Stocks & Equities

If you were to ask me what the most inefficient US market sector is, I would probably say, defense.

Now, that’s something no one likes to hear. How come the one sector the US government spends the most money on—the FY 2018 defense budget is $824.7 billion, more than that of the next nine countries combined—is the most inefficient?

Here’s what most people don’t understand: It’s inefficient by design.

Nobody wants war, yet governments are obliged to spend vast sums getting ready to fight it. They’re usually not very thrifty either.

For investors, that’s actually a perfect combination because inefficiency, in this case, spells opportunity. And right now is an especially good time to get your feet wet in defense spending.

Technology is changing the very nature of warfare. A lot of expensive equipment will get replaced in the next few years… and what replaces it may surprise you.

Photo: David~O via

Modern-Day Knights

Back in the Middle Ages, the most powerful weapons systems were armored men on horseback and catapults for long distances.

Modern-day knights have better armor and longer lances, their “horses” have wings or rotors, and missiles take the long-distance shots. At its core, though, warfare is still about arming soldiers and sending them to face the enemy.

That may not be the case much longer.

Drone aircraft were the first breakthrough. They enable pilots to control their planes remotely, from a safe place, firing missiles when they see an enemy. A big step, but the big drones still resemble conventional aircraft.

Photo: AP

The new drones are getting much smaller—and that will change everything.

Leaderless Swarms

A few months ago, I saw Dr. Will Roper, head of the Pentagon’s Strategic Capabilities Office, speak at the South by Southwest conference in Austin. His job is to keep our armed forces ahead of adversaries by adapting off-the-shelf commercial technology.

(I wrote more about Dr. Roper’s presentation in Yield Shark at the time. Subscribers can read it here.)

Among other things, he was very excited about “drone swarms.” He argued that large numbers of small, inexpensive, autonomous drones working together can accomplish many of the same missions as expensive aircraft and human pilots.

Key to Dr. Roper’s vision: Drone swarms have no leader an enemy can target. They operate much like a swarm of ants or bees. No single bee knows how to build a hive, protect the queen, and produce honey. But collectively, they still make it happen, which is quite impressive.

A few months ago, on 60 Minutes, Roper demonstrated some of his drones—and I bet the DoD has even better ones still under wraps. Some are small enough to hold in one hand.

That doesn’t mean the US government will stop buying fighter jets and armored vehicles. Wise generals don’t give up a capability that an enemy might have.

However, the defense industry will expand and change. Presently, leading companies profit by making sophisticated, expensive weapons platforms in relatively small numbers. Drones will be a different business. They’re small, simple, inexpensive, and the Pentagon will need a lot of them—maybe millions.

Customizing drones for particular missions will necessitate an ability to produce them quickly, as needed. Who knows, companies might even develop mobile drone factories that can deploy to a war zone and produce new swarms every day.

The Other Side

Of course, no one likes being swarmed, and there are already commercial anti-drone technologies. For example, paparazzi photographers using drones to spy on celebrities now meet everything from net-carrying counter-drones to trained falcons.

I expect we’ll see years of rapid development for both military and civilian uses. A military reconnaissance drone swarm could also quickly search large areas for lost children or shipwreck survivors.

To me, that’s the really exciting part. Some of today’s ubiquitous technology originated in military applications. I wish we could develop them for peaceful reasons, but at least we have them.

Defense technology is one of the themes I follow for Macro Growth & Income Alert subscribers. It’s an all-weather sector in which normal economic rules don’t apply.

Right now, we have two open defense stock positions. One is a blue-chip US aerospace conglomerate (up 46% since recommendation) and the other a small, Israel-based company that builds and sells drones worldwide (up 36%).

Defense stocks never go out of style, and they’re about to enter a period of rapid innovation. I think there will be more great opportunities in this sector. I’m keeping my eyes open and I suggest you do too.

Risks to the market appear elevated over the next 1-3 months with a variety of sentiment readings edging into overly bullish territory (see Rydex Trader Bullishness Surpasses 2000 Tech Bubble). Longer-term, however, the yield curve and other leading indicators aren’t suggesting the risk of an imminent major peak or recession.

Another important indicator that agrees with this outlook, which has been quite useful for identifying major trend changes in the S&P 500, is a trend-following momentum indicator called the MACD (in blue below).

We’ve shown green and red arrows on the S&P 500 corresponding to MACD buy and sell signals (when the blue line goes above and below the red-dotted zero line) and, though it has been less timely on market bottoms, following its advice on bearish crossover sell signals would’ve gotten you out near the very peak of the 2000 tech bubble, the 2007 top, and also at the intermediate-term 2015 market top.

If Barry Bannister’s timeline for a possible market peak and recession in the 2018-2019 timeframe plays out, we should expect to see this reflected through a combination of one or more of the following: waning momentum via the MACD above, a flattening and eventual inversion of the yield curve, or a slowdown in a variety of leading indicators.

As Chris Puplava mentioned in today’s podcast and recent quarterly newsletter, Preparing for the End Game, given the potential headwinds and current risk/reward setup, we believe Bridgewater’s Ray Dalio has it correct when he wrote, “our responsibility now is to keep dancing but closer to the exit and with a sharp eye on the tea leaves.”

Sign up for a FREE TRIAL to our premium podcast with leading investment strategists by clicking here.

Last week, the S&P 500 price/revenue ratio reached the highest level in history, outside of the single week of March 24, 2000 that represented the peak of the tech bubble. Meanwhile, the 30-day CBOE volatility index (largely reflecting the level of fear or complacency among option traders) dropped to a record low, as bullish sentiment surged to 57.8% bulls versus 16.7% bears (Investors Intelligence), and the S&P 500 pushed to its upper Bollinger bands (two standard deviations above a 20-period moving average) on daily, weekly, and monthly resolutions.

Last week, the S&P 500 price/revenue ratio reached the highest level in history, outside of the single week of March 24, 2000 that represented the peak of the tech bubble. Meanwhile, the 30-day CBOE volatility index (largely reflecting the level of fear or complacency among option traders) dropped to a record low, as bullish sentiment surged to 57.8% bulls versus 16.7% bears (Investors Intelligence), and the S&P 500 pushed to its upper Bollinger bands (two standard deviations above a 20-period moving average) on daily, weekly, and monthly resolutions.

Conventional “Wisdom:” Markets move up and down, but the stock market always comes back. The DOW is frothy and needs a correction, but the stock markets are healthy and big gains lie ahead.

Pessimistic version: Jim Rogers said, “the next crash will ‘the biggest in my lifetime.’” [Coming soon …]

Question: Given the craziness in politics, the Middle-East, Central Banking, and global debt levels … do you own enough gold bullion?

Conventional thinking:

“Trump will save the markets, reduce taxes, and boost stock prices even higher.” [Don’t plan on it.]

“Gold pays no interest and has gone down for six years.” [True but irrelevant.]

“The Yellen Fed can’t let market bubbles pop so they will create more QE, more bond monetization, “printing,” and Fed support. In short, the ‘Yellen Put’ is alive and will protect investors.” [Maybe not…]

“The market got hurt in 1987, 2000, and 2008. It rallied back each time and went higher. This time will be no different. Stocks may correct but they are a good long term investment.” Read “The Bull Case: S&P is heading to 3,000.” [How big a loss before the rally?]

In the long-term the S&P probably will hit 3,000 but the short-term risk is substantial. The attractive lie is appealing but not necessarily true. Sometimes reality is harsh.

The Fed and other central banks have added many $ trillions to their balance sheets since 2008. Official U.S. national debt is roughly $10 trillion larger in ten years. Consumer prices are higher, stocks and bonds have been levitated, the DOW and S&P are trading at all-time highs, and the markets haven’t crashed … YET. Something will puncture the bubble in stocks and bonds. Bubbles in currencies and confidence in central banks also await pins.

Examine the following chart of the S&P prices in average wages. Cause for concern?

Price to earnings can be “adjusted” by well compensated accountants, but is still high. Price to sales is more real and tells us the S&P is quite high.

But the economy is supposedly healthy. Why are tax receipts falling in the U.S.?

Henry Kissinger answers the question about the increasing deviation between the realities most people experience versus official narratives and statistics.

Question: If a corporation could borrow $ billions at near zero interest – thanks to Fed “stimulus” – and those $ billions would buy back millions of shares of corporate stock and boost share prices, and higher stock prices benefited corporate management, do you think the corporation would borrow to boost stock prices? [Of course!]

From Zero Hedge: “There Has Been Just One Buyer of Stocks Since the Financial Crisis”

“Stock buybacks enrich the bosses even when business sags.”

The consequences of inexpensive credit, “stimulus,” and relaxed lending standards (“Can you fog a mirror?”) are:

- More credit is available for less cost, so more credit is used. Auto loans, credit card debt, and student loans have steadily increased.

- Relaxed lending standards increase default rates.

- Banks and creditors reach the end of the credit cycle, reduce loans, and anticipate higher delinquencies.

- Delinquencies lead to reduced earnings, weakened confidence, and stock market crashes.

From Graham Summers: “Banks are Pulling the Plug on Another Debt Bubble”

Before the crash the S&P Index accelerates higher.

The “wedge” is narrowing, the RSI (timing indicator) is high, and prices have moved “too far, too fast.” Ask yourself:

- Can the S&P increase for several more years?

- Do you feel lucky?

- When will Buffet’s “pin” deflate the bubbles?

- Can the Fed save the markets?

- How much debt can the U.S. economy accommodate before “something breaks?”

- Gold or silver bullion?

PREPARE FOR TURBULENCE:

From John Mauldin, a self-described optimist:

“Looking with fresh eyes at the economic numbers and central bankers’ statements convinced me that we will soon be in deep trouble.”

“I believe a major crisis is coming.”

Yellen’s comment on a financial crisis: “… and I hope that it will not be in our lifetimes and I don’t believe it will be.”

Mauldin’s response: “I disagree with almost every word in those two sentences, but my belief is less important than Chair Yellen’s. If she really believes this, then she is oblivious to major instabilities that still riddle the financial system. That’s not good.”

His conclusion: A Major Crisis is Coming!

From Goldcore: “Bank of England Warns ‘Bigger Systemic Risk’ Now Than 2008”

“The central bank [England] is primarily concerned that those dealers making markets in bonds will not be able to cope with panic-selling levels by investors.”

“… the level of debt in the financial system in the UK and most western countries is unsustainable.”

From Graham Summers: “Did the Fed Just Ring a Bell at the Top?”

“A crash is coming…”

And the Solutions Will Be:

Western countries: More debt, more spending, increase the debt ceiling, extend and pretend, and boost stock prices until they crash and burn.

Since western countries have no ability or intent to repay their massive debts, we should expect one of two outcomes:

- Politicians and central bankers resign in mass, admit culpability, and revalue their debt to a much smaller value. [Seems unlikely!]

or

- Devalue their currencies (Inflate or die!) so the effective value of their debt is much smaller, perhaps near zero. [Much more likely! In that case, buy gold!]

Asian countries: Import gold, distance their economies from the U.S. dollar and convert “funny money” into real gold. China possesses a massive hoard of gold and wants more.

Russia and China aggressively mine gold, refuse to export it, and import all they can…

Timing:

Read “Wrecking Ball” by John P. Hussman, Ph.D.

“I’ve periodically framed market action from the perspective of Didier Sornette’s Model of log-periodic power-law bubbles…”

“… I’ve refined the date of the ‘finite-time singularity’ in this model.”

“That ‘critical point’ is not necessarily the date of a peak or the beginning of a crash, but what Sornette describes as ‘an inflection point from self-reinforcing speculation to fragile instability.’”

“… first week of August…”

CONCLUSIONS:

- Stock markets are trading at all-time highs in dangerous risk territory, as measured by price-to-sales and many other measures. Prepare for turbulence in the months ahead.

- Bubbles pop. Plan on it.

- Tax receipts are falling, new credit is slowing, and delinquencies are increasing.

- Inexpensive loans created by the Fed have fueled corporate stock buybacks and levitated the stock markets.

- Western countries will respond with currency devaluations, “printing” and other failed policies that benefit the financial elite.

- Asian countries, also in trouble, import gold and refuse to export gold. They understand its protective value.

- My estimate: Prepare for turbulence and rig for stormy weather in August, September and October 2017. Do you own due diligence!

Bonds, Yen, Euros, Dollars, and stocks have counter-party risk.

Depending upon “lucky” and central banks is unrealistic. Gold is safer and has no counter-party risk!

If you think “lucky” is an unreliable plan, consider gold and silver bullion, gold and silver stocks, cryptocurrencies, and a subscription to Gold Stock Bull.

Article written for Gold Stock Bull by Gary Christenson of The Deviant Investor

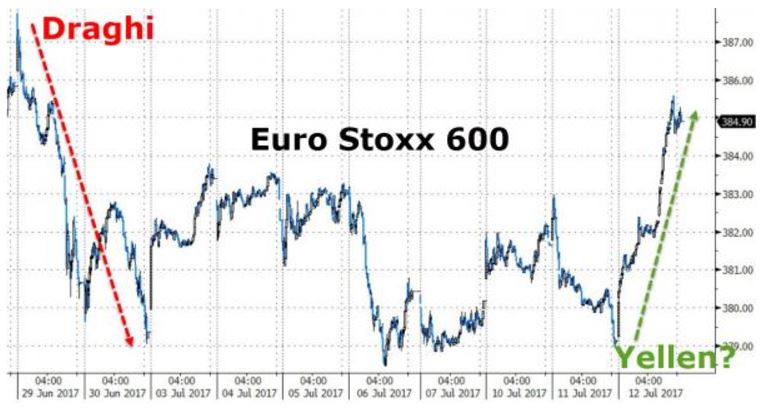

Aside from the post-Macron first-round-win in April, stocks across Europe surged to their best day since last September today, surging higher after Yellen’s dovish comments, presumably due to the market’s belief that as goes The Fed, so goes the rest of the hawkish hangers-on… CLICK HERE