Stocks & Equities

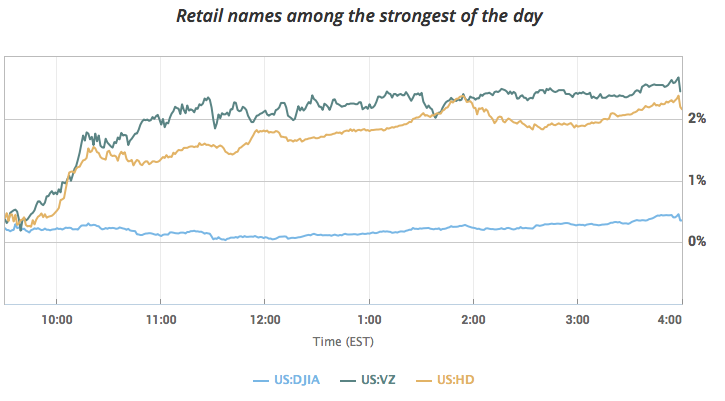

Major U.S. stock indexes closed at record highs for a second straight session Tuesday, with the Dow industrials and the S&P 500 also clearing noteworthy psychological barriers.

U.S. stocks closed higher Tuesday as the Dow industrials and S&P 500 cleared psychological milestones but major indexes simultaneously reached record highs for a second straight day.

…also:

Marc Faber, Author, The Gloom, Boom & Doom Report is most interested in investing for 5 to 10 years states that he prefers investing in India rather than investing in the US. He would also invest in other emerging economies and Europe as well as he thinks the US is an “over-valued over-promoted market”. Marc take on Indiia’s clampdown on “Black Money”

Men are afraid to rock the boat in which they hope to drift safely through life’s currents, when, actually, the boat is stuck on a sandbar. They would be better off to rock the boatand try to shake it loose, or, better still, jump in the water and swim for the shore. – Thomas Szasz

If we look at earnings and the underlying fundamentals, then it is easy to state that the stock market should have crashed a long time ago. Earnings are tepid and in many cases were it not for aggressive share buyback programs the outlook would look even more terrible. Regarding the economy, it is the strong stock market that helps support the illusion that the economy is doing well. Unofficially the unemployment rate is north of 20%. Why the huge discrepancy; the BLS (Bureau of Labour statistics) does not count individuals who have given up looking for a job even though they are unemployed. This paints a false picture of what is going on; many people are demoralised after trying in vain to land a new job that they have just given up. However, despite all these negative factors we have stated over and over again that this market is destined to trend higher. We provided many reasons for this in 2014, 2015 and 2016. The two most important of these are:

If we look at earnings and the underlying fundamentals, then it is easy to state that the stock market should have crashed a long time ago. Earnings are tepid and in many cases were it not for aggressive share buyback programs the outlook would look even more terrible. Regarding the economy, it is the strong stock market that helps support the illusion that the economy is doing well. Unofficially the unemployment rate is north of 20%. Why the huge discrepancy; the BLS (Bureau of Labour statistics) does not count individuals who have given up looking for a job even though they are unemployed. This paints a false picture of what is going on; many people are demoralised after trying in vain to land a new job that they have just given up. However, despite all these negative factors we have stated over and over again that this market is destined to trend higher. We provided many reasons for this in 2014, 2015 and 2016. The two most important of these are:

Hot money is supporting the market, and the Fed will not stop supporting this marketbecause it is the only factor that promotes the illusion of a healthy economy

This is still one of the most hated bull markets of all time- the crowd has not embraced this market, and no bull market has ever ended on a sour note

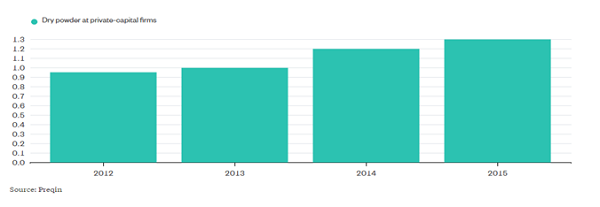

There is a massive amount of cash sitting on the sidelines; $50 trillion to be precise and this clearly cements the view that the crowd is far from euphoric. Until the masses are jumping in Joy, it is highly unlikely that the stock market will experience a crash.

Black Rock puts the figure at more than $50 trillion, a figure that includes a host of different metrics, from central-bank assets to financial-firm reserves and consumer savings accounts. Other measures show a similar trend. Private-equity firms are amassing greatpiles of liquid securities, with Blackstone saying that nearly one-third of its assets are in cash. Fund managers, in general, have boosted reserves as a share of their portfolios to levels that match the highest since 2001. Full Story

This chart shows that private equity firms are steadily building up their cash reserves; they have been waiting for the so-called fair valued market. A concept that makes absolutely no sense today; trying to assign a fair value on this market is the Joke of the century. Every trick has been used in the book to manipulate EPS and when you alter earnings every another key piece of data is becomes meaningless. The only thing to pay attention to in this period is mass sentiment and a few technical indicators.

This confirms what our psychological and sentiment indicators have been stating all along; the crowd is skittish even though the market is trading close to its highs. This is an unprecedented development, and it means that this bull market is going to soar to heights that only a man under the influence of some strong medicine could envision today. Slowly the term inflate to infinity will find its way into the mainstream media; this is the Fed’s secret new slogan.

Too many people are waiting for the so-called optimal entry point. Hence, the likely outcome is that they will be forced to chase this market as there is an excellent chance that this will not come to pass. These people are not looking for 1000-2000 point pullback; they are expecting more. Keep in mind what we recently stated before Trump won the elections

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. Full Story

Secondly, the vast amount of cash sitting on the sidelines is going to serve as a floor; additionally, it provides clear evidence that the masses are nervous and skittish; thus the path of least resistance is up.

Conclusion

The pullback in the bond markets and the strong dollar rally have already produced the effect of at least two interest rate hikes. Thus it is unlikely that the Fed is going to adopt a rate hiking stance. A strong dollar is not good for multinationals and as the World’s central bankers have embraced” the devalue or die era”, the Fed has no option but to play along. Strong negative reactions should be music to your ears for the trend is up, and we have no choice but to look at these developments through a bullish lens. The stronger the pull back, the better the opportunity- end of story

Insanity is often the logic of an accurate mind overtasked.

Oliver Wendell Holmes

….related:

Tyler Bolhorn’s “You Are The Enemy” StockScores Newsletter including 2 Stocks that fit the Strategy of the Week

![]()

In This Week’s Issue:

- Weekly Commentary

- Strategy of the Week

- Stocks That Meet The Featured Strategy

- Stockscores’ Market Minutes Video – Pay Attention to What Doesn’t Make Sense

- Stockscores Trader Training – The Enemy is You

- Stock Features of the Week – Stockscores Simple Weekly Under $10

Stockscores Market Minutes – Pay Attention to What Doesn’t Make Sense

Trade of the week on ZIOP, plus why opportunities that don’t seem to make sense often become big winners. Of course, my regular weekly market analysis as well. Click Here to Watch

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – The Enemy is You

Emotion is the enemy of every trader.

Our emotional attachment to money is what causes us to lose our discipline, to take big losses, to not let our strong and profitable trades run higher. It causes us to own too many stocks in one sector or fall in love with a stock that will only hurt us. Letting emotion in to our trading decisions is a fast way to insomnia.

The perception is that the stock market is too risky, many investors don’t like the potential for a sharp sell off that can destroy their portfolio in a very short time period. The collapse of the stock market in 2008 has given many a form of post-traumatic stress disorder, leaving them on the sidelines when it has not made sense to do so.

The stock market may be volatile at times but that is not what determines risk. Risk is how you respond to the volatility, how you manage the potential size of your losses. The stock market is not risky, the people that play it are. It is how you deal with price volatility that determines risk.

If you want to sleep well while invested in stocks, you need to have a plan for managing risk. The notion that you can buy some “good” companies and forget about them is outdated and reckless.

Here are my essentials to being invested in the stocks and sleeping well:

Plan to lose. When you buy a stock, know the price level where the stock market will have proven you wrong. Learn how to determine where a stock’s support price is and if the stock closes below that level, realize that the market is telling you that something is probably wrong at the company. Get out.

Know your tolerance for risk. How much are you willing to lose on any one stock trade? If you risk more than this amount, you will get emotional. Take the difference between the entry price and the stop loss price and divide that in to your risk tolerance to determine how many shares to buy. If you are buying a stock at $10 with a stop loss point at $9 and you are willing to lose $500 on any one trade then you should buy 500 shares.

Don’t obsess. You don’t need to watch your stocks constantly, if you are position trading then only look at the once a day or even once a week. You only need to check to see if your stock has given an exit signal, obsessing over every gyration will make you emotional and lead you to make mistakes.

Have a written plan. You must write down your trading rules. When will you buy, when will you sell, how will you manage risk and how will you review your positions. Keep the plan simple but concise enough that there is no room for interpretation.

Stick to your plan. Your plan should be based on strategies that you have tested and believe in. Deviating from the plan means you are going in to areas that have not been tested and that puts you closer to being a gambler. Gambling traders may win in the short term but in the long term they lose.

Remember that trading stocks is as risky as you make it. Not having a plan with rules for limiting the size of your losses leaves you exposed to big losses if the market corrects sharply. With loss limits and discipline, you should never be the victim of a major market correction.

With the election decided, small cap, lower priced stocks have started to come alive again. Since low priced Canadian stocks tend to be commodity based (which have suffered) I decided to run the Stockscores Simple Weely strategy on the US, but with the added filter of stocks under $10. Here are three names that have good long term charts:

1. CGNT

CGNT has had a good 2 day run higher and is showing a good three year weekly chart. I would like it better on a short term pull back to improve the reward for risk of the trade. Support at $1.50.

2. OBCI

Big break higher today for OBCI on strong volume, with resistance at $5.50 to $6 the economics of the trade look better on a pull back if some profit taking comes in over the next few days. Support at $3.15.

3. CENX

Nice break from a rising bottom on the three year chart for CENX, the gains were made over a succession of up days so a pull back in the short term is likely and will improve the economics. Support at $6.50.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

“Come to the edge,” He said. They said, “We are afraid. “Come to the edge,” He said. They came. He pushed them, and they flew. ~ Guillaume Apollinaire

In early October when the pollsters were all busy proclaiming that Hilary was going to win, we stated in an article titled Mass Psychology states Trump win Equals stock market buying opportunity that from a financial perspective a Trump win would present an excellent opportunity for the astute investor. We had made the same comments before Brexit became a reality, and it has been our theme that as long as the trend is up, all sharp pullbacks should be seen through a bullish lens. In other words the more substantial the deviation, the better the opportunity. Here is a small excerpt from the above-stated article:

Regardless of what you think of Trump, he is having the same effect as Brexit had on the markets but in smaller doses. If he should win the election, then the reaction will be several magnitudes larger. When the poll results came in stating that Hillary fared better in the 1st debates the markets responded positively and recouped their losses; this reinforces our argument of several years that says substantial pullbacks should be viewed as buying opportunities.

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking.

It turns out that the naysayers and doctors of doom sang the same old miserable song and instead of walking away with bags of cash, they were once again handed their heads on a platter. The action was fast and furious. The markets crashed, the dollar nose-dived, Gold took off, and oil dropped. It looked like hell was about to be unleashed, and then the markets reversed, and the momentary feeling of satisfaction the naysayers had was shattered. They were speechless as the markets not only recouped their losses but soared upwards; the action continues today; a clear validation of what we have been stating all along, that most of the advice coming from these so-called experts is on par with rubbish. The plot is always the same; scare the hell out of the masses and make it look like the world is going to end. Then trigger a strong reaction, and when the Crowd thinks the bottom is about to fall out, the smart money comes in and say’s “thank you lemmings for giving us another free meal.”

Take a look at the headlines before Trump was declared the winner

If Trump is elected president, it would be ‘exceedingly harmful’ to markets

The stock market could crash if Donald Trump is elected president

Economists: A Trump win would tank the markets

President Trump May Be Bad For Markets – Forbes

Mark Cuban Predicts a Stock Market Crash if Trump Wins

When we saw all this hype and nonsense being sold as news, we quickly fired an update to our subscribers stating the following:

This is Pavlovian programming at its best; the signal instead of a bell is a Trump win would be a disaster for the markets; the same signal was used to trigger the sell off after the vote for Brexit came in. It is a brilliant strategy, and it works all the time. Don’t fall for this nonsense. We do not know who will win, but what we do know is that the top players are going to do everything in their power to trigger a significant reaction. In the end, all they care about is the reaction, and they will use whatever is necessary to trigger such a response. It is a game to them, to watch the masses stampede or turn euphoric. They trigger a reaction in both directions; hence always trade with a relaxed mind. ~ Market Update Nov 2, 2016

This brilliant and evil strategy has been employed for generations and probably predates the Tulip mania. The idea is to create a feeding frenzy or a stampede; in other words, the crowd always leaps and then looks. The crowd has been on the wrong side of this bull market since its inception, and that is why it is famously referred to as the most hated bull market in history. While the naysayers keep blabbering about how the next correction is going to be the big one; they forget that each pullback leads to a higher low and that when the market does pull back it is always trading above the targets they issued a few months or years ago. How do you think the naysayers from 2011, 2012 or even 2014 are feeling? If they held onto their short positions, they would have bankrupted themselves several times over. Thus it stands to reason that most of these guys are all bark and no bite. In other words, they talk but rarely act for if they did, they would be dead broke by now.

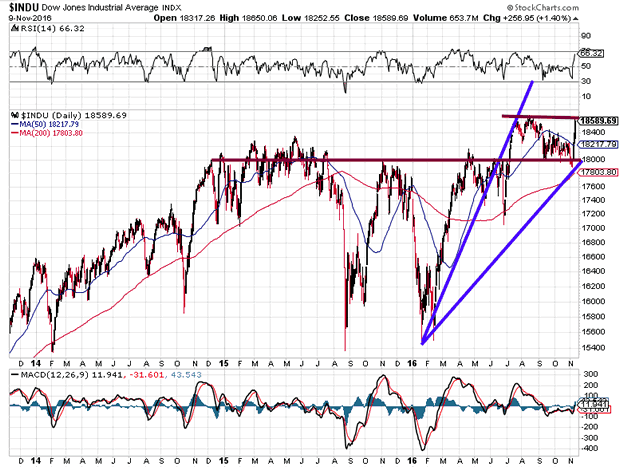

Instead of crashing the Dow is on its way to put in a series of new highs. There is a strong wall of support in the 17900-1800 ranges. Eventually, this support is going to move upwards, and 18200 should become the new floor. The Dow needs to trade above 18650 on a weekly basis, if it can achieve this, then19K could happen within the next 4-8 weeks.

Conclusion

The argument we laid out in our October article came to pass with almost perfect precision:

Just as Brexit was all bark and no bite; the same phenomenon is likely to play out if Trump wins. All the Naysayers from every crack and crevice will emerge screaming the end of the world and when the world does not end they will be forced to crawl under the rock again. It would be good to keep this saying in mind if Trump wins “dance when the crowd panics and standstill when they jump up with joy.

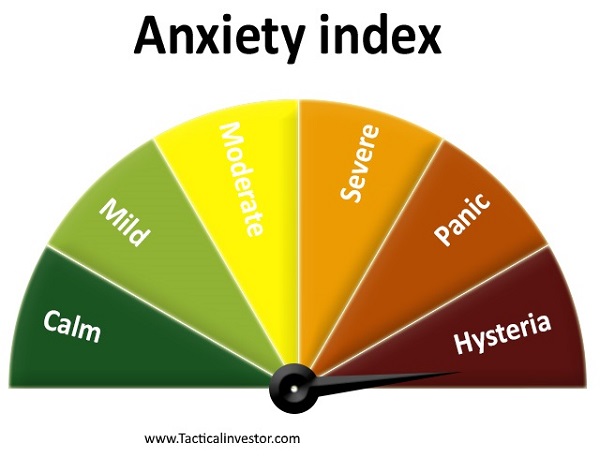

What we have repeatedly stated for the past several years is playing out to a T; don’t listen to the Drs of Doom, they love to sing miserable songs; the problem with misery is that it loves company and stupidity just demands it. Focus on market sentiment and the trend; the crowd was nervous for the past two months even though the markets were still trading relatively close to their highs. No bull market has ever ended when the crowd is anxious; bull markets end on a note of Euphoric and until the crowd turns euphoric corrections should be viewed through a bullish lens. Trump’s victory, just like Brexit provided the Astute investor who refused to let his emotions do the talking a brilliant opportunity to purchase high-quality stocks at a discount.

In the future, if you notice experts panicking, while market sentiment is negative, then you know they are full of hot air and the best mode of action is to do the opposite of what they prescribe. Regarding the markets crashing, the Dow is more likely to trade to 20K than it is of crashing. The stronger the deviation, the better the buying opportunity should be your motto going forward.

The next planned disaster is going to come from the Feds make belief attempt to convince the masses that they feel they are ready to embark on series of rate hikes. We all know what happened the last time they made such a bold proclamation. After one miserable rate hike, they backed down and resorted to telling tall tales. This economic recovery is a hoax, and they understand it, and so they are in no rush to destroy the illusion that they so painstakingly created. They might (emphasis on might) raise rates once more in order to have more leg room to manoeuvre before they push rates into negative territory. In the event, the markets do pull back sharply, be prepared to view that future pullback as a buying opportunity

“The privilege of absurdity; to which no living creature is subject, but man only.” ~ Thomas Hobbes