Stocks & Equities

The average daily price volatility of stocks has fallen more than 60% since the beginning of 2013. It’s the biggest straight-line drop in some 82 years.

A lot of investors are rejoicing. After all, stocks have risen an average of 17% a year when volatility is as low as it is right now, Bloomberg reports.

There is, however, a dark side to low volatility. Namely, it tends to precede powerful reversals that can wipe out investors, as was the case in 2000 and early 2008, and at other key turning points over the past 100 years.

…..read the whole article HERE

1987 Crash

Invest Overseas, The Fed Party Is Over

For four years the FOMC has been printing money to keep interest rates low in order to stimulate the economy. For just as long investors have been hand- variants on this form of stimulus, the “race to debase” currency has become a national phenomenon.

2013 The Year of Global Recession

A Global Recession Is Coming! Marc Faber appears on CNBC where he talks about a global recession that he see’s coming. Marc Faber is the author of the Gloom Boom and Doom report.

More from Peter Grandich:

- What he lacks in actual performance, he more than makes up with in showmanship.

- Ignoring #1 threat to stocks?

- Currency cold war and can gold benefit from it?

- Worst investment for next decade!

- Why Obama’s big government plans will hinder, not help, the middle class.

- Is the junior resource market dead?

And the Opposing Point of View on the Stock Market:

The greatest moment in two decades’… Three reasons stocks will soar

by Porter Stansberry

“Right now is the greatest moment to be an investor in my nearly two decades in this industry,” Steve Sjuggerud wrote in the most recent issue of True Wealth.

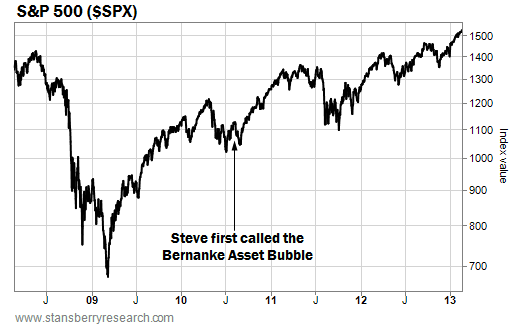

That’s because of what he called the “Bernanke Asset Bubble.”

Steve has been writing about the Bernanke Asset Bubble since August 2010. In short, he predicted Federal Reserve Chairman Ben Bernanke’s easy-money policies would boost all asset classes. And if you put your money into the market back then, you’ve made a fortune…

As you can see in the chart below… the stock market is up since Steve’s call. So is real estate up? Agriculture and farmland are up as well…

Since Steve originally wrote about the Bernanke Asset Bubble, the Fed chairman has gotten even more aggressive with his money printing… Bernanke will add $1 trillion to the Fed’s balance sheet this year – bringing the total debt to $4 trillion. And the Fed won’t raise interest rates “as long as inflation isn’t forecast to rise more than 2.5% in the future and as long as unemployment remains above 6.5%,” according to the Fed’s statement last December.

![]() Steve believes the stock market could rise 95% from current prices in the next three years… And that would only put stocks at fair value. He sees three reasons stocks are set to soar today. From the March issue of hisTrue Wealth newsletter…

Steve believes the stock market could rise 95% from current prices in the next three years… And that would only put stocks at fair value. He sees three reasons stocks are set to soar today. From the March issue of hisTrue Wealth newsletter…

1) U.S. stocks are the best value they’ve ever been during my investing lifetime. The upside potential in U.S. stocks over the next three years could be the biggest in my near-20-year career. And all stocks have to do is return to their average.

2) Zero-percent interest rates are here to stay. Low interest rates are the real “rocket fuel” to this boom. The good news is there’s no chance the government will raise interest rates over the next two years. Meanwhile, we have perfect “Goldilocks” conditions for investing… not too hot, not too cold – JUST RIGHT. THIS is the investing sweet spot… This is where the biggest gains happen over the longest stretches.

3) Lastly, today’s zero-percent rates will force Mom and Pop America to “migrate” into the U.S. stock market… pushing the stock boom into “bubble” territory, possibly in 2015.

In short, stocks remain cheap. And the low yields available in bonds will force investors, en masse, into stocks. This trend is just now beginning… But Steve believes it will reach epic proportions.

To sign up for True Wealth and see exactly how Steve recommends playing this trend, click here… You can readTrue Wealth at zero risk. We offer a 100% money-back guarantee on the product, no questions asked.

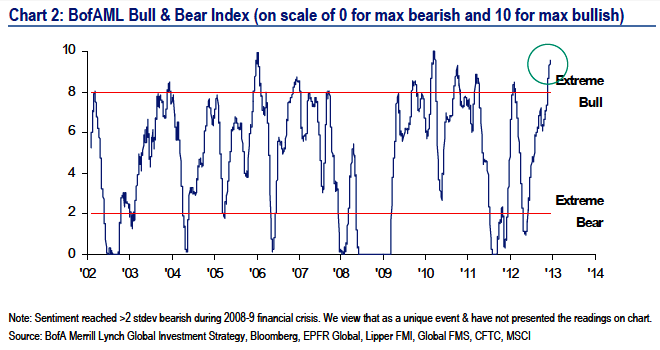

Since our January edition of Views from the Crows Nest, equity markets continued their slow grind higher for almost two weeks. In the last two weeks we’ve finally begun to see signs of a short-term market top. One of the most reliable signs of an inflection point was delivered yet again by the mainstream media.

Since our January edition of Views from the Crows Nest, equity markets continued their slow grind higher for almost two weeks. In the last two weeks we’ve finally begun to see signs of a short-term market top. One of the most reliable signs of an inflection point was delivered yet again by the mainstream media.On Saturday February 2nd, uber-accurate gold market timer Mark Leibovit spoke at the World Outlook Financial Conference and remarked about a powerful headline in that day’s business section of the Globe & Mail. In reference to the equity market rally, they declared “The End of Fear.” We know from experience that “The Herd is always wrong at the extremes, but creates the trend in between.”

Since the close on Friday February 1st, the Dow Jones Industrial Average has advanced a mere .06%, the S&P 500 grew .54%, and both look poised for a pullback; the TSX and major European equity indices peaked in the last few days of January and short-term corrective action appears to now be in motion.

To me, this is further proof of the important duality of mainstream media: they are simultaneously USELESS and USEFUL; useless as a source of insightful advice but extremely useful as a barometer of “group think.” Mass media mimics mass mania.

In last month’s newsletter I wrote, “While I remain long term bullish on Precious Metals, I’m getting increasingly concerned that we might have a downside scare before getting back to the secular trend.” Unfortunately for those holding longer term positions purchased at higher levels, my concerns are currently unfolding.

Gold and silver have now both violated short-term technical formations, causing us to take another step back and view longer-term charts for clues. Depending on whose indicators you follow, the failure of gold to hold support around $1,629 brings into play lower level support around $1585 or even as low as $1525.

Bullions and PM producers have reached very stretched “oversold” readings, and the shares of PM-producers are again radically under-valued versus bullion prices. The price of gold relative to other commodities is also very close to extreme readings that have typically marked significant turning points. We would not be surprised if these extreme conditions persist for a few weeks, though we hope the turn happens faster.

Sometimes bullions and producers move in concert with broader equity markets (currently pointed downward), and sometimes they act more as a “safe haven” and move contrary to other assets classes. We never know with certainty whether Dr Jekyll’s or Mr. Hyde’s Precious Metals persona will show up. Our strategy now is to hold onto very-recently-acquired positions with stops below major support levels.

Though this newsletter is primarily focused on providing higher level perspectives on global financial markets, this platform also affords me an opportunity to express other non-mainstream views about non-financial trends that are very relevant to your wealth, health and happiness. We will explore some of these non-financial issues in future articles…there’s lots to dig into!

In today’s world, there are a lot of things that thinking people can legitimately worry about. Though smaller doses of stress can actually be quite healthy, prolonged exposure to stress or worry can lead to chronic anxiety. Humans have many different ways of “self-medicating” their constant anxiety, including working or thinking too much, or zoning out in front of the TV or other screens. Some people abuse alcohol, food or other addictive substances. The result is always a negative spiral, and the anxiety continues until its root causes are addressed.

