Stocks & Equities

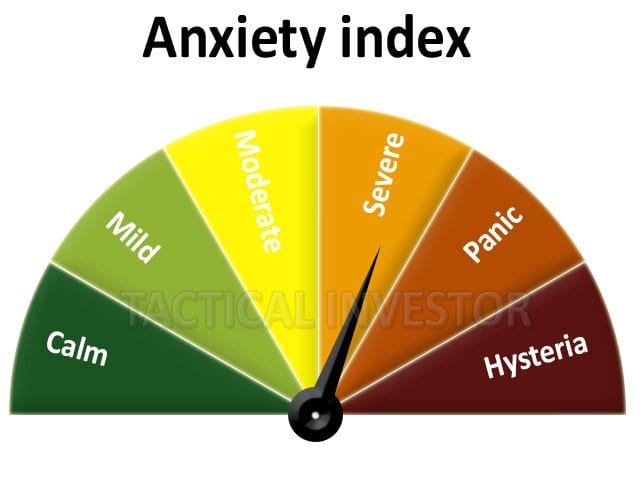

Let’s face it – investors around the world are nervous. Everywhere they look, read, and hear – someone is warning about the the stock market.

Let’s face it – investors around the world are nervous. Everywhere they look, read, and hear – someone is warning about the the stock market.

Yes, stock markets occasionally go down. But so do other markets as well.

The challenge today, is that the 2000 Tech Bubble and the 2008 Housing Bubble is fresh on everyone’s mind. And since these bubbles eventually manifested themselves in the stock market – people today believe every financial crisis must eventually be reflected in the stock market.

Of course, this is linear thinking. And considering bond, interest rate and currency markets dwarf the stock market – investors better understand that the tail doesn’t wag the dog.

Since the risk today is in the bond market – investors should prepare for an investment experience that is completely different than their expectations.

In this issue of the IceCap Global Outlook, we explore major investment markets and using music from the legendary 1980s rock band – The Clash, help guide you along the way to a better understanding of where market risk truly lies.

Read PDF here: IceCap Global Market Outlook

I know I am not the traditional author you come across on most financial sites. Most others will provide you with traditional notions of the stock market based upon rationalities. So, many authors will suggest that we “cannot separate public policy and geopolitics from the markets,” they will focus on “market valuations,” they will claim that “fundamentals do not support this rally,” and will provide you with many, many other reasons as to why they have continually believed that this rally would never happen.

I know I am not the traditional author you come across on most financial sites. Most others will provide you with traditional notions of the stock market based upon rationalities. So, many authors will suggest that we “cannot separate public policy and geopolitics from the markets,” they will focus on “market valuations,” they will claim that “fundamentals do not support this rally,” and will provide you with many, many other reasons as to why they have continually believed that this rally would never happen.

Yet, they have been left on the sidelines, scratching their heads for the last year and a half, as the US equity markets have rallied over 45% since February 2016.

I mean, think about all the reasons they have put before you over the last year and a half regarding the imminent risks facing the stock market, which they have lead you to believe will stop the market in its tracks. I have listed them before, and I think it is worthwhile listing them again:

Brexit – NOPE

Frexit – NOPE

Grexit – NOPE

Italian referendum – NOPE

Rise in interest rates – NOPE

Cessation of QE – NOPE

Terrorist attacks – NOPE

Crimea – NOPE

Trump – NOPE

Market not trading on fundamentals – NOPE

Low volatility – NOPE

Record high margin debt – NOPE

Hindenburg omens – NOPE

Syrian missile attack – NOPE

North Korea – NOPE

Record hurricane damage in Houston, Florida, and Puerto Rico – NOPE

Spanish referendum – NOPE

Las Vegas attack – NOPE

And, each month, the list continues to grow.

Yet, the same authors you have read for years just continue to repeat their mantras that we “cannot separate public policy and geopolitics from the markets,” they continue to focus on “market valuations,” and they continue to claim that “fundamentals do not support this rally.”

Einstein was purported to suggest that insanity is doing the same thing over and over while expecting a different result. But, you see, in the stock market, there is a bit of a difference. Just as trees do not grow to the sky, the stock market will not rally indefinitely. So, we will eventually see a bear market. Then, the broken clock syndrome will prove these authors to be “right,” rather than simply insane, and we will hear it from them incessantly about how they tried to warn us. Yes, warn us indeed.

Now, that does not mean we should expect analysts to be right all the time. Clearly, I was expecting the set ups we have seen in the metals market to spark a big rally in 2017, but when we broke upper support back in September, it caused me to turn quite cautious until 2018. But, the difference is that I use an objective methodology that listens to what the market is saying rather than trying to force a predetermined linear perspective on the market.

And, that is the issue with most of the bearish presentations you have read for the last year and half about the stock market, while they claim they are simply “opening your eyes to the inherent risks in the stock market.” Let me ask you a question: Is there anyone reading this article that believes the stock market does not have risk at all times? I will not belabor this point, but, needless to say, these bearish presentations couched as “risk awareness” is not based upon objective perspectives on the stock market.

My friends, look at the events I have listed above yet again. None of them (nor ALL of them cumulatively) have been able to put a dent in this market advance over the last year and a half. So, rather than view the market from a perspective of insanity, maybe one should come to the conclusion that public policy, geopolitics, market valuations, or fundamentals are really not what drive the stock market. Clearly, we have seen that none of this has mattered one iota. So, maybe we need to consider that there is a stronger force at work which overrides any of the traditional perspectives you were lead to believe drives the market?

Bernard Baruch, an exceptionally successful American financier and stock market speculator who lived from 1870– 1965, identified the following long ago:

All economic movements, by their very nature, are motivated by crowd psychology. Without due recognition of crowd-thinking … our theories of economics leave much to be desired. … It has always seemed to me that the periodic madness which afflicts mankind must reflect some deeply rooted trait in human nature — a trait akin to the force that motivates the migration of birds or the rush of lemmings to the sea … It is a force wholly impalpable … yet, knowledge of it is necessary to right judgments on passing events.

Price pattern sentiment indications and upcoming expectations

The upcoming week is rather simple, and centered around the 2572SPX region. As long we hold over the 2572SPX early in the coming week, we are on our way to the 2611SPX region.

However, if we break down below 2572SPX early in the coming week, it opens the market up to another decline which will revisit the 2520-2550SPX support region before we finally rally to the 2611SPX region.

See charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

Financial experts love to spin lovely yarns

In fact, most of them appear to have chosen the wrong field; writing fables would have probably been a better choice.

The real phase of a bull market starts after it has taken out its old highs. Until this moment occurs, it’s not a real bull market The Nasdaq recently achieved this milestone; this was not an easy feat as it took the Nasdaq 15 years to break through the strong zone of resistance illustrated In the chart below. A market normally doubles after breaking out to new highs, especially if it has been struggling to achieve this for 15 years. Roughly it should trade to the 9800-10,500 ranges before putting in a long term. Therefore until this occurs the most likely outcome is that it will experience corrections ranging from Mild to strong along the way up.

An expert who has stated the same thing over and over again hoping for a new outcome

Experts like the masses are always on the wrong side of the market

Experts felt the same way when we stated in Aug of 2016 that the Dow was gearing up for a move to 21K. However, these targets were hit at the beginning of this year. Since then we issued higher targets the second of which was 22k and that was also breached recently. The main reason for this stance boils down to market sentiment, the masses have not embraced this bull market, and therefore it is destined to trend higher. We dedicate an inordinate amount of time to mass sentiment analysis and to studying the mindset of the masses. Mass Psychology is very clear on this subject; the masses need to embrace this market with gusto; until they do, the market is destined to trend higher.

Experts would have felt the same way if someone told them that the Dow would be trading past 21K after it dropped below 7,000 in 2009.

Conclusion

We don’t expect the upward journey to be smooth; along the way up we expect the market to experience corrections ranging from mild to wild. As long as the primary trend is up, all corrections have to be viewed through a bullish lens.

The NASDAQ has just validated the statement which we first put out in 2014:

This Bull Market will trend to levels that will shock the most ardent of bulls.

This has proved to be true every year since and this stance will remain valid until the trend changes. Buy when the masses panic and flee when they are joyous.

Does yesterday’s modest – if sharp – selloff in stocks have legs? That is the question Morgan Stanley’s Institutional Equity Division director Chris Metli asks in a note to clients overnight. As Metli writes, the moves have been exacerbated by the lack of protection investors have on and their rising equity exposures over the last month.

The below charts update the positioning in options and futures that QDS noted two weeks ago – in general investors have continued to get more bullish. Meanwhile, as MS Equity Strategist Mike Wilson has noted 3Q earnings are now largely in the price and with the SPX rally overextended, earnings season should be a ‘sell the news’ event as there is “greater risk for a correction than we’ve seen in a while“.

- Equity demand from ETFs will surge to a record in 2018, Goldman Sachs predicts.

- Nonetheless, corporate demand for activities like buybacks will remain the biggest driver of stock demand next year.

Exchange-traded funds — which make up the most rapidly growing segment of the stock market — are showing no signs of slowing.

They’ll attract $400 billion of investor demand in 2018, up 33% from this year, according to a Goldman Sachs forecast. To further boost the case for the so-called passive vehicles, Goldman estimates that actively-managed mutual funds will be net sellers of equities next year, shedding $125 billion of exposure.