Stocks & Equities

Last week’s sell-off left the “bull market” on shaky ground.

The big question for investors at the moment is whether the 11-year old bull market is ending or is this just a “pause that refreshes?”

While the optimistic “hope” is that this is just a pause within a continuing “bull market” advance, from a money management standpoint getting the answer “right” is vastly more important to long-term investing outcomes.

The easiest way to approach this analysis is to start with the following basic premise:

“Bull markets are born on pessimism, grow on skepticism, and die on euphoria.” -Sir John Templeton

It’s almost as if the Biden administration and some of the most progressive Democrats out there, want the market to crash.

As a reminder to readers, the biggest reason why yields surged yesterday during Powell’s pow-wow is because the Fed chair refused to address the topic everyone has been obsessing over, namely what will be the fate of the SLR exemption which expires at the end of the month and which, unless renewed, will lead to dramatic balance sheet shrinkage across US banks leading to a violent deleveraging as banks are forced to dump bonds accelerating what is already a violent selloff in rates (read our full discussion on the SLR in “Why The SLR Is All That Matters For Markets Right Now“).

So, adding even more fuel to the fire, overnight Politico reported that the FDIC Chair Jelena McWilliams said it doesn’t seem like banking agencies need to extend an emergency move that made it cheaper for insured depository institutions to hold cash and U.S. government bonds on their balance sheets. The most important question rests with the Federal Reserve, she said.

“That’s because capital requirements for the parent holding company, which is regulated by the Fed, are more important for determining how expensive it is for those banks to hold Treasuries, she said.”

As a further reminder, late last week, Senators Elizabeth Warren and Sherrod Brown urged U.S. regulators to reject lenders’ appeals to extend the SLR exemption. In a joint letter to the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency, the Democratic Duo argued that the banking industry is taking advantage of the coronavirus crisis to “weaken one of the most important post-crisis regulatory reforms.” Warren of Massachusetts and Ohio’s Brown, who took over the Senate Banking Committee this year, said granting the extension would be a “grave error.”

As we said in response, perhaps that would indeed be a grave error “but a bond market crash and deeply negative short-term yields would be a far more grave error, especially to the Democrats who are demanding that the Fed monetize trillions in debt in 2021 to fund Biden’s trillions in fiscal stimulus bills, something the Fed would not be able to do if the SLR exemption was not indefinitely extended.”

In other words, for whatever reason – and it certainly may be because they simply have no idea how dire the consequences would be, it now appears that there is a full-court press by the administration and Democrat politicians to not renew the SLR and unless the Fed steps in and overrides this, brace for impact as banks will have no choice but to dump tens of billions of holdings into the open market sparking the next full-blown crash as first yields soar and then all high-duration stocks, i.e., growth names, crater.

- Powell was not concerned by higher yields early last week but he may change his tune on 4 March

- Brainard has already admitted that more recent price action has caught her attention

- We expect Powell to flag scope for a policy response if rising long-term yields threaten recovery

The key event for the market this week would usually be the US non-farm payroll report but focus is instead centred on Fed Chair Powell’s speech on 4 March. We doubt that he will signal near-term Fed policy action in response to the recent UST yield volatility. Given current yield levels and financial conditions, it is difficult to justify such a move without appearing to be driven solely by market developments. However, we see scope for Powell to flag potential for a Fed policy response if it starts to consider rising long-term yields a threat to the recovery. He is unlikely to mention options such as extending the duration of UST purchases or an Operation Twist, but we suspect this is the route the Fed would take, if action were needed.

In his 23-24 February congressional testimony, Powell gave no sign that he was worried about the rise in long-term UST yields. This was consistent with comments from other FOMC members. We suspect, however, that the price action on 25 February, when 10Y spiked to 1.60%, did cause concern. Fed Governor Brainard remarked on 2 March that “some of those moves last week and the speed of the moves caught my eye”. Moreover, she stated that she would be concerned if she saw “disorderly conditions or persistent tightening in financial conditions that could slow progress” toward the Fed’s full employment and 2% average inflation goals.

In terms of UST yields, we think Powell’s speech should support the calmer price action seen so far this week, as the market will likely conclude that 1.50-1.60% for the 10Y is, near-term at least, the top of the Fed’s comfort zone. Simply repeating the Fed’s current forward guidance and its view that near-term inflation will be transitory, however, runs the risk of allowing renewed yield upside (Figure 1).

