Stocks & Equities

We live in a modern world of acronyms and buzzwords, and the financial industry is certainly no exception. In fact, it may be one of the worst culprits, what with FANG, ZIRP, TINA, BREXIT, QUITALY, BRIC, etc. all entering the lexicon over the last few years. Yet, creating some catchy collection of consonants remains one of the most surefire ways to attract attention in this business since it, admittedly, makes for a great headline and gives strategists like us something fun to write about (“fun” being a relative measure).

We live in a modern world of acronyms and buzzwords, and the financial industry is certainly no exception. In fact, it may be one of the worst culprits, what with FANG, ZIRP, TINA, BREXIT, QUITALY, BRIC, etc. all entering the lexicon over the last few years. Yet, creating some catchy collection of consonants remains one of the most surefire ways to attract attention in this business since it, admittedly, makes for a great headline and gives strategists like us something fun to write about (“fun” being a relative measure).

Well, now the new eye-catching acronym to watch, according to Tom Lee of Fundstrat is C-R-A-P – Computers, Resources, American Banks, and Phone Carriers – which are all levered to the investment recovery, inflation, and deregulation expected over the next year. Before I comment further on those recommendations, though, I want to point out that I like to follow Tom Lee’s thoughts because, like us, he lets the data do most of his thinking, and, like us, he was one of the few pundits last year who actually saw potential for the U.S. stock market.

related: Tyler Bollhorn: Strength in Weekness

![]()

In This Week’s Issue:

– Stockscores’ Market Minutes Video – Trade the Evidence

– Stockscores Trader Training – Strength in Weakness

– Stock Features of the Week – Stockscores Simple Weekly Canada

Stockscores Market Minutes – Trade the Evidence

Traders can easily take trades for emotional reasons, we have to force ourselves to slow down and look for evidence that the trade is the right one to make. That plus my regular weekly market analysis and the trade of the week on GBX. Click Here to Watch

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – Strength in Weakness

Simple approaches to any practice usually work the best. Finding the simple solution is not always easy, doing so can take the most experience. This is true in trading too and one simple concept to keep in mind when trading stocks is that there is strength in weakness (and weakness in strength).

What do you do when you are optimistic about a stock? Assuming you invest in stocks at all, you probably buy. When you are pessimistic, there is a good chance you sell.

Suppose there are 100 people who are allowed to trade the stock market and approach the market in this rational way. If 30 of them are optimistic about the market and 70 are pessimistic then there are 30 potential buyers and 70 likely sellers. The sellers are stronger and will likely push the market lower.

What happens when a pessimist sells or an optimist buys? The seller no longer has shares to sell and becomes a more a person who is more likely to buy in the future. The buyer now has shares and is a more likely seller in the future.

If most people in the market are optimistic, they are also likely owners of the market and less likely to buy in the future. The more optimistic the market, the more likely people will sell in the future.

If most people in the market are pessimistic, they have likely already sold and are therefore likely to be future buyers as prices fall.

Market strength is driven by optimism that is likely to turn to pessimism once prices get high enough. Market weakness is driven by pessimism that will eventually turn to optimism once prices get low enough.

That is why weakness brings strength, and strength brings weakness.

Keep this in mind when analyzing a stock. It is why I don’t like to chase stocks that have been going up for a while. I prefer to buy just when stocks start to go up. I also like to sell just when upward trends are broken rather than sell after a stock has been going down for a while.

You can apply this thinking with a very simple chart analysis method. Use trendlines to define who is in control of the market and then look for a change of control. A downward trend means the sellers are in control so watch for a break of the downward trend to indicate the buyers are going to come in off of the sidelines and turn the market around. There is strength in weakness as long as you get the timing right.

I ran the Stockscores Simple Weekly Market Scan for Canada this week, using the 3 year weekly chart to indicate if a new trend may be developing. Here are two stocks that have a good potential to do well in the months ahead:

![]()

1. T.LAM

T.LAM had a pick up in volume with price strength last week as it moved up through $0.35 resistance. Good turnaround candidate with support at $0.25.

2. T.SJR.B

T.SJR.B recently made a move up through resistance from a rising bottom after breaking its downward trend line last year. It has a 4.34% historical yield and good potential for capital appreciation as long as support at $26.50 is not broken.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

January is a time for reflection and planning. While it’s easy to admit we need to lose a few pounds or watch less TV, matters related to our skills and competence strike closer to home, i.e. closer to our ego. This is where it gets delicate, and also where real learning can lead to genuine progress. Courage always precedes radical honesty, especially when WE are the subject.

