Stocks & Equities

GameStop’s Roller Coaster Ride Resumes

GameStop GME +35.7% had another huge move up on Wednesday after the company announced the CFO was resigning the company. Normally a stock declines when a CFO suddenly departs but GME increased over 100% yesterday, moving from $44.97 to $91.71, an increase of 104%. It continued the move in the after-market, rising $76.29 to $168, up an additional 83%. The market cap at Wednesday’s close was $6 billion and in the after-market was $11 billion.

The Wall Street Journal reported that, “GameStop’s finance chief was forced out of his role as activist investor Ryan Cohen pushes for a digital transformation of the ailing videogame retailer.” In this type of situation it could make sense for a stock to move higher but not to double. Wednesday’s rebound and the follow-through in the after-market is probably being driven by the Reddit crowd. They need to be very wary of another steep rise followed by another sharp fall.

Watching the market’s panicked reaction this morning as the reality of the recent surge in first breakevens then real yields, is finally appreciated by the “cubic zirconium” hands, the momentum chasing algos and the puking CTAs, can’t help but bring a smile to the face of any market cynic who has seen this hilarious market reaction ever so often when markets freak out over a modest if rapid rise in yields (putting the 10Y in perspective, it is at 1.35%, well below any level it traded at prior to the Covid crash of 2020 and financial conditions are still just about the loosest they have ever been).

So, with the world seemingly coming to an end – if only for all those WallStreetBets traders who have never seen a 3% drawdown in their trading careers – here are some very quick words of comfort from Deutsche Bank’s Jim Reid who – unlike so many this morning – gets that there will be no real rise in rates “for the most of our careers.”

Here is Reid:

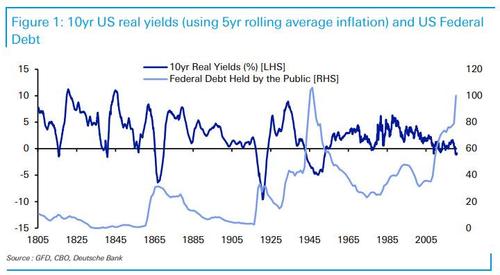

I did a CoTD showing real yields back over 200 years and highlighted that the only time real yields are negative for any period of time are around episodes of high debt. Given today’s debt levels, it’s likely real yields will stay ultra low for as far as the eye can see even if we’re seeing some cyclical pressure now.

And the punchline:

So with debt so high and likely to go notably higher, it is likely that real yields will have to stay artificially low for a very long period of time. Any return to something close to long-term averages would have grave consequences for debt sustainability. The Fed would likely step in well before this point.

Financial repression and QE will likely be alive and well for the rest of most of our careers.

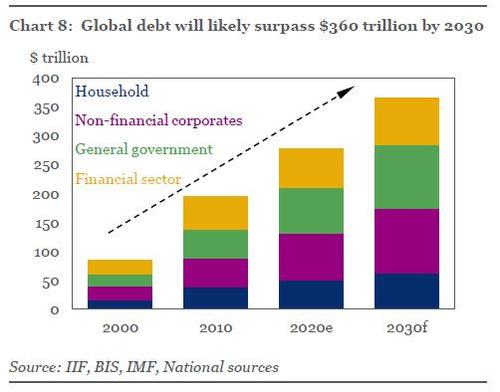

Why this matters? Because as the IIF forecast back in November, “if the global debt pile continues to grow at the average pace of the last 15 years, our back-of-the-envelope estimates suggest that global debt could exceed $360 trillion by 2030—over $85 trillion higher than current levels.”

Needless to say, $360TN in debt will never happen if rates rise from current levels without apocalyptic consequences.

What this means is that the Fed will never again allow rates to go up again or even approach reasonable levels, or else everything – not just stocks – but global economies and society will crash. It also means that the Fed’s nationalization of the bond market which started with purchases of IG bonds and junk ETFs last year alongside the tsunami of liquidity unleashed last March, is about to be complete.

So for everyone panicking about rising rates and liquidating stocks (such as what the CTAs did this morning) over fears of imminent rate hikes… don’t.

I had to do a double-take recently when reading a CNBC headline that stated: “The only reason to be bearish is there’s no reason to be bearish.”

It is indeed hard to argue the point. As the article explained:

“A majority of investors finally agree the V-shaped recovery is at play,” according to the Bank of America Global Fund Manager Survey. Plus, a record percentage of money managers believe that global growth is at an all-time high.”

When “everyone is in the pool,” it is an excellent time to remember a basic premise of investing from our post on trading rules:

“Opportunities are made up far easier than lost capital.” – Todd Harris

Frankly, we’ve had it with the constant stream of lies from Robinhood and neverending bullshit from the company’s CEO, Vlad Tenev.

With Tenev scheduled to testify on Thursday, alongside the CEOs of Citadel, Melvin Capital and Reddit, the apriori mea culpas have started to emerge – if a little too late – the former HFT trader spoke late on Friday on the All-In Podcast hosted by Chamath Palihapitiya, who had strongly criticized Robinhood over the trading restrictions, and Jason Calacanis, a Robinhood investor, and said that “no doubt we could have communicated this a little bit better to customers.”

What he is referring to, of course, is Robinhood’s outrageous decision to restrict the buying of 13 heavily shorted stocks on Jan 28 that had been driven to record highs, including GameStop, whose shares had surged more than 1,600%.

And then he decided to pull the oldest trick and deflect attention from his own mistakes by blaming “conspiracy theories.”

We are confident that this week’s Congressional hearings will quickly get to the bottom of this critical question of just how profitable this orderflow – which it paid Robinhood $362 million to procure – is for Citadel, because anything less will confirm that this latest hearing is nothing but a kangaroo court meant to appease retail investors that someone in Washington is doing something… when in reality everyone knows that what Citadel wants, Citadel gets and there is no sign that Citadel will ever tire of making billions out of the same orderflow for which it paid subpennies on the dollar to Robinhood.

As for Robinhood’s trite virtue signaling of taking from the rich and giving to the poor, all it took was 30 billion subpenny rebates from Citadel for the firm to remember who really calls the shots.

One of my favorite investing legends is Oaktree Management’s Howard Marks. His investing wisdom and in-depth knowledge of investor psychology and market dynamics are unparalleled. Given the “speculative mania” we continue to watch in the market, I thought a review of some of his previous thoughts is appropriate.

Over the weekend, I re-read some previous research and ran across an interview between Goldman Sach’s Hugo-Scott Gall and Howard Marks. The talk ranged from investment decisions to behavioral dynamics. While the interview occurred in 2013, it is just as relevant as if he said it yesterday.

I have annotated some of the points for clarity.

Investor Psychology

Hugo Scott-Gall: How can we understand investor psychology and use it to make investment decisions?

Howard Marks: It’s the swings of psychology that get people into the biggest trouble, especially since investors’ emotions invariably swing in the wrong direction at the wrong time. When things are going well people become greedy and enthusiastic, and when times are troubled, people become fearful and reticent. That’s just the wrong thing to do. It’s important to control fear and greed.

Another mistake that people often make is to compare themselves with others who are making more money than they are. They mistakenly conclude they should emulate the others’ actions after they’ve worked. This is the source of the herd behavior that so often gets them into trouble. We’re all human and so we’re subject to these influences, but we mustn’t succumb. This is why the best investors are quite cold-blooded in their professional activities. Continue Reading