Personal Finance

This 33 minute interview is encompasses the works, and especially on Rogers belief that the agricultural markets have been depressed for many years.

“I’m still extremely optimistic about agriculture, more so than many sectors of the world economy. Buy anywhere it’s raining! Anywhere that has good weather, good soil, good laws, and there are many of those around – the African continent, South America, the middle part of Asia. There are many places where there are astonishing opportunities. I’m not sure I would rush out and buy Iowa right now because it’s extremely expensive. But there are lots of places where the opportunities are good” – from the Daily Bell

Jim Rogers started trading the stock market with $600 in 1968.In 1973 he formed the Quantum Fund with the legendary investor George Soros before retiring, a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund while the S&P 500 returned just 47%.

“Happiness has dominated risk markets since early November and despair has characterized global bond markets.”

“For 10-year Treasuries, a multiple of influences obscure a rational conclusion that yields must inevitably move higher during Trump’s first year in office. When the fundamentals are confusing, however, technical indicators may come to the rescue and it’s there where a super three decade downward sloping trend line for 10-year yields could be critical. Shown in the chart below, it’s obvious to most observers that 10-year yields have been moving downward since their secular peak in the early 1980s, and at a rather linear rate. 30 basis point declines on average for the past 30 years have lowered the 10-year from 10% in 1987 to the current 2.40%.”

…reading Bill Gross Investment Outlook January 2017

Sent to subscribers on January 19, 2017, 7:11 AM.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

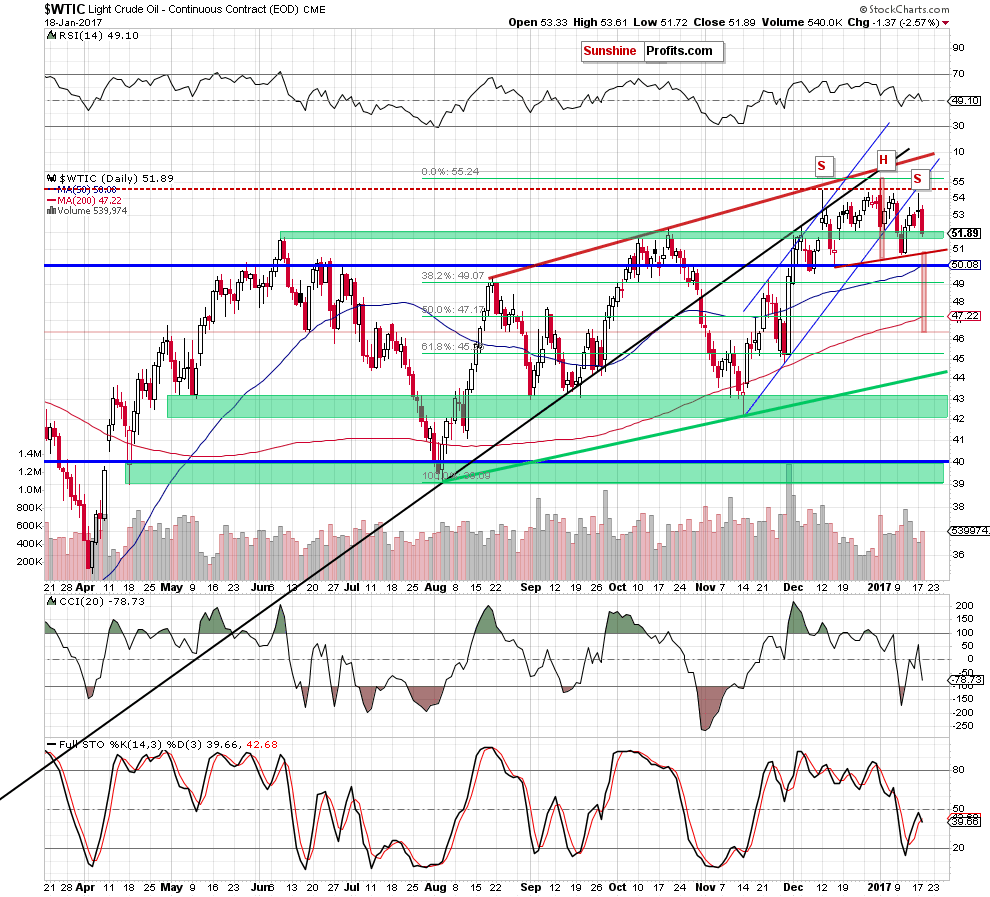

On Wednesday, crude oil lost 2.57% after the head of the IEA warned of a significant increase in U.S. shale output as OPEC and non-OPEC producers cut output. This news negatively affected the investors’ sentiment and pushed the black gold under important support levels. What does it mean for light crude?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) although crude oil moved higher yesterday, the red gap continues to keep gains in check. Additionally, the sell signals generated by the indicators are still in play, supporting oil bears and another attempt to move lower.