In the last ten weeks since I started writing again for the Money Talks blog, this is the kind of beautiful and painful honesty I’ve heard from readers who have contacted us.

“I/we started self-managing in 20XX because our advisor/broker didn’t prevent big losses when X or Y happened, and we felt like our trust was betrayed. Since then, I’ve done pretty well investing in some things, especially if it’s related to my work, but then I get busy with work or family life, and I don’t follow my own rules. Sometimes I struggle with patience and sell too soon. Other times I freeze when a position goes south and I excuse it because I like the company or the sector. That happened in gold/oil/technology stocks, and I sat there and watched $ X just evaporate. I know how this works intellectually, but my emotions take over when it’s real money in real time. And sometimes – like now – I feel like a deer in the headlights, too scared to get invested again because the world looks like it could come unravelled any second. I’ve made some very costly mistakes over the years and we cannot afford to keep making mistakes with our retirement funds. I don’t enjoy doing it anymore, I’m not that good at it, and we’re looking for someone we can trust with our life savings. What makes your firm different?”

All these people have real courage. Some folks are much harder on themselves. It’s both a privilege and a responsibility to hear their stories. Helping real people solve real pain and avoid repeating costly mistakes is what we specialize in…and it’s why we’re passionate about what we do.

Below are some questions for you to ask yourself…and maybe even share with your spouse. This is my Gift of Radical Honesty to those with the courage to unwrap the package. What you choose to do with the gift is completely up to you.

- Do I genuinely enjoy managing our portfolio? Is it deeply satisfying, given the time I’ve invested?

- Have I really made additional gains (or prevented additional losses) that more than make up for the investment fees we’re saving by self-managing? Does this extra return (or loss avoidance) fairly compensate me for my time and energy?

- Is keeping up with market information still fun and stimulating, or has it started becoming more of a burden? Is it bordering on being an unhealthy obsession?

- Have I been “beating the markets” consistently? Is this a realistic or necessary expectation?

- Does the sense of being independent and “in control” outweigh the work required, or is “the thrill” gone?

- Have I been generating the rate of return our family requires? Do I know the return we actually need to achieve our goals?

- Am I able to consistently shut off my “investment mind” and be fully present at work, engaged with family and friends, with enough time left over for personal pursuits? Or do the markets come flooding back into my consciousness whenever I start to slow down?

- Is managing our own portfolio feeding the healthiest parts of me, or has it shifted to highlighting my weaknesses (I’ve lost enthusiasm for this, I’m not very good at this, I keep making the same mistakes, etc.)…and it’s getting painful?

- Do I find myself resenting the time it takes to properly manage our money? Or have I gradually stopped watching things closely and then had things go sour because I wasn’t paying close attention?

- Is the idea of admitting to someone that I need or want help too painful to bear, so I’m just going to try harder, buy another research subscription, and put more time into it…or is it time to ask for help?

- Is managing our own portfolio making me – and those around me – healthier, wealthier and happier?

Please watch Mike’s emails and the Money Talk blog over the next few weeks. I’ll be following this article up with questions to ask yourself about how you might select a new advisor, and questions to ask any advisors you might interview for the job.

Cheers,

Andrew H. Ruhland, CFP, CIM

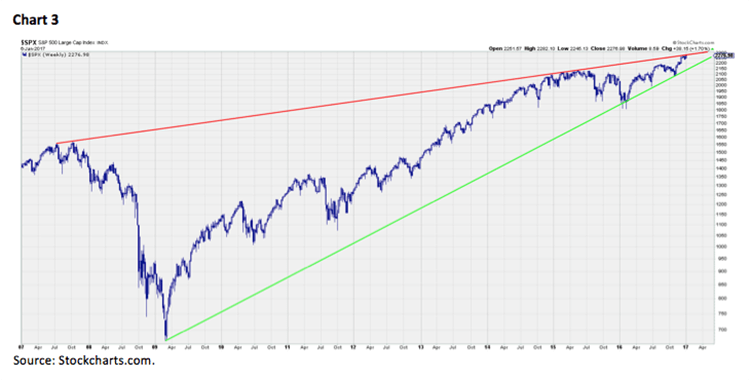

Go through the late 2015/early 2016 articles published on this and similar sites and you’ll find a consensus that 2016 was going to be a really bad year. Corporate profits were falling, business inventories had spiked, and deflation was deepening in Japan and Europe. See More Ominous Charts For 2016 for a longer list of indicators that seemed, a year ago, to portend imminent recession if not full-blown financial crisis.