As we walked the dog by the Bow River yesterday morning, our discussions turned to some of the destructive anxiety-provoking trends unfolding all around us. These subjects are rarely (if ever) part of the public discourse. So much of what is happening in our modern world is driven by promoting fear in the masses.

I’ll return to this subject in future articles because it’s critically important. In the meantime, I will continue to focus on serving readers by doing what is within my personal power to help reduce their stress.

These sessions are being promoted in various media, including our upcoming roadshow with Larry Berman on February 20th, so if you’d like to attend we encourage you to attend. Click Here to find out more and to register. Remember, “Applied knowledge is power,” and getting educated on how to optimize your outcomes is one of the most liberating and empowering actions you can take.

Patience and Discipline are accretive to your wealth, health and happiness; Fear and Greed are destructive.

If you would like to speak with our team about your personal situation, please Click HERE to arrange a time.

Cheers,

Andrew H. Ruhland, CFP, CPCA

President, Integrated Wealth Management Inc.

Portfolio Strategist, ETF Capital Management

So if you think all is calm now, or relatively calm …

And if you think that President Obama’s ending of our role in Afghanistan signals the end of the war on terrorism …

Then I urge you to reconsider your views by taking a look at what my war research is telling me.

You see, just like business cycles, or various different economic cycles, the waging of war within and between nations has definite, identifiable rhythms.

In my research on war, which has covered more than 5,000 years of war data, I’ve found that there are three distinct cycles to war.

There are the 8.8 and 17.7 cycles. They in turn are sub-cycles of a larger cycle that’s 53.5 years in duration.

The 53.5-year cycle can be seen in this cycle chart here.

As you can clearly see, the 53.5-year War Cycle nailed major turning points …

The War of 1812

The War of 1812

The Civil War

The Civil War

The end of WWI in 1918

The end of WWI in 1918

The U.S. entry into WWII

The U.S. entry into WWII

It then …

Rose during the Korean and Vietnamese Wars

Rose during the Korean and Vietnamese Wars

And bottomed in 1995, right around the middle of the “Peace Dividend,” which resulted from the initial fall of communism in the former Soviet Union and the opening up of China’s communist economy.

And bottomed in 1995, right around the middle of the “Peace Dividend,” which resulted from the initial fall of communism in the former Soviet Union and the opening up of China’s communist economy.

The 53.5-year cycle has been turning up ever since. It should now be picking up momentum as its amplitude is not set to peak until 2027.

Now consider the shorter-term war cycles. Consider the 17.7-year cycle shown here. You can see how it too uncannily pegged important turning points, right on cue.

The Civil War, the Spanish-American War, the financial Panic of 1907, the end of WWI, the beginning of WWII for the U.S., the Korean War, the Vietnam War, and more.

Where does it stand now? This war sub-cycle is pointing directly up into 2014!

Now consider this next chart I have for you, which synthesizes the 53.5, the 17.7 and the 8.8-year war rhythms into one chart to give you a complete picture of where we stand right now.

We are right on the edge of seeing the war cycles turn violently higher, heading all the way up into the year 2019 before any lull is found.

What kind of war could we be facing? It could be …

• Another surge of terrorism

• A civil war and the breakup of Europe

• Massive civil unrest in the U.S.

• A war in the Middle East

• A war between China and Japan over the Senkaku (or Diaoyu) Islands

• A war between China and Vietnam, Malaysia and the Philippines over the Spratly Islands

• A Cyber war

• Massive uncontrolled currency wars

Or any combination of many or even all of the above!

It’s coming. You can see it in the increased tensions between China and Japan.

Between China and the U.S.

Between China and the U.S.

Between North Korea and the U.S.

Between North Korea and Japan.

Between China and Vietnam and other countries laying claim to the Spratly islands.

And it’s going to impact markets in ways you simply must prepare for. It will likely drive U.S. equities sharply higher. It could be the main trigger for gold and other commodities to finally enter the next phase of their bull legs higher. Click for larger version

It would send interest rates higher, and bond prices lower. It could cause all kinds of economic and financial repercussions that will either strip you of your wealth this year …

Or help you become richer than Midas.

Until next week …

Best wishes,

Larry