Jan 3, 2017

- While the December 31 selling in gold and gold stocks may have rattled gold bugs a bit, the fact is that gold begins 2017 in pretty good shape.

- Big fundamental themes that weighed on the “ultimate asset” in 2016 appear ready to reverse and become supportive for higher price action.

- Please click here now. For much of 2016, the size of the commercial trader net short position was a headwind for gold.

- In recent weeks, that’s been reduced quite significantly.

- Leveraged hedge funds have also reduced their long positions. That’s healthy action because the funds use too much leverage. As a result, modest selling by the commercial traders creates margin calls for the funds, and gold community investors can feel pain too.

- The bottom line is that in terms of the overall positioning on the COMEX, the gold market is in a much healthier position now.

- Please click here now. Top jewellers in Dubai are predicting that the gold jewellery demand cycle is bottoming, and 2017 will see both Indians and UAE residents buying with confidence. This is very good news.

- Dubai is known as the “City of Gold”, and the Shanghai Gold Exchange is very active in building gold market infrastructure there. This partnership is likely to strengthen in 2017.

- In the short term, gold has a rough general tendency to decline ahead of the US jobs report, and then rally after the report is released. The next report comes out this Friday.

- Please click here now. Double-click to enlarge. In the world of fiat currencies, the price action of the US dollar versus the yen has tremendous influence on the gold price.

- There’s a pennant-like pattern in play on this daily chart, and a run to the 125 area looks likely.

- In the big picture, though, there’s a major bull non-confirmation taking place. The dollar is making intermediate trend highs against the USDX index, but not against gold or the yen.

- Please click here now. The commercial traders are buying the safe haven yen aggressively, while the leveraged funds are shorting it.

- For the funds, this is a very dangerous situation, and one that could produce a violent move higher in the gold price at a time when that seems impossible.

- The inauguration of Donald Trump on January 20 could also coincide with a price of 125 on the dollar versus yen chart. If so, the rally in the gold price of the past few weeks could be set to accelerate then, in a very big way.

- Please click here now. The franc is another safe haven currency, and its price action against the dollar has a high correlation with gold’s action against the dollar.

- The commercial traders have an outstanding track record in both the gold and fiat currency markets. They are suddenly buying the Swiss franc against the dollar, and doing so very aggressively.

- Gold bugs should pay attention to current commercial trader liquidity flows, which suggest that a major gold price rally is either imminent, or already underway!

- Please click here now. Double-click to enlarge. Another important correlation for gold investors to follow is the T-bond chart priced in US dollars.

- The T-bond appears to be basing, and commercial traders have also been buyers recently.

- Please click here now. The commercial “smart money” traders are now net long the T-bond. Do they have information that other traders are missing? Perhaps they have some insight into what will happen after Donald Trump gets inaugurated?

- Regardless, they are clearly strong buyers of safe haven francs, yen, T-bonds, and decent buyers of gold.

- Please click here now. Double-click to enlarge this GDX chart.

- I’ve been pretty emphatic that the $18 area is for buying GDX and $22 is for selling. From both a technical and fundamental perspective, it’s logical that gold stocks pause here ahead of the US jobs report. This pause will help them launch a second and more successful assault on the $22 – $22.50 resistance zone, after the report is released!

Thanks!

Cheers

st

Jan 3, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

….related:Gold: Getting There A Little At A Time

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am. The newsletter is attractively priced and the format is a unique numbered point form; giving clarity to each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Posted by Marty Chenard & CNNMoney

on

Tuesday, 3 January 2017 13:58

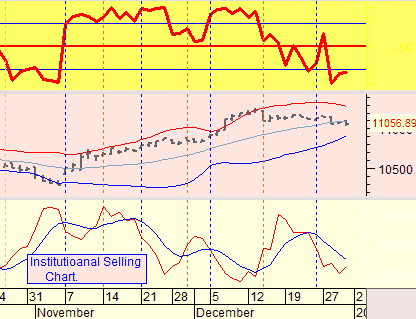

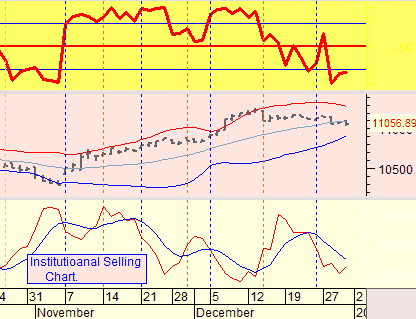

Institutional Selling trend lines showed that it has been trending lower. (Note that less selling is a positive and more selling is a negative.) The top part of the chart showed a small up tick in Upper-Q4 negative territory.

Sounds like good news except that Institutional Buying and Selling activity just showed the first day of Institutional Distribution on Friday’s close.

What now?

This needs be a test day because Institutional Selling had an up tick but it did not make a higher/high tick yet, so Institutional Selling is still technically in a down trend.

…for more on the CNN Fear & Greed Index go HERE

Posted by Forbes

on

Tuesday, 3 January 2017 13:55

It is becoming clear that not only do many scientists dispute the asserted global warming crisis, but these skeptical scientists may indeed form a scientific consensus.

It is becoming clear that not only do many scientists dispute the asserted global warming crisis, but these skeptical scientists may indeed form a scientific consensus.

Don’t look now, but maybe a scientific consensus exists concerning global warming after all. Only 36 percent of geoscientists and engineers believe that humans are creating a global warming crisis, according to a survey reported in the peer-reviewed Organization Studies. By contrast, a strong majority of the 1,077 respondents believe that nature is the primary cause of recent global warming and/or that future global warming will not be a very serious problem.

…continue reading HERE

Posted by The Felder Report

on

Tuesday, 3 January 2017 13:03

Last April I wrote a post about the specific trading style that has made guys like Stan Druckenmiller, Jim Rogers and George Soros so successful. That post focused on a single quote from Druck which I found particularly compelling because it goes against what most investment pundits would tell you is the right way to invest.

Last April I wrote a post about the specific trading style that has made guys like Stan Druckenmiller, Jim Rogers and George Soros so successful. That post focused on a single quote from Druck which I found particularly compelling because it goes against what most investment pundits would tell you is the right way to invest.

But Druck made an even more poignant and timely point in that speech a year ago. He singled out specifically what he believes to be the most important factor behind the returns in risk assets, namely the stock market:

….continue reading HERE

Posted by Mike "Mish" Shedlock - Global Economic Trend Analysis

on

Monday, 2 January 2017 15:09

As we head into 2017, how should one be positioned? Let’s explore that idea with a trio of contrarian indicators.

US Treasuries?

The one idea most widely agreed upon is that Trump will spur inflation and treasuries are the last place to be.

This headline says it all

….continue readng HERE.

It is becoming clear that not only do many scientists dispute the asserted global warming crisis, but these skeptical scientists may indeed form a scientific consensus.

It is becoming clear that not only do many scientists dispute the asserted global warming crisis, but these skeptical scientists may indeed form a scientific consensus.

Last April I wrote a post about the specific trading style that has made guys like Stan Druckenmiller, Jim Rogers and George Soros so successful. That post focused on a single quote from Druck which I found particularly compelling because it goes against what most investment pundits would tell you is the right way to invest.

Last April I wrote a post about the specific trading style that has made guys like Stan Druckenmiller, Jim Rogers and George Soros so successful. That post focused on a single quote from Druck which I found particularly compelling because it goes against what most investment pundits would tell you is the right way to invest.