Economic Outlook

I’m afraid the Trump train is headed for a sharp economic curve that takes the US further away from free-market capitalism. The US already pulled out of the free-market station a long time ago, but Trumponomics moves deeply into a “mixed economy,” an economy in which government funding and private funding are married. The bankster-baron confederation in the Trump cabinet is where business and government consumate their marriage.

My pervious article about Trump’s cabinet lineup demonstrated a major economic shift forming in the presidential cabinet. This article explains what that shift means.

How Trumponomics may radically change the US economy

In Trumponomics, this is worked out by placing corporate giants in direct control over all the reins of government in order to make sure that government is compliant to corporate interests as an effective way of boosting the economy. Trump has stated that most of his infrastructure spending will come from private enterprise, and this confederation assures government funding and business funding align.

While this union empowers rapid economic growth, the downside to Trumponomics is that a mixed economy easily sidetracks from its stimulus intentions to becoming the ultimate form of crony capitalism because government and industry become such intimate partners in development that you cannot tell where one begins and the other really ends. That entices a flow of money from public to private interests. The state risks becoming the weaker partner in this arrangement — a mere servant of corporate needs and wants — because those running the state have their former institutions, lifelong friends and their pocket books at heart.

Purportedly, Trumponomics is for the economic betterment of the entire nation, which is accelerated by combining the strength of state and business as a team in a unified direction. (It worked well for Germany after World War I.) I believe the Donald intends it for the best; but another downside is that Government — instead of having purely regulatory roles (congress and the executive branch) and the judicial role — effectively subsidizes certain businesses in creating the projects that government wants to accomplish.

Trump is proposing that government may, for example, pay half the cost of building a bridge while a private contractor pays the other half in exchange for owning the right to collect a toll at the bridge forever. A bridge can support a toll that will be profitable up to a certain cost of construction. Above that cost, no one will pay the toll. So, the government kicks in the full cost above what industry sees as leaving room for an acceptable margin of profit. Government also helps clear the hurdles for construction. That gets a lot more things done quickly, but at what risks?

Trumponomics is a plan for petal-to-the-metal growth; but it leaves no one regulating businesses when business executives are placed in charge of all the regulatory agencies. Another pitfall is that government, instead of simply assuring a level playing field for all businesses, can slip into favoritism toward businesses that are highly regarded by the corporate executives who assume the government reins of power.

Granted, the US hasn’t had a truly free market for decades. The Fed, which is corporately owned, already rigs the economy constantly by enticing banks to soak up government debt at practically no interest with its promises of buying the debt back from its member banks and by creating money that it gives freely to banks to invest in stocks.

Trump, however, is moving the country further in the direction of a mixed economy. Instead of state ownership of the economy (communism), it is corporate ownership of the state by corporate control of state offices, potentially directing them to the opposite end from what those offices were originally created for as regulatory bodies.

I’m not saying corporate leaders should never hold cabinet positions, but when the cabinet is stacked almost entirely in the direction of Trump placing his corporate cronies in power, it looks very problematic, whether they are truly cronies (as in friends) or just a clutch of high-power corporate colleagues.

The early surprise effects of Trumponomics

Trump is already boosting the economy, and he hasn’t even assumed office. His Wall-Street cabinet lineup and his enormous corporate tax gifts (See “Trump: Titan of Corporate Tax Cuts” and “Trump Tax Plan Turns the Donald into Trickle-Down King.”) coupled to his promise that the government will take out huge sums of debt to buy projects from corporate tycoons have all certainly goosed stock-market expectations. Investors now run long with hopes that Trump’s plans will further inflate the stock market bubble to all-time weather-balloon heights.

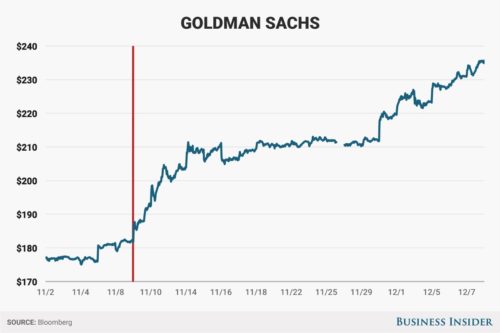

Given how Trump railed against Wall Street in his campaign, it is ironic that Trumponomics has proven most outstanding for Wall Street where bank stocks have risen more than any other sector. Leading the leaders of the pack, Goldman Sachs has absolutely skyrocketed, up a massive 33% since Trump won the election earlier this month:

The financial sector has taken off since the election, on the assumption that a Republican administration will foster a much more lenient regulatory environment than has been in place since the financial crisis…. In particular, Goldman Sachs — a previous employer of several key Trump advisers — has been on a tear…. Indeed, according to legendary trader Art Cashin, about one-third of the postelection increase in the Dow Jones Industrial Average came directly from Goldman Sachs’ performance. (Business Insider)

Three of Trump’s key team members are former Goldman Sachs executives. Several others come from or own other major banks. To be sure, the Trump cabinet looks like a cabal of the world’s biggest bankers, such as you might find meeting in a darkly paneled room at the Hotel de Bilderberg or in Davos, Switzerland.

This all builds a massive amount of steam to power economic growth (and, for that reason, it may be hard for Democrats to totally resist when confirmation time arrives, though they have manifold other reasons to object); but where does the Trump train end up?

To what extent will the corporate interests that now saturate the Trump cabinet come to own government and use its potent economic fuel to power their own engines? Such massive economic changes certainly have the power to change my predicted 2016 schedule for the Epocalypse, made before anyone knew Trump would be the engineer of the nation’s new economic train — vastly different from Obama’s sputtering economy.

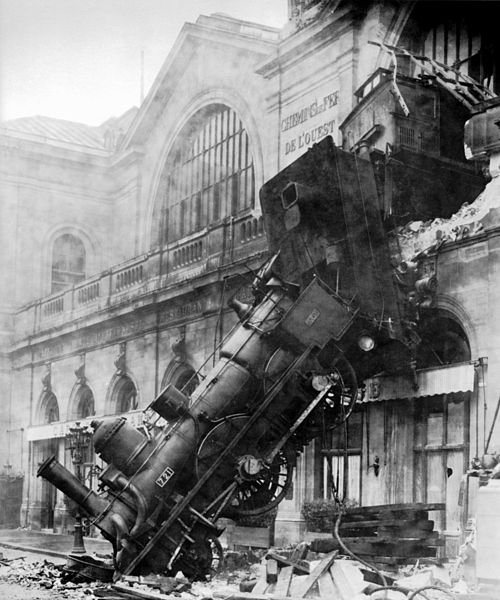

That would be good, except I think the Trumponomics train arrives at the same station only with much more momentum as we power headlong into much greater government debt, crewed by a cabinet rife with conflicts of interest and enticements toward self-serving corporate corruption. We are either counting on the sterling reputation of the nation’s biggest bankers and oil barons to resist temptation or on Trump’s mighty ability to keep this rambunctious train on the rails and out of the swamps of corruption while running the locomotive at a head pressure greater than the engine’s normal operating capacity.

Will we say at the end, “How the mighty have fallen?”

Trumponomics ends in a train wreck if it doesn’t end before it even begins.

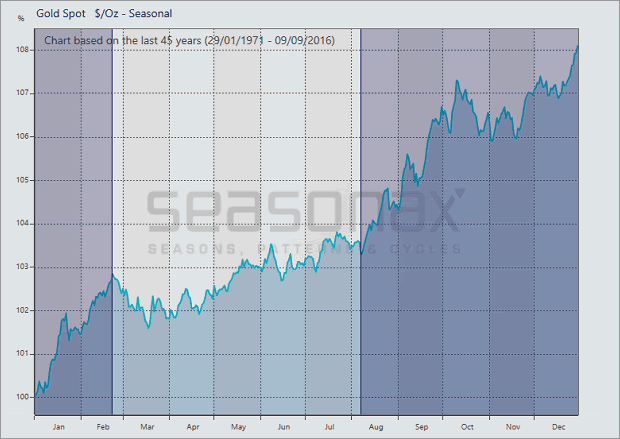

Prices in financial and commodity markets are exhibiting seasonal trends. This applies to the precious metals gold, silver, platinum and palladium as well.

The chart below depicts the seasonal trends of the gold price over a time period of 45 years.

Gold price in USD, seasonal trend over 45 years

The price of gold typically rises from early August until the end of February

Source: Seasonax

Gold prices typically experience a seasonal rally in the second half of the year, with the advance beginning in early August and extending into late February of the following year. The positive seasonal trend in gold prices is highlighted in dark blue.

The gold price has increased until the end of February in 29 out of 45 cases

Gold prices have risen in 29 out of 45 cases during the seasonally strong period. In the 29 rally years, the average gain over this time period amounted to 17.85%, while the average loss in the 16 years exhibiting declines amounted to 8.17%. An especially large gain of 133,25% was recorded in 1979. The largest loss occurred in 1976, but amounted a much smaller 20.36%.

The bar chart below shows the gains and losses gold has posted during the seasonally strong time period in every year since 1971 (green bars represent gains, red bars losses):

Gold in USD, return in percentage points between August 7 and February 21 for every year since 1971

Gains (green bars) significantly exceed losses (red bars).

Source: Seasonax

Evidently, gains in gold prices are both more frequent and larger than losses during the seasonally strong period. However, between 1980 and the late 1990s, no large returns were generated during this time period, as gold was mired in a large-scale bear market.

Festivities are driving the gold price

The main reason for the positive seasonal gold price performance between early August to late February are various festivities, including Christmas, the Chinese new year celebrations and the Indian wedding season. Gold is frequently given as a gift on these occasions. Jewelry makers and merchants tend to stock up on gold prior to the festivities, and tend to push up gold prices in the process. Around two thirds of annual mine production are used by the jewelry trade.

Silver: shooting star at the beginning of the year

Silver’s industrial metal characteristics are far more pronounced than those of gold. The next chart illustrates the seasonal trend of the silver price.

Silver price in USD, seasonal trend over 45 years

Silver tends to exhibit a rapid seasonal rally at the beginning of the year

Source: Seasonax

As you can see, the seasonal price trend of silver is completely different from that of gold. Silver typically rises rapidly at the beginning of the year. It has done so in 30 out of the past 46 years. Gains of up to 47.35% were posted – in a mere 26 trading days from the beginning of the year until February 19.

Industrial metals are subject to seasonal trends of their own

Interestingly, platinum and palladium prices are also recording strong seasonal gains at the beginning of the year – instead of from August onward like gold. In other words, industrial demand is the dominant driver of their seasonal price trends. Very likely many industrial users tend to place their buy orders early in the new financial year.

While such calendar-driven business practices appear detrimental if one wants to obtain the best possible prices, annual planning and ordering procedures are often aligned with the financial year. Purchasers of precious metals may not be aware of the seasonal price trends, may be ignoring them because their in-house procedures are taking precedence.

Take advantage of the seasonal trends in precious metals!

As an investor or trader you can take advantage of the seasonal trends in precious metals in order to improve the timing of your purchases and sales and to manage the appropriate level of investment. Over time, this should result in obtaining more favorable prices. Keep in mind that seasonal price trends are averages and deviations are possible in some years. Nevertheless, seasonal trends can benefit you by making probability work in your favor.

Over the past year, central banks, commercial bankers and prominent economists have expressed the view that digital money and transfers should replace large denomination cash and cash transactions. This dramatic transition has been fostered under the guise of the public interest in an effort to curb terrorism, tax evasion and criminal activity. Many observers contemplate more sinister motives that involve increased government control of economic activity. The latest country to engage in this ‘war on cash’ is India.

Over the past year, central banks, commercial bankers and prominent economists have expressed the view that digital money and transfers should replace large denomination cash and cash transactions. This dramatic transition has been fostered under the guise of the public interest in an effort to curb terrorism, tax evasion and criminal activity. Many observers contemplate more sinister motives that involve increased government control of economic activity. The latest country to engage in this ‘war on cash’ is India.

In a TV announcement on November 8th, India’s Prime Minister Narendra Modi announced that the Reserve Bank of India’s large denomination 500 and 1,000 rupee bank notes, worth some $7.5 and $15 respectively, would lose their status as legal tender on midnight on December 31, 2016. That meant holders of those notes (which represent 86 per cent of the value of all outstanding rupee notes) had less than two months to exchange the notes for smaller new notes, or lose out completely. The government also mandated than any large exchanges had to be accompanied by tax returns in order to prove that the cash generated had already been taxed.

The shock waves from this announcement fueled fear and panic among the Indian population which is heavily cash-oriented. As few people have bank accounts and banks are thinly spread in rural areas, many Indians have been left holding paper currency redeemable only in banks which often are difficult to access. To make matters worse, banks soon ran out of small denomination notes. The result was chaos, rioting and trauma-induced deaths. Millions of poor Indians were unable to buy necessities or transact business. Many merchant shops had no alternative but to close.

The BBC’s website notes that India, the world’s seventh largest economy “…is overwhelmingly a cash economy, with 90% of all transactions taking place that way.” At a sudden single stroke a socialist Prime Minister has converted most of the nation’s private cash into bank deposits subject to direct governmental controls including spending and withdrawal limitations. Furthermore, the new bank deposits can be leveraged up as bank loans to government and to allow banks to purchase government bonds to finance social programs.

It remains to be seen how severely India will be hit and what effect it will have on the international economy. With much of the world focused on the U.S. Presidential election, this Indian currency event was little reported in the western media.

The Indian action was a largely unexpected escalation of the ‘demonetization’ movement that has been spreading through the U.S. and Europe. This past year, Larry Summers proposed the withdrawal of the $100 bill and the ECB announced an end to printing 500-euro notes. The idea has been supported widely. With the notable exception of The Wall Street Journal, major news media including The Economist, The New York Times and a recent Harvard paper have called for the elimination of high denomination currency.

It could hardly be coincidental that just this week Nicolas Maduro, the bumbling socialist dictator of Venezuela, surprised his nation with monetary changes that are nearly identical to those being pursued by India. The collapsing Venezuelan economy already had the highest inflation rate in the world, and its starving citizens have had to transact what little commerce they can with ever larger stacks of nearly worthless currency. But to add insult to injury, Madura just deactivated the 100 Bolivar note, the country’s largest note denomination, which until recently had a value of just 3 U.S. cents. Although the government predictably claimed that the move was aimed at speculators and foreign capitalists, it will be the poorest Venezuelans who will suffer most acutely.

As in India and Venezeula, the reasons given for the elimination of cash is to protect citizens from terrorism, tax evasion and crime. Of course, when all financial transactions have to flow through banks, they can be monitored easily. Undoubtedly this does hinder some aspects of terrorism, tax evasion and crime. But the real reasons for demonetization are given far less oxygen. The move is spurred by the need to protect the ever larger “too big to fail” banks and the ability of governments to control and even legally utilize the private wealth of citizens. Cash can be sheltered from government, bank deposits cannot.

The advent of zero and negative interest rates has reduced investment reward and resulted in a tax on savings. In a low, or negative, rate environment, those with cash have little if any financial incentive to hold money in banks. Cash hoarding is the logical alternative. In economic terms, hoarded cash becomes dead money. Outside the system it contributes nothing to economic activity. Specifically, it deflates the velocity of monetary circulation, a vital element of economic growth. Perhaps more importantly to a technically insolvent banking system, deposits withdrawn from banks, especially when combined with a rising rate of non-performing loans, can result in potentially fatal capital shortages. In today’s over-leveraged and derivative-infused financial markets, a serious banking failure could escalate like lightning and threaten the entire international financial system.

In their 2015 rescue of Cypriot banks, the IMF, ECB and western politicians effectively devised the ‘bail-in’ as a new, less visible alternative to politically unpopular citizen bank bailouts. In a bail-in, it is the shareholders, bondholders and, ultimately, bank depositors who are called upon to fund an insolvent bank rather than injecting public funds. Despite the precedent of Cyprus, it remains surprising how many citizens remain blissfully unaware that when they open an account, they become creditors of the bank. Despite retaining rights to the funds, they no longer own the monies.

In addition, if excessive government borrowing results in a collapse of government bond markets and a potentially crippling rise in interest rates, legislation mandating that each citizen hold a certain percentage of their wealth in government bonds would not be unrealistic. With digital money, bank computers can execute such commands quickly and easily. The depositor has no recourse other than the ballot box.

While cash hoarding may offer added security to cash holders, as dead money it results in politically harmful damage to economic growth rates rendering banks more vulnerable. It follows that the increasingly ferocious and aggressive war on cash is a sign that central banks may see a dangerously deteriorating situation, one that has led to a feeling of desperation by governments and a strong wish to establish a legal means to control the wealth of citizens. They appear to be using political statements by banks, economists and the mass media to secure a meek surrender to a cashless society and the potential utilization of citizens’ accumulated cash wealth by legal means.

Cash is an efficient, free, and private means of payment for ordinary citizens, particularly those without the funds to pay ever-increasing bank charges. Following the January 2016 World Economic Forum in Davos, the war on cash appeared to intensify. At that meeting, PayPal’s CEO, Dan Schulman, claimed that 85 percent of transactions, by volume rather than by value, are in cash. Regardless, at the same conference, Deutsche Bank co-CEO, John Cryan, described cash as “terribly inefficient.” He predicted that we would “probably” see no more cash within the next ten years.

Already, some major countries have limited cash transactions for law abiding citizens. In Italy, the legal limit for cash purchases is some $1340, in France the limit is 1,000 euros. Even in the UK, any cash transaction above some 15,000 pounds must be reported to the Inland Revenue. In the U.S., the mandated reporting figure to the Internal Revenue Service is $10,000.

Some notably highly leveraged banks including Deutsche and UBS have called for the elimination of cash, while Citibank has eliminated cash in some of its Australian branches. As early as 2015, JPMorgan Chase warned that it would no longer accept cash in its safe deposit boxes. Separately, Chase said it was restricting cash payments for credit cards, mortgages, equity lines and auto loans.

The Indian government’s capture and compulsory transfer into bank accounts of some 86 percent of its citizens’ cash was a shock to Indians and to informed people around the world. It will be studied for lessons learned by the western nations as they pursue their own wars on cash. Likely they will take a more gradual approach, supported by mass media and senior bankers’ statements to support their assaults on the cash of compliant citizens. Whereas recently impoverished Indians may turn to silver, those in the developed world may look increasingly to gold as a store of wealth.

The extent and speed of the exercise of governmental power to restrict the use or to control the accumulated wealth of citizens never should be ignored or underestimated.

FCC Releases Canadian Agriculture’s Productivity and Trade Report

For 2016 to date:

Agri-Equities: +18%

S&P 500: +11%

NASDAQ: + 9%

Farm Credit Canada (FCC) has released its latest Canadian agriculture productivity and trade report.

The purpose of the report is to look at the overall performance of Canadian agriculture and world markets.

FCC chief economist J.P. Gervais explains what sets Canada apart from other countries when it comes to productivity.

“We’re the fifth largest exporter when it comes to agriculture commodities in the world. The idea that we’ve been able to grow production on our farms faster than the rate of growth of farm inputs. Because of that we manage to grow our exports in world markets, that’s what really sets us apart in when it comes to expanding our success in the world markets,”

Gervais notes that 30 per cent of Canada’s income in the ag sector comes from exports to the United States, although that could change in the future.

“We have diversified the importance of the US market, we’ve diversified away from the US, in terms of relying on the US as an export destination over the last few years. I think we’re going to be able to continue doing the same, I think it’s a good strategy, we’re going to always the United States for probably a long time, but diversifying away from the US is actually a pretty good thing,” Gervais said.

Canada was the world’s fifth largest agriculture exporter in 2015.

The Federal Reserve has raised a key interest rate in response to a solid US economy and expectations of higher inflation, and it foresees three rate hikes in 2017.

The Federal Reserve has raised a key interest rate in response to a solid US economy and expectations of higher inflation, and it foresees three rate hikes in 2017.

Key points:

- The US Federal Reserve raises the interest rate from 0.5 per cent to 0.75 per cent

- It is the first time in a year that the interest rate has been raised, and the second time since the GFC

- Analysts predict a faster pace of increases in 2017 as the Trump Administration takes over

The Fed’s action will mean modestly higher rates on some loans.

The central bank announced after its latest policy meeting that it is increasing its benchmark rate by a modest quarter-point to a still-low range of 0.5 per cent to 0.75 per cent.

The Fed last raised the rate in December 2015 from a record low near zero set during the 2008 financial crisis.

The Fed’s move, only the second rate hike in the past decade, came on a unanimous 10-0 vote.

It also released an updated economic forecast that showed modest changes to its outlook for economic growth, unemployment and inflation, mainly to take account of stronger growth and a drop in the unemployment rate for November to a nine-year low of 4.6 per cent.

Its new projection has the unemployment rate dipping to 4.5 per cent by the end of 2017 and remaining at that level in 2018.

The Fed foresees economic growth reaching 1.9 per cent this year, slightly above its forecast in September, and 2.1 per cent in 2017. The new prediction is slightly more optimistic than it projected in September.

The Fed kept its long-term estimate for economic growth at 1.8 per cent, far below the 4 per cent pace that President-elect Donald Trump has said he can achieve with his program of deregulation, tax cuts and increased spending on infrastructure.

The Fed’s estimate that it will raise rates three more times in 2017 is up from an estimate of two increases at the September meeting.

Its policy statement showed only modest changes in wording from the previous meeting. It said “economic activity has been expanding at a moderate pace since mid-year” helped along by solid job growth.

Mr Trump’s plans for tax cuts and infrastructure spending have led investors to expect that inflation will pick up in coming months.

Pick-up fuels hopes economy will keep rising ….continue, reading view video HERE

…related from Larry Edelson: The Two Biggest Debt Caverns in the World

…related: Can we expect as many as six rate hikes?