Gold & Precious Metals

The oil market has been heating up in recent weeks, and even Goldman Sachs revised its forecasts higher for oil prices this year. That was mostly due to supply-side changes, such as the wildfire in Canada and Nigeria’s oil disruptions. Even though these issues are likely to have already impacted oil inventories, the oil market still faces several hurdles that could keep oil prices from rising much higher than their current levels of around $50.

The oil market has been heating up in recent weeks, and even Goldman Sachs revised its forecasts higher for oil prices this year. That was mostly due to supply-side changes, such as the wildfire in Canada and Nigeria’s oil disruptions. Even though these issues are likely to have already impacted oil inventories, the oil market still faces several hurdles that could keep oil prices from rising much higher than their current levels of around $50.

related: Saudi Arabia’s Oil-Bust Cash-Flow Debacle Begins to Bite

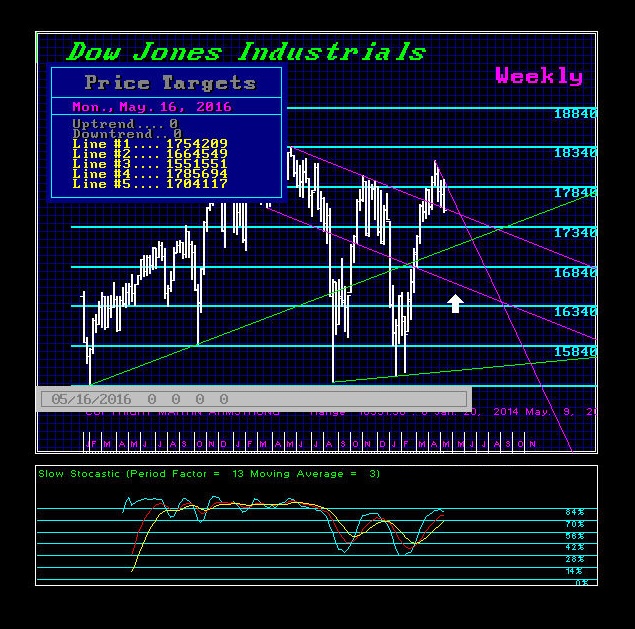

“There is ABSOLUTELY NO INDICATION yet that we are in a bearish trend poised to break last year’s low in the Dow. Another retest of support – YES.” – Martin Armstrong

The Dow does not need to break last year’s low, as that was accomplished in the NASDAQ and S&P 500. Nothing has changed there. The entire interest rate issue has far too many people brainwashed. No doubt, they would initially sell. However, the market will rise with higher interest rates as it has always done. Therefore, as shorts build, we can easily create a bear trap and that will be the fuel to rally again. This is the churning we are in until it appears at least after September.

This time, we have a far more serious problem with where to put money – big money. Stocks are the modern-day version of what gold used to be decades ago when you could jump on a plane with a suitcase full of gold and sell it wherever you landed. Today, metal detectors prevent that from taking place. Stocks are being used to move money, but they must be the high-end shares that are traded globally (see article posted on Egypt).

There is ABSOLUTELY NO INDICATION yet that we are in a bearish trend poised to break last year’s low in the Dow. Another retest of support – YES. This is the churning pattern. Breaking last year’s low would ONLY be indicated with a monthly closing beneath 16000 prior to August. Then we are merely extending this entire mess and not altering the long-term outcome.

That said, we have a more important number for month-end at 17579 followed by 17210. A May closing below 17210 would signal a possible test of the 16000 level in the months ahead.

Nevertheless, the first Minor Weekly Bearish Reversal in the Dow lies at 17434, which we flirted with on Thursday. We need a closing below this today to suggest a correction is unfolding. However, make no mistake about it, the next critical area is 17120, which happens to be a Daily and Weekly Bearish Reversal. That is the level to watch for a serious short-term break.

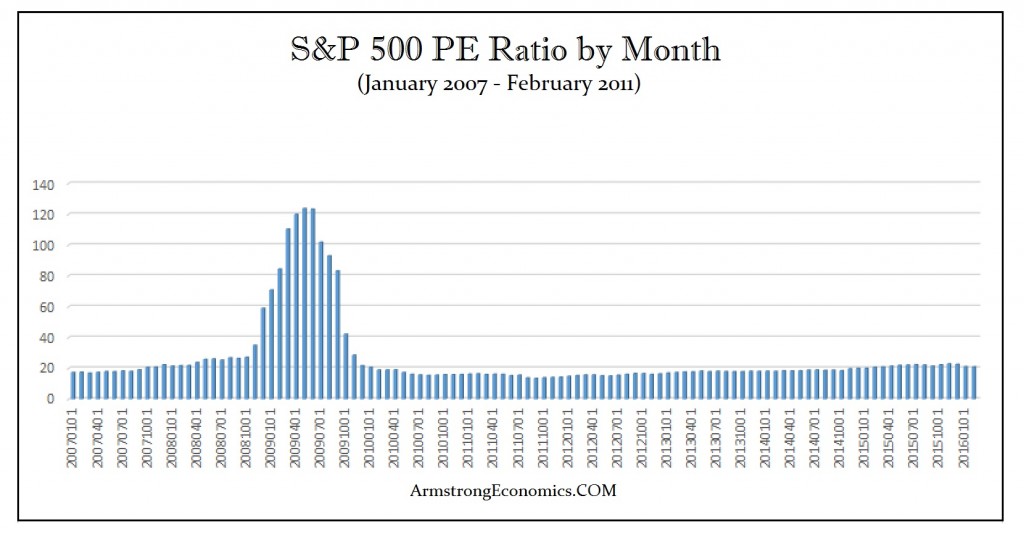

Keep in mind that people continue to think this market is “rich” in price and they are concerned about earnings. Those ideas are so out of touch with reality. The PE Ratioreached 50:1 in 2000 during the DOT.COM bubble, but it exceeded 120:1 during the 2007-2009 meltdown because blue chips are the place to secure money. The market is by no means “rich” from a historical perspective. We are not in some standard investment scenario. A 3% dividend is huge with negative interest rates in cash. Bonds are a disaster and have nowhere to go but down. So how is the market “rich” when there is no other alternative? This is why money has flowed into real estates, ancient coins, metals, and equities. We must look at the alternatives here and the idea of selling stocks must be followed with deciding where to put your cash. Banks or government bonds? Come on. Where’s the rational thinking here?

…more from Martin: Trading Volumes Decline as Hoarding Rises Due to Uncertainty

Bonds: Hedge funds profited this week on their big short in the 5-year, correctly betting on higher short-term rates. Commodities: Money managers aggressively sold copper. They continue to buy gold and sugar. Currencies: Institutions and hedge funds have a large net long position on in the Euro. Stocks: Hedge funds remain super short the Nasdaq.

Bonds: Hedge funds profited this week on their big short in the 5-year, correctly betting on higher short-term rates. Commodities: Money managers aggressively sold copper. They continue to buy gold and sugar. Currencies: Institutions and hedge funds have a large net long position on in the Euro. Stocks: Hedge funds remain super short the Nasdaq.

…click HERE for full Analysis and more charts

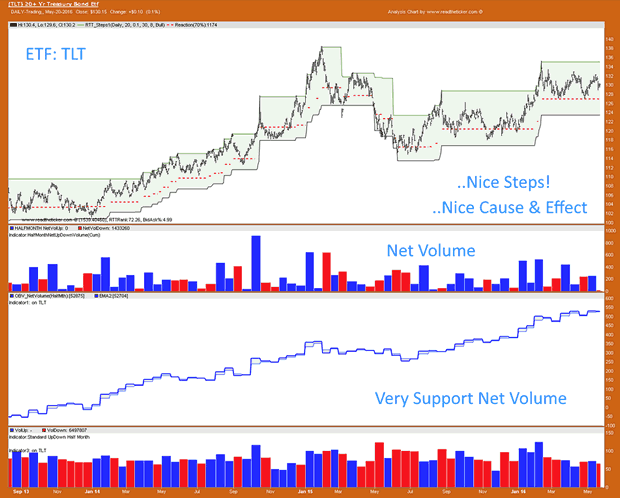

The TLT includes US Bonds maturing between 20 and 30 years. The TLT chart shows no fear of the US FED raising rates. It looks strong and higher prices should be expected in the months ahead. Higher prices means lower average bond yield or lower interest rates are expected. Simply the folks supporting the TLT price do not believe the FED is on a long term rate hike plan.

The chart below is showing off RTT NetVolume tools.(RTT = readtheticker)

Investing Quote…

“Anyone who buys or sells a stock, a bond or a commodity for profit is speculating if he employs intelligent foresight. If he does not, he is gambling.” ~ Richard D Wyckoff

“To me, the ‘tape’ is the final arbiter of any investment decision. I have a cardinal rule: Never fight the tape!” ~ Martin Zweig

“It’s not what you own that will send you bust but what you owe.” ~ Anon

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.” ~ Benjamin Graham

“If past history was all there was to the game, the richest people would be librarians.” ~ Warren Buffett

Also:

This was the message shared by Wayne Allyn Root, the “Capitalist Evangelist,” whose presentation I had the pleasure to see at the MoneyShow last week in Las Vegas. The week before last I said I would be speaking at the event, which was founded in 1981 by my dear friend Kim Githler, and I had no idea how popular Root really was. A businessman, politician and author, Root was the vice presidential candidate for the Libertarian party in 2008 and this year endorsed Donald Trump for president. At the MoneyShow, he packed the room with 1,400 people. Whole crowds turned out to hear him sermonize on entrepreneurship, individual rights and the importance of owning tangible assets such as precious metals and rare coins as a hedge against inflation and today’s uncertain financial markets. Owning gold, he said, is no longer a luxury but a necessity.

This was the message shared by Wayne Allyn Root, the “Capitalist Evangelist,” whose presentation I had the pleasure to see at the MoneyShow last week in Las Vegas. The week before last I said I would be speaking at the event, which was founded in 1981 by my dear friend Kim Githler, and I had no idea how popular Root really was. A businessman, politician and author, Root was the vice presidential candidate for the Libertarian party in 2008 and this year endorsed Donald Trump for president. At the MoneyShow, he packed the room with 1,400 people. Whole crowds turned out to hear him sermonize on entrepreneurship, individual rights and the importance of owning tangible assets such as precious metals and rare coins as a hedge against inflation and today’s uncertain financial markets. Owning gold, he said, is no longer a luxury but a necessity.