Europe is back on the map. That was one of the main takeaways last week from the SkyBridge Alternatives (SALT) hedge fund conference in Las Vegas, where $3 trillion in assets was represented. Speaker after speaker touted European equities for their attractive valuations and as a means to diversify away from the volatile American market in light of rising U.S. geopolitical risk. France’s election of centrist Emmanuel Macron over far-right nationalist Marine Le Pen this month has especially eased investors’ fears that antiestablishment forces would challenge the integrity of the European Union (EU).

Economic growth is finally picking up in Europe—“solid and broad,” as European Central Bank (ECB) president Mario Draghi recently put it—and many countries’ purchasing managers’ indexes (PMIs) are at five- and six-year highs. Export orders and hiring have accelerated. Labor participation is improving. European commodity sectors, including energy and metals, look cheap and oversold, meaning it might be time to start accumulating.

Trading at around 17 times earnings, European companies are priced to move compared to American firms, which are trading at 22 times earnings.

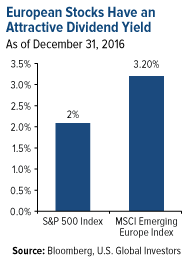

Dividend yields also look attractive relative to U.S. stocks. The MSCI Emerging Europe Index, which is most heavily weighted in Russian, Polish and Turkish stocks, currently yields 3.2 percent. The S&P 500 Index, by comparison, yields 2 percent.

A recent Barron’s article, “Europe on Sale: Time to Buy Foreign Stocks,” makes the same bullish case as many of the SALT presenters. Its author, Vito J. Racanelli, suggests that the eight-year bull run in the U.S. could be coming to an end, and that the baton is being passed to Europe. Overseas markets have already attracted more fund flows so far this year than the U.S. market, with a whopping $6.1 billion being plowed into European equity funds in the week ended May 10.

“Given attractive valuations, diminished political risk, low interest rates and a pickup in global growth, international markets, and Europe in particular, could finally start to outperform,” Racanelli writes.

Talking Geopolitics

Before moving on, I want to share a few other takeaways from SALT. One of the highlights was hearing billionaire investor Dan Loeb, who manages the $16 billion hedge fund firm Third Point. Loeb said that serious investors should closely monitor geopolitics as a backdrop or overlay when making investment decisions because government policy can have the fastest and most significant impact on your portfolio.

That was flattering to hear. Not only do I spend a lot of time discussing and analyzing geopolitics, both here in the weekly commentary and my CEO blog Frank Talk,but it’s baked right into U.S. Global Investors’ methodology: Our investment process clearly asserts that “government policy is a precursor to change.” Loeb’s comments, I felt, validated our emphasis on geopolitics.

Many conferences I attend can often get bogged down in partisan politics, but SALT was refreshingly balanced. Joe Biden was as welcome on-stage as Jeb Bush. No one came out entirely in favor of or against President Donald Trump or his policies. Instead, presenters discussed the inherent risks and opportunities in an intelligent, even-handed manner. I aspire to do the same.

One of the speakers was John Brennan, the former CIA director, who’s scheduled to testify before the House Intelligence Committee later this month as part of its investigation into Russia’s alleged involvement with the 2016 election. Brennan, who told lawmakers as far back ago as August that the agency had information pointing to possible collusion between Russia and the Trump campaign, shed some much-needed light on allegations that Trump shared sensitive intelligence with Russian officials this month—a “serious mistake,” he said—explaining that such leaks to the media are potentially just as damaging to national security as the president’s actions.

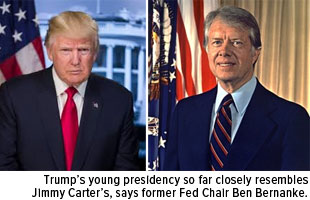

Also notable was former Federal Reserve Chair Ben Bernanke’s thoughts on Washington’s little-known power dynamics. He said there are really three parties jockeying for control in the capital—Republicans, Democrats… and the “beltway party.” It’s this last group, composed of deeply entrenched lobbyists and career bureaucrats, that gives Washington outsiders such as Trump the hardest time and actively tries to sabotage agendas that shake up the status quo.

In this regard, Bernanke said, the presidency Trump’s tenure so far resembles the most is not Richard Nixon’s, as some have suggested. It’s not even Andrew Jackson’s, which Trump himself expressly would like to emulate. Instead, it’s Jimmy Carter’s.

This might seem counterintuitive, but think about it: Both men were Washington outsiders. Both men arrived in the beltway with aspirations to transform the capital’s insular culture and “drain the swamp.” Both men had the great fortune of working with a party majority in both chambers of Congress. But because they exuded an “I alone” attitude and often picked fights with members of their own party, both men faced unusual difficulties in getting key components of their agendas passed. And just as Carter had little success in his first 100 days—in his entire four-year term, in fact—Trump’s young presidency has similarly been unable to make significant strides so far in getting much accomplished.

A White House in Crisis?

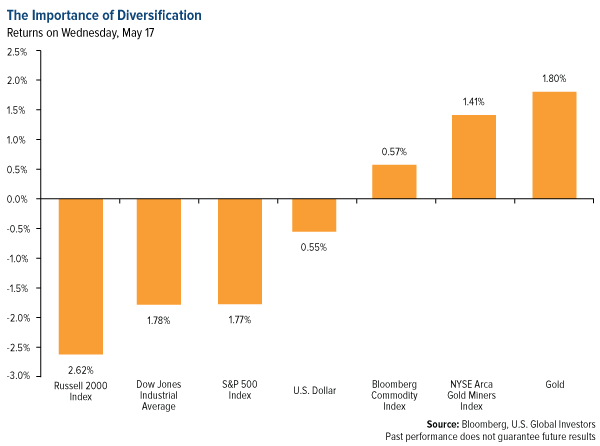

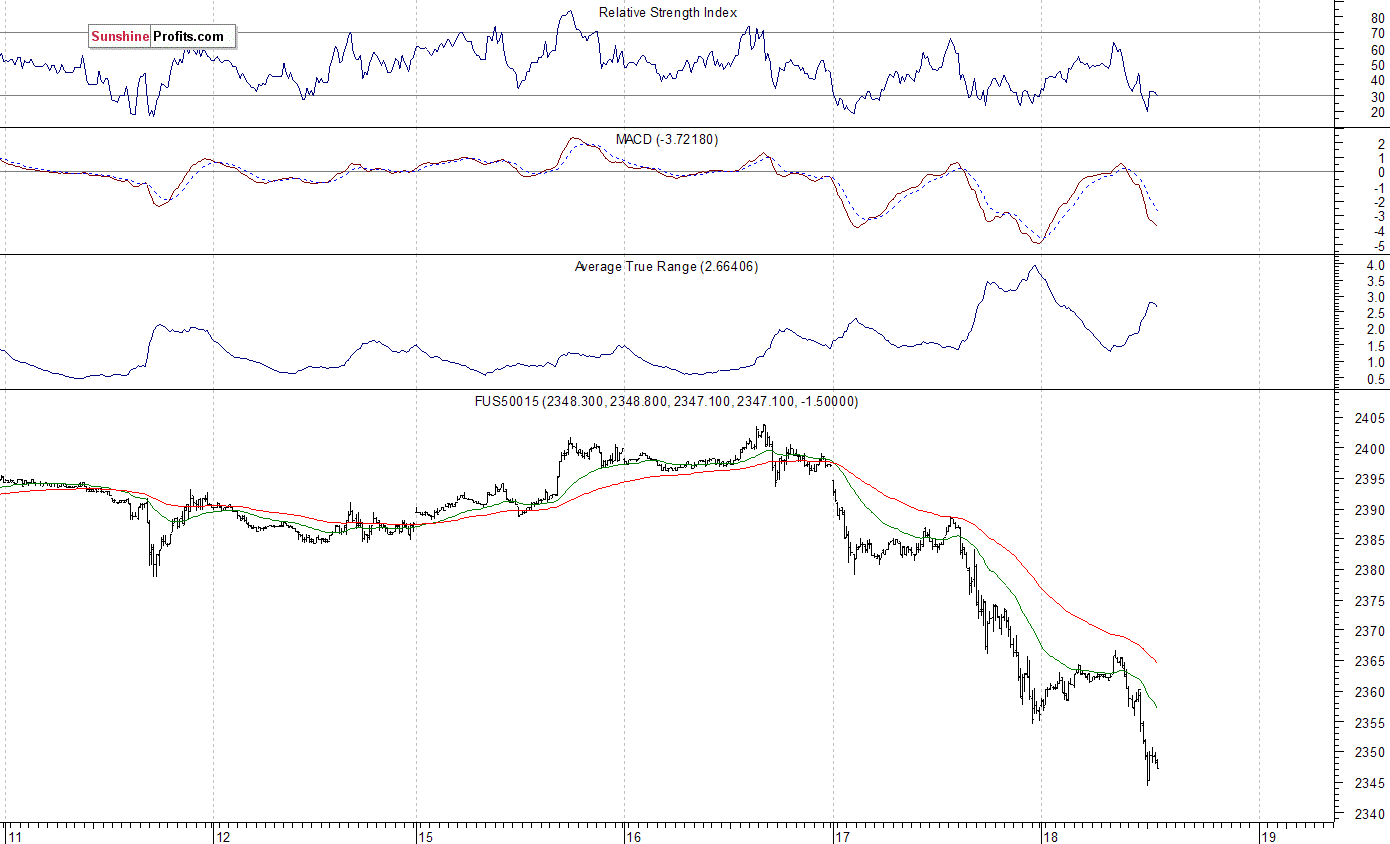

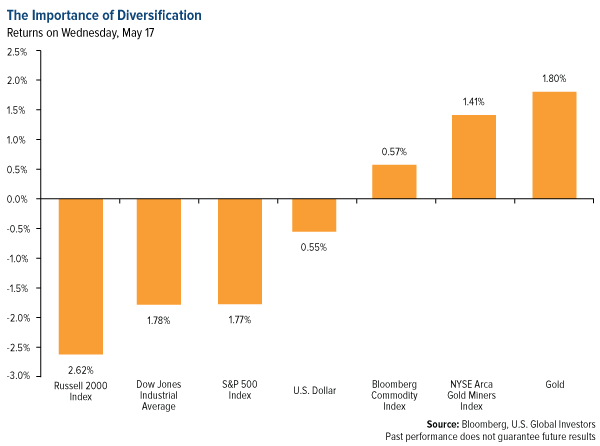

This is precisely what markets were reacting to last Wednesday, the worst week for major U.S. indices in months. Investors, fearing Trump’s pro-growth agenda could be threatened by troubling news and allegations coming out of the White House, punished small-cap stocks in particular, sending the Russell 2000 Index down 2.62 percent, its sharpest one-day loss since March. Recall that it was small caps that saw the strongest surge following the election, as investors bet on domestic growth stemming from the then-president-elect’s “American first” proposals.

click to enlarge

Now, however, some are wondering if Trump, embroiled in numerous scandals, will finish out his term. A few SALT presenters even uttered the “i” word. Jim Chanos, founder and investment manager of Kynikos Associates in New York, told the packed auditorium that he believes the market hopes Vice President Mike Pence will become president. Investors are seeking deregulation and tax cuts, plain and simple, Chanos said, and the “more stable” Pence is seen as having a better shot at delivering. This squares with reports from British gambling and betting company Ladbrokes, which announced last week that Trump is now odds-on, or highly likely, to face impeachment by the end of his first term, with bookies having to cut the price from 11/10 to 4/5.

Banks, which stand to benefit from Trump’s plan to loosen financial regulations, were Wednesday’s biggest losers. JPMorgan was down 3.81 percent, or $3.34 a share. Goldman Sachs fell 5.27 percent, or $11.88 a share.

Apple finished the day down 3.36 percent, wiping away some $20 billion in market value. The smartphone giant, which recently became the first company ever to be worth more than $800 billion, could also benefit from Treasury Secretary Steven Mnuchin’s efforts to make it easier for multinationals to repatriate cash that’s held overseas. And if that describes any company today, it would be Apple: The iPhone-maker holds nearly $250 billion in cash and securities in offshore accounts.

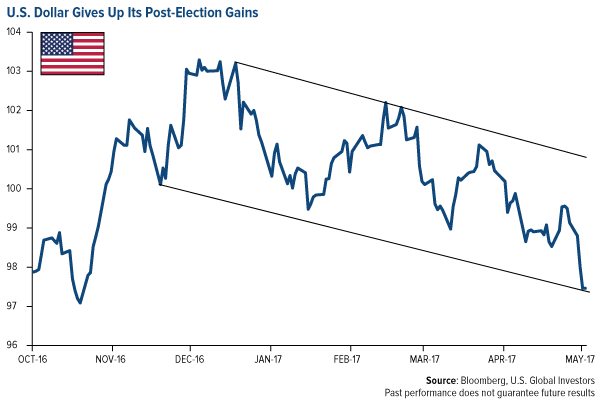

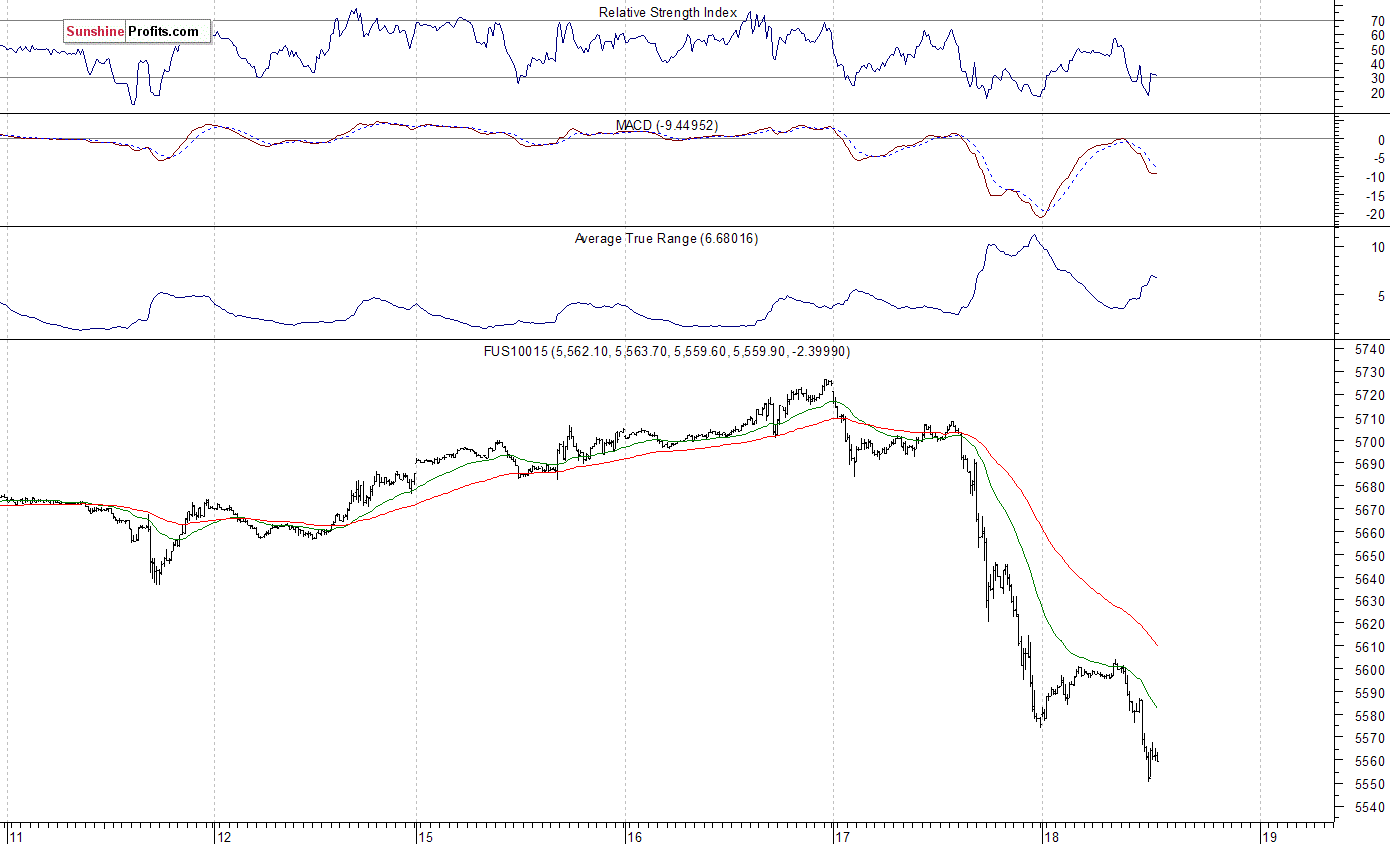

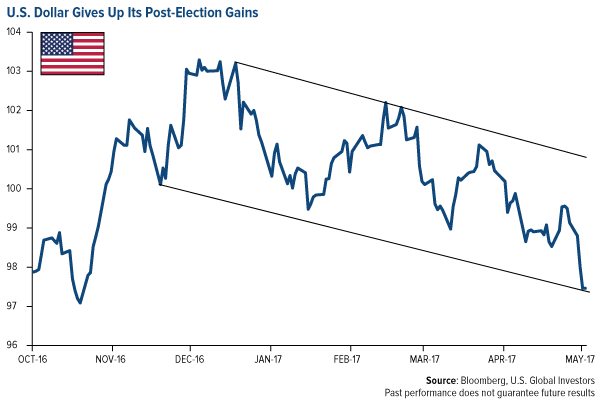

More so than equities, the U.S. dollar is highly sensitive to geopolitical drama. Last week, the greenback tumbled to its lowest level since the November election compared to other major currencies.

click to enlarge

This helped gold, miners and commodities end the week in positive territory. Gold gained 2 percent, gold miners 0.57 percent and commodities 1.36 percent. The S&P 500, meanwhile, finished the week down 0.8 percent.

For diversification benefits, I always recommend around a 10 percent weighting in gold and gold stocks, and last week proved yet again that this strategy could help mitigate the losses in risk assets.

Unsure what else drives the price of gold? Find out!

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Holdings may change daily.

The MSCI Emerging Markets Europe Index captures large and mid-cap representation across 6 Emerging Markets (EM) countries in Europe. With 83 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000, a widely recognized small-cap index. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

Dividend yield is a financial ratio that indicates how much a company pays out in dividends each year relative to its share price. There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 3/31/2017.

Volatility is at generational lows, and a new crop of products has made it easy to sell.

Volatility is at generational lows, and a new crop of products has made it easy to sell.