Speed and composition of yield move may be key to Fed action

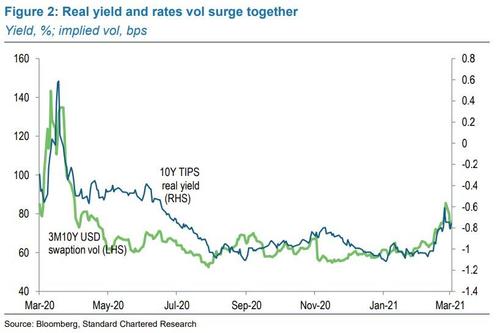

Until mid-February, the rise in UST yields and steepening of the curve since Q3-2020 was in keeping with the broader reflation trade across asset classes, and implied USD rates vol was extremely well behaved. The move in the 10Y UST yield from 0.5% last August to 1.20% was almost 100% explained by the rebuild in the breakeven inflation spread. The last fortnight, however, has seen the real yield component become the key driver of the 10Y UST yield and USD rates vol rose to its highest since the peak of the pandemic-related panic nearly a year ago (Figure 2).

Our interpretation of the move is that the UST market hit the limit of the reflation trade before expectations for growth and inflation strengthened sufficiently for investors to question how far the Fed’s dovish forward guidance would hold. In other words, the market started to price in an outlook buoyant enough to force the Fed to taper, and eventually to hike, earlier than its forward guidance suggests. Hence, the real yield, previously anchored by the Fed UST purchases, near-zero policy rate and forward guidance thereon, suddenly surged. At its intraday high on 25 February, it had risen by 50bps in the space of two weeks.

If Powell does change his tone in a similar fashion to Brainard, we doubt that he would dissect the recent price action from a real yield perspective as we have, for fear of implying that the Fed has an implicit real yield target. However, he could say that the Fed is closely watching inflation expectations as an early warning signal that higher long-end yields might threaten the recovery and progress toward the Fed’s 2% average inflation target (AIT). Having reached 2.25% in mid-February, at the height of the volatility last week, 10Y breakevens fell as low as 2.05% and the 5Y/10Y breakeven curve is now its most inverted ever. Hence, Powell could reasonably say that, while longer-term inflation expectations are still broadly anchored, the Fed would be concerned if they fell any further.

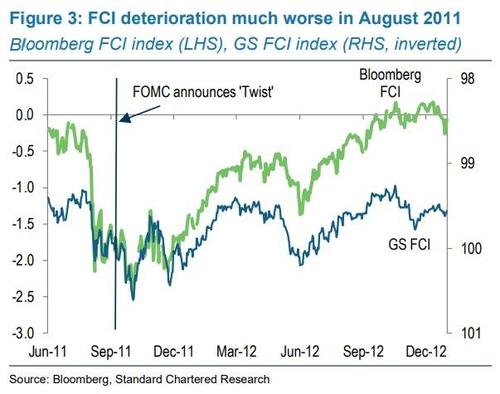

The short end of the yield curve has been suffering from excess liquidity and undesired downward yield pressures, while the long end has experienced undesired abrupt upward moves. It is tempting to see an Operation Twist or weighted-average maturity extension as solving both problems, but there is a major difficulty. Back in 2011, the FOMC move to Twist solved a monetary policy problem. Asset markets had sold off significantly in the aftermath of the debt ceiling crisis and financial conditions indices (FCI) had visibly tightened (Figure 3).

5Y5Y inflation breakevens had come off more than 70bps between end-July and early September.

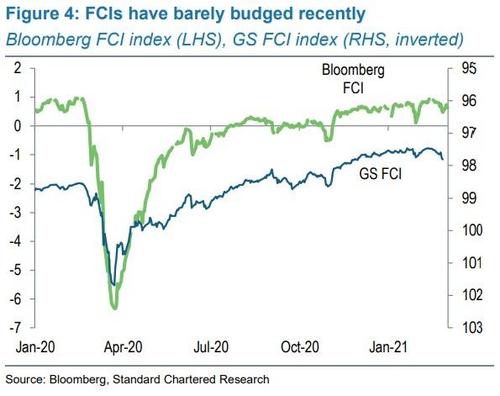

In contrast, financial conditions have barely budged in recent weeks from extremely accommodative levels and the move in breakevens has been much more modest (Figure 4).

We could see a renewed Operation Twist if economic and financial market conditions deteriorated, but the evidence for such deterioration is scant. As traumatic as recent weeks have been for fixed income investors and as much as the Fed would welcome higher short-term and lower long-term yields, the current yield curve issues do not look like monetary policy issues. Hence, we expect a warning of policy moves on further deterioration rather than immediate action.

Our problem, in a Canute shell

As posited yesterday morning, Monday indeed proved that Friday’s market price-action had been about end-of-month short covering in bonds, rather than a sudden market recognition that major central banks are ahead of the curve in controlling longer bond yields. Monday was a new day, a new week, a new month, and a new way to show us that inflation is still something bonds are unhappy about.

As such, at time of writing, long bond yields are going up; and so are stocks; and so are commodities. Yet the first and the third trend on that short list risk hitting the second, as we have already seen graphically displayed of late.

To repeat the analogy from yesterday, central banks are going to have to do something other than just expect markets to retreat at their verbal command like King Canute, whom popular British legend says believed the tides would obey him as he sat on his throne on the seashore.

They will certainly need to do more than the ECB did yesterday in sending the signal, genuine or not, that it may be scaling back its QE bond purchases just as at least one governing council member jawboned that it may need to increase it. (Markets, unlike tides, can count.)

They will arguably need to act more like the RBA, which smashed bond bears yesterday with a doubling of its QE purchase at the longer end to AUD4bn. However, it is vitally important that central banks in general, and the RBA in particular, understand that the huge intra-day drop in 10-year bond yields seen in the Aussie market yesterday was the product of follow-through short-covering from the US on Friday (i.e., the tide decided that it wanted to go out) rather than a reflection of shock and awe at the figure of AUD4bn.

The tactical risk for markets is that the conservative RBA, which meets today, sits on its throne with its crown at a jaunty angle, strokes its beard, and proudly announces that it is in full control of the curve. If so it, and then others by extension, are going to get pretty wet, pretty fast.

Yet our good King Canute and the central banks differ: the latter *do* have the ability to control the curve if they really want to; they *can* peg yields wherever they want them to be. Indeed, one can expect the market to start calling for exactly that both in word –and they are, with calls for the Fed to shift to a new Operation Twist focusing QE at the long end of the curve– and in deed, through both higher yields and bear steepening, with every inflation anecdote and data release.

As has been underlined here for years, and many times recently, the only problem with central banks displaying such awesome powers at a time when input prices are soaring is that there is no going back to normal market tides afterwards: no ripples; no waves; and certainly no surfing. The sea will be artificially becalmed – but lots of important things will still drown.

Tactically, let’s see what the Fed’s Brainard and Daly have to say today as they get their latest chance to dip their toes in the water on this key topic. Strategically, however, and given King Canute is NOT applying his powers to the labor market *directly*, where the waters still remain full of sharks and dangerous undercurrents (and no USD15 minimum wage), one has to recognize that there are only three ways that this all ends up: the tide is either coming in or going out, so to speak. Either:

- Central banks refuse to step in; longer yields rise sharply, and probably overshoot; stocks are dragged down; the US Dollar is pushed up; commodities are dragged down; markets start to panic; governments start to panic; corporations start to panic; and everyone ends up in rags crammed onto the tiny desert island of the short-end of the yield curve under a solitary coconut tree; or

- Central banks step in; longer yields are crushed, as we saw Monday in Australia; stocks rally further; the US Dollar is pushed down (assuming the Fed is doing this); commodities are pushed up; markets are on fire; governments are free to spend – if they can bothered, which still looks unlikely; corporations are free to build lots of ‘useful’ projects like The World islands in Dubai; and those long assets get to sit on man-made islands drinking cocktails under coconut trees, while those long labour get to swim with the sharks in wave-free seas to serve the drinks to them; or

- Central banks and governments step in; and they focus on the labour market *directly*, which will have to involve building a whole series of dykes to keep liquidity in and other fishers out, in a proletarian version of The World islands in Dubai where everyone has rolled up trousers and wears a white hankie on their head; and only the rich end up on a desert island, one way or another.

So which of the above is really nautical, and which is nice? That’s our problem in a Canute shell.

(CNN Business)Airbnb and DoorDash went public the same week in early December and were both met with strong demand from investors. But in their first earnings reports as publicly traded companies on Thursday, the two sharing economy businesses signaled very different possible paths forward after the pandemic ends.