And like that, it happened. Despite the polls, despite what anyone believed was possible, including many of his own supporters, billionaire developer Donald J. Trump was sworn in as the 45th President of the United States.

Whether you agree with him not, he’s now leader of the world’s largest economy and commander of history’s most powerful military force.

This is something that could only happen in the U.S.

President Trump and now-former President Barack Obama couldn’t be more different in their backgrounds, visions and leadership styles—more so than any other two men whose administrations happen to adjoin the other’s.

And yet the transition went remarkably smoothly and orderly.

I don’t believe there’s ever been such a meaningful and potentially consequential transfer of power in U.S. history, with the incoming president all but promising to undo every last policy of his predecessor, line by line. That Obama peacefully and cordially handed over the executive office to a man who led the charge in questioning his legitimacy for a number of years is a testament to the strength and durability of our democratic process.

It’s a process that’s key to America’s exceptionalism.

Although I don’t always agree with Trump, it saddens me to see so much negativity about him in the media and protests in the streets. Now that he’s president, the time has come to unite behind him and root for his success. If he succeeds, America succeeds. If he fails—as many seem to hope for—America fails.

Take Warren Buffett. He backed Hillary Clinton throughout the primaries and general election. And yet on the eve of Trump’s inauguration, he said he supported the new president and his cabinet “overwhelmingly,” adding that he’s confident America “will work fine under Donald Trump.”

I think what Buffett recognizes is that the vast majority of people who voted for Trump did so for the right reasons. Throughout his campaign, Trump’s promise to bring back American jobs and secure the nation’s borders resonated with everyday folks who have begun to feel overlooked. Entrepreneurs, small business owners and those working in the financial industry found hope and encouragement in his pledge to lower corporate taxes and roll back regulations. (Just today, Trump told a room full of CEOs that he promised to cut regulations “by 75 percent, maybe more.”) I believe most Americans, regardless of political ideology, want these things—which is why we saw such a large number of people who previously voted for Obama give Trump their vote this time.

As I often say, government policy is a precursor to change, and we’re likely about to see some sweeping changes. But as investors, it’s as important as ever that we don’t panic or get distracted by the noise. Instead, continue to focus on the fundamentals and keep your eyes on the long-term prize.

Inflation Plays Catch-Up

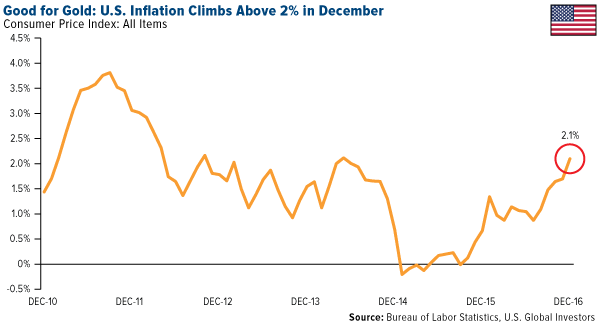

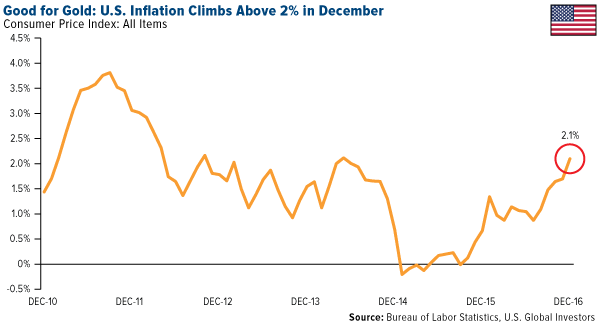

Inflation, as measured by the consumer price index (CPI), got a strong jolt in December, rising 2.1 percent year-over-year, its fastest pace in at least two-and-a-half years. Higher gasoline prices—which rose more than 8 percent in December—and health care costs were the main culprits, with medical bills surging the most in nine years.

click to enlarge

Although they might hurt your pocketbook, pricier goods and services have historically been constructive for gold, as I’ve explained many times before. In August 2011, when gold hit its all-time high of $1,900 an ounce, inflation was running at 3.8 percent and the government was paying you an average 0.23 percent on the 2-year T-Note. That means investors were earning a negative 3.5 percent return, which helped boost gold’s “safe haven” status.

I expect CPI to continue to climb throughout this year and next, supported by additional interest rate hikes—two or three in 2017 alone—and President Trump’s protectionist policies.

The metal’s investment case could be strengthened even more now that Trump has officially been sworn in. His personal shortcomings and public office inexperience might raise more than a few “unknown unknowns” for some investors, prompting them to seek an alternative to stocks and bonds. Scotiabank hinted at this in a recent note, saying it expects gold holdings “to increase as investors look to diversify their portfolios in what seems likely to be a challenging year for investors.”

On Inauguration Day, gold rose a little under 1 percent to close at $1,210.

Whether you support the new president’s policies or not, it’s still prudent to maintain a 10 percent weighting in gold, with 5 percent in gold stocks, the other 5 percent in coins and bullion.

Another Gold Rally in the Works?

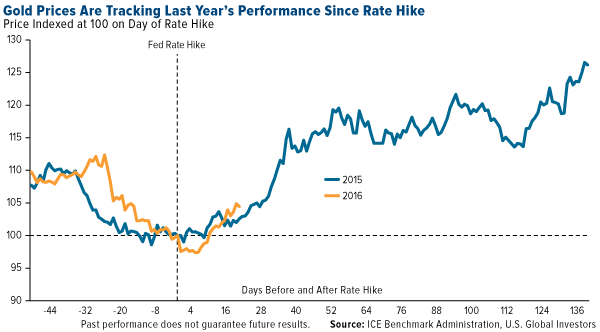

Look at the chart below. It’s indexed at 100 on the day the Federal Reserve raised rates in 2015 and 2016 (December 16 and 14, respectively). Although past performance doesn’t guarantee future results, gold prices so far this year appear to be tracking last year’s performance pretty closely, suggesting further upside potential.

click to enlarge

In the first half of 2016, gold rallied more than 31 percent, from a low of $1,046 in December 2015 to a high of $1,375 in July. With mid-December 2016 as our starting point, a similar 31 percent move this year would add close to $360 to the price of gold, taking it to above $1,520 an ounce.

