Personal Finance

When things are not working out, a lesser-known piece of Graham’s writing can show you the way

When things are not working out, a lesser-known piece of Graham’s writing can show you the way

One of the most overlooked sections in great value investing writing is chapter two in Benjamin Graham and David Dodd’s classic “Security Analysis.” [1] Entitled “Fundamental Elements in the Problem of Analysis. Quantitative and Qualitative Factors,” the chapter is filled with insights on both an investor’s approach and views on data and information about possible investments.

…also:

![]()

In This Week’s Issue:

- Weekly Commentary

- Strategy of the Week

- Stocks That Meet The Featured Strategy

- Stockscores’ Market Minutes Video – Pay Attention to What Doesn’t Make Sense

- Stockscores Trader Training – The Enemy is You

- Stock Features of the Week – Stockscores Simple Weekly Under $10

Stockscores Market Minutes – Pay Attention to What Doesn’t Make Sense

Trade of the week on ZIOP, plus why opportunities that don’t seem to make sense often become big winners. Of course, my regular weekly market analysis as well. Click Here to Watch

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – The Enemy is You

Emotion is the enemy of every trader.

Our emotional attachment to money is what causes us to lose our discipline, to take big losses, to not let our strong and profitable trades run higher. It causes us to own too many stocks in one sector or fall in love with a stock that will only hurt us. Letting emotion in to our trading decisions is a fast way to insomnia.

The perception is that the stock market is too risky, many investors don’t like the potential for a sharp sell off that can destroy their portfolio in a very short time period. The collapse of the stock market in 2008 has given many a form of post-traumatic stress disorder, leaving them on the sidelines when it has not made sense to do so.

The stock market may be volatile at times but that is not what determines risk. Risk is how you respond to the volatility, how you manage the potential size of your losses. The stock market is not risky, the people that play it are. It is how you deal with price volatility that determines risk.

If you want to sleep well while invested in stocks, you need to have a plan for managing risk. The notion that you can buy some “good” companies and forget about them is outdated and reckless.

Here are my essentials to being invested in the stocks and sleeping well:

Plan to lose. When you buy a stock, know the price level where the stock market will have proven you wrong. Learn how to determine where a stock’s support price is and if the stock closes below that level, realize that the market is telling you that something is probably wrong at the company. Get out.

Know your tolerance for risk. How much are you willing to lose on any one stock trade? If you risk more than this amount, you will get emotional. Take the difference between the entry price and the stop loss price and divide that in to your risk tolerance to determine how many shares to buy. If you are buying a stock at $10 with a stop loss point at $9 and you are willing to lose $500 on any one trade then you should buy 500 shares.

Don’t obsess. You don’t need to watch your stocks constantly, if you are position trading then only look at the once a day or even once a week. You only need to check to see if your stock has given an exit signal, obsessing over every gyration will make you emotional and lead you to make mistakes.

Have a written plan. You must write down your trading rules. When will you buy, when will you sell, how will you manage risk and how will you review your positions. Keep the plan simple but concise enough that there is no room for interpretation.

Stick to your plan. Your plan should be based on strategies that you have tested and believe in. Deviating from the plan means you are going in to areas that have not been tested and that puts you closer to being a gambler. Gambling traders may win in the short term but in the long term they lose.

Remember that trading stocks is as risky as you make it. Not having a plan with rules for limiting the size of your losses leaves you exposed to big losses if the market corrects sharply. With loss limits and discipline, you should never be the victim of a major market correction.

With the election decided, small cap, lower priced stocks have started to come alive again. Since low priced Canadian stocks tend to be commodity based (which have suffered) I decided to run the Stockscores Simple Weely strategy on the US, but with the added filter of stocks under $10. Here are three names that have good long term charts:

1. CGNT

CGNT has had a good 2 day run higher and is showing a good three year weekly chart. I would like it better on a short term pull back to improve the reward for risk of the trade. Support at $1.50.

2. OBCI

Big break higher today for OBCI on strong volume, with resistance at $5.50 to $6 the economics of the trade look better on a pull back if some profit taking comes in over the next few days. Support at $3.15.

3. CENX

Nice break from a rising bottom on the three year chart for CENX, the gains were made over a succession of up days so a pull back in the short term is likely and will improve the economics. Support at $6.50.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

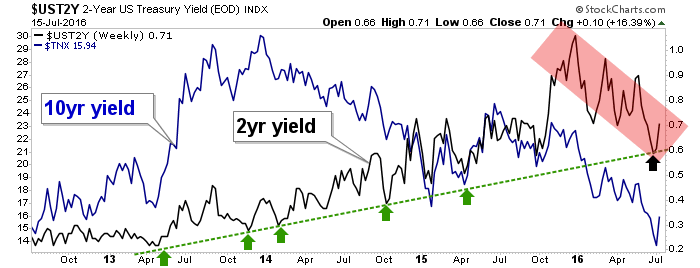

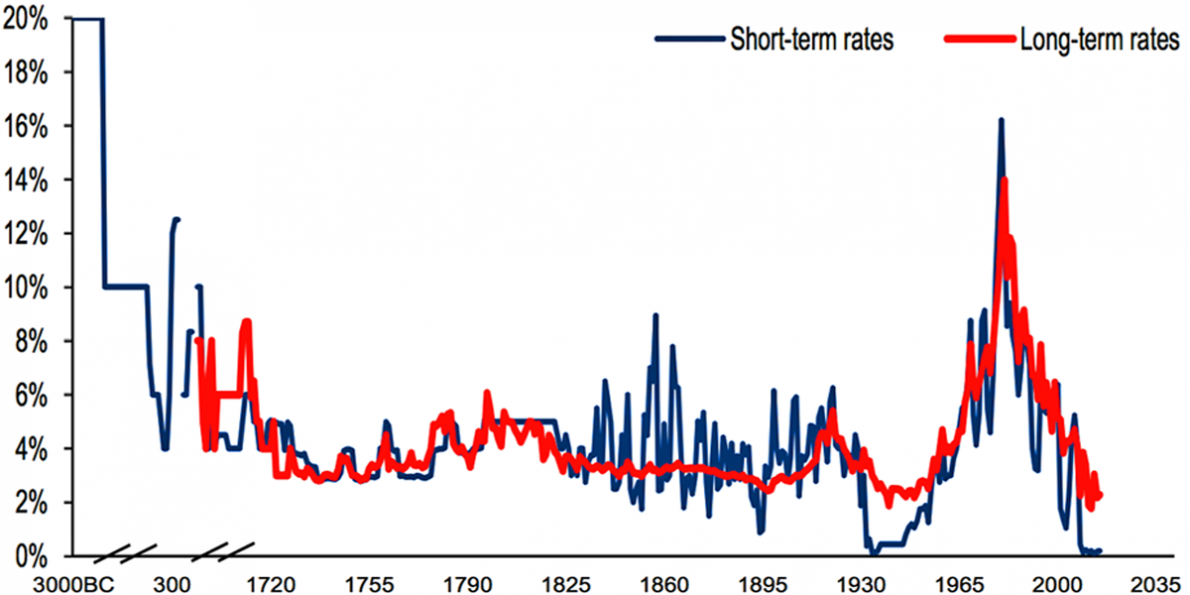

The evidence continues to mount that the 35 year bear market in US bonds is over, interest rates are heading up and the implications are dramatic. For example, the rate on a 10 year US bond is 2.37%. Compare that to the rate of a 10 year German bond of .35% and you know why German money is flooding into the US driving the dollar higher and other currencies down. (full transcript below)

Interest Rates Are Heading Higher

It is safe to say that most parents want to teach their children kindness, manners, and responsibility, and to impart knowledge on how to become self-sufficient and succeed in life. After all, no one plans on raising a deadbeat. However, when it comes to the latter, very few adults actually accomplish this task. Why? Because, as parents, we are limited to the experiences our parents passed on to us; the antiquated notion that to be successful is simply getting a job, saving a little money, and maybe purchasing a car or some equally important item. There is more to becoming successful in life, and it is my hope these seven rules will open your eyes and help you teach your children to avoid the traps that have stolen financial success from so many people.

It is safe to say that most parents want to teach their children kindness, manners, and responsibility, and to impart knowledge on how to become self-sufficient and succeed in life. After all, no one plans on raising a deadbeat. However, when it comes to the latter, very few adults actually accomplish this task. Why? Because, as parents, we are limited to the experiences our parents passed on to us; the antiquated notion that to be successful is simply getting a job, saving a little money, and maybe purchasing a car or some equally important item. There is more to becoming successful in life, and it is my hope these seven rules will open your eyes and help you teach your children to avoid the traps that have stolen financial success from so many people.

Wealth Building Rule 1: Find a Financially Compatible Spouse

Wealth Building Rule 2: Recognize That Debt Is a Habit That Must Be Broken

Wealth Building Rule 3: If You Don’t Like Where your Parents Were at Your Age – Do Things Differently

Wealth Building Rule 4: When you Begin a Job, Look at the Pay of the Highest Employee

Wealth Building Rule 5: Do Something You Love and Get Paid for It

Wealth Building Rule 6: Understand the Money Myth

Wealth Building Rule 7: Your New Commodity is Not Your Labor, It’s Your Ideas

….read about all 7 Wealth Building rules HERE

…related: