In This Week’s Issue:

In This Week’s Issue:

– Stockscores Active Trader Webinar – Tuesday Feb 17 6pm PT, 9pm ET

– Stockscores’ Market Minutes Video – How Resistance Works

– Stockscores Trader Training – Information Pitfalls

– Stock Features of the Week – Flag Breaks on the Weekly

Stockscores Active Trader Webinar

Tuesday Feb 17 6pm PT, 9pm ET

Learn how the Stockscores Approach works for day and swing trading with this free, one hour webinar.

Click here to register

Stockscores Market Minutes Video – How Resistance Works

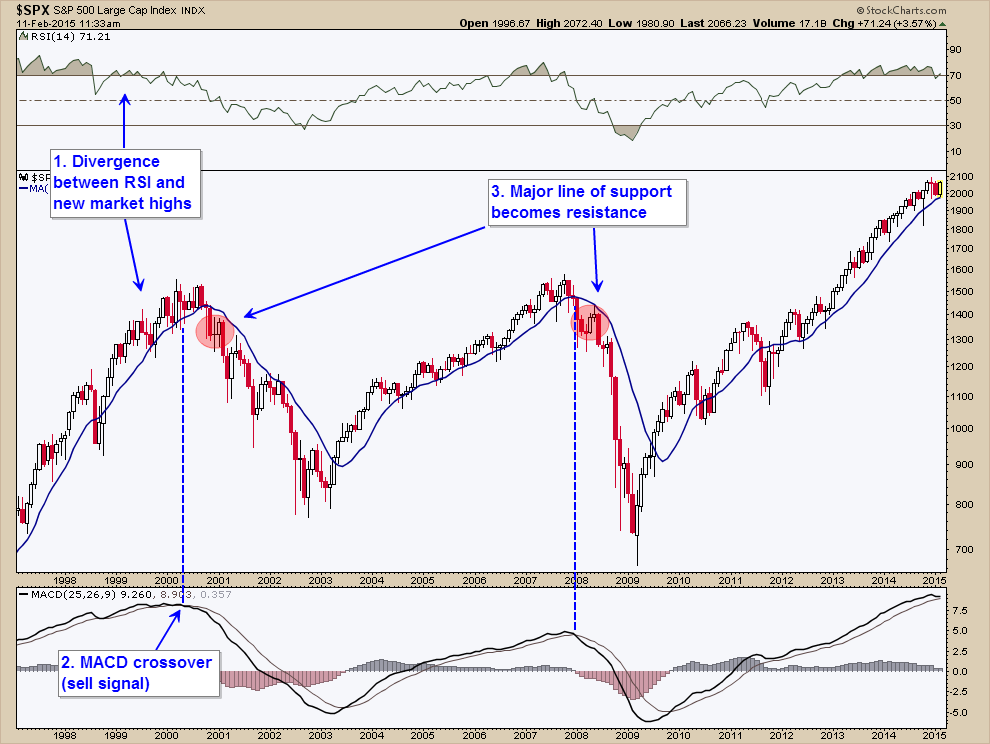

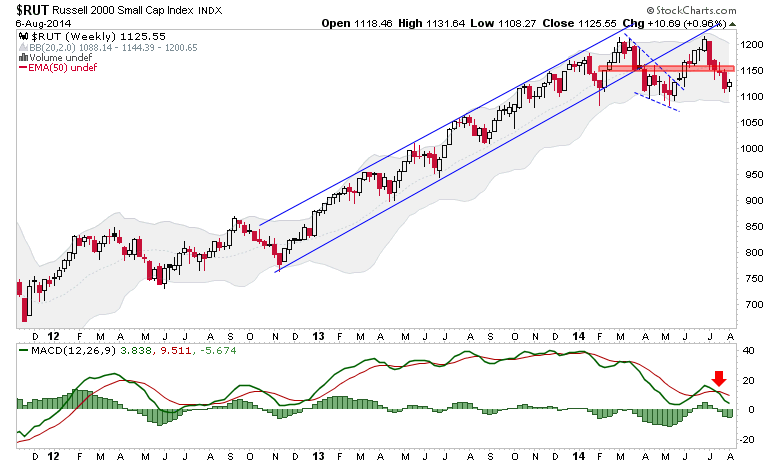

How price action behaves around resistance helps to determine whether a trend will evolve out of a breakout through resistance. This week, I explain how this works plus provide my analysis of the markets for the week ahead.Click here to watch

Trader Training – Information Pitfalls

In theory, information should make the stock market’s world go round. Information about companies and their ability to make money in the future is what should determine share price. As the market learns of new information, price is adjusted up and down to reflect the value of that information.

This implies that investors should focus their analysis on information so they can predict where share prices should go in the future.

While this makes good sense, I have found it to be extremely rare that investors who use information are able to consistently beat the stock market. With smaller retail investors (you and I) in particular, the use of information for making investing decisions is more destructive than it is beneficial. Here are ten reasons why:

1. Information is Usually Already Priced In – most investors use publicly available information. That means it is widely known and available to anyone considering the stock. If information is available to a large number of investors then we should expect that the market will have priced that information in to the stock. Therefore, the information has not value to us.

2. Information Usually Comes with a Bias – as a general rule, people do what they are financially motivated to do. If someone is encouraging you to purchase a stock, there is a good chance that they have some financial motivation to do so. Before you trust the information you receive, understand the financial motivation. If you find the reason, you will often usually find that there is a strong bias in the information being provided to you.

3. Trading on Truly Insider Information is Illegal – there are few risk free trades in the stock market, but trading on significant, inside information is one. You stand to make a lot of money buying stock in a company that will be acquired by another at a premium tomorrow. If you have that information and act on it, you are trading on inside information and that can land you in jail.

4. Gathering Good Private Information is Expensive and Time Consuming – there are investors who are able to uncover information that is not priced in to a stock but is not considered inside information. This private information is valuable because it can lead to market beating returns. However, gathering private information typically requires significant resources, knowledge and time. For small investors, it is not feasible to do this kind of work across a broad range of stocks.

5. Information Causes You to Ignore the Market’s Message – when you have an understanding of a company’s story, there is a tendency to fall in love with that story and ignore new information that goes against your outlook for the stock. This leads the committed shareholder to hang on to a losing position, allowing the loser to bog down the performance of the overall portfolio.

6. You May Not Have All of the Information You Need – the market tends to focus on two or three key information points that affect the price investors are willing to pay for it. An investor who does a thorough fundamental analysis of the stock may still have an incomplete understanding of the company’s business. If missing one of the key points, this investor can make a gross error in valuing the stock.

7. The Market May Not Be Trading On Fundamentals – in theory, stock price is based on the present value of future earnings expectations. In practice, there are often very non fundamental influences on share price. A large investor that has a liquidity crisis may be forced to unload a large position with little regard for price. Often, the laws of supply and demand affect share price even though theory tells us that they should not have an influence.

8. Your Interpretation May Not Be the Same as The Market’s – Our mood affects how we judge information and the same can be said for the market in general. Your fundamental analysis may be correct in an optimistic environment, but if the market is in a pessimistic mood, the investment can lead to losses. Even the market is wrong, it is right.

9. There Is No Standard for What Information is Worth – There are many formulas for determining what a company’s share price should. Many fundamental analysts look for stocks to trade at a certain multiple of their earnings with that multiple to be based on growth. However, there are great variations in accounting methods that can have a profound effect on how earnings are reported. More importantly, there is no rule that a company should trade at a certain multiple of earnings, that target multiple is just an opinion.

10. We Tend to Focus On Information That is Easy to Get – we often looks for the easiest way to achieve a goal. With information, there is a tendency to focus on the information that is front of us. Rather than work to find something to disprove our thesis on a stock, we instead look for information to strengthen our thesis. In doing so, we present our own biased outlook for our investment decisions that can often be very incomplete and wrong.

Ultimately, I look at the market’s interpretation of all available information when I look at a chart of price and volume. It shows not only every bit of information detail but also what the market thinks of it.

This week I ran the Stockscores Simple Weekly Market Scan but I went in search of flag pattern breaks. A flag pattern is an uptrend continuation pattern where there is a break higher after a short pull back. It allows for risk management at the low of the pull back and has a high probability of success because there is strong momentum in the chart. I day trade these patterns daily but they are also worth considering on the longer term weekly chart.

Here are two stocks in strong upward trends that made flag breaks last week:

1. T.MAL

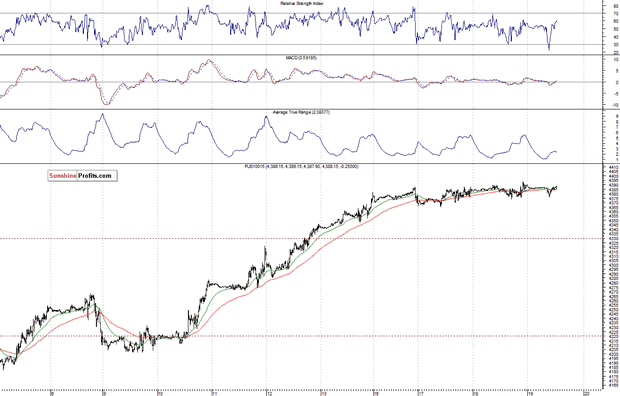

T.MAL moved up well over the past week and has defined support at $12.90. It may stall at the old highs of $14.40 but the long term trend is strong and up.

2. T.PLI

T.PLI made a strong break on Friday but was halted before the close. The long term chart is showing a good flag break but wait to see how it opens after it resumes trading, a big gap up could hinder the reward for risk of the trade. Support at $1.82.

References

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligenc