Timing & trends

The Euro soared to 113 and then crashed and burned to the 109 level. The Dow exceeded yesterday’s high but has not penetrated the previous day’s low. Gold had its reaction up to 1340 and fell back under 1300. Let’s get this much straight. Our computer is NOT showing a major change in trend because of the election. We have warned this is not the case and at the end of the day, fundamentally, Trump will be far more bullish for the US economy that war and more taxes from Hillary.

The Euro soared to 113 and then crashed and burned to the 109 level. The Dow exceeded yesterday’s high but has not penetrated the previous day’s low. Gold had its reaction up to 1340 and fell back under 1300. Let’s get this much straight. Our computer is NOT showing a major change in trend because of the election. We have warned this is not the case and at the end of the day, fundamentally, Trump will be far more bullish for the US economy that war and more taxes from Hillary.

This is more of a Reagan Moment. Ronald Reagan was the outsider every and the “establishment” in Washington resisted him. This will play-out the same. So let everything calm down. There appears to be no major change in trend at hand. If Trump gets the 15% corporate tax rate in, then look for the dollar to soar and almost $3 trillion come homes.

The Trump victory was expected by the jackass, but to be honest, it took my breath away with a certain dash of surprise. At an hour past 2am, I could not break away from the TV set, wanting to see the final result. I actually covered my eyes and had empty tears with joy. The US nation can now move past the NeoCon era, the warmonger era, the bank fraud era, the economic gutting era whereby the NeoCon nazis almost completely destroyed their host. Many key figures among the elite will find themselves being hunted, not just by the law enforcement, but by hidden entities with intentions to clean the planet of this deeply corrupted human vermin. Trump as president will have an enormous daunting task to rebuild the national economy, which has been systematically wrecked by the BushJr Admin and the Obama Admin. For those still too dim mentally to perceive, the NeoCons cut across political parties, joining the Bush Team, the Clinton Team, and the Obama Team with narcotics and globalization their common cord. That cord will be cut.

The next big shock to hit the United States will be a positive thrust from the end of military threatened conflict with respect to Russia, and even to China. With Russia the detente will involve a measured end to sanctions and a possible dismantle of NATO, whereby the Gazprom pipeline might be agreed upon with some special provisions that benefit the poorer European states. With relaxed tensions on the Chinese front, look instead to new escalation to trade war between the US and China. Trump has promised to reverse tax breaks for US-based multinational corporations that outsourced labor to the Asian front, only to have their output imported into the US. Expect some thorny negotiations, and some compromise, along with a truly massive reconstruction of the USEconomy with thousands of new little companies being formed, even with free trade zones.

The other shock will be negative to hit the United States. The global rejection of the USDollar will become put under stronger light very soon. The several non-USD platforms have greatly accelerated their volumes, something not well publicized within the US financial press. Trump will work constructively on this matter, but he might actually be a little on the defensive, since he knows well the gravity of the situation. The USDollar will soon lose its global currency reserve status, and with it comes the manifested necessity of the domestic USDollar. The Jackass has called this the New Scheiss Dollar. It has numerous east coast warehouses full of the so-called rainbow dollar. Given the $550 billion annual trade deficit, any new dollar must be devalued. My firm belief is that it will be subject to a 30% devaluation immediately, and another 30% devaluation within its first year after inception. Given the extreme difficulty and challenge to reduce the trade deficit, expect a series of further 10% devaluations in the future even after new companies are formed with a national emergency mission to export in greater volume in order to reduce the deficit. The Gold price will be released during these nasty developmental phases. Expect the COMEX and LBMA to be shut down on their paper gold operations.

The Gold price will rise during this entire period of transition. The uncertainty will initially drive it higher. Later, the extreme challenges behind the new dollar and its steep devaluation schedule will drive the price higher. Meanwhile the transition from a fascist state to a capitalist state will see numerous elite figures and established institutions put under legal scrutiny. Some will be jailed, while some institutions will be reformed or vanish. The Gold price will respond to the legal strains on these former power centers. Trump knows what a fair sound currency means, since a smart man. He will eventually embrace the Gold Standard as a plank toward USEconomic Reconstruction. Many are the missing details however. Under his administration, the Gold price might find its true value, but only during a horrendous chapter for the USEconomy in its transition. It must pass through the Third World gates, at least for a year or two, maybe more.

