Eden Rahim of Toronto-based Next Edge Capital has had his share of multibagger and grand-slam successes, and is one of the few mutual fund managers who feels comfortable investing in micro-cap biotech names side-by-side with billion-dollar biotech stocks. In this interview with The Life Sciences Report, Rahim describes a group of micro-, small- and mid-cap biotech names possessing powerful growth drivers that could perform even when the overall market is not so hot.

The Life Sciences Report: After China’s shares began selling off in early January, investors all over the globe began dumping shares of everything, especially healthcare and biotech. You have managed biotech portfolios since 1994, and you put on hedges so your downside is limited. How did you do during the downturn? Did it take you by surprise?

Eden Rahim: Admittedly, I did not see the intensity of the selling that began in January, compared to when stocks began to slide last August. I was nervous at that time and wrote options against 11 of the fund’s largest holdings. I also had a few hundred IBB (iShares Nasdaq Biotechnology Fund [IBB:NASDAQ]) and XLV (Health Care SPDR (ETF) [XLV:NYSE.Arca]) puts on the portfolio. When the market took that first leg down of 30%, the portfolio weathered the storm really well.

Traditionally, January and February have been a favorable season for biotech, so coming into this year I had small hedges in place, and my cash was only around 10% versus close to 20% back in August. This downturn really came as a surprise.

TLSR: What precipitated the selloff?

ER: It started when the U.S. Federal Reserve raised interest rates a quarter of a percent in mid-December. Rates were near zero, and that was the first hike in nine years. Personally, I would have thought that hike was fully priced into the market, but strangely, the market acted as if it was a complete surprise. Market breadth began to weaken.

Part of the market reaction might have been due to the rhetoric that this was going to be the first of many hikes. When that talk began, we saw the risk-off trade really come to fruition, so that any emerging market—any high-yield debt, any high-beta asset, even housing stocks—came under intense pressure. This included biotech. Biotech, having the longest duration of all asset classes, suffered the brunt of it.

TLSR: How do individual investors maneuver in these situations?

ER: Individual investors are as empowered as I am to hedge their portfolios. In the fund, we use options on the XLV and on the IBB. Investors can use these for protection in their own portfolios. For biotech, you can also sell (write) options against your positions. You can write one-month, out-of-the-money options, and once they go far out of the money, you can cover and rewrite another month. The individual investor is as empowered as a portfolio manager to do these things.

TLSR: Are you ever long the IBB ETF, or do you just use its options?

ER: The fund can be long the index, but generally is not because the portfolio is comprised of fairly high-beta stocks in the mid-cap area, where the fund is focused. If you look at the weighted volatility of the individual portfolio positions, they are roughly 70%, versus ~35% for the IBB. But the portfolio volatility is still less than the IBB’s because of the use of options to mitigate some of that unpredictability. That’s the advantage.

The fund generally uses the IBB options as a counter to the existing portfolio direction because, given the beta of the stocks held—primarily Phase 3 companies—in a market rally such as I think we might embark upon soon, they will have a beta of two or three times the IBB. I’m comfortable being there. Generally, the IBB is a hedge, but as your question implies, it doesn’t have to be. Never say never.

TLSR: You perform meticulous fundamental analysis on biotech stocks, but you are also an elf, as Louis Rukeyser used to call his technical analyst guests on Wall Street Week. I want you to put on your elf’s hat for a moment. You sent out an e-mail on Feb. 10 that included a chart showing the IBB index over a 15-year period. You highlighted the huge biotech rallies following periods when only 0–4% of biotech stocks in the IBB were above their 50-day moving averages. What percentage of biotech stocks in the IBB are above their 50-day moving averages today, and what does that bode for the future?

ER: Technical analysis is an important tool for biotech because of the extent to which shares and biotech indices oscillate between feast and famine. I look at a number of indicators.

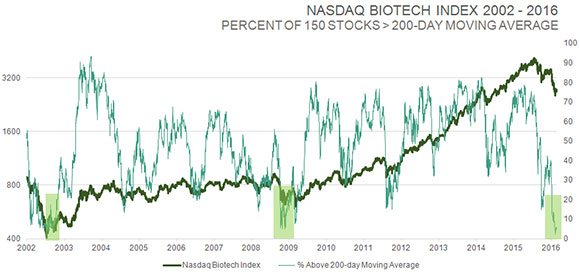

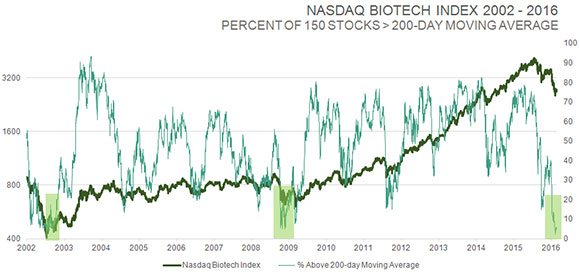

Biotech has achieved a very rare oversold level, by many measures. Looking at one of those indicators, such as the 150 stocks in the NASDAQ Biotech Index, only 3% of those stocks were above their 50-day moving average when I sent out that e-mail. That’s the second lowest reading going back to 2001. It hit zero at the very bottom during the crash in 2008, but then again, every market class hit zero at that point. Now, ~6% of stocks in the IBB are above their 50-day moving average, and that’s probably going to go much higher because we are dealing with an elastic band that is stretched at the moment.

But there are other measures as well. The percentage of those same stocks above the 200-day moving average has dropped below 10% to the lowest reading in 14 years, at the bottom of the two-year bear market in 2002. A similar reading in 2008 occurred after the stock market was down more than 50%; the conditions were pretty extreme at that time. That’s the magnitude of extreme oversold readings you are seeing with biotech stocks right now.

TLSR: Having ~6% of stocks in the IBB above the 50-day moving average is a bullish signal from your point of view?

ER: Right. That elastic band could really snap hard off this low. Sometimes, when the market is selling a sector with impunity, you’re not sure where it ends, but usually it ends when you start to see off-the-chart readings like this, because they only happen once every six or seven years.

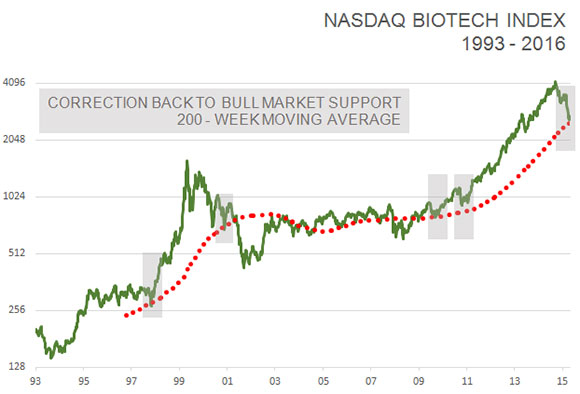

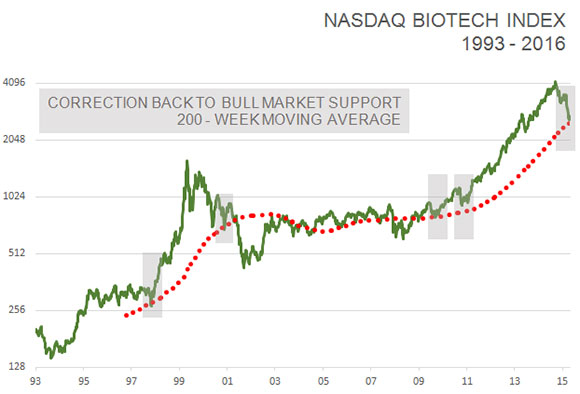

Furthermore, the NASDAQ biotech index has corrected back to its 200-week moving average for the first time since the bull market began in 2011. It has served as a good starting point for new bull markets four out of the past five times since 2002.

TLSR: Even the worst markets come back eventually. But small-cap biotech investors worry that this kind of weakness will impede the progress of the companies they own. It gets harder to raise capital, new funding comes with less favorable terms, and initial public offerings (IPOs) are nearly unheard of in this kind of market. Even with a market snap-back, is this going to have a damaging effect on very small companies?

ER: After periods like this, small companies remain in the wilderness for some time. That is because you can buy Phase 3 companies pretty cheaply that have already passed key data point barriers, or that are close to commercialization, and hold large cash balances. But there are exceptions. One small company I like has been very resourceful, and has managed to achieve a lot with limited financial reserves. That is a testament to management.

TLSR: Go ahead and talk about that company.

ER: My focus tends to be on larger mid-cap, late-stage development companies, but I do like RepliCel Life Sciences Inc. (RP:TSX.V; REPCF:OTCQB), a micro-cap, Canadian, regenerative medicine company with a novel technology developing autologous cell therapies. What’s interesting about RepliCel is that it has four novel programs on the go, and management has secured a partnership with Shiseido Company Ltd. (4911:TYO) in Japan to fund its alopecia trials.

“Individual investors are as empowered as the portfolio manager is to hedge their portfolios.”

RCH-01 for pattern baldness could be on the market in 2018. The company has developed a dermal injector device, RCI-02, to pair with its therapeutic approach. It will file for CE mark approval of the dermal injector in the European Union (EU) later this year, and I think the product will be on the market in Europe in 2017. Management has been able to derisk this little company in a way many small companies haven’t been able to do.

TLSR: Tell me a little about the dermal injector, RCI-02.

ER: It’s a novel instrument with extreme precision that sources the cells in the scalp. It has an analgesic delivery capability built in so it can simultaneously anesthetize the skin and obtain autologous dermal sheath cells. It will have many applications. It will be on the market in Europe first, and then in the U.S. RepliCel won’t market the product itself, but will partner that out. The company could have the alopecia therapy on the market in Japan in 2018, and the dermal injector could be on the market in the EU in 2017.

TLSR: What should investors anticipate as a share-moving catalyst for RepliCel?

ER: The device is a catalyst. Even though RepliCel will have data in the alopecia and tendon repair indications, later this year I think the dermal injector may carry more weight because the market may realize it represents the fastest route to commercialization and revenues, which would help the company mitigate some of its cash burn. The adoption and costs to market the device are much less than they would be for developing and commercializing a therapeutic.

TLSR: Another name, please.

ER: Alzheimer’s disease is a significant unmet medical need. We also know that it’s been a graveyard for drug developers as the cadavers of failed trials are everywhere. There hasn’t been a drug approved for Alzheimer’s since 2003. Current products on the market are not disease-modifying agents—all they do is provide symptomatic relief.

Another dominant approach is to use antibodies to cross the blood-brain barrier and break up the amyloid beta protein plaque. That, too, has been a graveyard, but that is the approach that Biogen Idec Inc. (BIIB:NASDAQ) and Eli Lilly and Co. (LLY:NYSE) are taking. Axovant Sciences Ltd. (AXON:NYSE) has RVT-101, a selective 5-hydroxytryptamine receptor antagonist, in Phase 3, and H. Lundbeck A/S (LUN:CPH) is taking a similar approach to promote the release of the neurotransmitter acetylcholine.

“Biotech has achieved a very rare oversold level.”

But I have come across a micro-cap company called Neurotrope BioScience Inc. (NTRP:OTCQB), and find it intriguing. The company has a drug called bryostatin-1, which crosses the blood-brain barrier to activate protein kinase C-epsilon and upregulate brain-derived neurotrophic factor, which has been associated with synaptogenesis, or synaptic regrowth. There was such activity seen in a small Phase 1 study that several patients were granted an FDA-approved compassionate use protocol to continue using the drug. That’s what got to me. I like the novel mechanism of action. I think this company is extremely undervalued, with a market cap of ~$20M.

TLSR: The company started a Phase 2 trial with 150 patients in November 2015. Will we see data—a catalyst—this year?

ER: Yes. The Phase 2 is double-blind and placebo-controlled, and there will be three- and six-month treatment arms. The three-month arm should read out top-line data by year-end, and the final six-month data are due mid-2017. From an investor perspective, we are not talking about a long time. A lot is already known about the safety of bryostatin-1. If the data bear out, it could prove to be a disease-modifying agent, which is the Holy Grail in Alzheimer’s. This is a position that I like very much.

TLSR: With Neurotrope’s very small market valuation, is this stock a significant position for you?

ER: Yes; I’ve been accumulating it over the last three months. The company did a private placement in November and raised $15M, which will fund the Phase 2 trial. Some warrants were included, which could provide additional funding even if the market shuts down.

TLSR: Two other indications for bryostatin-1 are in preclinical studies, for Fragile X Syndrome (FXS) and Niemann-Pick Type C (NPC) disease. Those are orphan diseases, and they seem like ideal candidates for nondilutive funding. Has there been any activity or funding from government or advocacy organizations?

ER: Not yet. But these disease indication candidates could attract nondilutive funding. This drug has been tested in humans for more than a decade, in many oncology trials. It was licensed from the Blanchette Rockefeller Neuroscience Institute, where it was in Phase 2 clinical studies in Alzheimer’s patients in 2008. That’s how Neurotrope knows so much about its safety, and why it thinks the drug has potential indications in Fragile X as well.

I see Neurotrope as being extremely undervalued, given the large unmet medical need. That the FDA is already familiar with the activity of bryostatin-1 and that it has allowed compassionate use for the drug is very telling for me.

TLSR: You have an interest in companies involved in central nervous system disease. I know you follow another company in this area. Would you talk about it?

ER: Sure. BrainStorm Cell Therapeutics Inc. (BCLI:NASDAQ) is a regenerative medicine company with its lead indication in amyotrophic lateral sclerosis (ALS). Brainstorm’s lead agent is NurOwn (autologous mesenchymal stem cells [MSCs] engineered to express neurotrophic growth factors [NTFs]). On Jan. 11, the company published its Phase 2a data in JAMA Neurology. There was some confusion surrounding those data because another party made lofty promises, and that created some confusion. The stock spiked up and then fell back down. There is a Phase 2b trial underway now.

TLSR: There were 14 patients in the Phase 2a trial. Of that total, 13 patients, or 87%, got a response to either the ALS Functional Rating Scale or forced vital capacity. The Phase 2b trial has enrolled 48 patients. Do you expect that to be a catalyst?

ER: Yes. We are supposed to see data at the end of Q2. If the company can corroborate in a controlled setting the response it saw in the Phase 2a trial, that could be a tremendous value driver.

TLSR: Brainstorm has good relative strength compared to other biotech stocks. Investors must be anticipating good news. Do you see it that way?

ER: Yes. The market may be looking through the valley for value-transforming binary events over the next quarter or two.

TLSR: Could you go to another name, please?

ER: Cipher Pharmaceuticals Inc. (CPHR:NASDAQ; CPH:TSX) is a name I like a lot. It sold off sharply: It experienced valuation compression as all specialty pharma companies did, and that was compounded by the fact that it had growth pains associated with its core product, Absorica (isotretinoin), for severe acne. But Cipher bounced back when the company announced its new drug submission for Sitavig (acyclovir mucoadhesive buccal tablets), a herpes/cold sore antiviral, was accepted by Health Canada for review.

TLSR: Absorica being Cipher’s core product, can it grow this company’s cash flow?

ER: I think Absorica has plateaued for a while, and that’s part of the negative reaction. Cipher collects roughly a 9% royalty on sales. Sun Pharmaceutical Industries Ltd. (SUNPHARMA:NSE), through its acquisition of Ranbaxy, is now spearheading this product, and it has made some inroads. In early December, Sun announced that Olympic gold medalist snowboarder Kelly Clark would be spokeswoman for Absorica. She has a presence, and the company has big plans for Absorica, but I haven’t factored that into my models as yet.

TLSR: This company now has a ~$117M market cap, and it can be owned by small-cap institutions. Do you factor that into your thinking?

ER: Yes, I do. A turnaround is definitely in place for this stock. The company has been dramatically derisked. It’s going to be in the penalty box for a quarter or two, but after that, if it executes on its turnaround plan, Cipher could be substantially revalued. Growth in this market will eventually go to a premium as institutions come in. It’s a slow-growth world, but if you can show good organic growth, the market will eventually pay up.

TLSR: Another name?

ER: Microbix Biosystems Inc. (MBX:TSX) is a very small Canadian name. The base of business is selling infectious disease antigen reagents, and its specialty is in tropical disease diagnostics. The company will deliver about $9M in revenues this year in that business. It has about 50% gross margins, about $3M in EBITDA (earnings before interest, taxes, depreciation and amortization). The reason its current valuation is so cheap, at about CA$21M, is that management hasn’t delivered on certain expectations. The company is in the penalty box right now, but a penalty box with good visibility means opportunity for investors.

“After periods like this, small companies remain in the wilderness for some time.”

Microbix has two blue-sky opportunities that could surface. One is in Kinlytic (urokinase), an FDA-approved clot-busting product that is well received but not currently on the market. The company needs to create a manufacturing plant to get the drug back on the market and compete with tissue plasminogen activator (tPA), which is used in stroke patients and other indications such as pulmonary embolism. The company is in the process of working out a partnership to get a plant built, and therefore the market is giving Kinlytic zero value.

TLSR: There are a lot of uses for clot busters. What else could Kinlytic be used for?

ER: It is used in many situations—life-threatening pulmonary embolism and myocardial infarction, for example. Those are two big indications. Cardiologists would like to have the product for catheter clearing and clot busting. They already know the drug well, and they like it. Microbix believes Kinlytic, alone, could be worth several hundred million dollars per year, but to make it worthwhile for the company, it only has to be a $50M drug. By contrast, tPA is unsupported by many clinicians, but it still does $300–400M a year.

TLSR: There are barriers standing in the way of getting Kinlytic on the market. What are the issues?

ER: The barriers are significant because of where urokinase is sourced. It comes from placental cells, and its manufacture is very complicated.

TLSR: Can you update other technologies at Microbix?

ER: The company also has a unique, light-based technology called LumiSort that separates male from female sex cells in bull semen. It’s an optical technology that detects the different sperm cells, and kills the unwanted ones so that livestock offspring will be of the desired sex. This represents a huge opportunity, so that dairy farmers can get cows and beef farmers can get bulls. LumiSort is in beta testing right now. The market, again, is attributing zero value to this platform.

TLSR: You also follow companies with solid mid-cap valuations. I know you wanted to talk about a couple of these names. Go ahead.

ER: Some of the late-stage, mid-cap companies that I like are Acadia Pharmaceuticals Inc. (ACAD:NASDAQ), Medivation Inc. (MDVN:NASDAQ), Intra-Cellular Therapies Inc. (ITCI:NASDAQ), Portola Pharmaceuticals Inc. (PTLA:NASDAQ) and Synergy Pharmaceuticals Inc. (SGYP:NASDAQ). Several of these companies have FDA-designated breakthrough technologies, are past Phase 3 data hurdles, and are on their way to FDA advisory committee (AdCom) meetings. Acadia, Portola and Synergy will have products on the market before the end of 2016, and with labeling that addresses large, unmet medical needs.

Acadia has its AdCom meeting on March 29 for Nuplazid (pimavanserin) for Parkinson’s disease psychosis. It’s hard to handicap how that’s going to go, but the FDA obviously sees a pressing need for the drug. The stock has been cut in half, but the company has a tremendous amount of cash—about $0.5 billion ($0.5B) on its balance sheet, with an enterprise value (EV) of $1.85B.

“Biotech is a slow-growth world, but if you can show good organic growth, the market will eventually pay up.”

The risks are fairly limited given what we know about the data. If Nuplazid gets FDA approval, it will be on the market probably by August or September. It will do a couple hundred million dollars in sales in 2017, and $1B by 2019–2020. The opportunity is huge. The company will probably have an application in at the European Medicines Agency in 2017 or 2018. This company is completely cashed up, and it’s a tremendous value.

Medivation is another company that has been hit hard. It’s down about 35% from six months ago and rose 35% during the selloff. It has a label expansion for pre- and post-chemotherapy in prostate cancer with its lead drug, Xtandi (enzalutamide), which is partnered with Astellas Pharma Inc. (ALPMF:OTCPK). The company will be entering a Phase 3 trial for triple-negative breast cancer, which is a large unmet medical need. To this point, Xtandi has been primarily prescribed by oncologists for prostate cancer patients, but we think the big, growing market is among the urologists who see prostate patients first and want to follow and manage some of their treatments. Right now, 20% of sales come from urologist prescriptions, and 80% come from oncologists. The big growth is in increasing prescriptions among urologists.

Medivation is developing the breast cancer indication itself, for now. As far as its potential triple-negative breast cancer indication, Xtandi showed 14 months’ survival benefit in Phase 2. There is unbelievable value at these levels, considering both expansion of the prostate market with the urologist community, and the potential of the breast cancer indication. Given its sales growth, its visibility, the label and market expansion, I think Medivation is a compelling Buy. Again, it’s growth in a no-growth world. No oncology company approaching $1B in sales has ever stayed independent. Medivation will bring in $900M in sales for 2016.

I should say the company has other pipeline products, too. But those can be given zero value for the time being. The risk/reward is strong right now. The company is trading at about 4x EV-to-sales. Biotech companies like this usually get taken out at 8–10x EV-to-sales.

TLSR: You wanted to mention Intra-Cellular Therapies, Portola Pharmaceuticals and Synergy Pharmaceuticals. Go ahead with those.

ER: Intra-Cellular reported efficacious Phase 3 data in schizophrenia last fall. It was a great performer for me. Again, a cashed-up company and a value in this market.

Portola’s andexanet alfa is a first-in-class drug and has been deemed a breakthrough therapy. It offsets the uncontrolled bleeding—the anticoagulant effects—associated with Factor Xa inhibitors like Xarelto (rivaroxaban) and Eliquis (apixaban). Besides uncontrolled bleeding episodes, some patients on anticoagulants might require emergency surgery, and they can be given Portola’s drug to make the surgery safe. There’s probably a 50,000-patient market per year for andexanet. It’s probably a $300–400M product in a few years—in a captive market—and a big opportunity.

Synergy just filed a new drug application (NDA) on its drug, plecanatide, at the end of January. It’s an analog of a naturally occurring peptide called uroguanylin that mediates digestion. The NDA was filed for chronic idiopathic constipation, but the drug is also being evaluated in Phase 3 for irritable bowel syndrome with constipation. It will probably be on the market before year-end. It has shown a superior side-effect profile to Ironwood Pharmaceuticals Inc.’s (IRWD:NASDAQ) Linzess (linaclotide), which has a similar mechanism and is already on the market. Plecanatide has similar efficacy but with a third to a half of the diarrhea side-effect profile you see with Linzess. It’s a $600M market between Amitiza (lubiprostone and Linzess. Synergy owns all the economics to plecanatide.

TLSR: Thank you, Eden.

Eden Rahim is portfolio manager and option strategist at Next Edge Capital. He manages the Next Edge Biotech Plus Fund and the Next Edge Theta Yield Fund. His experience includes two decades of portfolio and hedge fund money management, as well as work as an options strategist, derivatives and biotech analyst and portfolio manager. Rahim has managed and traded an options book spanning 250+ securities globally and four commodities, with open interest of 500,000 contracts in addition to 14 covered call ETFs (over $0.5B AUM) in Canada, the U.S. and Australia, employing his options writing discipline at Horizons Exchange-Traded Funds. Rahim possessed a top-quartile, five-year, five-star growth fund portfolio manager track record on more $1B in assets across four mandates at RBC Global Asset Management. In addition, Rahim has delivered a +26% compounded annual return across a biotechnology mandate between 1995 and 2003. He also has extensive institutional hedging experience through major crises, and experience in the structuring of notes to create specific payoff profiles.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Related Articles

DISCLOSURE:

1) Dr. George S. Mack conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: None. RepliCel Life Sciences Inc. is not affiliated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Eden Rahim: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts provided by Eden Rahim

People never intend to bring disasters upon themselves.

People never intend to bring disasters upon themselves.

Summary

Summary