Timing & trends

A specter is haunting the world … and it’s NOT the specter of Communism.

It’s the specter of war … bloody regional and civil wars like we haven’t seen since the 1930s … wars that may soon wreak havoc with your finances … further erode your civil liberties … and maybe even endanger your personal safety.

From Istanbul and Rio de Janeiro to Syria and India, the world’s Internet-connected masses are rising up against incompetent, corrupt, increasingly authoritarian governments … and the results will NOT be pretty.

From Istanbul and Rio de Janeiro to Syria and India, the world’s Internet-connected masses are rising up against incompetent, corrupt, increasingly authoritarian governments … and the results will NOT be pretty.

For most of this century, I’ve been reporting on the global financial markets while based in Bangkok, Thailand.

Living in Southeast Asia, just a few hundred miles from China’s southwestern border, has given me a unique perspective on world events and access to news about imminent wars that is rarely, if ever, reported in U.S. media outlets.

Now, here’s the key point: .

I believe we are now on the cusp of what will be the single most important economic events of our lifetime — events that will shape your financial future, and the financial future of all those you care for, for the next 50 years. I’m talking about a series of cascading regional wars and terrorism.

Hundreds of millions of people — in the Middle East, Europe, Asia and South America — are already starting to revolt against the economic misery imposed by their authoritarian governments.

These regional conflicts and civil wars are going to do two things:

First, they are going to unleash the full fury of heavily armed, increasingly authoritarian governments — new Big Brother states all over the world — that now track nearly everything we write, say, buy or even think.

Second — and most surprising of all — this new cycle of warfare will also coincide with the last stock and commodity market booms of our lifetimes — booms that too many ordinary investors will miss out on due to bad advice and even blind panic.

Now mind you, I am not a politician, or a military expert. I am a student of history, a student of human behavior, a student of the markets, and I have an avid thirst for understanding how societies and cultures are cyclic in nature, inevitably causing history to forever repeat itself.

I won’t get into too many technical details today. Suffice it to say that over the past 30 or so years, I have devoted a substantial amount of my time to studying the cyclical nature of war, and what I have found is simply astounding.

You see, just like business cycles, or various different economic cycles, the waging of war within and between nations has definite, identifiable rhythms.

In my research on war, which has covered more than 5,000 years of war data, I’ve found that there are three distinct cycles to war.

There are the 8.8- and 17.7-year cycles. They in turn are sub-cycles of a larger cycle that’s 53.5 years in duration.

The 53.5-year cycle can be seen in this cycle chart here.

As you can clearly see, the 53.5-year War Cycle nailed major turning points …

|

The War of 1812

The Civil War

The end of WWI in 1918

The U.S. entry into WWII

It then …

Rose during the Korean and Vietnamese Wars

And bottomed in 1995, right around the middle of the “Peace Dividend,” which resulted from the initial fall of Communism in the former Soviet Union and the opening up of China’s communist economy.

The 53.5-year cycle has been turning up ever since. It is now clearly picking up momentum and strength, as evidenced by all the recent horrible events all over the globe.

We are right on the edge of seeing the war cycles turn violently higher, heading all the way up into the year 2020/21 before any lull is found.

What kind of war(s) could we be facing? It could be …

- Definitely more terrorism;

- A civil war and the breakup of Europe (already started);

- Massive civil unrest in the U.S. (already starting);

- A war in the Middle East (already underway in Syria and with ISIS, will get much worse);

- A war between China and Japan over the Senkaku (or Diaoyu) Islands;

- A war between China and Vietnam, Malaysia and the Philippines over the Spratly Islands;

- Cyber wars;

- Massive uncontrolled currency wars;

- Capital controls (already in place in many countries in Europe).

Or any combination of many or even all of the above!

It’s coming. You can see it everywhere.

And it’s going to impact markets in ways you simply must prepare for. It will likely drive U.S. equities sharply higher. It will be the main trigger for gold and other commodities in their new bull legs higher.

It will eventually send interest rates soaring higher, and bond prices crashing.

It could cause all kinds of economic and financial repercussions that will either strip you of your wealth in the months and years ahead …

Or help you become richer than Midas.

Best wishes and stay safe,

Larry

Larry publishes the Real Wealth Report

Due to a change in sentiment Victor Adair has initiated a bearish position on the Stock Market. In Live From The Trading Desk Victor also covers the CDN Dollar, Gold, Yen and interest rates in a clear and succinct manner.

related: Forex Trading Alert: USD/CAD – Third Time Lucky

Yesterday, the greenback moved sharply higher against its Canadian counterpart as the price of crude oil slipped to the lowest level since late Apr, weighing on the Canadian currency. Thanks to these circumstances, USD/CAD broke above important resistance zone and closed the day above it. Will we see further rally in the coming days?

In our opinion the following forex trading positions are justified – summary:

- EUR/USD: short (a stop-loss at 1.1236; initial downside target at 1.0708)

- GBP/USD: short (a stop-loss at 1.3579; initial downside target at 1.2519)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

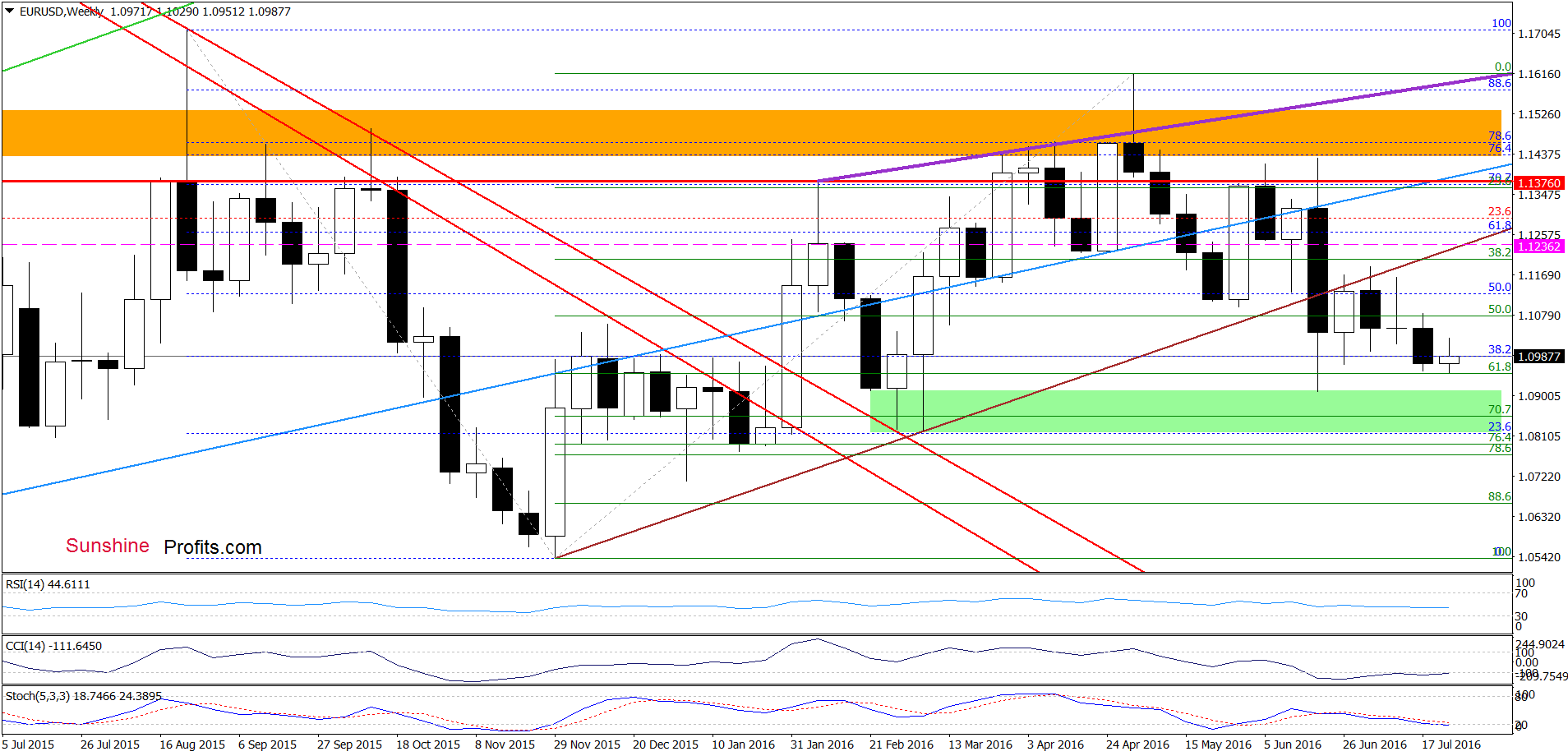

EUR/USD

Looking at the daily chart, we see that although EUR/USD broke above the upper border of the purple declining trend channel earlier today, this improvement was temporary and the exchange rate reversed and declined, invalidating earlier breakout. This is a negative signal, which suggests further deterioration. However, this scenario will be more reliable if we see a daily closure under the upper line of the formation.

Having said the above, let’s check whether anything changed on the medium-term picture or not.

From this perspective, we see that the pair is still trading in a narrow range between the green support zone (created by the late Feb and early Mar lows and reinforced by the 70.7% Fibonacci retracement) and the previously-broken brown rising resistance line, which means that what we wrote yesterday is up-to-date:

(…) we think that another bigger move will be more likely if we see a breakdown under the green zone or invalidation of the breakdown under the brown line. Until this time short-lived moves in both directions should not surprise us.

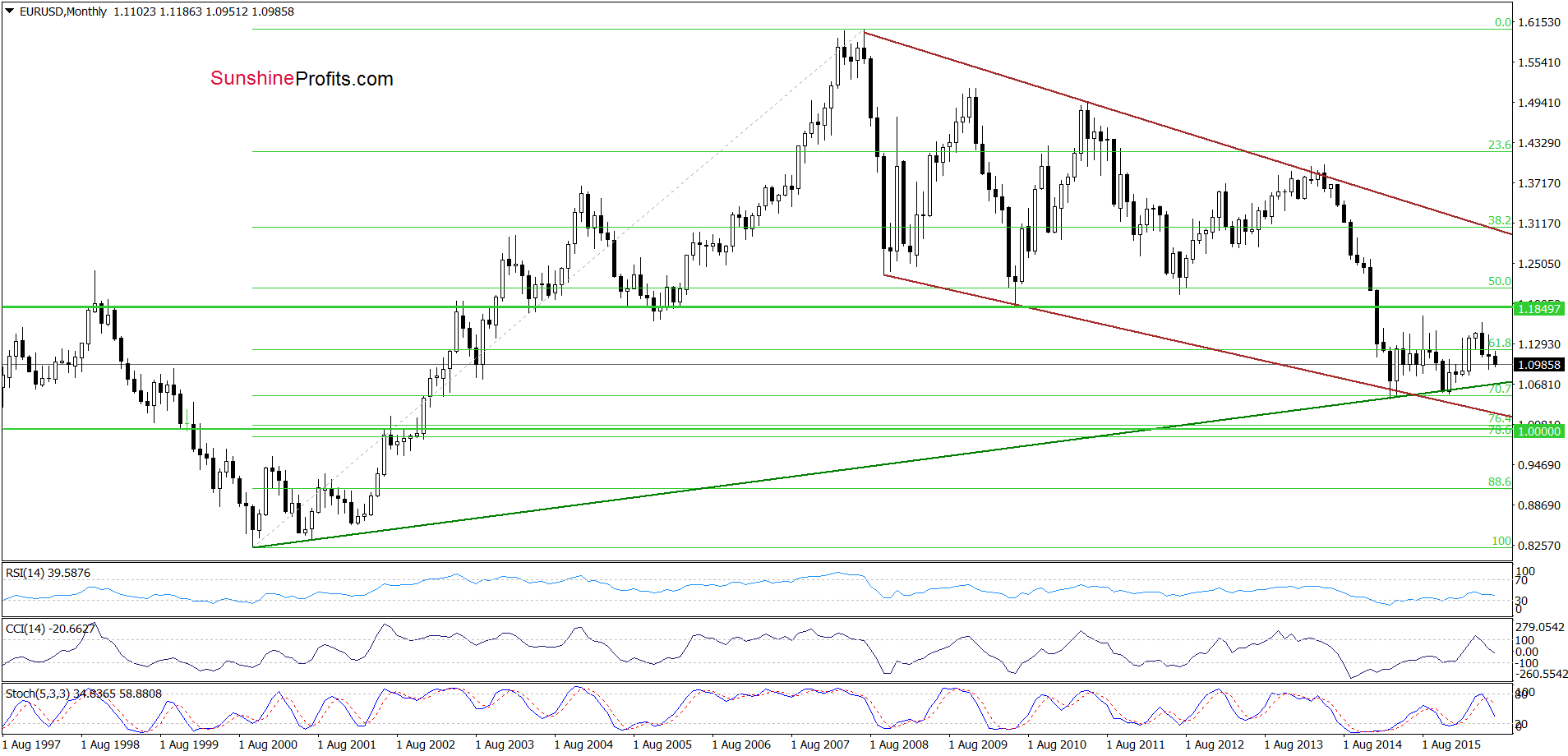

Nevertheless, the long-term picture below suggests that further declines are just a matter of time. Why?

Because sell signals generated by the indicators remain in place, supporting further deterioration and a re-test of the strength of the long-term green support line (currently around 1.0708) in the coming week(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1236 and initial downside target at 1.0708 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

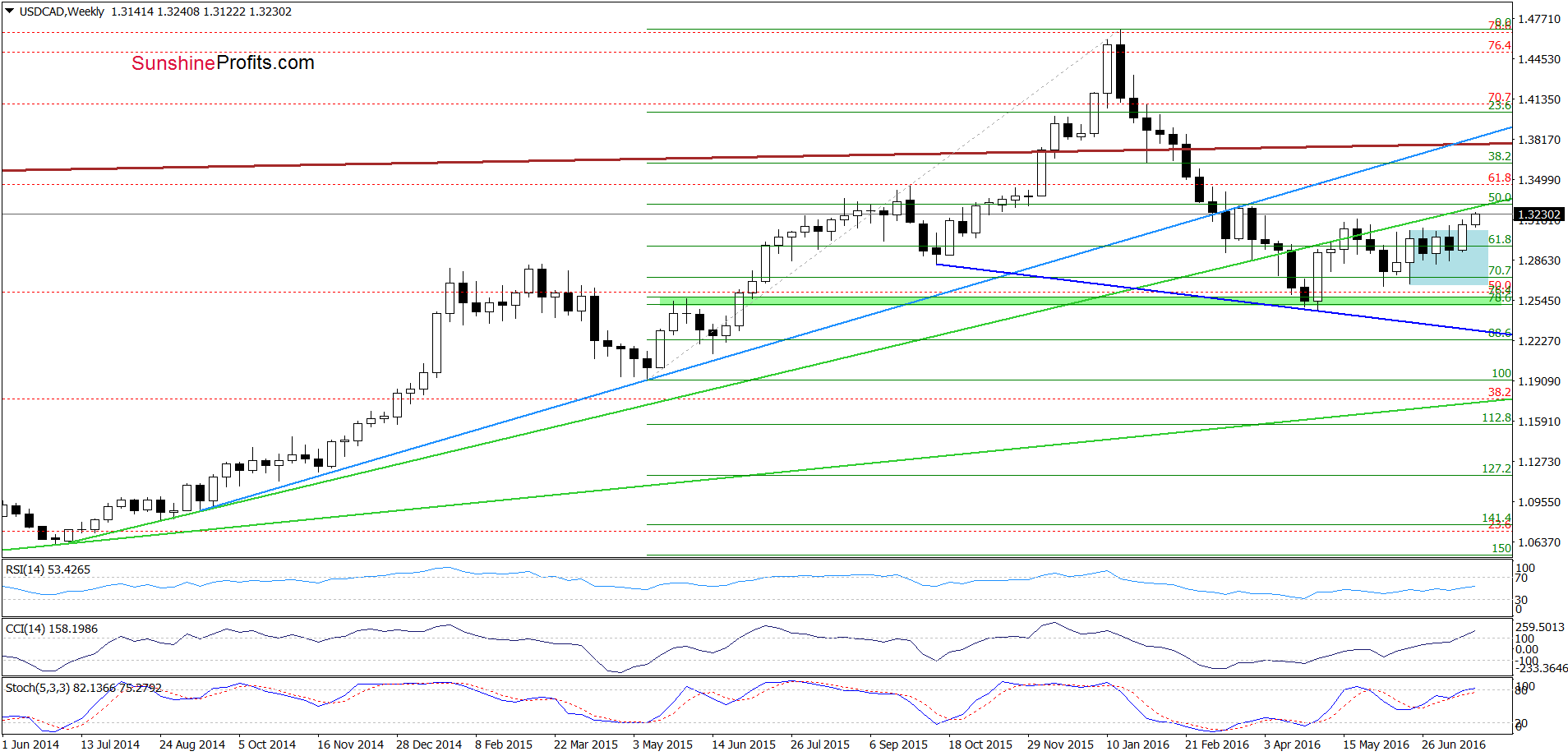

USD/CAD

On the medium-term chart, we see that USD/CAD broke above the upper border of the consolidation, which is a positive signal that suggests further improvement and a test of the previously-broken green line (currently around 1.3272) in the coming week.

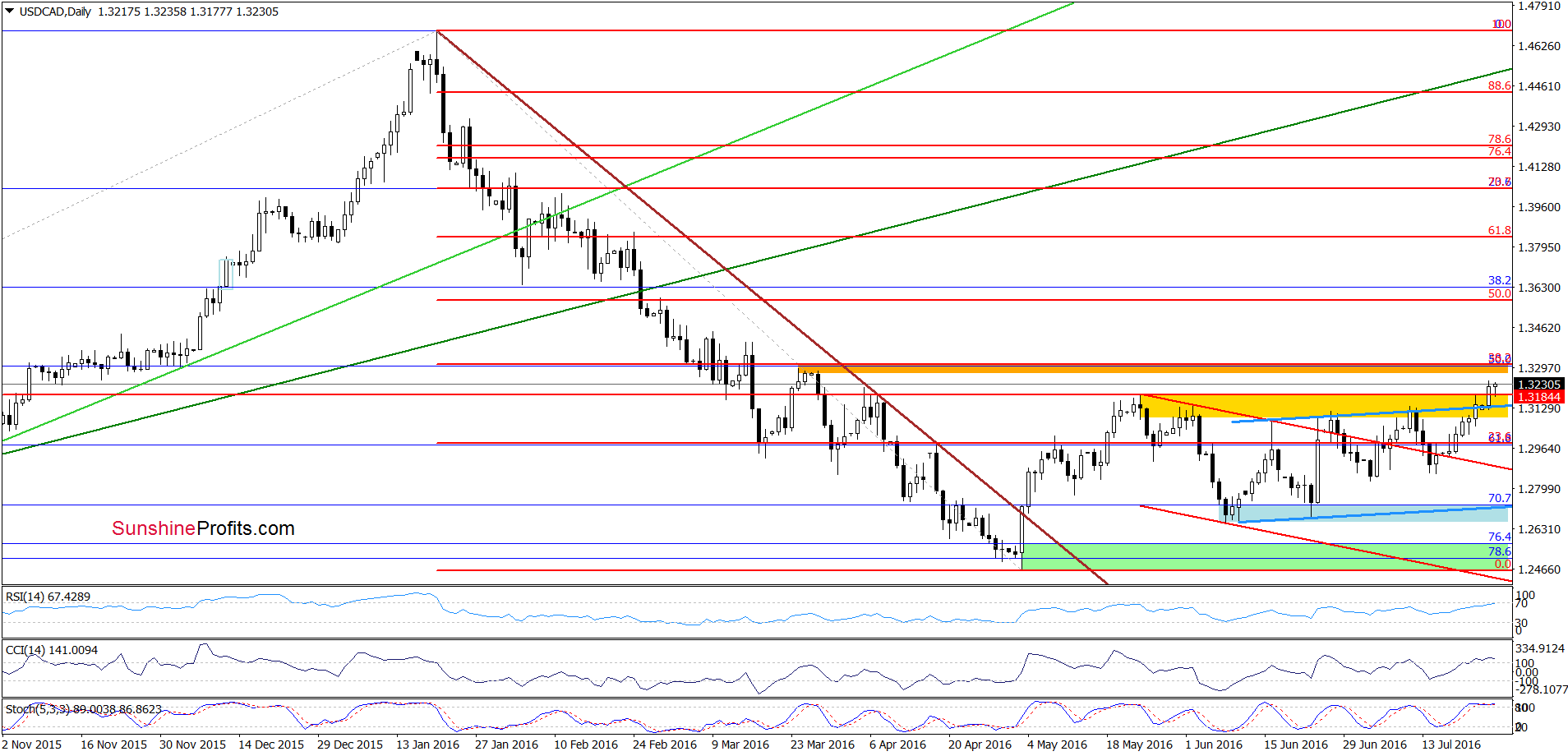

Are there any negative factors that could hinder the realization of the above scenario? Let’s examine the daily chart and find out.

Looking at the daily chart, we see that USD/CAD finally broke above the yellow resistance zone and the upper border of the blue rising trend channel, which encouraged currency bulls to act. As a result, the exchange rate closed yesterday’s session above these resistances, which suggests further improvement and a climb to the orange resistance zone (created by the late Mar highs and the 38.2% Fibonacci retracement based on the entire Jan-May decline) in the coming days (around 1.3283-1.3315). Nevertheless, please keep in mind that the current position of the indicators suggests that the space for gains may be limited and reversal in the coming days can’t be ruled out – especially when we factor in the current picture of crude oil (if you would like to know more about the commodity we encourage you to read our yesterday’s Oil Trading Alert).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

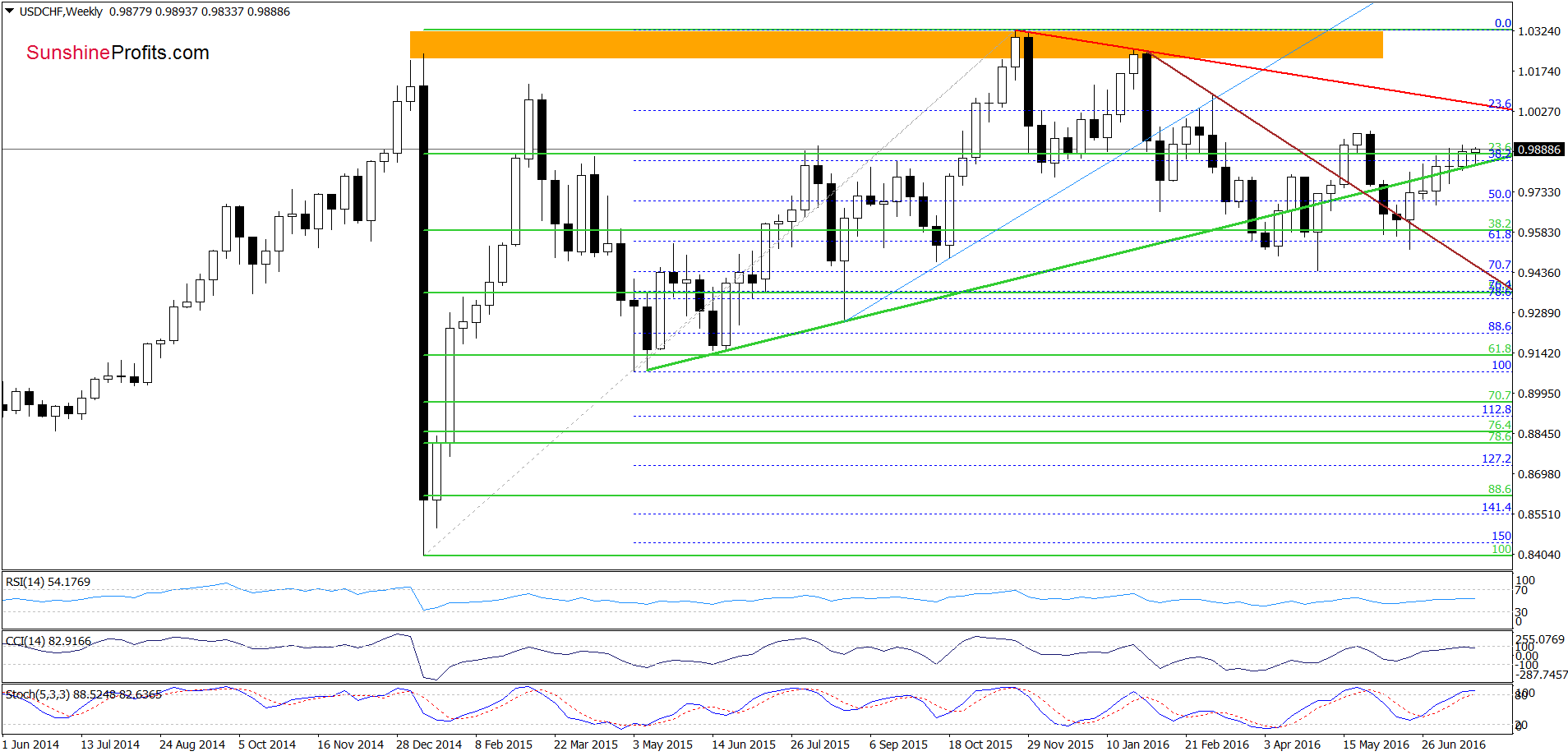

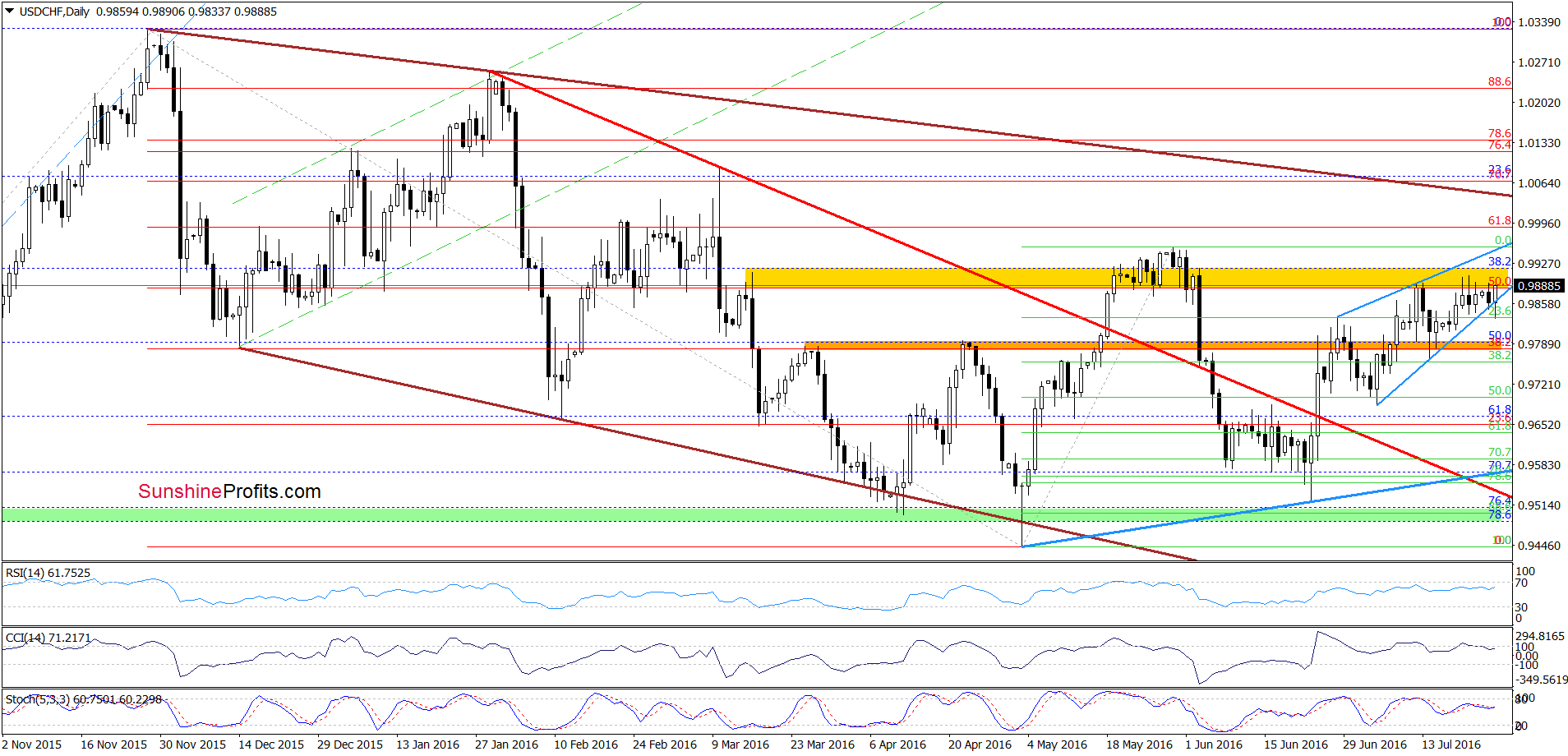

USD/CHF

Looking at the daily chart, we see that although USD/CHF slipped under the lower border of the blue rising wedge, currency bulls managed to stop their opponents and push the exchange rate higher. As a result, the pair came back to the yellow resistance area once again. Taking these facts into account and combining them with a buy signal generated by the Stochastic Oscillator, it seems to us that currency bulls will try to push the exchange rate higher in the coming days. If this is the case, and the pair increases from here, we may see a test of the May and Jun highs. At this point it is also worth noting that in this area is also the upper border of the blue rising wedge, which could encourage currency bears to trigger a reversal and decline.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

“Heroes are made by the paths they choose, not the powers they are graced with.”

“Heroes are made by the paths they choose, not the powers they are graced with.”

― Brodi Ashton

Action, Courage, Character, Tenacity

Great leadership is built upon many small actions we take throughout the day, punctuated periodically by severe crises and significant decisions. However, in order to prepare as leaders for the severe crisis and significant decisions we must practice daily leadership, so when called upon, we have the mental and emotional preparedness to deal with the significant challenges of the moment.

I have found the ACCT a great reminder of the important aspects of being a daily leader. Being significant in the small actions of the day puts me into the frame of mind to be the leader of the moment.

Action – Great leadership is about getting things done. Period. It’s about outcomes not activity. It’s about achieving results and making progress towards a worthwhile goal. It’s about overcoming fear and being hungry to achieve success, all of which require action. Nothing gets done without action.

Courage – Being in positions of leadership comes with great responsibility. In any organization, whether a business, government, church or family, the weighty decisions are made first and easily by those in more junior roles, while the substantial decisions are elevated to the top. A courageous heart gives us the fortitude and faith to make those decisions with the best information we have at the time and with our best judgment. A daily dose of taking courageous actions helps build our moral fabric and makes it easier to make the difficult decisions, when the time ultimately arrives.

Character – While reputation is the way others see us, character is the way we truly are. Great leaders need to be very mindful of their character which includes integrity, humility, gratitude, caring, wisdom, self-control, positive attitude, a loving nature, and sense of fairness. By being aware of these traits and working hard to develop and maintain them throughout the day, we build our character and become better human beings and become more able to affect positive change. Be mindful of the very small things you do throughout the day that can either erode or build your character.

Tenacity – Many people fail to become exceptional leaders because they have trouble overcoming obstactles. Great leadership requires the vision AND ability to see beyond the obstacle and find way to solve problems and achieve progress. Tenacity can be practiced, not necessarily by looking for problems, but by overcoming the vicissitudes of life in a positive, cheerful, focused and productive manner, seeking the help of others, coming up with creative solutions or mitigating the impact of the problem. Overcoming failure often comes with lessons that accelerate our future success, so you practice overcoming challenges in a low-risk environment in preparation for the day it really counts.

Business Tip of The Week:

Focus on the few critical things you do well, and outsource or stop doing all else. We can only win by focusing on the tasks that leverage your natural talents and skills.

Janet, you have a problem…

If soaring home prices and record high stocks won’t spike consumer confidence, what will?

also from ZeroHedge: USDJPY Plunges On Japan Stimulus Concerns; US Futures Flat With As Fed Begins Meeting