Gold & Precious Metals

Whenever I meet an aspiring investor, one of the very first steps is to see if we can unlock home equity to use to invest in real estate or other investments. Many of you may have heard of the term before (or it’s shorthand name HELOC) but may not understand all of the benefits or how the product works. I am going to explain how the approval process works, what the advantages are and how to best use the product to maximize interest and tax savings.

How does a HELOC work?

A Home Equity Line of Credit is a product that, if you work with the right lender, is “re-advanceable”. This means that you get approved for a global limit of up to 80% of the value of your home, and are able to break that amount into chunks as you see fit. One of the neat things about a HELOC is that as you pay down the principal on the mortgage portion(s), those funds become automatically accessible to be re-borrowed within another mortgage or line of credit portion inside the “global limit”. This can be extremely advantageous that I point out later of how people have been able to save money in tax but also simply have access to capital.

Most of our clients that take a HELOC are interested in having money available to them to do renovations, pay for future expenses, invest in real estate or other investments, or simply to have funds available “just in case” (especially for those of you who are self employed). The most common setup is 1 mortgage portion for the amount they currently owe, and a line of credit limit to fill the remainder of the available credit (up to 80% of the property value combined with the mortgage amount).

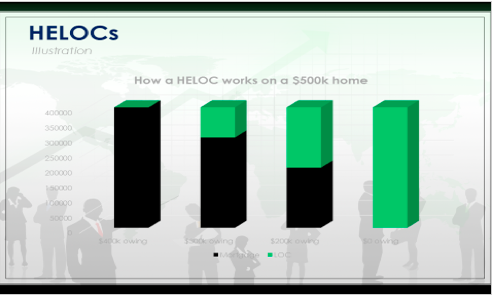

In the above example, we have refinanced or purchased a home worth $500,000 and obtained a HELOC for 80% ($400,000) of the value. In this example, perhaps the individual needed to borrow all of the money at this time which means that as they pay down their mortgage over time, the green part (the available credit on a Line of Credit) slowly increases. This means that after $100,000 is paid down, you could walk into the bank and take out $100,000 on a mortgage or line of credit portion without having to re-qualify. I recently had a client who had a rental property under contract but was short by $19,000 for all of her down payment and closing costs. Luckily, 2 years ago we set up one of her properties with a HELOC product and it allowed them to complete on the purchase.

How do you qualify for this product and which bank is best?

HELOC’s are traditionally harder to qualify for. Some lenders have restrictions on how many you can have in total, only being able to have it on your residence, etc. In general, with federally regulated lenders the entire global limit must qualify at the 5 year posted rate (currently 4.79% as of Aug 1st, 2016) and often on a 25 year amortization as well. This is due to government regulations that if any of the mortgage facility is variable or a term less than 5 years, it must qualify at the 5 year posted rate just like any regular mortgage. Also, when you qualify for the product, you have to qualify as if you are borrowing all of the money inside the global limit even if you don’t intend on doing so. This means that the product can be difficult to qualify for. It’s also one of the main reasons we recommend to our real estate investors that you get the max approval on this product first before investing because:

-

Rental properties generally hurt your borrowing power, not help, due to banks using a low amount of the actual rental income for qualifying purposes.

-

Once the product is in place, however, when you qualify for future debt the lenders look at just the balance inside the facility, not the limit (like they do when you are qualify to get the product).

It’s important to note that Credit Unions are not federally regulated so when qualifying for a product like this you may find that a Credit Union can offer a larger amount than a bank can. The banks also differ in underwriting policies and guidelines which may mean one bank can offer much more than another. My advice is that if one lender says they can’t offer 80% financing, you should seek the advice of an experienced broker to get another opinion. Perhaps some creativity is required or simply another lender would be a better fit.

Also, keep in mind that each lender has a slightly difference product. CIBC for instance only allows 1 mortgage and 1 line of credit inside the facility. Scotia allows 3 mortgages and 3 lines of credit, while National Bank allows up to a whopping 99. Although 99 is overkill, being able to separate the portions is a nice feature as we will see in the next section.

Using the HELOC

When setting up the HELOC, we usually suggest that you should have all money you want or need now should be on mortgage portions and money you want available for future use should be on Line of Credit portions. This is because typically the line of credit rate is higher than a mortgage rate, but also because the money sitting available to you doesn’t cost you anything if it is sitting on a line of credit. Line of Credit rates have been Prime + .5% (3.2% as of Aug 1, 2016) for about 6 years now and seem to be the going rate. However, as of now the going rate for a mortgage is 2.2% – 2.5%. Per $100,000 on a mortgage instead of a line of credit would save $700 – $1,000 per year. I’m always surprised to see clients with hundreds of thousands owing on a Line of credit with no intention of paying it off early as they’re paying much more in interest than necessary.

