Wealth Building Strategies

When you’re in your 20s, it might seem like you have plenty of time to save and invest. But time is more fleeting than you think. Building wealth when you’re paying off student loan debt or starting a career isn’t easy, but it’ll be worth the effort later on. If you’re ready to buckle down and increase your net worth, here are seven things to do before you turn 30.

When you’re in your 20s, it might seem like you have plenty of time to save and invest. But time is more fleeting than you think. Building wealth when you’re paying off student loan debt or starting a career isn’t easy, but it’ll be worth the effort later on. If you’re ready to buckle down and increase your net worth, here are seven things to do before you turn 30.

….related:

Dr Marc Faber: NEW BULL MARKET 2017 . Dr. Faber is famous for his contrarian approach to investing, Marc Faber does not run with the bulls or bait the bears but steers his own course through the maelstrom of international finance markets…

Marc Faber Warns Higher Yields May Disrupt Rally Says to Sell

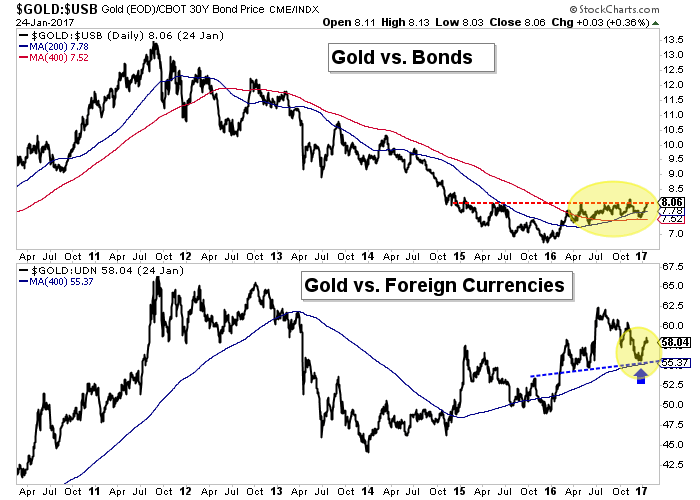

As Gold and gold mining stocks approach strong resistance, we wonder if the outcome will be a sharp selloff or a period of bullish consolidation. While there are a handful of things we can examine (sentiment, momentum, relative strength, etc), today we will focus on Gold and its relative strength against two key markets. How Gold fares against Bonds and foreign currencies in the weeks ahead could be a hint of its trend heading into spring.

Below we plot Gold against Bonds and Gold against Foreign Currencies (FC). Gold against the 30-year bond is shown with the 200 and 400-day moving averages while Gold against FC and the 400-day moving average is plotted at the bottom.

As we can see, the Gold/Bonds ratio is attempting to breakout from two-year resistance. The ratio has consolidated for the past nine months and now the moving averages are aligned in bullish fashion. Meanwhile, Gold/FC is trading above support but like Gold itself faces resistance from early autumn.

Gold vs. Bonds, Gold vs. Foreign Currencies

Gold has been lagging the miners recently and that is a good thing. The miners should lead. However, as Gold nears resistance (potentially at $1250/oz) it is important for it to show relative strength against the other asset classes and in particular Bonds and FC. A breakout in the Gold/Bonds ratio would signal that Gold would be less affected by weakness in Bonds (and rising yields). Meanwhile, continued strength for Gold/FC would signal that Gold would be less impacted by a rising US Dollar.

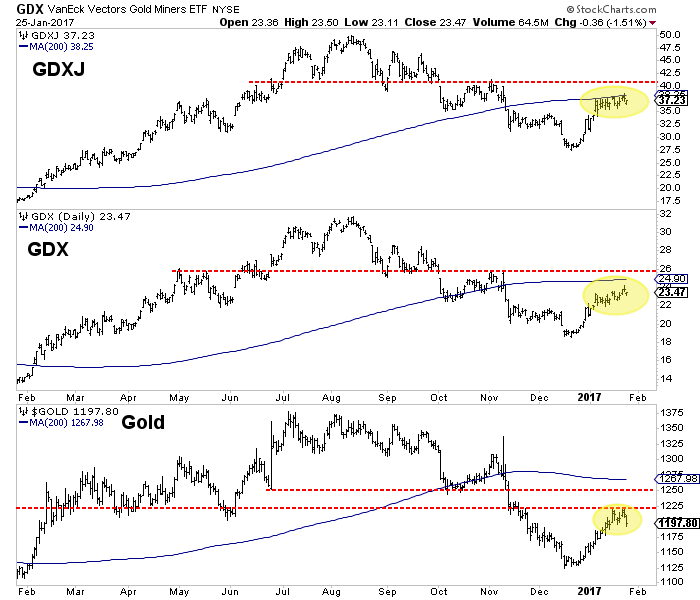

When focusing on the very short-term we see that Gold has been turned back at $1220/oz while the miners have continued to grind higher. They opened lower Wednesday but managed to close at the highs of the day. Their rebound is getting long in the tooth but there is a chance they could grind higher towards the red lines.