One has to question his choice of Newt Gingrich as Secretary of State, and Rudy Guiliani as Attorney General. So the Crew of Deplorables won, and the Crew of Deportables lost, how funny! Gingrich might actually enjoy a fine second career as statesman, which could be constructive to reverse the NeoCon aggressions. Guiliani might be very effective in enabling the truth to emerge on the 9/11 crime scene, winning a pardon for himself in the process. Trump captured the anger on the clearly delineated justice gap, whereby the upper levels enjoy a pass on high crimes and misdemeanors like murder, grand larceny, influence peddling, and treason. Trump won with the men vote, the white no college vote, and the vote for real change. He embodies Andrew Jackson, Teddy Roosevelt, and PT Barnum, as one newscaster put it last night. Hillary could not energize sufficiently the black vote, and lost the white woman suburban vote very interestingly. Many women voters do indeed want a woman to break the glass ceiling, like that symbolically placed at the Javitz Center last night, but just not her. They might want a woman who is not a liar, murderer, and traitor. Hillary tried to win the Satanist vote, using Beyonce and Katie Perry and Jay-Z in campaign rallies, but Trump won with a Christian theme which was under-stated. Those entertainment professionals are all avowed Satanists. The spotlight is finally on the Satanist element of the elite. In the recent past, several clients warned the Jackass not to pursue the Satanist theme. I ignored them. Now the disgusting sordid theme is in the headlines, thanks to the courageous efforts of Wikileaks and certain FBI officers. The link between NeoCons and Satanists will be established soon in the open, to include the leading banks.

A certain degree of credit goes to Bob Scheiffer and Charlie Rose at CBS, for their not so hidden criticism of the press, for getting it wrong on the polls. Other press executives showed their yellow streak and fascist bias to the end, refusing to call Pennsylvania until the bitter end. It will be extremely interesting to watch the mainstream news networks struggle for press passes to attend White House functions when their reporting was so badly biased over the past few months, and their polls were intentionally biased with over-representation of Democrats in their sampling process. Let the rebuilding begin, and not too much forgiveness for treason. Let no respite be given for murder, including the children by the Clinton Foundation. Watch the name of Madeline McCann rise up, a little girl from England. She was abducted a couple years ago, and Hillary’s campaign manager Podesta might find himself embroiled in the investigation. She might have been on the Satanist altar for sacrifice by these sick gangsters.

As the evening developed, and it began to dawn on Americans – and the world – that Donald Trump might actually win, markets plunged. The S&P was down 100 points before midnight; the dollar index was off 2%. Gold rose about $70; 10-year yields rose 15bps. Nothing about that was surprising. Lots of people predicted that if Trump somehow won, markets would gyrate and move in something close to this way. If Clinton won, the ‘status quo’ election would mean much calmer markets.

So, we got the upset. Despite the hyperbole, it was hardly a “stunning” upset.[1] Going into yesterday, the “No Toss Ups” maps had Trump down about 8 electoral votes. Polls in all of the “battleground” states were within 1-2 points, many with Trump in the lead. Yes, the “road to victory” was narrow, requiring Trump to win Florida, Ohio, North Carolina, and a few other hotly-contested battlegrounds, but no step along that road was a long shot (and it wasn’t like winning 6 coin flips, because these are correlated events). Trump’s victory odds were probably 20%-25% at worst: long odds, but not ridiculous odds. (And I believe the following wind to Trump from the timing of Obamacare letters was underappreciated; I wrote about this effect on October 27th).

And yet, stock markets in the two days prior to the election rose aggressively, pricing in a near-certainty of a Clinton victory. Again, recall that pundits thought that a Clinton victory would see little market reaction, but a violent reaction could obtain if Trump won. Markets, in other words, were offering tremendous odds on an event that was unlikely, but within the realm of possibility. The market was offering nearly-free options. The same thing happened with Brexit: although the vote was close to a coin-flip, the market was offering massive odds on the less-likely event. Here is an important point as well – in both cases, the error bars had to be much wider than normal, because there were dynamics that were not fully understood. Therefore, the “out of the money” outcome was not nearly as far out of the money as it seemed. And yet, the market paid you handsomely to be short markets (or less long) before the Brexit vote. The market paid you handsomely to be short markets (or less long) before yesterday’s election results were reported. And, patting myself on the back, I said so.

This is not a political blog, but an investing blog. And my point here about investing is simple: any competent investor cannot afford to ignore free, or nearly-free, options. Whatever you thought the outcome of the Presidential election was likely to be, it was an investing imperative to lighten up longs (at least) going into the results. If the status-quo happened, you would not have lost much, but if the status quo was upset, you would have gained much. As I’ve been writing recently about inflation breakevens (which was also a hard-to-lose trade, though less dramatic), the tail risks were really underpriced. Investing, like poker, is not about winning every hand. It is about betting correctly when the hand is played.

At this hour, stock markets are bouncing and bond markets are selling off. These next moves are the difficult ones, of course, because now we all have the same information. I suspect stocks will recover some, at least temporarily, because investors will price a Federal Reserve that is less likely to tighten and the knee-jerk response is to buy stocks in that circumstance. But it is interesting that at the moment, while stocks remain lower the bond market gains have completely reversed and are turning into a rout. 10-year inflation breakevens are wider by about 9-10bps, which is a huge move. But there will be lots of gyrations from here. The easy trade was the first one.

Unfortunately, it doesn’t really matter which party wins the presidential election as neither one will be unable to stop the coming MOTHER OF ALL DEFLATIONS. While it is frustrating to watch just how insane this presidential race has disintegrated into, I try to not to focus on it.

Why? Because the U.S. Government will become totally powerless to deal with the future financial and economic collapse. Furthermore, most institutions will also lose the ability to function when the system cracks. This really isn’t a matter of if or when…. IT’S HAPPENING NOW.

According to a recent Zerohedge article, Dallas “Pension Fund Panic” As Major Warns Of 130% Property Tax Hike To Avoid Collapse,

“This is much like a Bernie Madoff scheme, if you ask me,” said Dallas mayor Miek Rawling discussing the collapse of the local Dallas Police and Fire Pension Fund. The Dallas pension board wants the city to contribute $1.1. billion in 2018, but to do that, they would have to increase the property tax rate by 130%.

This is just one sign of many hundreds that continue to eat away at the financial and economic system. What is ironic to witness is the complete failure of the analyst community to understand the real reason for these financial disasters. While most of the blame is put on the totally useless Mainstream Financial Networks, the majority of the alternative media analysts are clueless as well.

This is due to the alternative media’s failure to understand the underlying energy dynamics. I used to read a lot of the alternative media sites (especially the precious metals), but presently only look over a few. Many of the precious metals sites continue to harp on matters that really aren’t important anymore.

Of course, they do this because they do not want to look at the vital energy dynamics. For some reason, most of the precious metals analysts look at energy as just another industry…. much like the retail or health care industries. It doesn’t matter to them that the price of oil is now $75 below the cost of new production of $125 a barrel(according to the Hills Group work).

The falling oil price is totally gutting the U.S. and Global Oil Industry. I wrote about this in my article, The End Of The U.S. Major Oil Industry Era: Big Trouble At ExxonMobil. Without transports fuels, the world’s economy disintegrates…. and disintegrate it will.

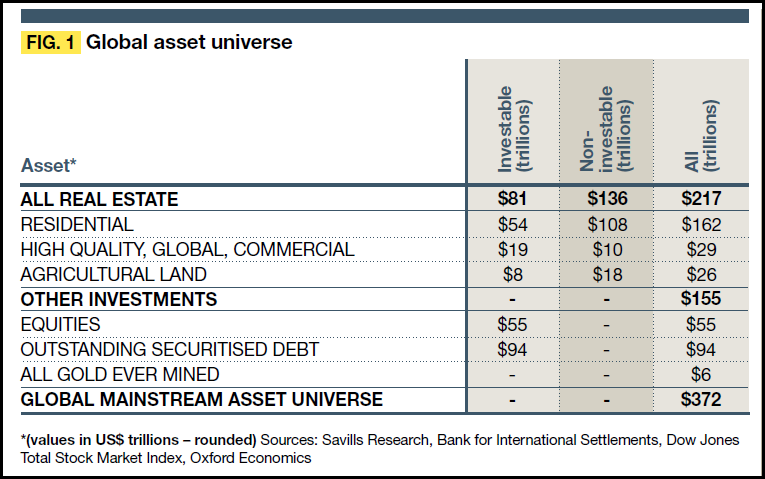

Thus, the collapsing oil price will destroy the value of most physical and paper assets, BUT NOT GOLD & SILVER. Here is a chart of the “Global Asset Universe” by the Savills Research Group Report:

As we can see, they estimate that the total Global Real Estate Market is valued at $217 trillion, Securitized Debt (Treasuries & Bonds) at $94 trillion and Equities (Stocks) at $55 trillion. In their report, they stated that all the gold mined in the world was valued at $6 trillion. I revised that figure to only include “physical investment gold and silver” which is estimated to be $3.1 trillion. You can check how I estimated the $3.1 trillion of gold and silver in my article, How High Will Silver’s Value Increase Compared To Gold During The Next Financial Crisis?

The Savills Group breaks down the Global Real Estate market into “investable” and ‘non-investable.” According to their estimates, they list that of the total $217 trillion in global real estate, only $81 trillion are investable, while the remainder is held privately.

The value of global real estate, stocks and bonds are totally inflated based on a much higher oil price of $110-$125. Now with the price of oil at $45, the value of these assets should have collapsed a few years ago. If we consider the price of oil was $110 in 2012 and now is $45, that represents a collapse of nearly 60%.

Unfortunately, many people do not understand that the value of real estate, stocks and bonds are based on the value of energy. Instead, they blindly believe the value of these assets are based on “SUPPLY & DEMAND” or some other VOO-DOO Economics.

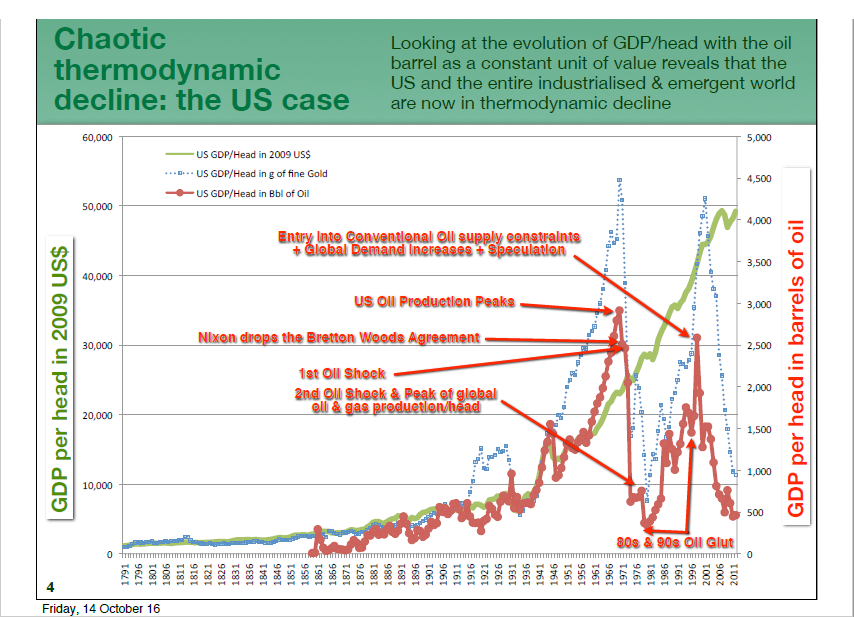

If we look at Louis Arnoux’s chart showing the U.S. GDP value per American in gold and oil units, it collapsed back in 2012. Again, the U.S. GDP and value of most paper assets should have collapsed along with gold and oil, but they didn’t:

The chart shows how U.S. GDP per American (Green) continues higher even though gold per head (Blue) and oil per head (Red) collapsed in 2012.

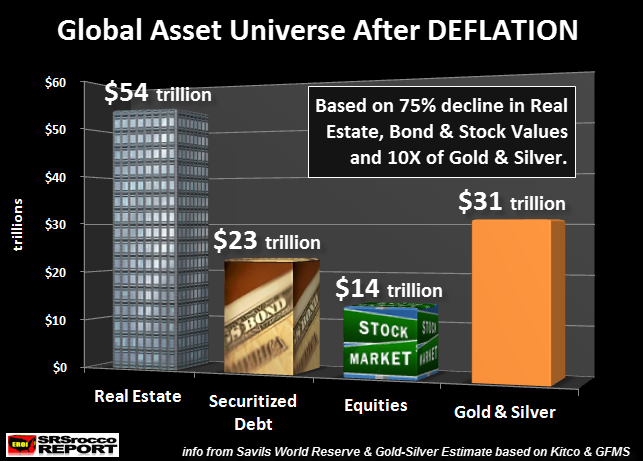

Thus, we have the Greatest Real Estate and Financial Bubble in history looking for a pin…… and the pin is the falling price and production of oil. I will explain this in more detail in upcoming articles, however if we assume a 75% collapse in the value of real estate, bonds and stocks, this would be the result:

Global Real Estate values would fall to $54 trillion, Securitized Debt would drop to $23 trillion and equity values would fall to $14 trillion. Thus, the total value of these assets would collapse by $274 trillion to $91 trillion. However, the value of physical gold and silver would surge to ten times its value to $31 trillion.

Of course, this is just an estimate, but if we consider the value of real estate, stocks and bonds falling 75%, only 10% of that $274 trillion lost is $27 trillion. Which means, just 10% of the value of these assets moving into gold and silver would push their value up to $31 trillion.

Again, this is just an estimate, but investors have no idea just how quickly the value of global real estate, bonds and stocks will fall in the future. I put a figure of a 75% collapse, but that is just in the beginning to middle stages. I would imagine, by the time the global crash is complete, these values could literally fall by 90-95%.

The current Presidential Election is a complete farce. Even though I try to stay away from politics, it becomes extremely frustrating to see the public totally brainwashed by Mainstream media propaganda.

People need to start distancing themselves from anything that is run by a centralized system, whether that be government, finance or the economy. It is time to look to more local and regional solutions as the viability of centralized systems collapse over the next 5-10 years.

Check back for new articles and updates at the SRSrocco Report.