Stocks & Equities

In this week’s issue:

- Weekly Commentary

- Strategy of the Week

- Stocks That Meet The Featured Strategy

In This Week’s Issue:

– Stockscores Canadian Tour

– Stockscores’ Market Minutes Video – The Trend Is Your Friend

– Stockscores Trader Training – Think Differently

– Stock Features of the Week – Canadian Long Term Breakouts

Stockscores Canadian Tour

For these upcoming presentations, I plan to walk through the processes I use to find longer term position trades, medium term swing trades and short term day trades. But first, I will highlight the one simple thing that starts almost all market beating trends. Capital preservation should be the number one goal of all traders so I will show how I manage risk. Finally, I will show our new Stockscores Education Center and how you use it

to become a better trader. Hope to see at one of these upcoming events:

Ottawa – Nov 11

Montreal – Nov 12

Edmonton – Nov 15

Calgary – Nov 17 and 18

Vancouver – Nov 19

Surrey – Nov 20

Webinar – Nov 25

For details and to register for one of these free events, Click Here.

Stockscores Market Minutes Video – The Trend Is Your Friend

Investors constantly doubt the trend and lose money as a result. Keep it simple and trade with the trend of the market and the stocks that you are considering!

Trader Training – Think Differently

Here are 10 things that may help you be a better investor, some ways to think differently from the crowd in that pursuit to achieve market dominance.

1. Do not think about making money, think about losing money – the first step toward success is accepting that losing is part of trading. You will not be right all of the time, you cannot always trade your way out of a bad situation. There will be times when you simply have to walk away with a loss. The key is to keeping the losses small and manageable. When the market proves you wrong, take the loss.

2. Do not think you can average down to win – it is a logical idea, add more to a losing position with the expectation that the market must eventually go your way. Many times this strategy will work but, when it does not work, the loss may be insurmountable. The market does not eventually have to go your way.

3. Do not think that your success is entitled – you may make a great trade, pick a really great stock and have a feeling like you really have the market figured out. Forget your gloating, no one ever has the market figured out. We must always remember that we have to work as smart for the next trade as we did for the last.

4. Do not think that talent is required – making money in any trading endeavor is a small part technical skill and a big part emotional management. Learn to limit losses, let winners run and be selective with what you trade. Emotional mastery is more important than stock picking skill.

5. Do not think that you can tell the market what to do – the market does not care about you, it does not know that you want to make a profit. You are the slave, the market is your master. Be obedient and do what the market tells you to.

6. Do not think you are competing against other traders – trading success comes to those who overcome themselves, it is you and your persistent desire to break trading rules that is the ultimate adversary. What others are doing is of little consequence, only you can react to the market and achieve your success.

7. Do not think that Fear and Greed can ever be positive – in life, fear can keep us from harm, greed can give us the motivation to work hard. In the market, these two emotional forces will lead to losses. If your decisions are governed by either or both you will most certainly find that your money escapes you.

8. Do not think you will remember everything you learn – every trade provides a lesson, some valuable education on what to do and what not to do. However, it is likely that your lessons will contradict one another and lead you to forget many of them. Write down the knowledge that you accumulate, return to this trading journal so that you can retain some value from the lessons taught by the market. Remember, the market is cruel, it gives the test first and the lesson after.

9. Do not think that being right will lead to profits – you may be exactly right about what the fundamentals are and what they are worth. However, timing is everything, if your expectations for the future are ill timed, you may find yourself losing more than you can tolerate. Remember, the market can be wrong longer than you can be liquid.

10. Do not think you can overcome the laws of probability – traders tend to be gamblers when they face a loss and risk averse when the have a potential for gain. They would rather lock in a sure profit and gamble against a probable loss even if the expected value of doing so is irrational. Trading is a probability game, each decision should be made on the basis of the best expected value and not what feels best.

![]()

Here are two Canadian stocks that made good weekly moves last week and have good chart patterns indicating they have good potential to move in the months ahead.

1. T.MAL

T.MAL is breaking through resistance on the weekly chart after trending sideways for a number of months. The long term trend is up and appears likely to continue.

2. T.DSG

T.DSG has been trending sideways for most of 2014 but came alive in the past couple of weeks, moving to new highs on stronger than normal volume.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligenc

The main U.S. stock market indexes were virtually flat on Friday, as investors continued to hesitate following recent advance, despite some important economic data releases.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

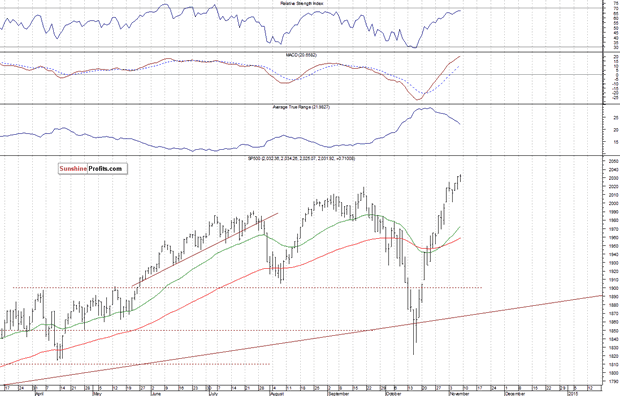

Our Friday’s neutral intraday outlook has proved accurate. However, the S&P 500 index has managed to reach yet another new all-time high at the level of 2,034.26. The nearest important level of resistance is at around 2,030-2,035. On the other hand, the support level is at 2,020, marked by previous high, and the next support level is at around 2,000. There have been no confirmed negative signals so far, however, we can see some overbought conditions which may lead to a downward correction:

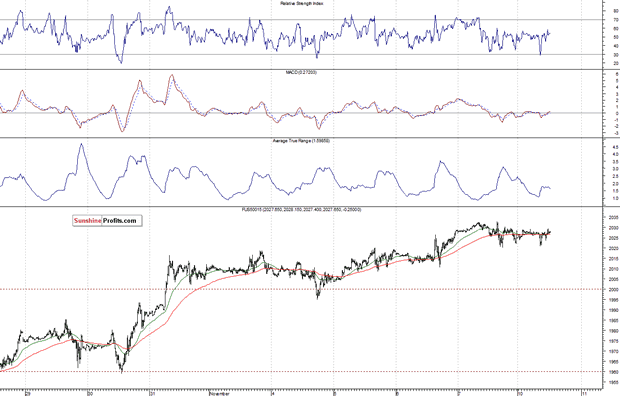

Expectations before the opening of today’s trading session are slightly positive, with index futures currently up 0.1-0.2%. The European stock market indexes have gained 0.3-0.5% so far. The S&P 500 futures contract (CFD) trades along the level of 2,025. The nearest important resistance level remains at around 2,035, and support level is at 2,020, among others:

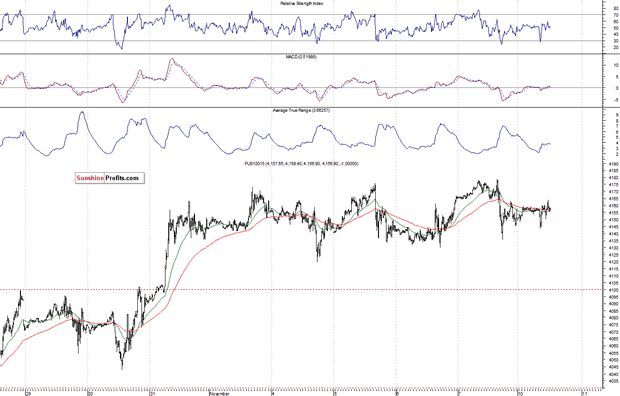

The technology Nasdaq 100 futures contract (CFD) extends its short-term consolidation, as it fluctuates along the level of 4,160. The resistance level is at 4,180, marked by local highs, and support level remains at 4,120-4,140, as we can see on the 15-minute chart:

Concluding, the broad stock market extends its short-term consolidation, following recent move up. There have been no confirmed negative signals so far. However, we can see some short-term overbought conditions which may lead to a downward correction at some point in time. We still prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Americans spoke loudly and clearly at the polls this week, repudiating Obama’s and the Democrats’ failed big-government policies. This huge Republican victory has serious implications for the Fed and US stock markets. Republican lawmakers have long opposed this easy Fed, and they will put great pressure on it to normalize its balance sheet and interest rates. This is an ominous omen for these Fed-inflated stock markets.

Americans spoke loudly and clearly at the polls this week, repudiating Obama’s and the Democrats’ failed big-government policies. This huge Republican victory has serious implications for the Fed and US stock markets. Republican lawmakers have long opposed this easy Fed, and they will put great pressure on it to normalize its balance sheet and interest rates. This is an ominous omen for these Fed-inflated stock markets.

Prior to Tuesday, the mainstream media dominated by Democratic sycophants did its best to downplay the American anger at Obama and the Democrats. There were endless reports about how awesome the US economy is, despite the fact most Americans aren’t feeling it in their pocketbooks. Recent Republican polling gains were ignored. Without honest coverage leading into the elections, the results seemed shocking.

In the critical Senate, the Republicans picked up at least 7 seats for a solid 52-seat majority. And 3 more are yet to be decided. And in the House, the Republicans won at least 16 seats for a strong majority of at least 243. And it could go as high as 249 when the recounts are done for the close races. This would give Republicans their largest majority in the House since 1928! Americans kicked out Democrats in droves.

Since Republicans are business-friendly and anti-regulation, traders saw their sweep as a major positive for the US stock markets. And there are all kinds of historic stats about how stock markets almost always rise after midterm elections. But the stock-market situation today is far from normal, with the major indexes at nominal record highs thanks to the big boost from the Fed’s unprecedented third quantitative-easing campaign.

Republican lawmakers have long opposed Fed inflation and easy money for several reasons. Interest rates are effectively the price of money. That should be neutral, not favoring savers or debtors. Interest rates should be set by free markets, not government decree, at a fair level that is mutually beneficial for both savers and debtors. The Fed’s zero-interest-rate policy has robbed savers blind to subsidize debtors’ binge.

The Bernanke Fed launched ZIRP in December 2008, and it was promised to be a temporary measurefor the stock-panic crisis. But here we are, nearly 6 years later with stock markets at record highs, and the Fed has kept rates at zero. The Fed has aggressively discouraged saving, even though that is what builds wealth and makes economies grow. Republican lawmakers want to end this asinine attack on savers.

The Fed’s easy money is also essential to “finance” Obama’s and the Democrats’ big government. The artificially-low interest rates ZIRP fostered have dramatically lowered the borrowing costs for the federal government. This has enabled the Obama Administration to go on the biggest debt-fueled spending spree in the history of the world. The government debt growth under Obama has been staggering, very scary.

Republican lawmakers want to bring back accountability and restraint to government spending. And the quickest way to force it is to normalize interest rates. If Treasury yields were back up near normal levels, the government’s interest expense would be far higher. That would make it far more difficult for debt growth to continue, imposing market discipline. Normalizing interest rates would dramatically slow Democrats’ overspending.

Finally, Republican lawmakers recognize the Fed is overtly political and pro-Democrat. Janet Yellen is a hardcore Democrat, all for big government. And back before the November 2012 elections that gave a second term to Obama, the Fed manipulated the markets into his favor. Just before those elections in September 2012, the Fed launched QE3. This goosed the stock markets in the critical final pre-election months.

The stock markets were topping and starting to roll over before the Fed birthed QE3. And the stock-market performance in September and October before presidential elections almost always decides them. In the 28 presidential elections since 1900 before that 2012 one, the stock markets rallied in September and October 16 times. The incumbent party won 15 of those 16 presidential elections, a stellar correlation.

And during the 12 times when stock markets fell in September and October before a presidential election, the incumbent party lost 10 times. This may sound surprising, but it makes perfect sense. The fortunes of the US stock markets dominate American sentiment, leading voters to feel better or worse about their political leaders. The Fed launching QE3 right before the 2012 election almost certainly gave Obama his victory.

So Republican lawmakers are openly hostile to this easy-money Fed that has robbed American savers, enabled the Democrats’ big-government spending binge, and even got Obama reelected despite him presiding over the worst US economy since the Great Depression. A Republican-dominated Congress is the worst nightmare for the Federal Reserve, and vastly limits the Fed’s ability to continue printing money.

Republican legislators are ready to make life a living hell for the Yellen Fed. They can drag Yellen before endless hearings, putting intense political pressure on her to normalize the Fed’s balance sheet and interest rates. They can vote for more Fed oversight, or even force the Fed to tie its interest-rate targets to hard mathematical metrics rather than the FOMC’s discretion. They could even threaten to revoke the Fed’s charter!

The Federal Reserve was created by an act of Congress 101 years ago, and it serves at the Congress’s pleasure. The Congress can kill it anytime, or impose any restrictions it wants. Sure, Obama can and will veto any aggressive anti-Fed legislation since he needs the Fed’s inflation to “pay for” the big-government spending that bribes Americans to vote Democrat. But Yellen will still be forced to tread very softly now.

Shackling this easy-money Fed has massive implications for the Fed-levitated US stock markets. For all kinds of fundamental, technical, and sentimental reasons based on over a century of market history, this cyclical stock bull was topping in late 2012. The bull was overvalued, overextended, at its secular-bear resistance, and euphoria was rampant. It was starting to roll over on schedule before the Fed hatched QE3.

Its third quantitative-easing campaign, which means creating new money out of thin air to buy bonds, was unprecedented on multiple fronts. Unlike QE1 and QE2, it was open-ended. The Fed didn’t announce an end date up front, and kept promising it could ramp up the QE3 debt monetizations if the stock markets started to flag. This created a Fed Put, a psychological backstop that kept traders aggressively buying stocks.

QE3 was also unprecedented in its direct monetization of US Treasuries, inflating away the Democrats’ excessive spending. QE1 had $300b of Treasury buying, QE2 had $600b of new Treasury buying, and QE3 weighed in at $790b by its recent end. The whole QE experiment since late 2008 has ballooned the Fed’s Treasury holdings by $1982b! That’s $2t of government spending that wouldn’t have otherwise happened.

Without this brazen Fed effort to artificially manipulate interest rates lower, the stock markets would look very different today. If bond yields weren’t so anomalously low, stock markets wouldn’t have soared on bond investors grudgingly giving up on that manipulated market to move capital into stocks to seek out some returns. And without that QE-fueled government spending, overall corporate profits would’ve been lower.

And with Republicans now running Congress, the QE era is definitely over. The Fed can’t risk launching QE4 to support stock markets when they inevitably start to swoon. The political backlash would be too great, threatening the Fed’s coveted independence or maybe even its very existence. Yellen’s hands are tied, she can’t further alienate a hostile Congress. So the Fed’s balance sheet is done growing through QE.

Curiously the euphoric stock bulls think these extraordinarily anomalous stock markets are normal and righteous. But nothing could be farther from the truth. As of this week, this latest cyclical stock bull in benchmark S&P 500 (SPX) terms was up 199.1% over 68 months. This is far beyond the average size and duration of mid-secular-bear cyclical bulls of a doubling over merely 35 months. Talk about overextended!

And healthy stock bulls see periodic corrections, selloffs greater than 10%, to rebalance sentiment and bleed off excess greed. These generally happen about once per year or so. But today’s stock markets have gone an astounding, and near-record, 37 months without a single correction-magnitude selloff! Without sentiment being rebalanced, greed has blossomed into extremely dangerous full-blown euphoria.

How did such a wildly-unprecedented market extreme come to pass? The Fed. QE3 convinced stock traders the Fed would quickly jump in and print money to arrest any stock-market selloff. So they quickly forgot about market history and cycles to buy, buy, buy no matter what. The Fed had their backs, so why bother selling ever? With the Fed printing money, couldn’t the stock markets only rise to the end of time?

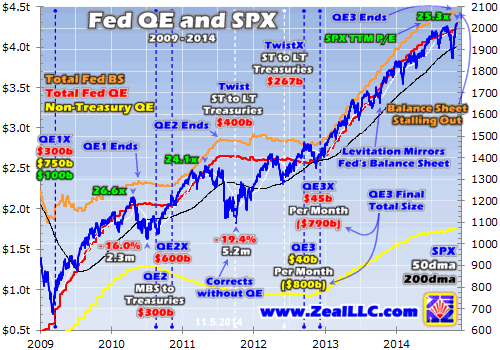

While the cyclical bull between early 2009 and late 2012 was normal, everything since was an illusionthat was conjured by the Fed’s QE3 inflation. This chart shows the SPX superimposed over the Fed’s balance sheet, and is incredibly damning. Even before late 2012’s QE3 launch, the stock markets only rose when the Fed’s balance sheet was ramping up through debt monetization. Whenever it stalled, stocks sold off hard.

For more background on this chart, check out an essay I wrote a couple months ago. But basically it shows the Fed’s total balance sheet in orange, its Treasury holdings in red, and its mortgage-backed-securities holdings in yellow. Also shown are key dates in QE, when the Fed’s campaigns began, were expanded, and ended. The message of this chart is crystal-clear, without QE4 the stock markets are doomed.

This mighty cyclical bull, one of the largest in history, has had two full-blown corrections. They happened in mid-2010 and mid-2011, and weighed in at 16.0% and 19.4% SPX declines in a matter of months. Note that the catalyst both times was the Fed’s balance-sheet growth stalling out when QE1 and QE2 ended! In both cases the stock markets didn’t start rallying again until the Fed announced more debt monetizations.

QE2’s birth ended the post-QE1 correction, and the so-called Operation Twist campaign of migrating the Fed’s Treasury holdings from short-term to long-term to manipulate long rates lower ended the post-QE2 correction. If the Fed hadn’t continued its radically unprecedented balance-sheet expansions, would either of those corrections ended where they did? No one knows, but we are about to find out I suspect.

Since late 2012 when the Fed goosed the stock markets with QE3 and gave the election to Obama, the growth rate in the Fed’s balance sheet has been unprecedented. Look at how steeply that orange line in this chart rises! And the correlation between it and the US stock markets is nearly perfect. As long as the Fed was aggressively printing new money to buy bonds, the stock markets soared on all this inflation.

The FOMC just ended QE3 in late October, and it ultimately weighed in at total monetizing of $1590b. This dwarfs QE2’s $600b of new buying, and challenges QE1’s staggering $1750b right after 2008’s big stock panic. In the first 8 months of 2008 before Bernanke launched ZIRP and QE, the Fed’s balance sheet averaged $875b. Today it is a jaw-dropping $4451b! QE has totaled nearly $3.6t, a staggering sum.

With QE3 over, the Fed’s balance sheet has stalled out and will soon start to shrink. This is happening at a time when stocks are near nominal record highs after an outsized bull market and trading at extremely high valuations. The simple average of the individual trailing-twelve-month price-to-earnings ratios of all 500 SPX stocks is now 25.3x. This is far above 14x historical fair value and nearing the 28x bubble level!

If everything beyond 1500 in the S&P 500 was the result of the Fed’s QE3 manipulations, what is going to happen to the stock markets with QE3 over and QE4 impossible politically? It isn’t going to be pretty. Absolute best case we are looking at a full-blown correction approaching 20%, which would drag the SPX back under 1625. And far more likely the overdue cyclical bear will arrive, ultimately cutting stocks in half.

The new Republican Congress won’t only pressure the Fed to normalize its balance sheet, but its interest rates too. In the quarter century between the early 1980s rate spike and 2008’s stock panic, the federal-funds rate the Fed directly controls averaged 5.3%. That’s far higher than today’s zero! Stock markets abhor rising rates, as bonds look relatively more attractive and therefore suck increasing capital out of the stock markets.

Coupling rising interest rates with the Fed’s soon-to-be-shrinking balance sheet greatly compounds risk for today’s stock markets. This would be a recipe for serious selling no matter when it happened. But at a time when the euphoric stock markets are at record highs after an overextended bull, haven’t experienced a single correction in several years, and are dangerously overvalued, the implications couldn’t be more ominous.

And almost certainly the Republican lawmakers’ righteous disdain for this easy-money Fed will not lapse merely because the stock markets sell off. America needs to get back on an even keel financially, to stop the Obama Administration’s debt binge and restore normal interest rates. Republicans aren’t going to betray their fiscally-conservative convictions to encourage QE4 no matter how low the stock markets go.

And they may not even care due to political calculus! Obama is still in charge for the next two years, and if the stock markets suffer a new cyclical bear between now and the 2016 elections the voters will put the blame squarely on his shoulders. Weaker stock markets actually increase the odds a Republican will win the presidency in 2016! And there’s nothing Republicans want more than one of our own in that high office.

So contrary to euphoric stock traders’ belief that the massive Republican victory this week will prove great for stock markets, just the opposite is likely true. The artificial Fed-spawned levitation of stocks over the past couple years or so is doomed without more QE. And the Republican Congress makes it far too risky for the Fed to push its luck with QE4. This will make for tough sledding for the SPX and all its derivatives.

And it’s not just SPX ETFs like SPY at risk, but the entire stock markets. As the general stock markets sell off on the Fed’s QE backstop vanishing, nearly all stocks will be dragged lower in the carnage. The one sector that thrives when stock markets are selling off is gold, as demand for alternative investments surges when conventional ones are struggling. Gold is a proven stock-bear-market performer, with great upside.

With more QE politically impossible, investors and speculators alike need to prepare for a much different stock-market environment going forward. It’s absolutely essential to cultivate contrarian thought and trading philosophies when the stock markets are overdue for a major selloff. Contrarianism is all about fighting the crowd, buying low when few others will then later selling high when everyone gets excited.

At Zeal we’ve been walking this contrarian walk for well over a decade. We publish acclaimed weekly and monthly subscription newsletters that help investors and speculators successfully navigate these markets. They draw on our decades of hard-won experience, knowledge, wisdom, and ongoing research to explain what is happening in the markets, why, and how to trade them with specific stocks. Subscribe today, as big market changes are afoot.

The bottom line is the massive Republican Congressional victory is not bullish for these overextended and overvalued Fed-levitated stock markets. The Republican lawmakers are going to put tremendous pressure on the Fed to normalize its bloated balance sheet and horrible zero-interest-rate policy. The Fed serves at the pleasure of Congress, and can’t risk infuriating it to launch a QE4 to rescue stock markets.

Thus the overdue major selloff is still imminent. At very best it will be a full-blown 20% correction, but far more likely is a 50% cyclical bear market unfolding over a couple years. The markets are forever cyclical, and bears always follow bulls. With the Yellen easy-money Fed’s hands now tied, the implied backstop that temporarily delayed that down cycle has vanished. It’s time for these Fed-inflated stock markets to pay the piper.

“What has been carrying the U.S. economy for the past six years? Answer, the Fed. Without the Fed the U.S. economy would have had a much more difficult time. There have not been any policies by the current administration which have helped the economy. The political agenda is to move the country toward even greater socialism, not to help the economy….”

“But the Fed is absolutely a political animal with its own political agenda. What I think the Fed is going to do if the Republicans win is let the stock market go down by 25 percent. So I told you before that the market would not be allowed to fall, and that’s exactly how it unfolded. Now I am telling you that the market will be allowed to fall….”

….continue reading HERE

…also:

We’re Close To One Of The Most Dramatic Reversals In History

“I find it fascinating that we are seeing continued weakness in the price of oil. What’s interesting is that Saudi Arabia is clearly in favor of lower oil prices. Saudi Arabia’s production levels are close to all-time highs. And the Saudi’s are driving the price of oil lower in the face of enormous turmoil in the Middle East, including violence in six Saudi cities….

“I find it fascinating that we are seeing continued weakness in the price of oil. What’s interesting is that Saudi Arabia is clearly in favor of lower oil prices. Saudi Arabia’s production levels are close to all-time highs. And the Saudi’s are driving the price of oil lower in the face of enormous turmoil in the Middle East, including violence in six Saudi cities….

“Obviously the Saudis are sending a message by taking the oil market to unsustainably low levels. This is going to kill the fracking industry in the United States if prices remain at these depressed levels. There will be bankruptcies in this space and it will also hinder financing for future projects.”

….continue reading HERE

![]()

The small cap stocks are getting better, at least those outside of the commodity sectors but they still have some more work to do until they start to show good chart patterns. Right now, the area of the market that has recovered the best from the correction are the stocks that suffered the least – the higher priced stocks with stronger liquidity. Here are a few Position Trade candidates for your consideration. I found these using the Stockscores Simple Weekly Market Scan.

1. IBKR

IBKR started its show of strength a couple of months ago but that upward surge was tempered by the correction, which took prices back down to support. Support was never broken and with the recovery in the overall stock market, the stock is now moving to multi-year highs again.

2. PVTB

PVTB has been a strong performer over the past couple of years but has trended sideways for most of 2014. It is now breaking through resistance and looks like it can continue the long term upward trend toward the $45 all-time high range.

3. RDN

RDN has sat below $15 resistance for seven years but last week it finally broke through that price threshold and looks like it is ready to start a market beating trend.

….for the Weekly Commentary continue reading HERE