Many clients are taking advantage of the low borrowing rates to borrow money from their HELOC and using those funds to invest. One easy way a lot of our clients have been doing this is by borrowing money on their HELOC and investing in companies that lend out private money, backed by real estate. The returns to the investors are typically 6% – 10% depending on the risk of the fund which means that you could be making $3,000 – $6,000 simply by borrowing money from your line of credit at 3% and re-lending it out at 6% – 9%.

When investing, keep in mind that your return on investment tends to rise as the amount that you need to put into the investment drops. So if you have borrowed all of the money for an investment, technically the return is infinite. Borrowing money to invest comes with it’s own risks of course, but if you are looking to expand your portfolio, utilizing a HELOC could be a good

option. One of the reasons most of our real estate investors use this product is because they can borrow their 20% down from their HELOC and not need to have savings (since the line of credit is now the emergency savings).

The other really nice feature is that no longer do you have to decide whether you want to save up money to invest or pay down your debt. By paying down your mortgage debt, you are freeing up that same capital to be able to invest in the future and saving interest in the short term. Also, in the next section you will learn that by doing so you will also create tax savings for yourself too.

Tax Savings

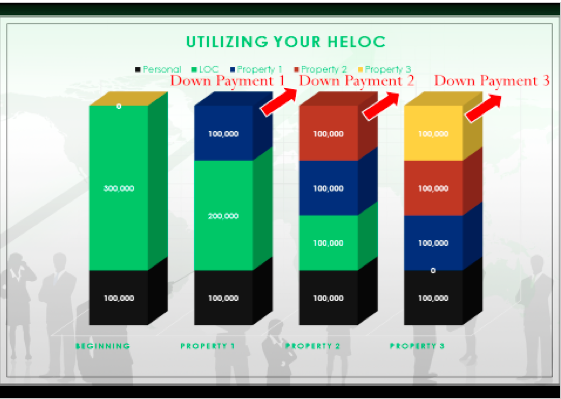

Although most clients set up their Home Equity Line of Credit with 1 mortgage and 1 line of credit product to start, most want the flexibility to be able to separate additional portions later on. Below is an example of how someone would slowly borrow money from their line of credit to purchase real estate and borrow their down payments from their line of credit.

This setup allows you to easily track each portion, and be able to indicate to your accountant which portions are tax deductible.

Yes, when you borrow money to invest, the interest cost is tax deductible! A book written by Victorian native Fraser Smith in the early 2000’s called the Smith Manoeuver popularized the idea and although it was based on borrowing to invest in stocks etc, the idea works just as well with real estate.

We had a client who was awarded $80,000 in an ICBC settlement and was going to use this cash for down payment for a rental. Instead, we recommend that she pre-pay her mortgage by $80,000, restructure the mortgage as a HELOC, and create a new portion for $80,000 which has now been borrowed for the down payment. Now she is able to write off about $2400 per year in interest which saves her about $800 per year in tax!

Is a Home Equity Line of Credit right for you?

Really, the only disadvantages are:

-

Restricting yourself to only lenders with this product. Many “non-bank” lenders that are exclusively available only through brokers have slightly lower rates than major banks but are not able to offer these kinds of products. If you are not intending on using the funds, it may not make sense to pay a “premium” on the mortgage rate.

-

Since these products are only available with major banks, breaking a mortgage like this mid-term may incur higher penalties as major banks calculate your penalty in a way that often costs 2 – 5 times more than non-bank lenders.

-

If you are not good with money, having money accessible to you may result in careless spending habits.

However, if you plan on investing in real estate or other investments or simply want access to funds for the future, this product could be a good fit!

If you are interested in learning more about Home Equity Line of Credit products, feel free to contact us at 604-229-5515 or Kyle@GreenMortgageTeam.ca. website: greenmortgageteam.ca

related:

Michael Campbell interviews Ozzie Jurock about hot properties and Who Got Screwed By The New Foreign Purchase Property Tax

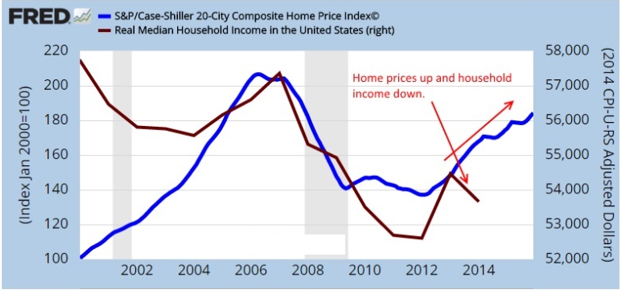

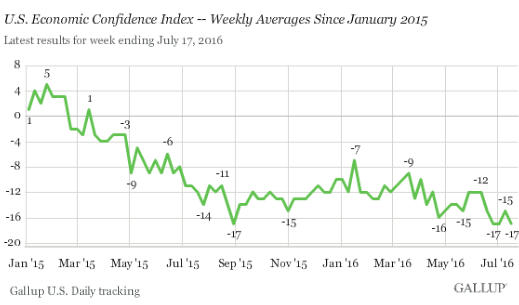

The Gallup Poll has released an Economic Confidence Index which reflects the sentiment of Americans, as it pertains to the economy.

As the stock market makes new record highs and the housing “bubble” market soars, one would expect that the “average” American would be smiling from ear to ear. However, the chart below appears to present nothing but gloom and doom. The Gallup Polls results are dumbfounding the American public as to why this divergence has occurred. I feel we have touched upon a few points as to why this is occurring.

First off, half of all Americans do not even own one stock. Secondly, there are many U.S. companies making large profits overseas. That may be positive for the company but that does not necessarily translate into a better financial position for mainstream Americans.

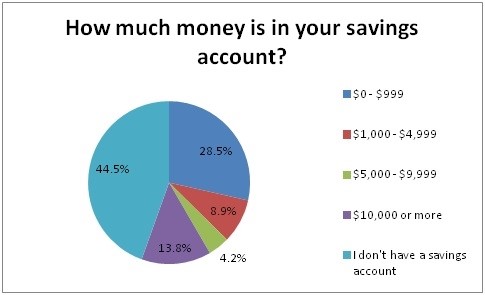

A survey was recently released showing that 62 percent of Americans do not even have $1000.00 in their savings accounts. Most Americans are only one small emergency expense away from being on the streets. What this means is that many will simply rely on credit cards, friends and/or family for their funding should a financial emergency arise. Is this meant to be our economic recovery?

How much do Americans save?

Housing values, which are being “artificially” inflated, only prevent Americans from purchasing their ‘dream homes’, as is reflected in low homeownership rates.

The housing market is once again too expensive for most American families to afford. During the last housing “bubble”, many Americans were able to partake in the mania and enjoy equity gains although they were fleeting.

This time around, most of the gains are going to investors and large institutional buyers that have crowded out mainstream America. This is a first in history to occur, at least on this large of a scale. The homeownership rate is the lowest in a generation as many young Americans are saddled with unsurmountable student loans and consequently forced to return to living at home.

Inflated home prices coupled with decreasing incomes, provide a recipe for disaster! Total wealth, in the U.S., is at a record high level, once again. Consequently, most of the gains are in the hands of a very few.

Americans are angry with the “establishment” and are frustrated with their economic ‘uncertainty’

Americans no longer trust mainstream media. This is being reflected in the political climate: i.e., non-establishment candidates, Brexit, etc. and even new asset classes like digital currencies like bitcoin.

The stock market is fully “decoupled” as to how good Americans are doing, overall.

The SPX is up a stunning 220% since the lows that were reached in 2009 and US economic confidence index shows more people simply do not trust the economic numbers and media.

Concluding Thoughts:

In short, I continue to warn about a down turn in both the economy and stock market. The markets continue to mature and the leading indicators point to a sharp correction in the financial systems I the coming months.

Safe haven investments have rocketed higher like bonds, gold, silver, mining stocks as smart money positioned its self in preparation for a crisis. As I have mentioned many times already, is just going to take one bad event or piece of data to cause the tipping point for the market. The question is when and what will it be?

Just like the 2008 bear market in stocks and financial down turn, this will be no different in terms of what will happen, just like every previous bear market/financial down turn before that. Stock prices will fall, people will lose their jobs, companies go bankrupt, housing defaults increase, personal spending comes to a grinding halt.

When it comes to our investment and trading capital, you can either ride the financial rollercoaster and do nothing, move to cash with some safe haven investments like bonds/precious metals, or bet against the US economy and watch your net worth reach new highs during a time when everyone you know is losing money, jobs and confidence.

Follow my weekly articles, swing trades, and long-term ETF investing positions.

Chris Vermeulen – www.TheGoldAndOilGuy.com

also:

Ever since Brexit, traders – and mostly bears – have been scratching their heads over not only by the S&P500’s tremendous rally but also but the market’s seeming ability to immediately digest through any incremental negative news, both economic and geopolitical and rebound immediately from a support level at around 2,150. And while there has been speculation of central bank intervention to prop up the S&P any time it approaches this key level (something which several years ago would be considered ridiculous but now is all too possible), it turns out there is another – perhaps even more unexpected – reason why the market remains “pinned” in its historic trading range of 2,150 to 2,180.

Ever since Brexit, traders – and mostly bears – have been scratching their heads over not only by the S&P500’s tremendous rally but also but the market’s seeming ability to immediately digest through any incremental negative news, both economic and geopolitical and rebound immediately from a support level at around 2,150. And while there has been speculation of central bank intervention to prop up the S&P any time it approaches this key level (something which several years ago would be considered ridiculous but now is all too possible), it turns out there is another – perhaps even more unexpected – reason why the market remains “pinned” in its historic trading range of 2,150 to 2,180.

Here it the explanation from JPM’s head quant, Marko Kolanovic..…continue reading HERE

related: