David McALvany : With over 40 central banks setting rates at or near zero percent, there is the potential for problems to arise in almost every part of the globe, and perhaps this fits the earlier question: Where would you see opportunities, where would you see risks, and should we have any concerns lingering in terms of the old inflation versus deflation debate?

David McALvany : With over 40 central banks setting rates at or near zero percent, there is the potential for problems to arise in almost every part of the globe, and perhaps this fits the earlier question: Where would you see opportunities, where would you see risks, and should we have any concerns lingering in terms of the old inflation versus deflation debate?Stocks & Equities

The current investment market for junior gold companies is arguably one of the worst since the United States went off the Gold Standard in 1971.

Despite the current high price of gold (and many other commodities), investors have almost abandoned the junior gold mining sector to invest in physical bullion, ETF’s, and producing companies. The value of the TSX-Venture Composite Index, shown below, is similar to what it was in the early 2000’s when the price of gold was below US$300 per ounce.

In 2013 I expect to see the equity market in the junior gold sector begin to correct itself and investors should currently be taking advantage of the investment opportunities resulting from the severely beat up junior sector. There presently exists a great opportunity for those investors who are “ahead of the herd” and want to invest in the market at or near the bottom.

TSX-V Composite Index 10 Year Chart

The Venture exchange is down over 50 percent from its March 2011 high.

The questions become – How does an investor take advantage of the dislocation in the junior markets? What might be a good junior to have on our radar screens?

Investing in junior gold miners is a speculative business at best, with risk on the downside but the potential for significant reward on the upside.

Investing in junior gold miners is a speculative business at best, with risk on the downside but the potential for significant reward on the upside.

Two ways to mitigate risk for investors is to buy at market bottoms and have a long-term view of their investments to take advantage of a company’s increasing value as its projects move through exploration and development while markets recover. Ideally, the pay off comes when a project is brought into production, gets joint ventured, or is sold by the junior.

So in this environment, companies should have the following key attributes:

- Established track record

- Experienced and competent management teams

- Established mineral resources

- Projects in safe and stable jurisdictions of the world

- Strategically located properties – existing infrastructure

- Significant upside potential

….if you are interested in a company Richard has selected according to this criterea, read more HERE

U.S. Stock Market – I don’t believe the Cyprus situation is big enough (yet) to cause any meaningful sell-off in the stock market. While the market is overextended, it has yet to suggest a meaningful correction at the minimum is upon us. However, I do wish to remind you that if it was me, I would be implementing a scale-up sell program.

Gold – After several good days it should come as no surprise that they now try a typical “walk-down” to erase much of the gains in minutes and hours that took days to achieve. With silver relatively weak and shares even weaker, we’re left in the hands of the Crimenex this morning – how nice! Just once I like to see them get whats coming to them but believing today shall be the day has led to nothing but disappointment up until now.

Mining and Exploration Shares – Remain totally engulfed in the worse junior resource market in 30 years. Nothing outside of time and a gold price above $1,700 can change this. Investors only have one word on their mind (sell) on any increasing volume and price lift. I can’t blame them.

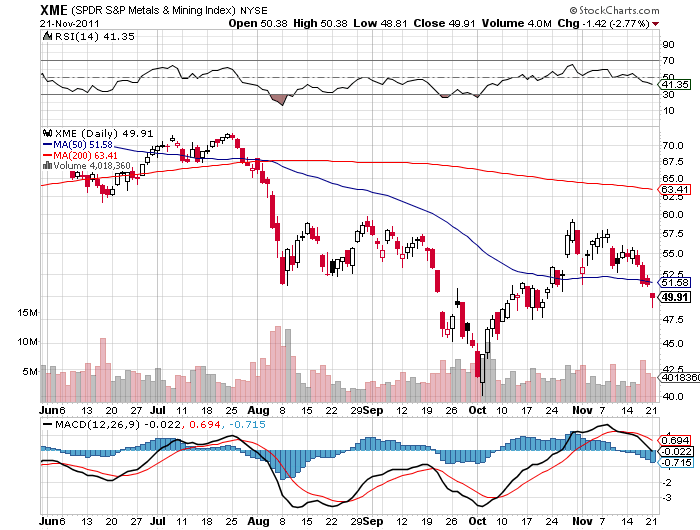

Weekly GDXJ Chart below:

….a read suggested by Peter Grandich:

Bond crash dead ahead: tick, tick … boom!

Commentary: ‘Investors have no idea what’s about to happen’

…..read it all HERE

With these words, the 89 year old Godfather of Newsletter writers, Richard Russell went Bullish the Dow on March 11th.

“Yes, I know that this market is uncorrected during its long rise from the 2009 low, and I know that there are risks in buying an uncorrected advance that is becoming uncomfortably long in the tooth, but my suggestion is that my subscribers should take a chance (after all, Columbus took a chance) and take a position in the DIAs.”

“My intuition tells me that there will be an early period [around now] of erratic and uneven scary advance, this to occur while formerly battered investors work up the nerve to enter this market,” Russell predicted.

“Then the action will smooth out as the crowd gathers courage and confidence.Finally, in the last stage of this advance we might see the stock averages rise in parabolic fashion.This will be the time to pack our bags and get out.”

One of the toughest things to do is buy when it is the ideal time to do so. When it is terrifying. For most people that would have been at Dow 6,547 after the shocking 2007-2009 collapse,

For old experienced market hounds like Richard Russell, buying stocks right here at Dow 14,455, up 7,908 points or more than double from the 6,547 low in 2009 must be about as terrifying as it gets! Thats probably why Ben Gersten, Editor for Money Morning, has probably written the article below questioning Russell’s conversion.

The writer of Dow Theory Letters, clearly one reason for Russell’s change of mind was his use of the 100 year old Dow Theory. A theory that is said to have formed the basis for all modern technical analysis through its definition of a trend and its reliance on studying price action.

You can read Ben’s analysis of Russell’s decision HERE, or click on the link below:

Should Investors Still Trust the Dow Theory as a “Buy” Signal?

David McALvany : With over 40 central banks setting rates at or near zero percent, there is the potential for problems to arise in almost every part of the globe, and perhaps this fits the earlier question: Where would you see opportunities, where would you see risks, and should we have any concerns lingering in terms of the old inflation versus deflation debate?

David McALvany : With over 40 central banks setting rates at or near zero percent, there is the potential for problems to arise in almost every part of the globe, and perhaps this fits the earlier question: Where would you see opportunities, where would you see risks, and should we have any concerns lingering in terms of the old inflation versus deflation debate?You Don’t create Wealth in a Nation by boosting Asset Prices. You create Wealth through Employment and Capital Investment

Marc Faber : So if you want to boost equity prices, or asset prices, print that much money. But as I just tried to explain, you don’t create wealth in a nation by boosting asset prices. You create wealth through employment and capital investment in factories, in infrastructure, in education, and in research and development.

Marc Faber : you cannot create Real Wealth by Printing Money

The once-great promise of Fisker is gone, and unless it pulls off a miracle, it could go down as a repeat of the Solyndra fiasco: a symbol of poorly thought out federal loans and too much ambition.

The once-great promise of Fisker is gone, and unless it pulls off a miracle, it could go down as a repeat of the Solyndra fiasco: a symbol of poorly thought out federal loans and too much ambition.