Stocks & Equities

From Jason Goepfert at SentimenTrader: “U.S. equity funds got punched again. There was a huge outflow from domestic funds that focus on stocks, the 5th-largest since 2007. Total fund assets have grown over that time, but even if we express the outflow as a % of total assets, it was large. There is a temptation to automatically consider such an outflow to be a contrary indicator (and bullish for stocks) but the history of other large weekly outflows has been mixed….

From Jason Goepfert at SentimenTrader: “U.S. equity funds got punched again. There was a huge outflow from domestic funds that focus on stocks, the 5th-largest since 2007. Total fund assets have grown over that time, but even if we express the outflow as a % of total assets, it was large. There is a temptation to automatically consider such an outflow to be a contrary indicator (and bullish for stocks) but the history of other large weekly outflows has been mixed….

also:

We’re about to enter that time when financial commentators offer up their best guesses as to what investors can expect in the Near Year. It always makes for fun reading, but it also never fails to disappoint. Instead of engaging in that tired exercise in futility, investors would do better to focus on something more productive. And that would be next year’s most likely catalyst for stock and commodity prices.

Instead of asking the fruitless question, “At what price will the S&P 500 finish in 2017?” wouldn’t it be better to ponder what could possibly stimulate asset prices out of their lethargy? Granted, this is as much a guessing game as the former question. But at least applying critical thinking to the catalyst question, investors are almost certain to uncover some hidden opportunities for profit.

Having said that, what could be next year’s biggest catalyst for a meaningful breakout-type move in: the broad equities market, the commodities market, or individual issues within both categories? Putting the pieces of global events over the last year together and reading between the lines allows us to make at least one educated guess: military conflict. War is after all one of the biggest catalysts for both stock and commodity prices, and it has the added benefit of boosting the economy, short-term. Of course war must be paid for down the line, but that’s why “kicking the can” was invented (so that the day of reckoning can be perpetually delayed).

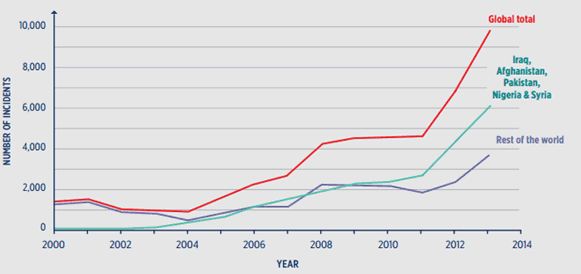

Terrorist events have historically served both as precursors and pretexts for going to war. As the following graph shows, terrorism has expanded dramatically in recent years [Source: www.civilserviceindia.com]. The exponential increase in terrorist events will likely be used to justify further military excursions among the Western nations which have become the targets of these events.

Indeed, the rumblings of war have been audible for some time now, and it’s evident that what has kept the U.S. out of another overseas conflict has been the focus on this year’s presidential race. The current Commander-in-Chief is bound by his promise to end America’s long wars in Iraq and Afghanistan. The incoming president, however, will be under no such constraint. If that president just happens to be a certain candidate with the initials H.R.C., it’s also likely that America will have its next war-time president.

As Micah Zenko argued in his recent Foreign Policy article on Hillary Clinton, the presidential hopeful has a long track record which strongly suggests she is a war hawk. “Though she has opposed uses of force that she believed were a bad idea,” he wrote, “she has consistently endorsed starting new wars and expanding others.”

While the U.S. has already been at war for 15 years, the intensity of our nation’s war efforts have been dramatically scaled back in recent years. Under Clinton, it’s easy to foresee a revival of warfare activities in the Mid East region. While Zenko’s article was supportive of Hillary in the role of chief military commander he also acknowledged that “those who vote for her should know that she will approach such crises with a long track record of being generally supportive of initiating U.S. military interventions and expanding them.”

The U.S. isn’t the only major country which will likely see military action in the intermediate term. One region which of the world in which military activity may see a notable increase in the foreseeable future is the Far East. Japan is a case in point.

Earlier this year, Japan’s Prime Minister Shinzo Abe has made a controversial call to revise Article 9 of the nation’s constitution, which declares that “the Japanese people forever renounce war as a sovereign right of the nation and the threat or use of force as means of settling international disputes.” In view of China’s ongoing military buildup in the South China Sea and other threats, Abe has said the restrictions on Japan’s military “do not fit into the current period.”

Bert Dohmen of the Wellington Letter observed that an amendment to Article 9 “would lead to a military buildup, which always stimulates the economy,” adding that “Japan could finally get out of its 25 year deflation” if Article is deleted.

In response to increasingly hostile behavior from nearby North Korea, Japan may also accelerate roughly $1 billion of planned upgrades to ballistic missile defense systems, according to Reuters. This consideration comes shortly after United States Strategic Command systems detected& a failed missile launch recently in the northwest North Korean town Kusong. Japan has been considering the budget request that will determine whether to add a new missile defense layer from either Lockheed Martin Corp or from Aegis Ashore.

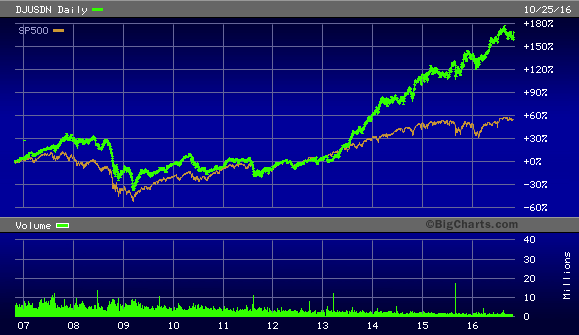

Defense firms like Ratheon, Lockheed Martin, Mitsubishi, and Boeing are reportedly on tight production schedules with a backlog of international orders. Following is a 10-year chart of the Dow Jones U.S. Defense Index (DJUSDN). As this graph illustrates, defense stocks have significantly outperformed the S&P 500 (SPX) in recent years. The average stock price for the leading defense companies underscores the immense war-related preparations and activity taking place within the sector.

All over the world, it seems, nations are arming themselves with the offensive and defensive weapons of war. The production-for-use theory of economics states that military buildups always eventually lead to the employment of those weapons in actual warfare. Sooner or later the expansive activity that has been taking place in the defense sector in recent years will be implemented on the battlefields of the world. When it happens, investors who are prepared for it will not only avoid the deleterious aspects of war, but will also profit from it.

…related by Martin Armstrong: Is the World Political Economy Melting Down?

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today’s fast-moving and sometimes volatile market environment. If you’re interested in moving average trading techniques, you’ll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies For Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

“A champion is afraid of losing. Everyone else is afraid of winning.” ~ Billie Jean King

The financial crisis of 2008 scarred many individuals and scared away even more; add in the Great Recession, and one can see that the average can come up with many reasons to avoid the stock market. To make matters worse, the unemployment rate remains stubbornly high, and wages in most instances are dropping instead of rising which means that many Americans have little to no disposable income left after expenses. Don’t for one second believe the twisted statistics issued by the BLS (Bureau of labour department); those statistics are on par with toilet paper.

Individuals making $30,000 or less per year are more likely to avoid the stock market, citing insufficient funds as one of the main reasons. There appears to be a misconception in thinking that one needs a lot of money to invest in the markets. Nothing could be further from the truth. One can start off with small amounts and slowly add to this base over the years.; the power of compounding is amazing. If you start young enough even putting away $50-$100 a month can add up to a sizable bundle by the time you retire.

Another misconception is that investing in the markets is risky especially after the crisis of 2008. If one is investing for the long haul and in quality stocks, then investing is one of the surest ways of making money and building a sustainable nest egg. However, one needs to understand what one is getting into and not pluge into the markets blindly as is the case with most individuals.

Lack of education

We are referring to financial education and not higher education from institutes such as colleges or universities. We would even go as far as to suggest what these institutes teach regarding the stock market is useless. If you want to learn something, you need to allocate some time to it and then put that knowledge into practise. Regarding the stock markets it would be wise to look at the history of the markets; study past stock market crashes; the events that lead to the crash and events that set the foundation for the next bull run. Then paper trade before deploying your hard earned cash?

If you are going to rely on a financial advisor; how are you going to know if he is not selling you sack of sawdust if you know next to nothing. In most cases people set themselves up to lose in the markets or to be taken advantage of; it takes two to tango. Surveys done by bank rate shows that Millennials were twice as likely as any other group to cite lack of financial knowledge as their main reason for avoiding the markets. If this trend persists, they are going to ten times more likely to ask the government for handouts when they retire.

Distrust of the Financial Markets

Yes, one could say there is a valid reason to fear the markets as many Millennials have grown up in an era of financial disasters; two of the most painful ones were the dot.com bubble and the Financial Crisis of 2008, which later came to be known as the Great Recession. However, again, lack of financial knowledge and the wrong perspective is what provides the foundation for this fear. Fear is a useless emotion when it comes to the stock markets; the best time to buy is when blood is flowing freely; translation, so-called disasters always provide opportunities for the astute investor. Additionally, one could have easily sidestepped both disasters by paying attention to market sentiment; in both instances the masses were euphoric, and they thought the bull market could last forever. Nothing lasts forever and when the masses are ecstatic it is time to leave the party.

Disaster can be viewed as an opportunity or as a tragedy; it all comes down to one’s perspective. Alter the angle of observance and the perspective changes.

Concept of retirement planning is nonexistent for many

Bankrate states that only 25% of Americans check their investments and retirement accounts more than once a month. These same individuals can spend countless of hours on their phones texting each other or on Facebook or otherwise known as Face Crack. One does not need to look at one’s investments every day, however, spending time on finding out what’s trending or where the crowd is leaning could make the difference between banking your profits or trying to catch a falling dagger.

Ideally, individuals should have a rough idea of how much they would like to have by the time they retire and then come out with a feasible plan. Otherwise, they are bound to come up with some harebrained scheme that is fuelled by fear when they suddenly realise that the years have passed away, but the account is looking as miserable as it did on the day of its inception.

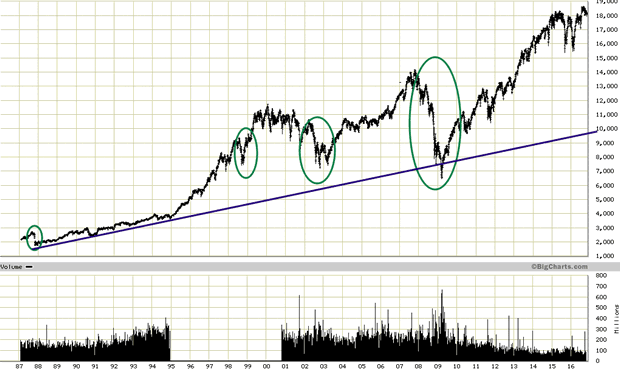

Disaster is usually opportunity knocking in disguise; take a look at the chart below

The financial world often refers to black Monday (the crash of 1987) when they want to ratchet up the fear factor; on a long-term chart, it is just another blip that more aptly represents an opportunity rather than a disaster. In every instance before the market pulled back firmly, the sentiment was extremely bullish; in other words, the crowd was euphoric. If you used just followed the emotion you would have managed to avoid almost every disaster and this dates back to the tulip bubble. We are not talking about timing the exact top; those that try to time the exact top usually have plenty of time on their hand and an enormous appetite for pain.

For the masses, sharp pullbacks feel like a crash because they have the uncanny ability to buy exactly at the wrong time; they buy high and sell low. We will examine the concept of opportunity being masked as a disaster in a future article.

Conclusion

The word disaster represents an opportunity for the astute investor. It is only the uneducated investor that views a market pullback through a negative lens, and this is usually done because they have not taken the time to study the markets. One would be well served if one spent some time in examining the history of stock market crashes and what was taking place before the markets crashed. In every instance, one will find out that the crowd was bullish and every Tom, Dick and Harry was busy giving out financial advice. When the crowd is happy, you should leave the party.

Spending a little time on history and market psychology could prove to be priceless. If you take the time to do this, you will have a better understanding of the markets than most so-called financial experts. The phrase “knowledge is power” was not coined for no reason, but there is a difference between knowledge and rubbish. When it comes to the stock markets, most of the stuff that is marketed as valuable is nothing but garbage and in many cases what the experts make fun of is what you should be paying attention to.

For instance, market sentiment is far from bullish even though the stock market is trading close to its highs. Hence, all sharp pullbacks have to be viewed as buying opportunities. When the crowd embraces this bull market, it will be time to leave the party.

“A man’s doubts and fears are his worst enemies.” ~ William Wrigley Jr.

With all the surprising and/or disturbing things going on – Brexit, China’s soaring debt, US/Russia/China saber rattling, the, um, unique US presidential race, the cyber attack that shut down big parts of the US Internet – you’d think that an unsettled world would be reflected in skittish financial markets.

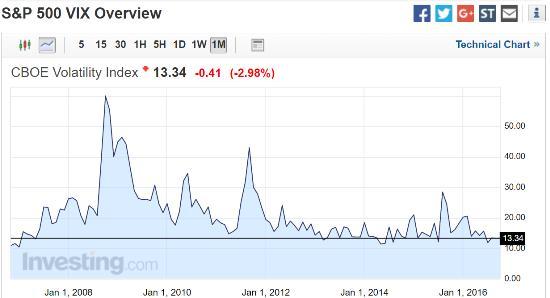

Instead we’re getting the opposite, with stock price movements becoming more and more placid as the year goes on. The following chart shows the volatility index (VIX) for the S&P 500 which, after some notable action in 2008 and 2011, has become ever-calmer, with recent readings comparable to the (in retrospect delusional) levels of 2006, just before the biggest financial crisis since the Great Depression.

What’s going on? First, during credit bubbles volatility normally contracts because enough new money is being created to provide pretty much everything with a bid. In other words, all the new liquidity being created by desperate governments has to go somewhere, so dips get bought before they can become dramatic and traders accept the placid present as the new normal.

Second, we’re in an election year and the people currently in charge badly want their chosen candidates to win. So government spending is rising dramatically. The federal deficit is up 17% so far this year, but jumped 67% in August. This burst of new borrowing has given the economy its current “all is well, stay the course” gloss. A bit more on this from MarketWatch:

U.S. runs $107 billion budget deficit in August, Treasury says

The federal government ran a budget deficit of $107 billion in August, the Treasury Department said Tuesday, $43 billion more than in August 2015.

The government spent $338 billion last month, up 23% from the same month a year ago. Spending rose notably for veterans’ programs and Medicare, Treasury said.

For the fiscal year so far, the budget deficit is up 17%. The government’s fiscal year runs from October through September. The Congressional Budget Office estimates the shortfall for fiscal 2016 will be $590 billion, or about $152 billion more than last year.

And what does it mean?

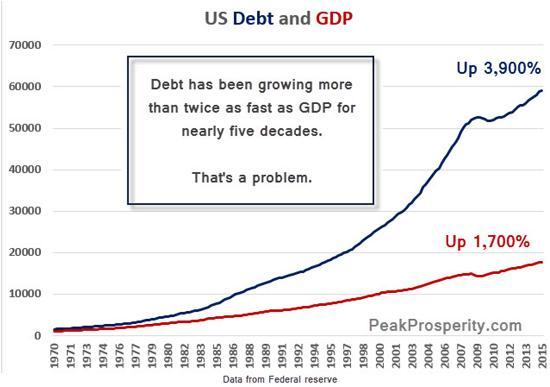

The current financial market insouciance is no more sustainable than that of 2006 because it’s caused by temporary factors that can’t continue without themselves causing turmoil. Debt, for instance, can’t grow relative to GDP forever…

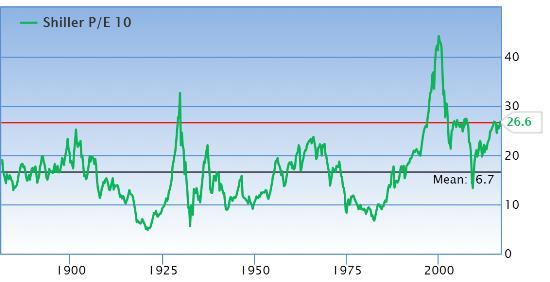

…and equity valuations have only exceeded their current levels thrice in the past century, each time with notable volatility following shortly.

So it’s a safe bet that 2017 will be in many ways a mirror image of 2016. US politics will be decided if not settled, government spending will stop spiking, and equities will return – possibly suddenly – to more historically normal valuations. And rising volatility will once again become the norm – as it should be in a world this dysfunctional.

How to play it? VXX is an ETF that tracks the VIX – but only for short periods of time. So it’s strictly a trading vehicle, not an investment. Shorting high P/E stocks is a longer-term way to bet on the coming mean-reversion of equities to lower valuations. Put options are a medium-term way to make the same bet with leverage. If we’re heading back to the exciting days of 2008 (which we are) then all of the above should provide both thrills and trading profits.

And precious metals, because they attract fearful capital, should benefit from the coming anxiety spike. Last time around – after an initial plunge – gold, silver and the shares of the companies that mine them embarked on a multi-year run that made them the best performing assets of the decade.

….also: Hot Properties: Government Blows Up Canada’s Hottest Industry

Last Tuesday, I noted that a market decision was coming soon. It came sooner than I anticipated with a sell-off that broke the bullish trend line from the February lows. To wit:

“A major decision point is rapidly approaching which will decide the fate of the market for the rest of the year.”

In the daily price chart below, the break of that bullish trend line is clearly evident.

“Notice in the bottom part of the chart the market currently remains on a sell signal. That sell signal is problematic for two reasons:

1) ‘Sell signals’ combined with overbought conditions tend to lead to at least short-term corrections.

2) ‘Sell signals’ formed at very high levels, such as currently, suggests limited upside and larger correction probabilities.”

Let’s zoom in on the recent price action in the chart above. The chart below is the last 3-months of daily price movement. As you will see, while prices have been quite volatile, there has been virtually no progress in the market during the period.