Currency

The world has woken up to the fact that the Central Banks are a curse, rather than a boom to the global economies, and their time left is slowly coming to an end because of new technologies and currencies.

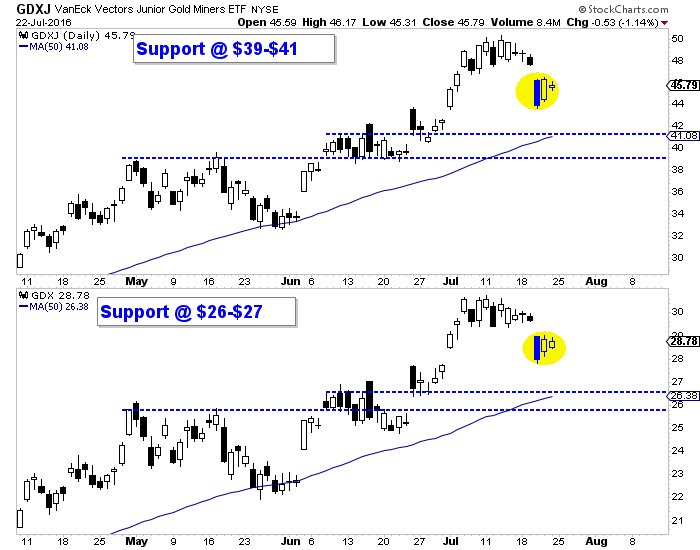

People are starting to park their money in digital currencies, like Bitcoin, rather than parking them in fiat currencies. This is primarily due to the Negative Interest Rate Policy as well as Zero Interest Rate Policy of the Central Banks, which explains the sharp rise in the price of Bitcoin, this year as seen in the chart below.

Billionaire resource investor, Carlo Civelli, believes that the Central Banks cannot get away with all the monetary printing. And I believe that the more they print, the more they push investors away from wanting their fiat currency.

“If we all talk about the end game and a scenario of total collapse, I can see the governments telling everybody that your money is now worthless and the bonds you own are now worthless. You all have to take a haircut”, said Civelli.

The institutional investors are recognizing this outcome,

hence, they are the largest group of Bitcoin buyers.

Jeremy Millar, Founder and Managing Partner at Ledger Partners in London, believes that people at hedge funds and family offices contribute 50% to 90% of the Bitcoin’s current $6.4 billion market cap.

“What is clear though is that over the last two years, bitcoin has emerged from its ‘hacktivist’ origins to a more institutionalized ecosystem which includes the participation of hedge funds, traders, and professional investors,” said Millar, reports Reuters.

Lack of regulation was scaring a few customers; not that regulation helped in any way during the 2007 crash, and neither will it help in the next crash. Nonetheless, the entry of the Winklevoss twins has given the whole industry an entrepreneurial boost. The twin brothers have co-founded the Bitcoin exchange Gemini.

“With Gemini, we’re a regulated trust company in the state of New York; we’re regulated under banking law, so we operate and have the same controls and procedures that you would expect of any financial institution (like your bank). That didn’t exist in the early days of Bitcoin. Quite frankly, it didn’t exist a year ago . . . It was a Wild West in the early days,” said Tyler Winklevoss.

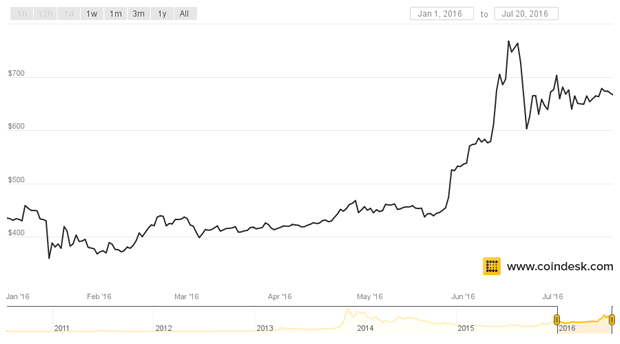

It is not only the U.S. and the European investors who are worried about their currencies, but the Chinese investors are worried, as well, about the decreasing value of the yuan.

Zennon Kapron, founder of Financial Technology Consultancy Kapronasia and author of a book on Bitcoin said, “it seems that China is leading a lot of the movement. People are protecting their investments [by converting yuan into bitcoin],” reports the Wall Street Journal.

The chart below shows the Chinese appetite for Bitcoin. The two Chinese exchanges, Huobi and OKCoin, both witness approximately 92% of the global trade in Bitcoin.

“There’s a lot of hot money in China that has to go somewhere,” says Du Jin, Chief Marketing Officer at Huobi, reports The WSJ.

Austrian economist and investor Tuur Demeester believes that “it is important to use Bitcoin as part of a diversified portfolio.” He adds that bitcoin “offers a counterbalance to a series of growing risks that are associated with traditional investment practices,” reports the Brave New Coin.

“We think a well-rounded portfolio includes investments in a basket of block chain technologies (altcoins), with an emphasis on Bitcoin. This portfolio can play a part in three distinct strategies: as an insurance policy, as a hedge in a broad speculative portfolio and as a calculated bet on an early retirement,” wrote Mr. Demeester, in his report.

He goes on to add that “we believe returns of 100x over 10 years are possible, though obviously not guaranteed.”

Conclusion:

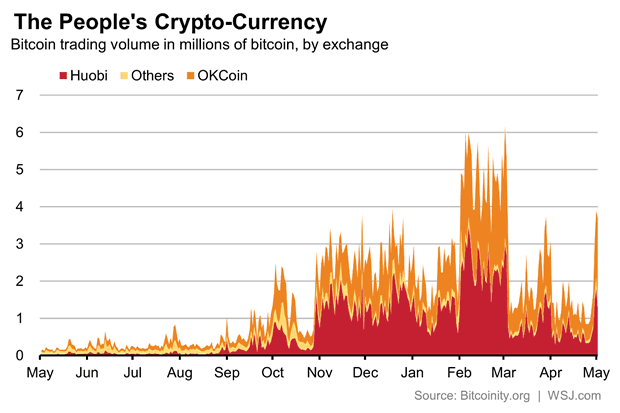

My readers know that I do not big believer in owning fiat currencies for the long-term. My main emphasis is to find ‘alternative’ asset classes, which are mature enough, but not saturated. The risk-reward in such classes should be high.

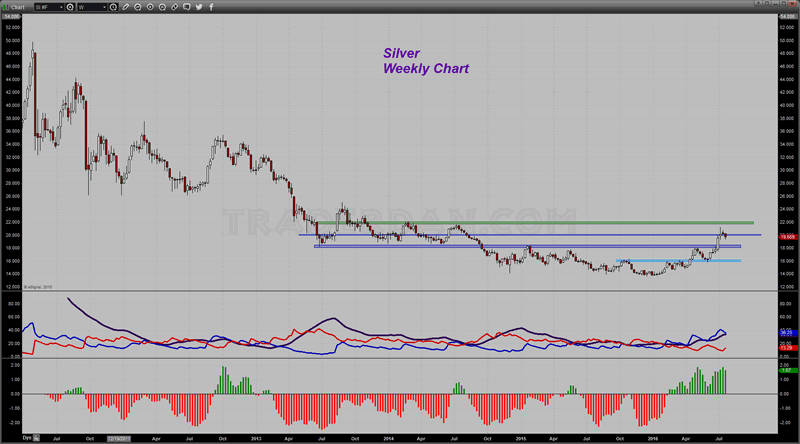

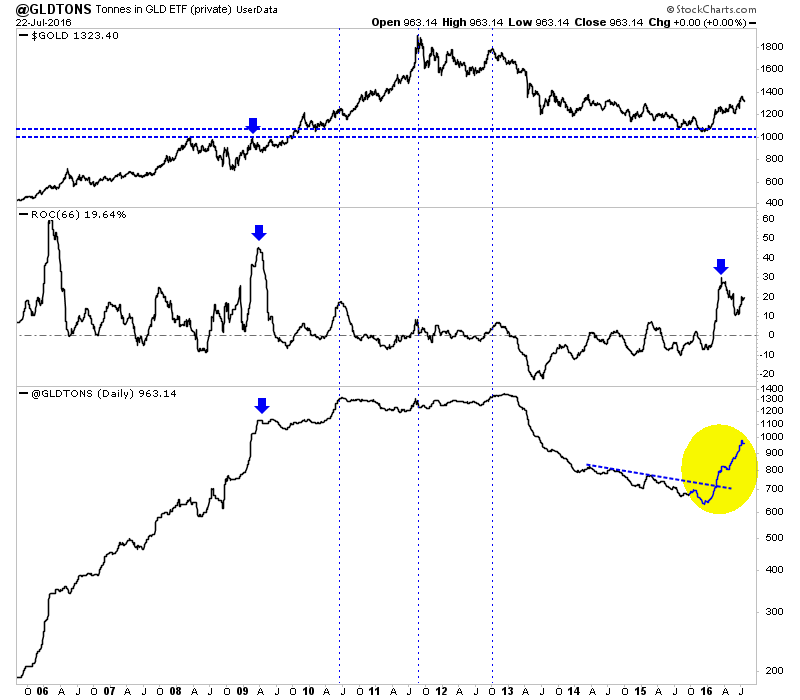

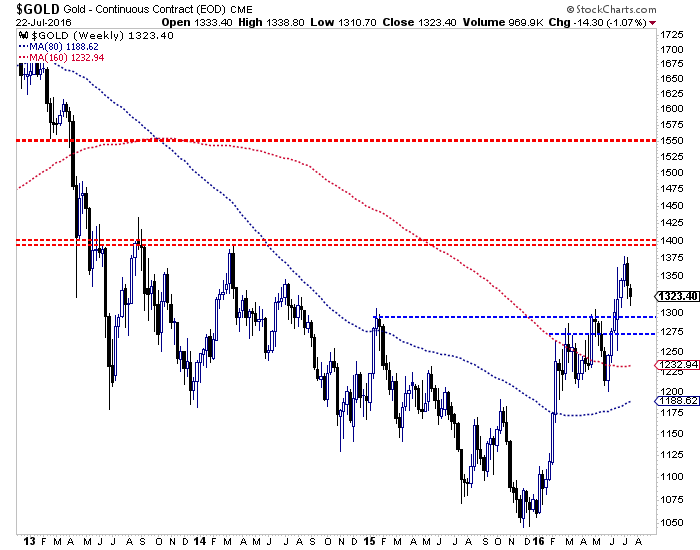

Gold and silver are undeniably the best investments for the long-term considering the low-risk that they carry. Similarly, within the next few days, I will keep an eye on Bitcoins, as well, and suggest trading ideas so as to profit from it.

Keep watching this space so as to know when to buy each one of the ‘asset classes’

also:

Don’t miss Michael Campbell’s interview: A Truly Great Interview With Uber Money Manager, James Thorne

This series is based on the premise that debt works the same way for countries as it does for individuals and families: When you borrow too much your life spins out of control. For national and multi-national entities that means elections become unpredictable, economies function erratically, and public policies become more ad hoc and less effective.

And civil unrest becomes the rule rather than the exception. In the US, for instance, it’s suddenly open season on both black men and the police. And in Europe, the following happened in just the past couple of weeks:

Machete-Wielding Syrian Refugee Kills One; Injures Two In Southern German City

(Zero Hedge) – The perpetrator had an argument with a woman near the central bus terminal in Reutlingen, and during the altercation severely injured the woman using a machete. The woman died of her injuries at the scene, police said. The perpetrator was then detained near the scene “in minutes” after the incident but managed to injure another woman and a man, police added. The eye witnesses described the attacker to Bild as “fully insane,” adding that he tried to attack a police car with his machete.

German Police Kill Assailant After Ax Attack Aboard a Train

(New York Times) – WEIMAR, Germany — A 17-year-old Afghan youth who came to Germanyas a migrant last year attacked several passengers with an ax and a knife on a train in the south of the country late on Monday, injuring at least four people, while 14 others were treated for shock, the police said.

After the train made an emergency stop, the attacker fled and was pursued by police officers, who fatally shot him, according to the interior minister of the state of Bavaria, Joachim Herrmann. The motive for the attack remained unclear.

The young man had entered Germany without his parents and applied for asylum, Mr. Herrmann said. According to government figures, more than 14,400 unaccompanied minors arrived last year among the more than one million migrants who entered the country.

Munich shooting: 9 victims, gunman dead, police say

(CNN) – At least nine people were killed and 16 others injured Friday in a shooting rampage at a busy shopping district in Munich, Germany, police said.

The unidentified attacker was an 18-year-old German-Iranian who had lived in Munich for at least two years. The man was not known to police and his motives are unclear, authorities said. No group has claimed responsibility.

Many children were among the casualties.

Attack on Nice | Truck rampage rattles an already unsettled France

(AP) — The Bastille Day truck attack in Nice may have shaken France’s collective psyche, further unnerving a country already traumatized by extremist attacks that have become alarmingly more frequent.

Despite being under a heightened state of emergency, French security forces failed to stop Mohamed Lahouaiej Bouhlel from barging past police vehicles at the entrance to Nice’s famed Riviera beachfront, where the zig-zagging truck he was driving instantly transformed a crowd of families and fun-seekers into utter tragedy.

“The fact that this attack occurred when security measures were supposedly in place makes this very different from previous attacks,” said Neil Greenberg, a professor of military mental health at King’s College London. “That undermines the trust people have in the government to stop these events and it is extraordinarily hard to rebuild that trust once it’s lost.”

This sudden outbreak of apparent insanity doesn’t seem closely tied to the recent change in our borrowing habits. But it is, in several ways. First, the ability to borrow effectively-unlimited amounts of money has set major governments free to intervene militarily in the Middle East and elsewhere, leading to the flood of refugees now destabilizing Europe and breeding the kinds of nothing-left-to-lose behavior chronicled above.

Second, since borrowing and spending money in the present is effectively stealing growth from the future, the more a country borrows, the harder it becomes to provide good jobs and effective public services for the people at the bottom of the economic ladder. Poor, desperate people are inherently more volatile and more likely to crack under the strain of their poverty.

Third, as the easy money policies that once greased the wheels of statist political machines stop working, the people in charge (who have just that one tool in their box) are resorting to ever-more-extreme parodies of past policies – low interest rates being replaced by negative rates, short-term infusions of modest liquidity giving way to massive and apparently permanent central bank purchases of bonds and stocks). These new policies, rather than being simply ineffective, are actively damaging. So the death spiral of the fiat currency, fractional reserve banking system is being turbocharged, which is why the atrocities seem to be occurring at shorter and shorter intervals.

Note that three of the four attacks mentioned here didn’t require guns. People are figuring out that trucks and tools work just fine for mass slaughter as long as the attacker doesn’t mind dying at the end. This opens up myriad possibilities for creative nihilists.

Two headlines hint at what happens next:

Donald Trump says French and Germans to face “extreme vetting”

Don’t miss Michael Campbell’s: A Truly Great Interview With Uber Money Manager, James Thorne

Brexit, Federal Reserve, Turkish Coup…what does it mean for your investments? What’s coming next? Not an easy answer but Caldwell Investment’s chief strategist, James Thorne says there’s one the key variable that you must keep a close eye on.

Do not miss Michael’s Saturday Comment: The Biggest Change in Canada’s Culture…. It’s Not Good News