Gold Has a 100-Year History of Outperforming All Major Currencies

In its 2017 outlook, the influential World Gold Council (WGC) listed six major trends that will likely support gold demand throughout the year, including heightened geopolitical risks (Brexit, Trump, the global rise of populism), a potential stock market correction, rising inflation expectations and long-term Asian growth.

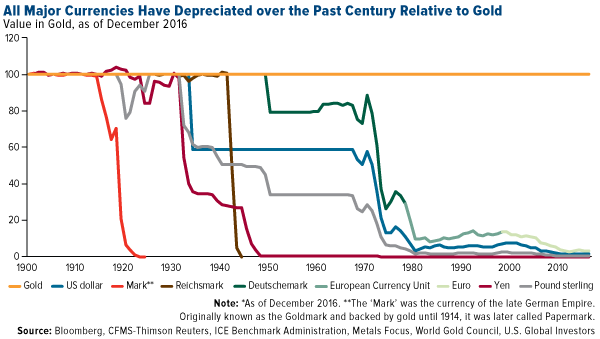

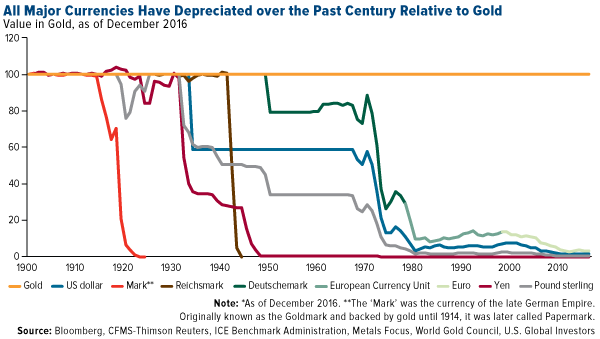

The group also calls out currency depreciation. Over the past 100 years, gold has strongly outperformed all major currencies. Whereas global gold supply grows at an annual average of only 2 percent, there’s no limit to how much fiat money can be printed.

click to enlarge

Inflation and currency depreciation are among the Fear Trade’s triggers that I often write and speak about.

Spending Watchdog: U.S. Is on an “Unsustainable Fiscal Path”

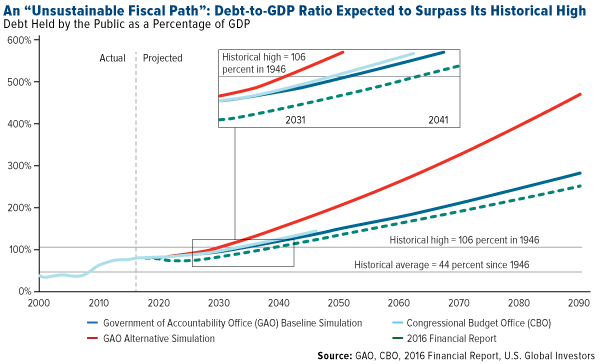

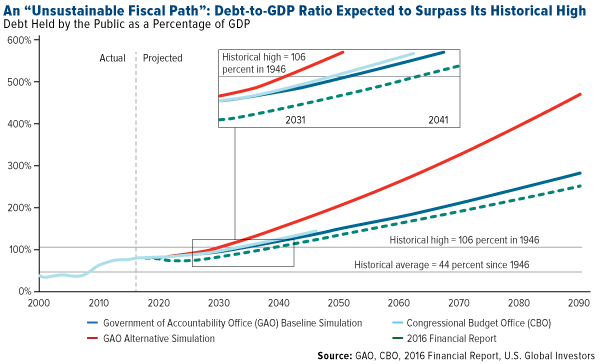

This point about currency depreciation is especially relevant in light of an alarming new report from the U.S. Government Accountability Office (GAO), the nation’s watchdog. According to the report, the federal government’s spending is “unsustainable,” and if no action is taken to rectify the problem, the debt-to-GDP ratio will soon exceed its historical high of 106 percent, set in 1946.

To be clear, that means our nation’s debt will be larger than its economy.

click to enlarge

The federal deficit increased to $587 billion in 2016, after six years of declining deficits. Spending increases were driven by entitlement programs such as Medicare and Medicaid, which surged 4.9 percent and 5.3 percent, respectively, during the year.

Whether Trump can change any of this, we’ll just have to wait and see. He seems interested in lowering costs and bringing some fiscal sanity to the government, as demonstrated by his criticism of Boeing over the perceived cost of Air Force One. At the same time, massive tax cuts, coupled with a $1 trillion infrastructure package, will likely drive up deficit spending even more.

All the more reason to have a portion of your portfolio invested in gold and gold stocks.

In the meantime, I wish President Trump all the best!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2016: The Boeing Co.

The truth is, we were heading down this path no matter who became our next Commander in Chief. But the fact that Donald J. Trump is our 45thpresident at this critical time in our nation’s history, indeed in the annals of world history, fits in perfectly with my cycle analysis.

The truth is, we were heading down this path no matter who became our next Commander in Chief. But the fact that Donald J. Trump is our 45thpresident at this critical time in our nation’s history, indeed in the annals of world history, fits in perfectly with my cycle analysis.