Bonds & Interest Rates

-

Duration buildup creates vulnerability to interest-rate shock

The hottest craze in fixed income is at risk of overheating.

A headlong rush into higher-yielding, long-term bonds in recent years has created one of the most crowded trades in financial markets. Investors seeking relief from central banks’ zero-interest-rate policies have poured into government debt due in a decade or more, swelling the amount worldwide by a record $733 billion this year. It’s more than doubled since 2009 to about $6 trillion, data compiled by Bloomberg and Bank of America Corp. show.

Now money managers overseeing more than $1 trillion say..…continue reading HERE

….related: Bank of America: Investors are getting worried that a bond market crash is coming

This is what happens when government doesn’t understand markets as sales numbers for Vancouver to October 21st has condo’s down 53% & single family homes down 77%! Thank you foreign buyers tax and Canada’s Mortgage rule changes. Where to from here for Canada’s strongest industry?

….also from Michael: Powerful Trends That Are Changing Everything

Cyclical turning points tend to feature large numbers of people doing and saying what in retrospect turn out to be amazingly dumb things. Think GM highlighting its line of Hummers just before an oil price spike bankrupts the company. Or half the world betting that tech stocks with infinite P/E ratios would keep rising in 2000. Or pretty much everything that was said and done in the housing market in 2006.

Today’s financial bubble is vastly bigger and more wide-spread than any of its predecessors, so the stupidity is correspondingly global and varied. Some examples:

GM bets big (again!) on gas guzzlers

General Motors third-quarter earnings widely beat expectations

(CNBC) – General Motors reported much higher-than-expected third-quarter earnings on strong North American truck and SUV sales, calming fears that a U.S. auto market slowdown would dent profitability. Overall, GM said third-quarter net income more than doubled to $2.8 billion, or $1.76 a share, from a year earlier.

Rival Ford Motor, due to release third-quarter results Thursday, warned in July that a slowing U.S. auto market would put its full-year profit forecast at risk.

The contrast between the GM and Ford outlooks in part reflects different bets on oil prices in the past. Ford during the past decade spent heavily to boost the efficiency of its top-selling F-series pickup truck by engineering a light, aluminum body, cut back production of large sport utilities and focused on small- and medium-sized cars.

Ford executives have told analysts that with gasoline prices relatively low, it is harder to recover the costs of fuel-saving technology from consumers.

GM stuck with the large SUV market, and now controls more than 70 percent of that market in North America. Models such as the Cadillac Escalade start at more than $70,000.

GM’s results and its outlook depend primarily on strong U.S. and Chinese economies. The company said it lost money in Europe, South America and in Asian markets outside of China.

That’s right, GM is once again on the wrong side of history, and not just because 12-mile-per-gallon SUVs are vulnerable to the next (inevitable) oil shock. Such vehicles’ high sticker prices also make them a luxury purchase for most families, and luxuries will be the first things to go in a downturn.

Meanwhile, relying on the US and China for growth is classic rear-view-mirror thinking. The US is at the tail end of a car loan binge that saw pretty much everyone who walked into a dealership drive out with a 7-year car mortgage. So new buyers will be scarce in coming years. And China, as pretty much everyone (besides apparently GM execs) knows by now, is buying its current growth with a tsunami of new debt that will, as excessive debt tends to do, produce a slowdown if not a crisis in the near future. A safe bet: GM will report losses in 2018 and beyond that more than wipe out the past year’s record profits.

Someone tries to buy Time Warner, again

In 1999 America Online bought Time Warner in a deal that marked the end of the tech bubble. Now AT&T has the same idea. Here’s a great chart from Zero Hedge illustrating the rather terrifying symmetry:

Gigantic mergers are of course a traditional sign of a market top. Before Time Warner there was the RJR Nabisco LBO in 1989 that helped burst the junk bond bubble. See Corporate kleptocracy at RJR Nabisco. And so it has gone back to the dawn of financial capitalism.

Why is this so? Because towards the end of cycles corporate CEOs and their bankers are flush with cash and borrowing power but short on internal growth ideas. New factories are boring and also risky, since so many of them have already been built recently. But buying out a big competitor instantly expands your empire while generating tons of fees that can be milked in various ways. So the deals get bigger and more extravagant — until someone notices that Time Warner is available. Then the system resets.

Bond maturities begin to exceed the human lifespan

Italy’s first 50-year bond sale had huge demand

(Reuters) – Italy sold its first 50-year bond on Tuesday as some investors bet the European Central Bank may soon add ultra-long debt to its asset-purchase stimulus scheme.

About 16.5 billion euros of orders were placed for the bond – 5-1/2 times the expected sale amount, despite concerns over Italy’s banks and an upcoming referendum that could unseat its prime minister.

Many of the fund managers who lend to Italy – and those who have already bought 50-year bonds from France, Belgium and Spain this year – may not live to see it paid back. Those who signed up to Ireland’s 100-year bond in March almost certainly won’t.

Where to begin…well, these are euro-denominated bonds and the eurozone is in crisis, with a growing chorus of former fans now predicting dissolution. What happens to a 100-year bond when the currency in which it’s denominated ceases to exist? Interesting question! And one that will be answered long before these bonds mature.

Keynsians feel free to speak their minds

In normal times, arguing for massive government deficits or exotica like helicopter money and guaranteed incomes is generally done behind closed doors in order to find a way to hide the true nature of the proposal. But in late-stage bubbles so many “innovative” ideas are being put into practice that pretty much everyone’s wish list finds high-profile backers. The following is excerpted from an article by Paul McCulley, a mainstream bond fund manager and, as he is now freely admits, a full-on financial Keynesian. Which of course means he loves government spending of all kinds in every situation:

The deficit is too small, not too big

(The Hill) – First things first: I am (early, via mail) voting for Democratic nominee Hillary Clinton.

My progressive pedigree is robust. I am proudly a liberal Democrat. Not a centrist Democrat, but a liberal Democrat.

And I’m not just a socially liberal Democrat, but a fiscally liberal Democrat.

Thus, while Clinton gets my vote, her insistence at the final debate that her proposed fiscal program will not “add a penny” to the national debt is fouling my wonk serenity this morning.

Every penny of new expenditure, she says, will be “paid for” with a new penny of tax revenue.

Her deficit-neutral fiscal proposal is, I readily acknowledge, better than the status quo, as her proposed new spending would add 100 cents on the dollar to the nation’s aggregate demand, while her proposed tax increases would not subtract 100 cents on the dollar.

Why?

Because she proposes getting the new tax revenue from those with a low marginal propensity to spend, or alternatively, a high marginal propensity to save. To wit, from the not poor, including yes, the rich.

Thus, in simple Keynesian terms, there is some solace in her deficit-neutral fiscal package: It would be net stimulative to the economy, because it would — in technical terms — drive down the private sector’s savings rate.

In less technical terms, it would take money from people who don’t live paycheck to paycheck, who would still spend the same, but just have less left over to save.

And I have no problem with that.

McCulley goes on to explain that the problem with current policy is that the past decade’s trillion-dollar federal deficits were too small because government spending is “investment” while private savings is apparently not. And you can never have too much “investment.”

Again, it’s hard to know where to start. How about with the assertion that private savings doesn’t contribute to growth and progress, when history implies that it’s the only source of productive investment. If government spending produced sustainable growth then the dozens of experiments with massive deficits in pursuit of growth/equity/efficiency would have worked. But they didn’t. Japan’s three decades of record-breaking stimulus produced a flat-lining economy where deflation is now the norm. China’s epic post-2008 infrastructure program quintupled the national debt without making the economy five times as large – thus setting the stage for what looks like an epic and imminent credit crisis. Europe’s experiments with state takeovers of major industries failed across the board.

Anyhow, suffice it to say that in late-stage bubbles lots of ideas that have been previously discredited (or were never seriously considered) seem new again to people who either don’t have a sense of history or do have political agendas dressed up as science. And the result, so far at least, has been the same every time: Debts implode, stocks plunge, economies contract, financial assets fall out of favor and real things start attracting capital. And the people who caused the mess go quiet for a while.

We’re about to enter that time when financial commentators offer up their best guesses as to what investors can expect in the Near Year. It always makes for fun reading, but it also never fails to disappoint. Instead of engaging in that tired exercise in futility, investors would do better to focus on something more productive. And that would be next year’s most likely catalyst for stock and commodity prices.

Instead of asking the fruitless question, “At what price will the S&P 500 finish in 2017?” wouldn’t it be better to ponder what could possibly stimulate asset prices out of their lethargy? Granted, this is as much a guessing game as the former question. But at least applying critical thinking to the catalyst question, investors are almost certain to uncover some hidden opportunities for profit.

Having said that, what could be next year’s biggest catalyst for a meaningful breakout-type move in: the broad equities market, the commodities market, or individual issues within both categories? Putting the pieces of global events over the last year together and reading between the lines allows us to make at least one educated guess: military conflict. War is after all one of the biggest catalysts for both stock and commodity prices, and it has the added benefit of boosting the economy, short-term. Of course war must be paid for down the line, but that’s why “kicking the can” was invented (so that the day of reckoning can be perpetually delayed).

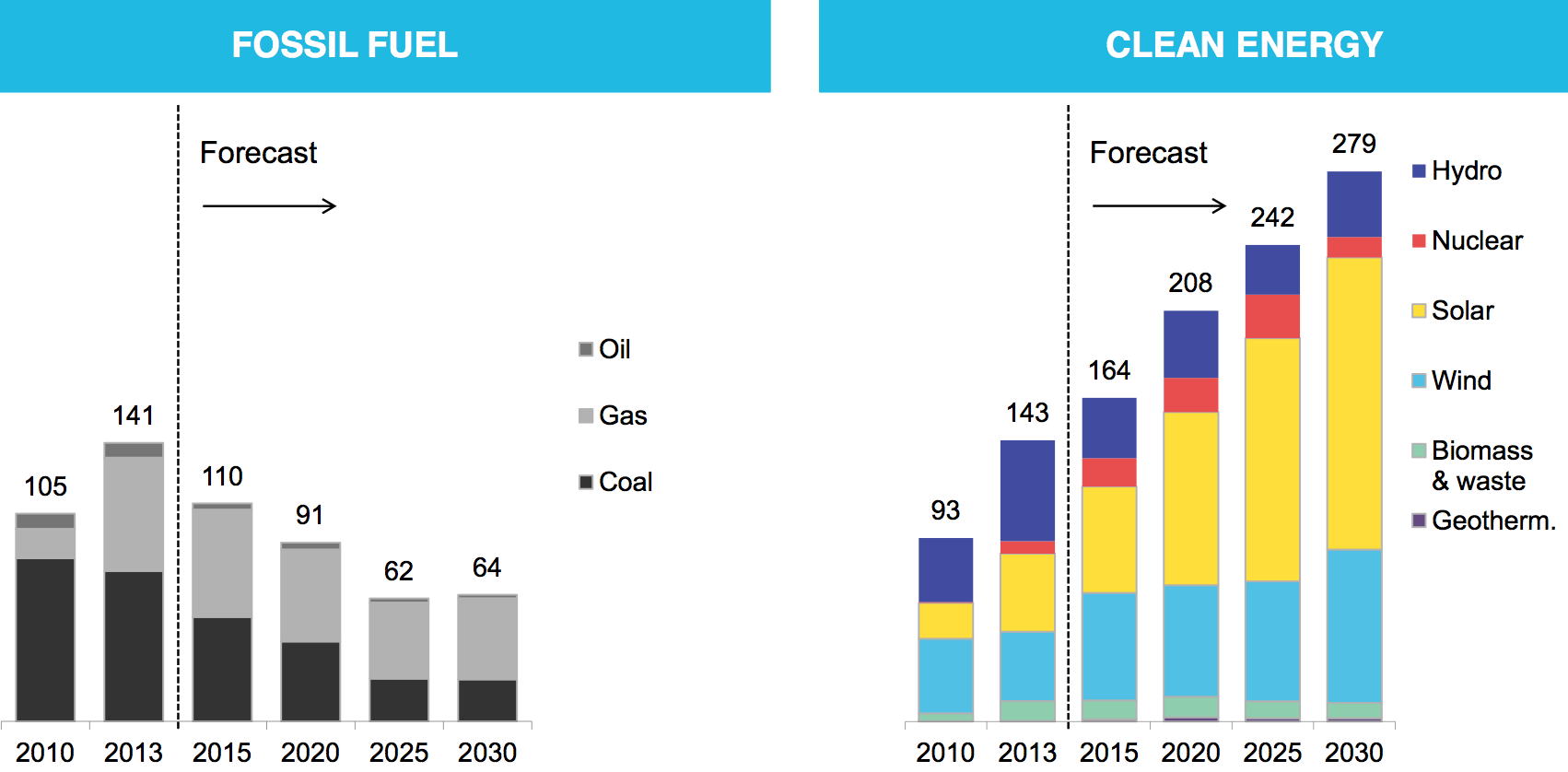

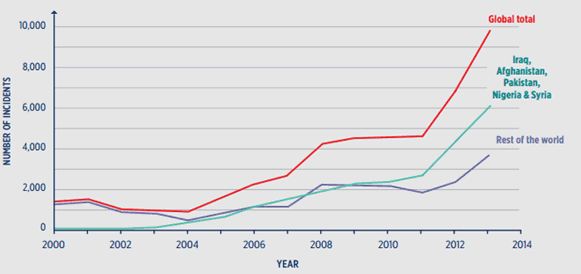

Terrorist events have historically served both as precursors and pretexts for going to war. As the following graph shows, terrorism has expanded dramatically in recent years [Source: www.civilserviceindia.com]. The exponential increase in terrorist events will likely be used to justify further military excursions among the Western nations which have become the targets of these events.

Indeed, the rumblings of war have been audible for some time now, and it’s evident that what has kept the U.S. out of another overseas conflict has been the focus on this year’s presidential race. The current Commander-in-Chief is bound by his promise to end America’s long wars in Iraq and Afghanistan. The incoming president, however, will be under no such constraint. If that president just happens to be a certain candidate with the initials H.R.C., it’s also likely that America will have its next war-time president.

As Micah Zenko argued in his recent Foreign Policy article on Hillary Clinton, the presidential hopeful has a long track record which strongly suggests she is a war hawk. “Though she has opposed uses of force that she believed were a bad idea,” he wrote, “she has consistently endorsed starting new wars and expanding others.”

While the U.S. has already been at war for 15 years, the intensity of our nation’s war efforts have been dramatically scaled back in recent years. Under Clinton, it’s easy to foresee a revival of warfare activities in the Mid East region. While Zenko’s article was supportive of Hillary in the role of chief military commander he also acknowledged that “those who vote for her should know that she will approach such crises with a long track record of being generally supportive of initiating U.S. military interventions and expanding them.”

The U.S. isn’t the only major country which will likely see military action in the intermediate term. One region which of the world in which military activity may see a notable increase in the foreseeable future is the Far East. Japan is a case in point.

Earlier this year, Japan’s Prime Minister Shinzo Abe has made a controversial call to revise Article 9 of the nation’s constitution, which declares that “the Japanese people forever renounce war as a sovereign right of the nation and the threat or use of force as means of settling international disputes.” In view of China’s ongoing military buildup in the South China Sea and other threats, Abe has said the restrictions on Japan’s military “do not fit into the current period.”

Bert Dohmen of the Wellington Letter observed that an amendment to Article 9 “would lead to a military buildup, which always stimulates the economy,” adding that “Japan could finally get out of its 25 year deflation” if Article is deleted.

In response to increasingly hostile behavior from nearby North Korea, Japan may also accelerate roughly $1 billion of planned upgrades to ballistic missile defense systems, according to Reuters. This consideration comes shortly after United States Strategic Command systems detected& a failed missile launch recently in the northwest North Korean town Kusong. Japan has been considering the budget request that will determine whether to add a new missile defense layer from either Lockheed Martin Corp or from Aegis Ashore.

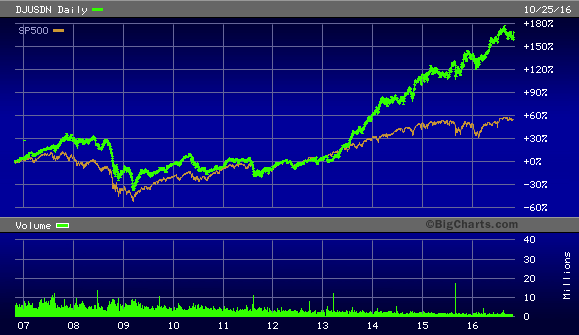

Defense firms like Ratheon, Lockheed Martin, Mitsubishi, and Boeing are reportedly on tight production schedules with a backlog of international orders. Following is a 10-year chart of the Dow Jones U.S. Defense Index (DJUSDN). As this graph illustrates, defense stocks have significantly outperformed the S&P 500 (SPX) in recent years. The average stock price for the leading defense companies underscores the immense war-related preparations and activity taking place within the sector.

All over the world, it seems, nations are arming themselves with the offensive and defensive weapons of war. The production-for-use theory of economics states that military buildups always eventually lead to the employment of those weapons in actual warfare. Sooner or later the expansive activity that has been taking place in the defense sector in recent years will be implemented on the battlefields of the world. When it happens, investors who are prepared for it will not only avoid the deleterious aspects of war, but will also profit from it.

…related by Martin Armstrong: Is the World Political Economy Melting Down?

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today’s fast-moving and sometimes volatile market environment. If you’re interested in moving average trading techniques, you’ll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies For Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html