From today’s point of view we see that the situation developed in line with the above scenario and crude came back below the previously-broken long-term red support/resistance line, invalidating the earlier breakout. This is a negative event, which together with the sell signals suggests further deterioration in the following days.

Having said the above let’s examine the daily chart and look for more bearish factors.

Looking at the very short-term chart, we see that crude oil extended losses and dropped under the October high. This move materialized on higher volume, which confirms the oil bears’ strength. Additionally, the CCI reversed and the Stochastic Oscillator re-generated a sell signal, which suggests that what we wrote yesterday is up-to-date also today:

(…) light crude not only hit a double top, but also declined below last week’s high, which doesn’t bode well for the commodity.

On top of that, when we take a closer look at the daily chart, we can notice a potential head and shoulders formation. If this is the case, yesterday’s move to the upside created the right shoulder of the pattern, suggesting lower prices of the black gold in the coming days.

How low could crude oil go in the near future? In our opinion, the initial downside target will be the neck line of the head and shoulders formation (around $50.89 at the moment of writing these words). If it is broken, we’ll see an acceleration of declines and a drop even to around $46.36, where the size of the downward move will correspond to the height of the mentioned formation.

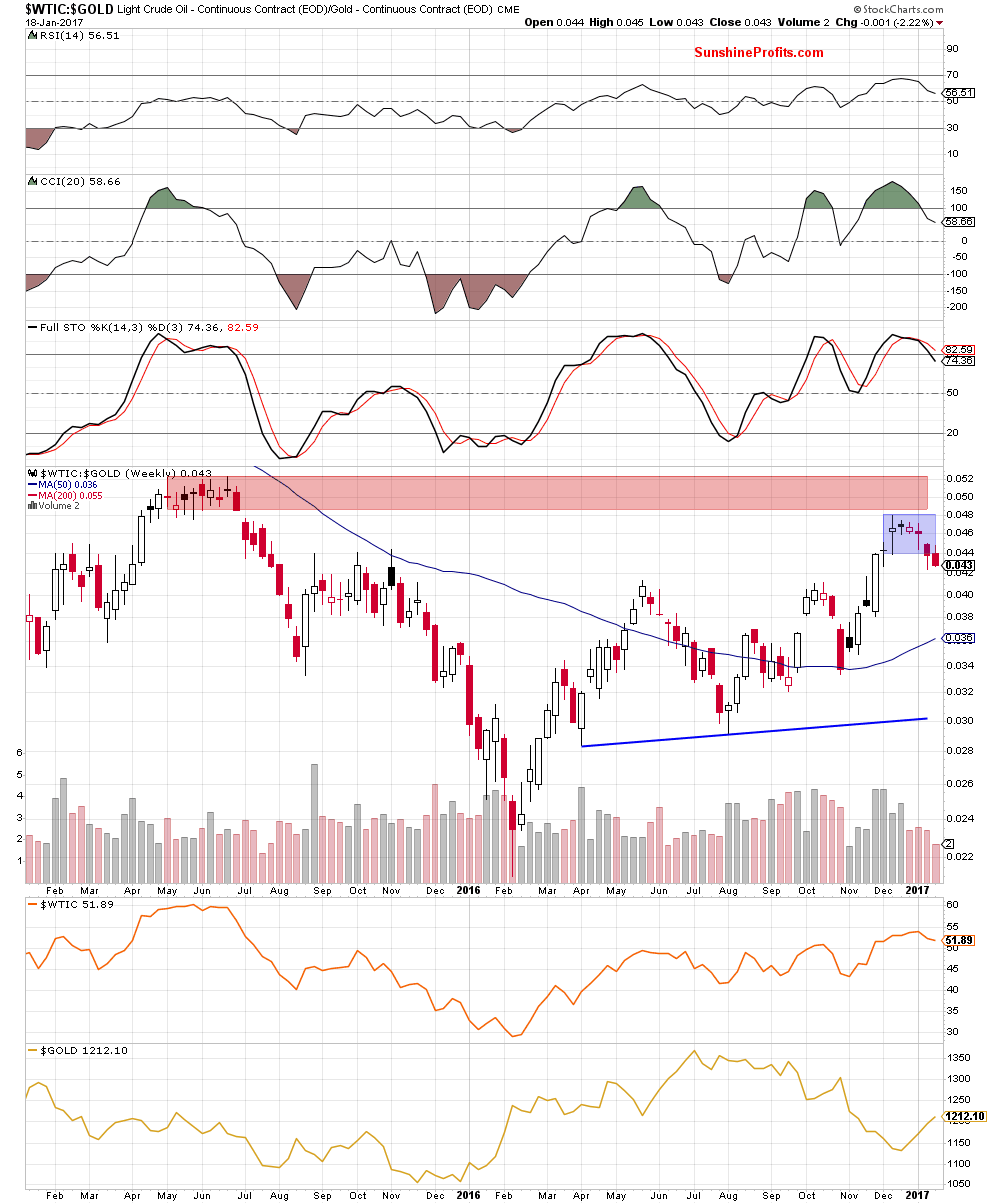

Before we finish today’s alert we would also like to draw your attention to the relationship between the black gold and the precious metals.

On the medium-term chart, we see that the oil-to-gold ratio declined under the lower border of the blue consolidation once again, which increases the probability of further deterioration in the coming week(s). If his is the case and we see such action, crude oil will also move lower, because the strong positive correlation between light crude and the ratio remains in place.

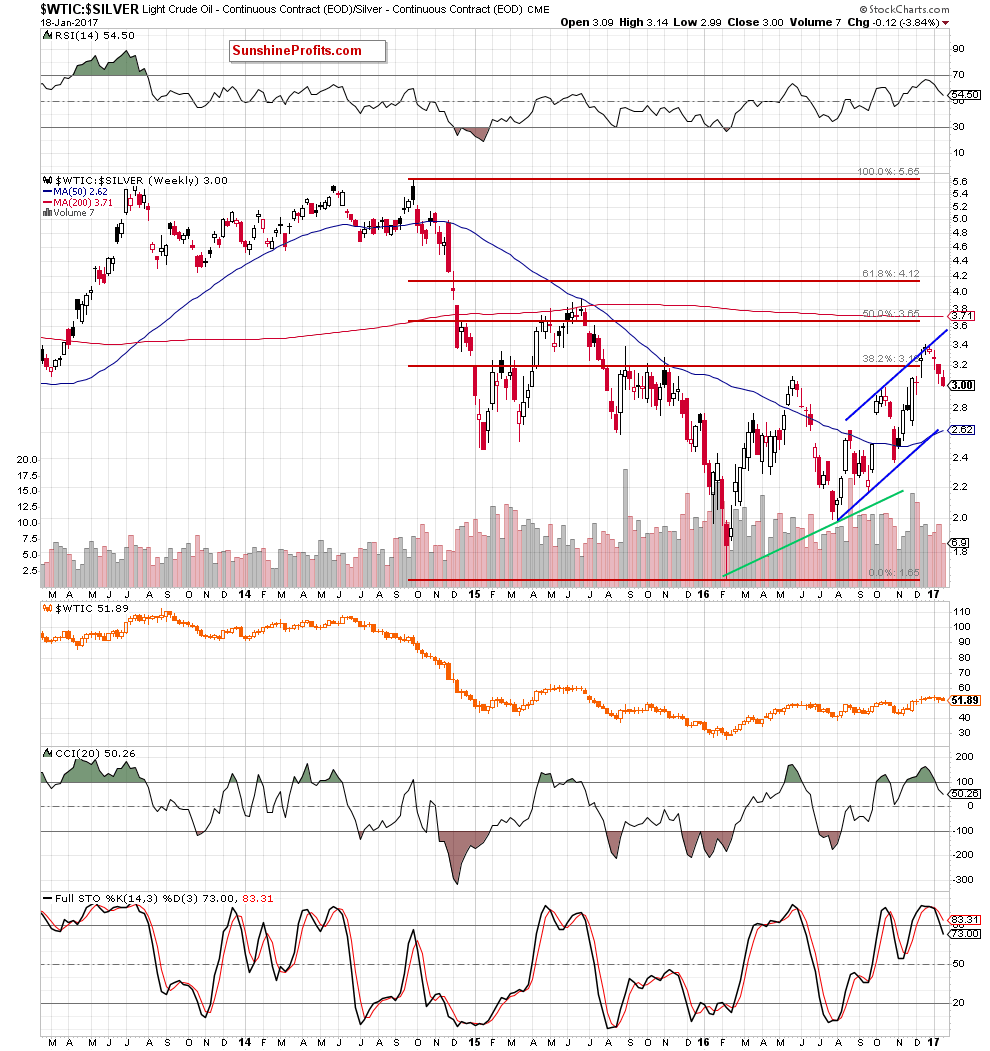

We can also notice one more bearish development on the medium-term chart of the oil-to-silver ratio.

