Currency

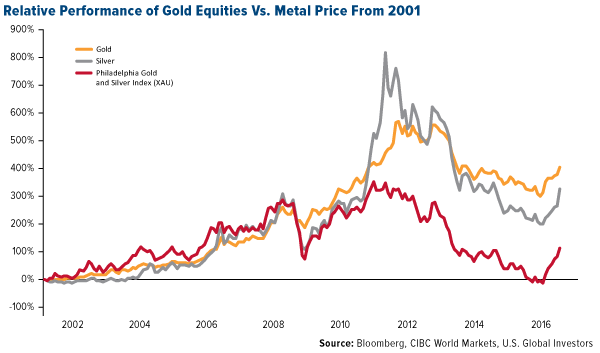

We have already figured out that, faced with the choice between doing “helicopter money” and allowing a deflationary implosion to occur, those in power will elect the former, because it buys them more time by keeping the system limping along for longer, and we have now arrived at the stage where it will be one or other. The market has already figured it out too, which is why gold and silver have started a new bullmarket.

We have already figured out that, faced with the choice between doing “helicopter money” and allowing a deflationary implosion to occur, those in power will elect the former, because it buys them more time by keeping the system limping along for longer, and we have now arrived at the stage where it will be one or other. The market has already figured it out too, which is why gold and silver have started a new bullmarket.

…related: Faber Warns of A Currency Collapse

Bond Sentiment will lead to a Cycle Turn

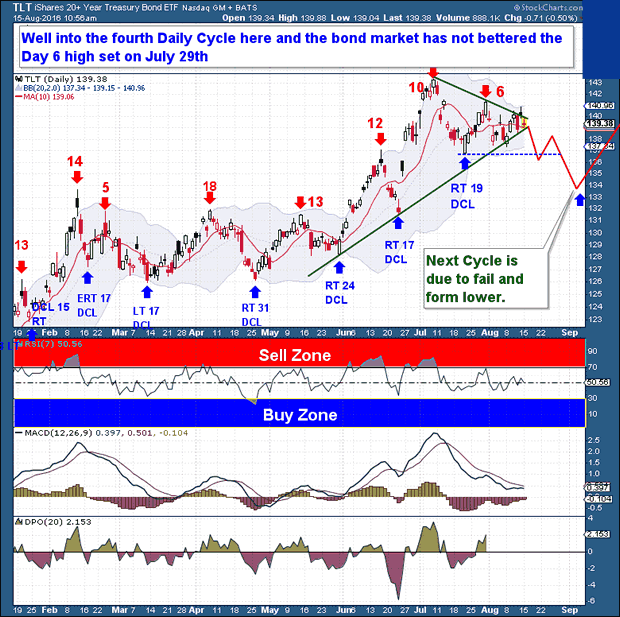

The Bond market has obviously been in a strong rally since the April Investor Cycle Low (ICL). History teaches, however, that even during solid bull market moves, corrections into major Cycle Lows are a normal part of the Cycle flow process.

And this is where we find Bonds today. The Commitment of Traders report shows a massive Long speculative position, while overall Bond Sentiment remains sky-high. Weekly Cycle timing is well into its topping range, and the 4th Daily Cycle (shown below) is beginning to struggle. I would never count Bonds out, at least until we see a failed Daily Cycle, but I am starting to believe that a new down leg in Bonds is almost upon us.

A technical caution – if price were to move higher and exceed the current day 6 high, a bullish continuation is possible. For the bulls, loss of the 10-day moving average would be extremely negative, as it would signal a potential downturn and Left Translated Daily Cycle.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences. NOTE: special offer SIGN UP PAGE!

….related: Big Hitters Warn Of Market Meltdowns

Commodities

The decline in crude oil fell into the Sequential Buy Pattern, which concluded earlier in the week. Also, as Ross pointed out it was declining into support. The market seems to be turning and it could retrace around half of the recent loss. That works out to 45.50, or there-a-bouts.

The turn was being helped by the weakening dollar, which could continue flat to down through August.

For most commodities, we have been looking for a trading range through August, and perhaps into September. Often crude can set a seasonal high around late September.

However, as pointed out a few weeks ago breaking below 41 would be significant. The low was 39.26 on Tuesday.

Most commodities started the August trading range at support. The DBC declined to the 200-Day ma at 13.96 on Tuesday and has recovered to 14.21.

Base metals (GYX) tested support at 271 a couple of weeks ago and are at 277. The last high was 283 and getting beyond that level the swing could reach 300.

Grains (GKX) soared to 339 in early June and slumped to 281 on Tuesday. This was down to 30 on the Daily RSI and at support. Firming for some weeks is possible. There is resistance at the 293 level.

Since March, lumber’s advance has had corrections limited by the rising 50-Day ma. The high at 338 a couple of weeks ago was at resistance. And, again, the correction was to the

50-Day, this time at 313 on Monday. There is resistance from 338 to 342 and we still think a cyclical peak is building.

This year’s “Rotation” in iron ore was outstanding. That’s in the price gain as well as in its technical peak. The low was 31 in January and the high was 60.58 in April, which generated a Sequential (9) Sell. The price fell to 42 at the end of May.

The next zoom made it to 58.65 on Monday.

This was with enough thrust to register a Sequential Sell on both the 9-week and 13-week determinations. This should be effective within a week.

We can’t help but wonder if iron ore and copper have been again leveraged in the financial engineering game that was the sensation in 2015. As Shanghai was blowing out.

Once rolled, the target becomes the low at 42. After all, iron is the most common element, not the most precious.

Small Cap Valuation Goes Sky High

Source: Zero Hedge

- “Normal” is around 11.

- Now at 21.

- Latest rally is testing the December high.

- What could drive it higher?

- What could go wrong?

GDP: Rate of Change and Recessions

- Note the “best” level reached in June 2007.

- Also note the jump as crude oil and credit spreads came off of their best in June 2014.

U.S. Leveraged Loan Default Rate Since 2003

Debt to EBITDA Ratios

- The two previous sharp increases occurred in severe contractions.

- Perhaps an involuntary plunge in earnings.

- The huge rise since 2011 seems to be during the “good times”.

- Could be driven by an inordinate increase in debt.

- While voluntary, it may soon be regrettable.

The above is part of Pivotal Events that was published for our subscribers August 4, 2016.

also: Peter Schiff on Central Banks Are Choking Productivity

Listen to the Bob Hoye Podcast every Friday afternoon at TalkDigitalNetwork.com

It’s a fledgling industry with a $6 billion dollar price tag. The question – is it time for a little weed in your portfolio? Justin Trudeau’s government intends legalize by next spring and 25 US states have now passed medical marijuana laws, 4 states allow recreational use.

Perhaps related? another Big Fat Idea – Making Money From The Oldies