GDX, GDXJ, Gold Daily Bar Charts

As Gold and gold mining stocks approach resistance we will keep an eye on their performance relative to the movements in other asset classes. A pullback from resistance is very likely but the question is if the pullback evolves into a deeper correction or a bullish consolidation. In the meantime we have focused on buying quality and value in the junior space while maintaining some cash. The good buying opportunity we noted a month ago has passed but another one will come soon one way or another.

Jordan Roy-Byrne, CMT, MFTA

The Nasdaq Composite Index also climbed to a record, with materials producers leading gains as copper and aluminum advanced. Housing stocks surged after the largest U.S. builder delivered earnings, while engineering firms gained as President Donald Trump took steps to advance construction of oil pipelines. Banks jumped as the yield on the 10-year Treasury note climbed back above 2.45 percent. Crude topped $53 a barrel.

The Nasdaq Composite Index also climbed to a record, with materials producers leading gains as copper and aluminum advanced. Housing stocks surged after the largest U.S. builder delivered earnings, while engineering firms gained as President Donald Trump took steps to advance construction of oil pipelines. Banks jumped as the yield on the 10-year Treasury note climbed back above 2.45 percent. Crude topped $53 a barrel.

While politics continued to sway financial markets as a U.K. court ruled parliament must vote on any Brexit plan. Donald Trump sought to cajole U.S. automakers to build plants in America and vowed to renegotiate the Keystone XL and Dakota Access pipelines. Investors also turned to a slate of corporate earnings that began to show signs that the economy was on firm footing at the end of 2016. D.R. Horton Inc.’s results come amid data showing rising home construction and a pickup in demand as mortgage rates start to climb. The first reading on last quarter’s U.S. economic output is due Friday.

Investors replaced Monday’s cautious tone with a risk-on attitude. Why not? It was ‘Turnaround Tuesday’! The change of heart was most obvious in the Treasury market, which lost all of Monday’s gain as the 10-yr yield swung seven basis points higher to 2.47% after losing the same amount the day before. The U.S. dollar faced a similar dynamic, with the U.S. Dollar Index (100.34, +0.39) adding 0.4% after succumbing to selling pressure on Monday.

Generally speaking, investors traded Treasuries for stocks, but they were more specifically after growth-sensitive equities as all six cyclical sectors outpaced the broader market. Materials led all sectors with a 2.5% gain, setting the pace early following DuPont’s (DD 76.05, +3.27) positive earnings report. The stock jumped 4.5% after the company beat earnings estimates and announced that its merger with Dow Chemical (DOW 59.64, +2.50) is expected to close in the first half of 2017.

A ways off from the materials sector was the financial space (+1.2%). The sector ended in second place after many of its top components recouped some of the losses suffered at the start of the earnings season. Technology, the only sector with more influence than financials, finished the day 1.0% higher after strength in chipmakers sent the PHLX Semiconductor Index higher by 2.0%. In the broader tech space, Yahoo! (YHOO 43.90, +1.50) was the most notable advancer after reporting favorable earnings results following yesterday’s close.

Economic data was limited to December Existing Home Sales:

Existing home sales for December decreased 2.8% from November to an annualized rate of 5.49 million units while the Briefing.com consensus expected a reading of 5.55 million. The key takeaway from the report is that inventory constraints, rising prices, and higher mortgage rates remain a key obstacle to stronger sales activity.

I am still in the camp that probabilities still favor a seasonal (cyclical) pullback between now and mid-February, but we’re not short (having covered our inverse ETFs on Monday) and awaiting renewed bearish technical signals. With the SPX and Nasdaq into new highs and most other indexes with the exception of the Russell 2000 on the verge of breaking out, patience is the key. That said, followers of my VR Cannabis/Vice, VR Gold Letter and VR Platinum portfolios know we’re remain committed to recommended positions.

…also from Martin Armstrong: