Stocks & Equities

Time for some old-fashioned disciplining… (a. D. 1891)

Photo credit: Littleton View Co.

Iffy Looking Charts

The stock market has held up quite well this year in the face of numerous developments that are usually regarded as negative (from declining earnings, to the Brexit, to a US presidential election that leaves a lot to be desired, to put it mildly). Of course, the market is never driven by the news – it is exactly the other way around. It is the market that actually writes the news. It may finally be time for a spanking though.

….continue reading and view charts HERE

…also:

We have been waiting for a bounce into the high forecast by the Hybrid Lindsay model and it looks to have come on Tuesday. Cycles warned that the high might come on the late side of the margin of error but internals now appear set-up to give us that rally early this week. Bears don’t have much to worry about, however, as the high is expected no later than Wednesday.

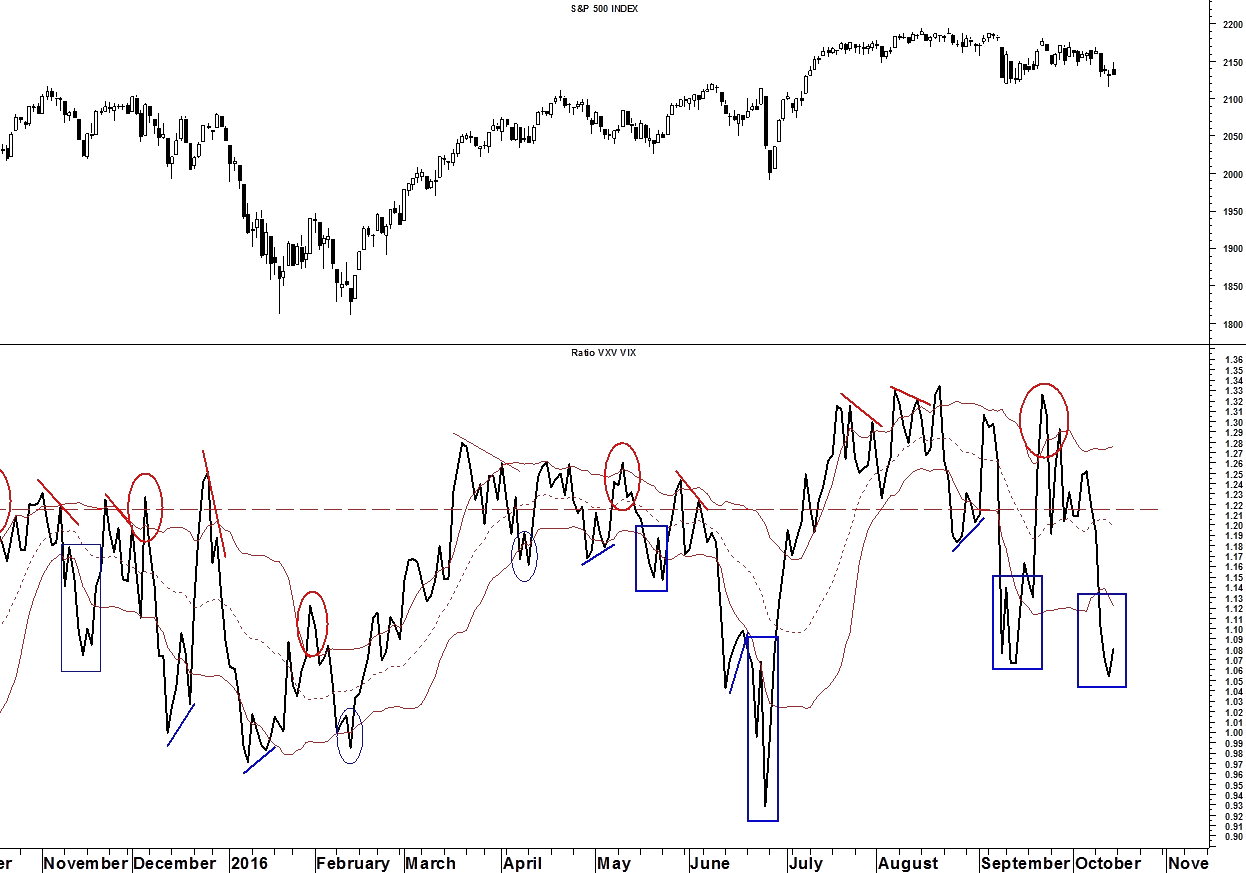

The VXV is a CBOE index similar to the VIX that projects volatility out three months instead of the VIX’s one month time frame. A simple ratio of the two indices produce excellent buy and sell signals (as seen below).

Get your copy of the October Lindsay Report at Seattle Technical Advisors.com

It is finally going to be a make or break earnings season for stocks. This is because the justification for record high stock prices that have been perched atop extremely stretched valuation metrics has been the following false assumptions: the hope that the Federal Reserve will not resume its interest rate hiking cycle, the U.S. dollar stops rising, the price of oil enters a sustainable bull market and long-term interest rates continue to fall.

It is finally going to be a make or break earnings season for stocks. This is because the justification for record high stock prices that have been perched atop extremely stretched valuation metrics has been the following false assumptions: the hope that the Federal Reserve will not resume its interest rate hiking cycle, the U.S. dollar stops rising, the price of oil enters a sustainable bull market and long-term interest rates continue to fall.

If all those conditions were in place investors could continue to believe a turnaround in the anemic 2% GDP growth rate endured since 2010 was imminent. And, most importantly, that a reversal in the 5 straight quarters of negative earnings on the S&P 500 was just around the corner. But even if they were perpetually disappointed in growth and earnings that didn’t materialize, they could always afford to wait until the next quarterly earnings report because there just wasn’t any alternative to owning stocks.

However, if earnings come in weak for the current quarter—which would be the 6th quarter in a row—that disappointment would occur in the context of a rising U.S. dollar, falling commodity prices, spiking long-term interest rates and a Federal Reserve that will most likely resume its hiking cycle in December. In other words, it would be game over for the equity bubble.

After all, market pundits have placed nearly all of the blame for the negative earnings string on a crashing oil price and a spiking U.S. dollar. However, during the 3rd quarter the WTI Crude price and the dollar were both very stable. And the price of crude was trading in the mid $40 a barrel range for both Q3 2015 and 2016. Therefore, if earnings don’t bounce back now how can they be expected to improve in Q4 and beyond, especially while the Fed re-commences its hiking cycle, which should cause the dollar to rise and commodity prices to fall once again?

So how does the earnings season look so far? Industrial and Metals giants such as Honywell, Dover Corporation, PPG Industries, Alcoa and United Technologies have all missed and/or warned on earnings for the third quarter. In the case of worldwide lightweight metals producer Alcoa, (down 11.4% on its earnings report) not only missed bottom line expectations but revenue fell by 6% year over year, which indicates the lack of global growth and demand for industrial metals. Multinational industrial giant Honeywell’s CEO Dave Cote said last week that Jet engine service orders, scanners, and logistic and shipping services simply failed to materialize in September. His warning and comments sent the shares down 7.5% last Friday. The company further sited worsening growth in the Middle East, Russia and China.

The free pass on overhyped stock valuations is now over. And with the S&P 500 trading at 25x reported earnings, this market needs a huge revenue and earnings rebound in Q3 or the gravitational forces of rising interest rates will send stock prices significantly lower.

The low on Treasury yields is most likely behind us. In fact, the Ten-year Note yield has risen from 1.36% in July, to 1.8% recently. Indeed, interest rates are rising across the globe as central bankers now believe higher long-term rates and a steeper yield curve are necessary for a healthy banking system. And the Fed has similarly duped itself into believing asset prices are not in a bubble and that borrowing costs can normalize without hurting equity prices and economic growth. However, both assumptions are extremely far removed from reality.

The truth is this protracted economic and earnings malaise—that shows no sign of turning around–coupled with record high stock prices and the reversal of a nearly decade-long zero interest policy on the part of the Fed is clear: a collapse in equity, bond and commodity prices concurrently. The reversal of the central bank’s trickle down wealth effect should cause a recession to hit the economy hard by the middle of 2017.

But this next bear market and recession may once again lead to a change in monetary policy on the part of the Fed. Collapsing equity prices and rising bond yields should cause the monetary megalomaniacs on the FOMC to follow up on Ms. Yellen’s recent threat to use fiat credit to purchase corporate securities in an attempt to reflate the bubble once again. That is when Pento Portfolio Strategies will close out our current short hedges, aggressively repurchase precious metals and use our substantial amount of spare capital to pick up internationally diversified high-dividend yielding stocks at a steep discount from today’s unreasonable prices.

Last December, the Fed’s liftoff from ZIRP sent stock prices tumbling over 10%–for their worst start of a year in its history. Investors still have time avoid a similar outcome. But since that correction in equity and bond prices should be enough to tilt this anemic economy into a recession, the cumulative collapse could end up being much worse.

In just a few weeks time, the ballots will be in for one of the most controversial elections in U.S. history. Whether the tally ends in a Clinton or Trump presidency, it’s difficult to know the potential range of implications that the 2016 election will have on markets.

In the mean time, investors are wondering how to best position themselves. How could the election possibly affect their portfolio, and how can they hedge against tail risks?

MARKET PERFORMANCE IN ELECTION YEARS

The good news for investors is that historically, the market has performed well in election years with the S&P 500 ending up in positive territory 82% of the time.

The bad news? This is clearly not a normal election.

The following infographic uses data from Fisher Investments to show how the S&P 500 historically performs during U.S. election years, as well as during the terms of specific presidents.

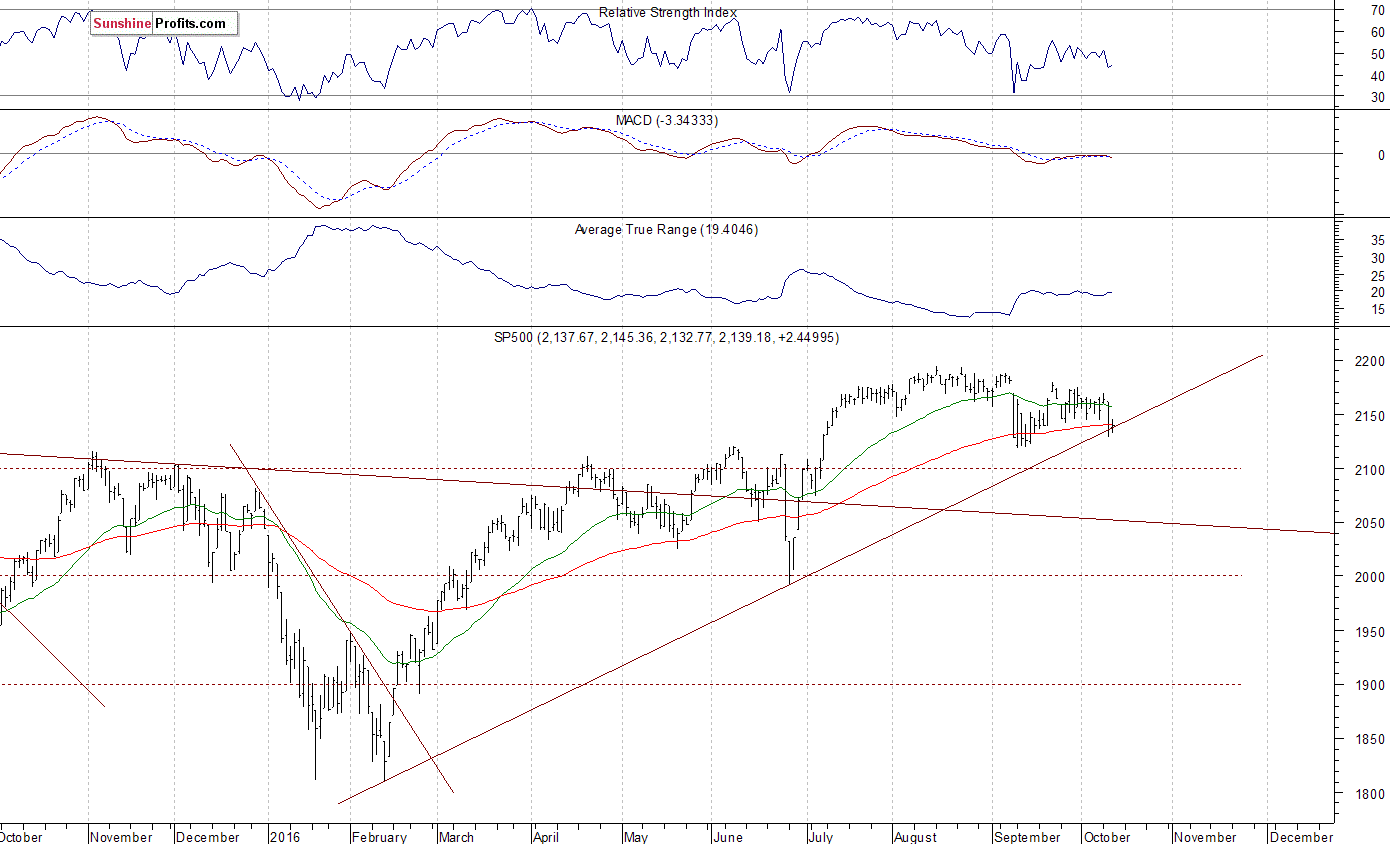

Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,210, and profit target at 2,050, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook is neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

The main U.S. stock market indexes were mixed between -0.1% and +0.1% on Wednesday, as investors hesitated following Tuesday’s decline. The S&P 500 index is the lowest since half of September. Is this a new downtrend or just more consolidation following June – July rally? The nearest important level of resistance is at around 2,140-2,150, marked by previous support level. The next resistance level is at 2,170, among others. On the other hand, support level is at around 2,120, marked by September local low. The market trades along medium-term upward trend line, as the daily chart shows:

Expectations before the opening of today’s trading session are negative, with index futures currently down 0.5-0.6%. The European stock market indexes have lost 0.7-1.3% so far. Investors will now wait for the Initial Claims number release at 8:30 a.m. The S&P 500 futures contract trades within an intraday downtrend, as it extends its recent move down. The nearest important level of support is at around 2,100-2,110. On the other hand, resistance level remains at 2,130-2,140, marked by short-term consolidation, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract follows a similar path, as it extends its recent sell-off. The nearest important level of resistance is at around 4,800-4,820, marked by previous support level. On the other hand, support level is at 4,750-4,770, marked by some previous consolidation.

Concluding, the broad stock market fluctuated yesterday, following its recent decline. For now, it looks like a flat correction within a short-term downtrend. Therefore, we continue to maintain our speculative short position (opened on July 18th at 2,162, S&P 500 index). Stop-loss level is at 2,210 and potential profit target is at 2,050 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract – SP, E-mini S&P 500 futures contract – ES) or an ETF like the SPDR S&P 500 ETF – SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

Thank you.

….also:

Wall Street Earnings Recession is No Cause for Worry; Stock Market Bull has Been Ignoring It