As David Stockman put it in a late-2015 prediction piece,

The Keynesian Recovery Meme Is About To Get Mugged, Part 1

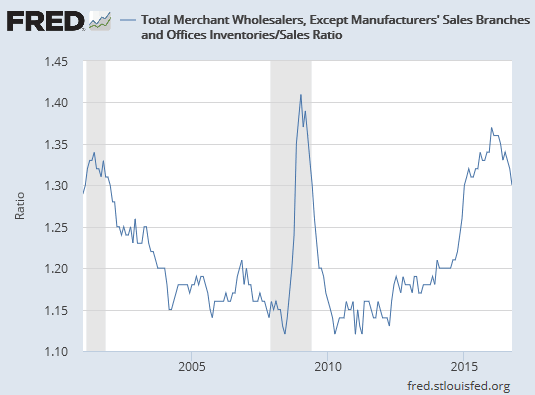

Just consider the most recent data on wholesale sales and inventory. This sector of the domestic economy embodies the leading edge of business activity, meaning that trends in wholesale level sales and inventory stocking are advance indicators of the general macroeconomic outlook.

Needless to say, the soaring inventory-sales ratio is not a sign that “escape velocity” is just around the corner. Contrariwise, whenever the ratio has busted through 1.30X in the past, what came next was a recession.

Recessions happen on the main street economy, of course, when sales weaken and inventories build to the point where liquidation of excess stocks becomes unavoidable. Accordingly, of far greater significance than the 19 labor market graphs supposedly on Yellen’s dashboard is the unassailable fact that wholesale sales have now rolled over.

The natural market driven bounce back from the deep liquidation during the Great Recession is now over and done. Wholesale sales are down 4.5% from their June 2014 peak and have returned to September 2013 levels.

Moreover, it is also well worth noting that at the most recent October 2015 level, wholesale sales are now up at only a 1.6% annual rate from the pre-crisis peak. Surely that does not measure an economy that is healed and heading toward the promised land of full-employment.

So the false conclusion about the US economy’s strength derived from the Fed’s faulty labor market telemetry cannot be emphasized enough.

There has been no Fed driven main street recovery. Instead, the tepid business expansion after the 2009 bottom embodied nothing more than the natural regenerative impulses of our badly impaired but still functioning capitalist system. As the inventories of goods and labor that were thrown overboard during the post-crisis plunge were rebuilt, incomes recovered and the cycle of expansion paddled forward on its own motion.

But that’s now done, and the US economy stands fully exposed to the albatross of peak debt and the gale forces of global deflation.

Yet here we are a year later, with US stocks at record levels, growth apparently accelerating and deflation morphing into modest inflation. What happened? Two things.

First, 2016 was a US presidential election year, and the desire to see incumbents hold power trumped whatever qualms Washington might have had about adding to its debt. So the Feds borrowed another trillion+ dollars, presumably spending it on things designed to make voters want to stay the course.

Second, the threat of deflation terrified governments from Japan to Germany, leading them to push interest rates into negative territory for a wide range of sovereign (and some corporate) bonds. Corporations, as a result, felt compelled to borrow as much as possible even if they had no material use for the money.

All this government/corporate cash sloshing around the global financial system has pushed up equity prices and led to a bit more hiring – though apparently still mostly of bartenders and waiters – that has in turn generated some good headline numbers. See Debt Surge Producing Fake Recovery.

The success of this latest bit of can-kicking leaves critics of the current system with a bad case of prediction fatigue. We’ve been tossing around terms like “unsustainable” and “imminent crisis” for so long that they’ve begun to lose both meaning and credibility.

The only consolation is that this is familiar territory. Bubbles tend to go on until most of their critics have been silenced. Tech stocks, for instance, were clearly a bubble in 1998 but didn’t pop until 2000. US housing became an obvious bubble in 2005 but didn’t pop until 2007. In each case the people who initially pointed out the danger were exhausted and/or ignored by the time they were finally proven right.

Since the current bubble – encompassing fiat currencies, government bonds and related derivatives – is by far the biggest and broadest ever, it shouldn’t be a surprise that it’s lasted well beyond what rational analysis says is possible. But it too will pop. In fact, 2017 is looking pretty bad…

….related: The Greatest Money Manager Alive Attributes The Majority Of His Success To Just This One Thing