From this perspective we see that the invalidation of the breakout above the 38.2% Fibonacci retracement triggered further deterioration and a drop below last week’s low, which is a negative event. Additionally, there are also the sell signals generated by the indicators, which support oil bears and lower values of the ratio and crude oil.

Summing up, short positions continue to be justified as the double top formation, the potential head and shoulders pattern and the current situation in the oil-to-gold and oil-to-silver ratios suggest further deterioration in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

… which should help banks, investor Bill Miller says.

… which should help banks, investor Bill Miller says.

The bull market in bonds is over and that should benefit financials, legendary investor Bill Miller told CNBC on Wednesday.

“We’re at the beginning of a long bear market in bonds that will last for who knows how long,” he said in an interview with “Closing Bell.”

…. continue reading/listening HERE

…related:

There are many advantages to spread betting not least the flexibility to engage in transactions whilst on the move and in your spare time. In addition to this, as you don’t own the asset there is no need for large capital investment. The basic principle of this form of investment and trading is a simple one. However, albeit straightforward it would be prudent to enlist the support of a professional such as the CMC markets, an online trading and investment company.

There are many advantages to spread betting not least the flexibility to engage in transactions whilst on the move and in your spare time. In addition to this, as you don’t own the asset there is no need for large capital investment. The basic principle of this form of investment and trading is a simple one. However, albeit straightforward it would be prudent to enlist the support of a professional such as the CMC markets, an online trading and investment company.

The recent United States Presidential election has, as would be expected caused some nervousness in the markets, however careful analysis is required to determine the possible impact on the markets over the coming months and in particular the impact on spread betting.

To look at this in detail we need to consider the principles of spread betting. There are different methods of spread betting but we will concentrate on online trading. This provides an excellent method of monitoring the markets and managing individual spread betting. We have already touched on the advantages of the process but in addition to this a key factor is the fact that spread betting is considered to be gambling and as such any profit is not subject to taxation. Unlike some forms of trading the investor does not buy shares but buys a stake (points). In addition the investor can also sell their stake. The point at which the stake is sold is the important factor as this will dictate the profit (or loss) that will be made. Spread betting allows the trader to trade on the price of movement of thousands of financial markets including commodities, indices, stocks and shares.

The fact that the trader is trading on the price of movements on thousands of financial markets is where the outcome of the US Presidential elections becomes a factor, in that elections affect markets and confidence in them which in turn impacts on values. Trump continues to affect the stock market but concerns his election would have disastrous effects on the markets have simply not come to fruition with markets holding firm. So, for the time being it remains “business as usual”. The coming months are of course difficult to predict but it is possible to analyse the potential impact of Trump’s proposed policies on the markets.

Trump’s plan on tax is the reduction of 7 income tax brackets to just 4 which would lead to tax cuts for many and in some cases will see some households pay no income tax at all. This may well increase spending and boost both the dollar and the indices. In addition, Trump claims he will half corporation tax to encourage US companies to keep their activities in the US rather than using less expensive territories abroad. This again is likely to lead to higher stock prices. In addition cutting regulation on business should have a positive impact on the markets. If Trump is able to deliver this, as promised, within his first 100 days of office it is likely this will improve market optimism. Increase in spending will also likely boost the economy and in turn increase stock and share values. This has to be tempered with the strict management of the national debt over the mid to long term duration of the administration. Concern on how Trump’s policies will be funded may have a negative impact on the economy but one that in the short term is unlikely to impact significantly on the markets. Managing debt plays part of his overall plan.

The end result of the new President taking up office is that the markets are likely to be at worst stable but are actually more likely to be boosted. This should provide the spread better significant opportunities to see their stakes increase in value to allow a good profit to be made if carefully monitored and managed. Online technology will allow the spread better to monitor the markets closely and buy and sell at the most opportune times. Online management of transaction should allow them to act promptly regardless of their physical location.

So with a little optimism and nerve there remains profit to be made.

….also from Tyler Bolhorn: