Mike's Content

Despite the uncertainty of another anti-EU vote in Italy, the 3rd largest European economy and 4th largest debtor nation in the world the markets shook it off and rose sharply. What happens next if a total collapse of the EU is said could evolve into “the most violent economic shock in history”

…more from Michael: The lesson of Cuba – Which System is better – it’s not even close

The Euro/Dollar was exposed to extreme levels of volatility during trading on Thursday following the European Central Bank’s market shaking decision to taper its monetary stimulus to the Eurozone from April 2017 until the end of December 2017 or beyond. Although the central bank has decided to maintain its monthly purchases by 80 billion euros until March 2017, the reduction to 60 billion euros from April 2017 till year end could spark fears of a taper tantrum potentially sabotaging growth and pressuring the ECB to take further actions. With concerns still elevated over the health of the European economy and mounting political instability from Italy weighing heavily on sentiment, investors may turn to Draghi for further clarity on why the ECB made such a move.

The Euro/Dollar was exposed to extreme levels of volatility during trading on Thursday following the European Central Bank’s market shaking decision to taper its monetary stimulus to the Eurozone from April 2017 until the end of December 2017 or beyond. Although the central bank has decided to maintain its monthly purchases by 80 billion euros until March 2017, the reduction to 60 billion euros from April 2017 till year end could spark fears of a taper tantrum potentially sabotaging growth and pressuring the ECB to take further actions. With concerns still elevated over the health of the European economy and mounting political instability from Italy weighing heavily on sentiment, investors may turn to Draghi for further clarity on why the ECB made such a move.

…read more plus analysis on Crude & Gold

also:

tock Trading Alert originally sent to subscribers on December 8, 2016, 6:52 AM.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

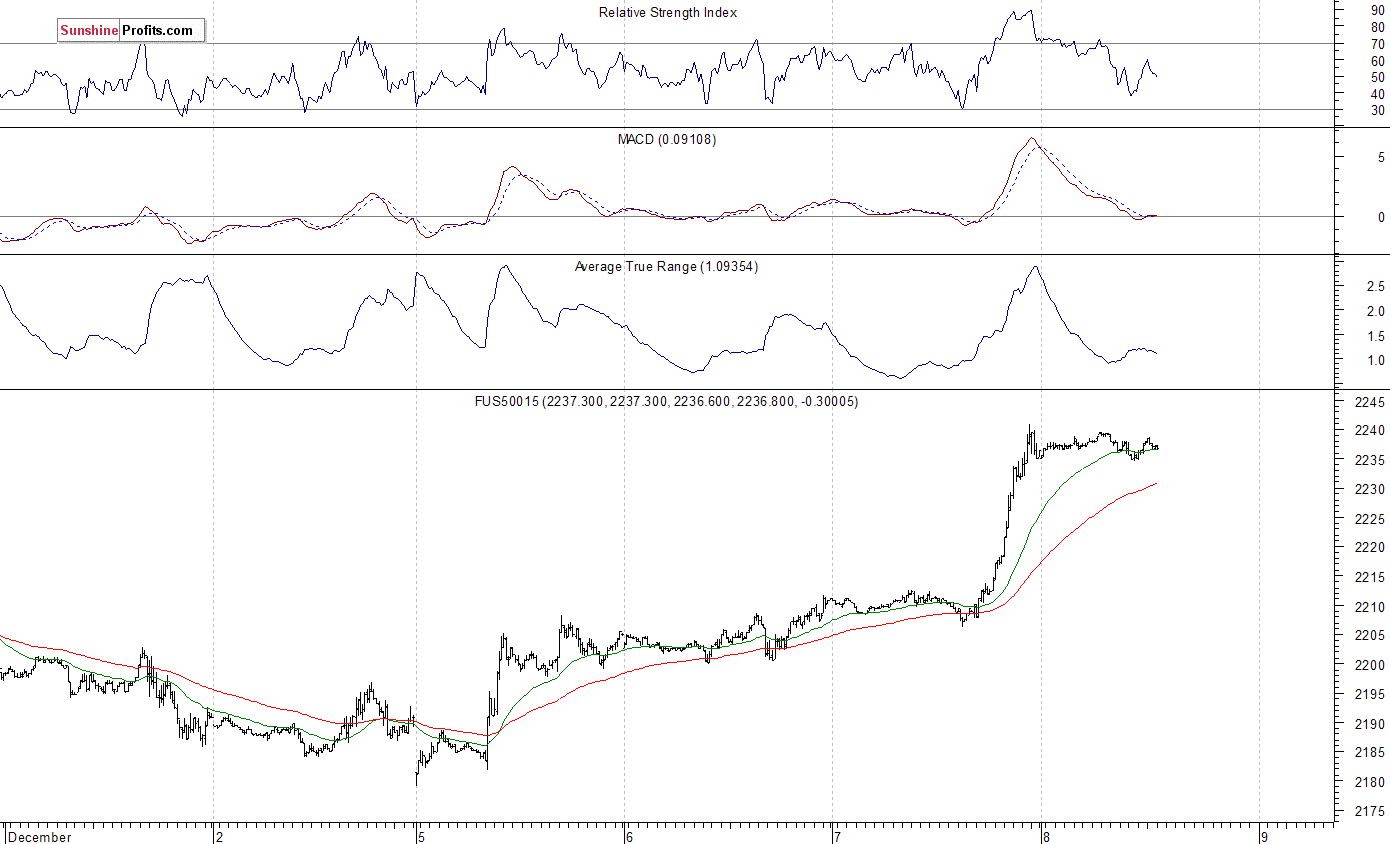

The main U.S. stock market indexes gained between 1.3% and 1.6% on Wednesday, accelerating their short-term uptrend, as investors’ sentiment improved. The S&P 500 index has reached new all-time high at the level of 2,241.63. The nearest important support level is at around 2,215-2,220, marked by previous resistance level. The next support level remains at 2,200. The market broke above its medium-term upward trend line, as we can see on the daily chart:

Expectations before the opening of today’s trading session are virtually flat. The European stock market indexes have gained 0.1-0.3% so far. Investors will now wait for the Initial Claims number release at 8:30 a.m. The S&P 500 futures contract trades within an intraday consolidation following yesterday’s rally. The nearest important level of resistance is at around 2,240, marked by new record high. On the other hand, support level is at 2,230-2,235, and the next support level is at 2,210-2,215, marked by recent local highs:

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades within an intraday consolidation following yesterday’s rally. However, it remains relatively weaker than the broad stock market, as it trades below last months’ local highs along 4,900 mark. The nearest important level of resistance is at around 4,850. On the other hand, support level is at 4,780-4,800, marked by previous resistance level, as the 15-minute chart shows:

Concluding, the broad stock market has reached new all-time high yesterday following a breakout above short-term consolidation. We still can see technical overbought conditions. However, there have been no confirmed negative signals so far. Our speculative short position has been closed yesterday, at the stop-loss level of 2,240 (S&P 500 index). We lost 63 index points on that trade, betting against short-term uptrend off early November local low. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

…..also: WORLD ECONOMIES IN TROUBLE: Middle East Oil Exports Lower Than 40 Years Ago

In a bout of intense volatility, the euro swung from a sharp gain to a steep decline Thursday after the European Central Bank said it would begin tapering its massive monthly bond-buying program in April.

In a bout of intense volatility, the euro swung from a sharp gain to a steep decline Thursday after the European Central Bank said it would begin tapering its massive monthly bond-buying program in April.

The ECB’s decision surprised many market strategists and investors who had expected the central bank to extend its program of buying public and private eurozone debt at its present pace of €80 billion ($80.6 billion) for most of 2017. Instead, the central bank announced it would taper the program to €60 billion ($64 billion) beginning in April. The central bank also left interest rates unchanged, as expected.

Looking ahead, the Federal Reserve is widely expected to raise interest rates at the close of its two-day policy meeting on Wednesday. Fed-funds futures, used by investors to speculate on the direction and pace of rising interest rates, were pricing in a more than 97% probability of a hike next week.

…also: How Italy’s ‘no’ vote might be the ECB’s silver lining

Don’t get me wrong: The time is edging ever closer when the precious metals and miners will again explode higher. It could be soon, or, it could be from below $1,000 gold in the first quarter of the new year that’s coming.

Don’t get me wrong: The time is edging ever closer when the precious metals and miners will again explode higher. It could be soon, or, it could be from below $1,000 gold in the first quarter of the new year that’s coming.