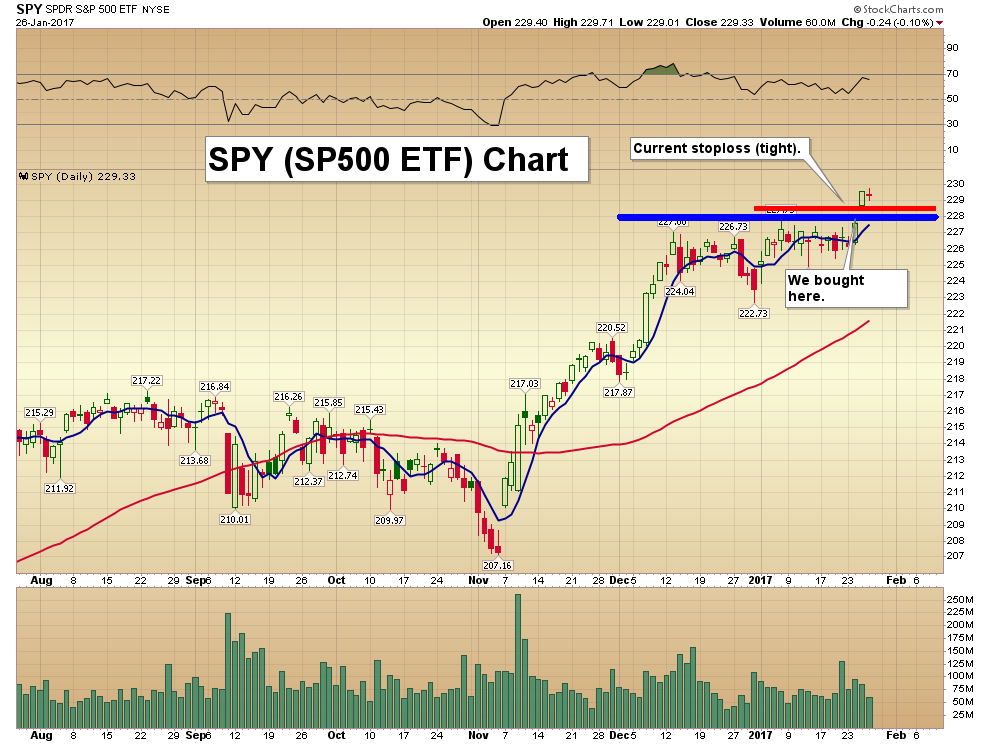

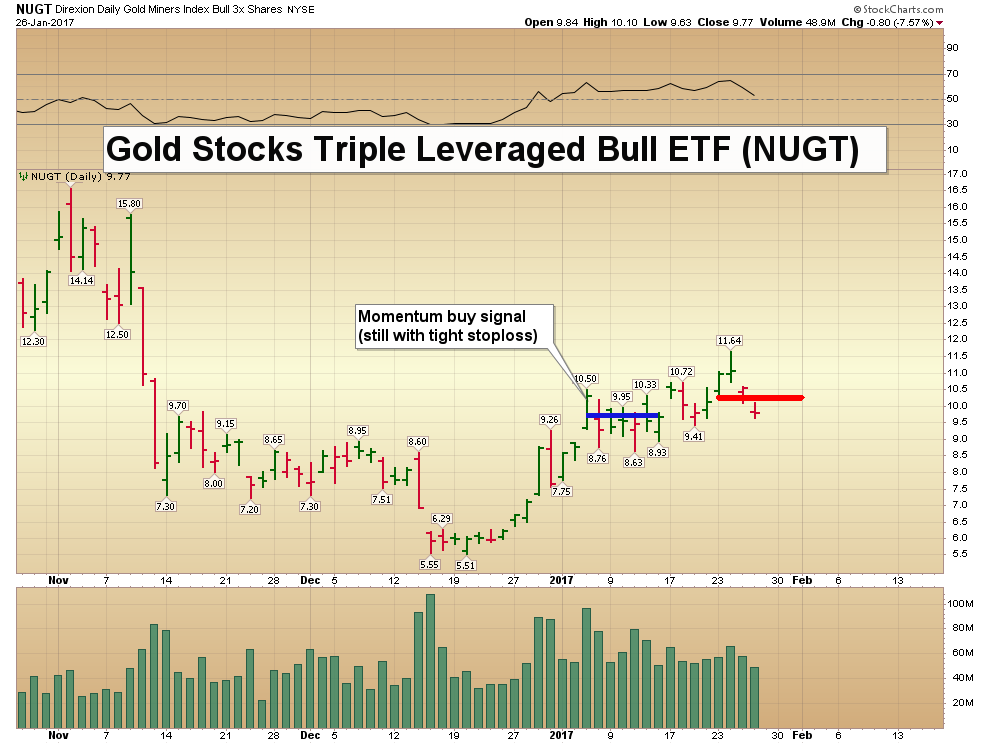

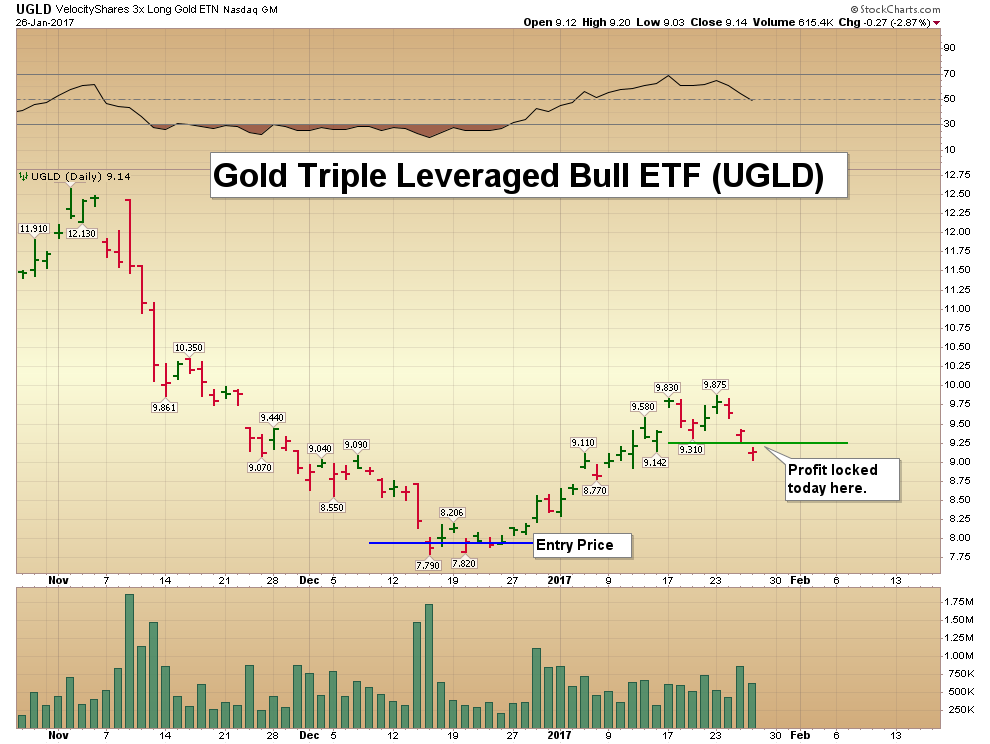

Today’s videos and charts (double-click to enlarge):

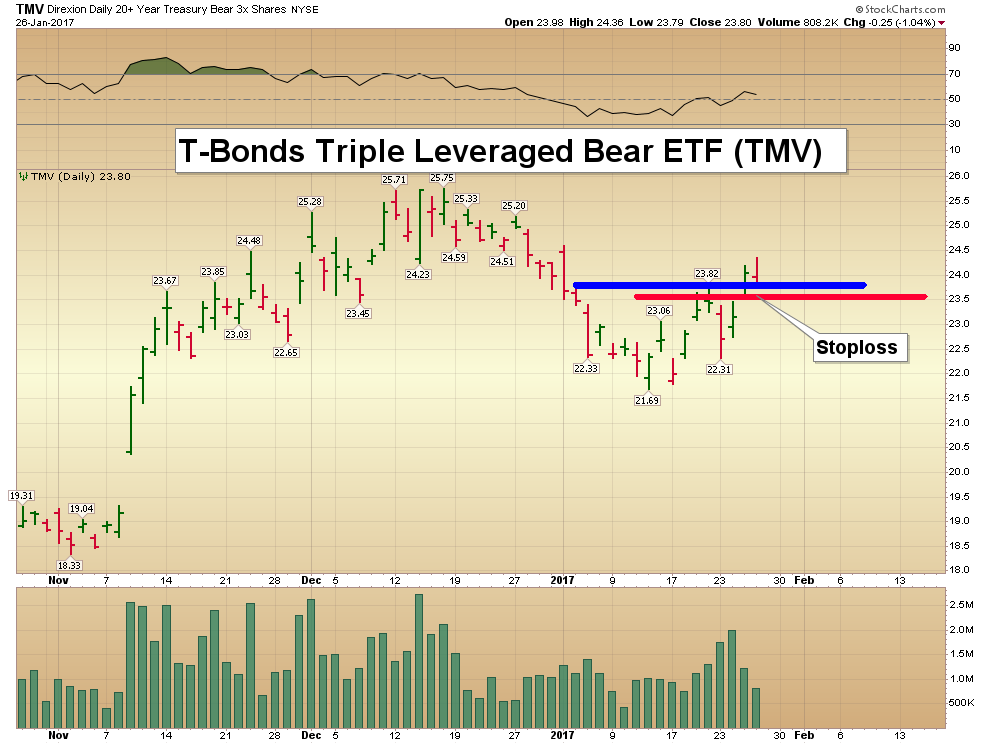

Gold, Silver, & T-Bonds Key Charts Video Analysis

SFS Key Charts & Tactics Video Analysis

SF60 Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Thanks,

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

The rally in bitcoin has come out of China, which has accounted for 98% of bitcoin trading in the past six months. China is also home to about two-thirds of the world’s bitcoin mining power. The Phase Transition spike in bitcoin is very alarming, for it flies right in the face of government attempts to eliminate currency. The Chinese have been buying bitcoin onshore, selling it offshore for another currency, and then moving the money to a bank account. This is how the Chinese individuals can take cash out of the country, circumventing all regulation.

The rally in bitcoin has come out of China, which has accounted for 98% of bitcoin trading in the past six months. China is also home to about two-thirds of the world’s bitcoin mining power. The Phase Transition spike in bitcoin is very alarming, for it flies right in the face of government attempts to eliminate currency. The Chinese have been buying bitcoin onshore, selling it offshore for another currency, and then moving the money to a bank account. This is how the Chinese individuals can take cash out of the country, circumventing all regulation.

The Chinese government has been strengthening requirements for citizens by converting their yuan. With Trump coming into office, China fears that lower values for the yuan will become a trade war even if the government is not actively trying to depreciate the yuan for trade. Conversions of yuan are already subject to a quota or currency controls in an effort to curb capital outflows.

Bitcoin has been the escape method for capital fleeing China. With the looming trade war on the horizon, the Chinese government will have absolutely NO CHOICE but to come in and regulate bitcoin as its citizens now account for 98% of all trading. From a regulatory perspective, the days of passive treatment of bitcoin may come to an end. Bitcoin has soared only because it has been the mechanism to obtain foreign exchange and take capital out of China. This could easily be considered an illegal operation, such as money laundering, to justify closing that window.

Of course, you have the zealots who preach bitcoin as the alternative to the dollar that they cannot shut down. All they need to do is declare bitcoins illegal and the PRESUMPTION of being in bitcoin is a PRESUMPTION of being a criminal. They are already using terms like “CASH IS FOR CRIMINALS” and if you have a few thousand in cash, they just confiscate it presuming you are criminal under Civil Asset Forfeiture without having to prove you committed a crime or charging you.

Keep in mind we are dancing with the devil. There are no rules — just ruthless self-interest. They will do whatever it takes to survive. They will not relinquish power willingly.