Stocks & Equities

Mark Leibovit has been bullish the Stock Market for awhile, and if you’ve been following his Platinum trading service, it certainly hasn’t hurt him to have been Bullish.

Now, that the S& P 500 has sold off 50 points from its recent high of 1380, Mark thinks we are at an crucial juncture. Specifically, the two previous 50 point selloffs from the June10th and July 3rd S&P 500 peaks have defined a clear line at 1330 (it touched 1329.24 today then rallied). If that line at 1330 is broken with authority he thinks that will signal that the S&P 500 is heading down more than double the previous corrections. Or another fat 63 points to the June 4th low of 1267 “and possibly well beyond” . No wonder he’s warning about a potential for a big decline. Just a quick glance around and you’ve got Ben Bernanke’s talking before Congress about the Fiscal Cliff the US is facing, while any one of 3 major European countries could plunge over a Fiscal Cliff in the blink of an eye. “We could be looking at another ‘Flash Crash‘ type scenario” – Mark Leibovit

(Mark continues below the chart).

A bit more from Mark on the market’s health:

“Volume increased to the downside yesterday and, as you know, Apple (AAPL) which has been long viewed as a surrogate for the current bull market disappointed the Street with last night’s earnings report. Earlier in the day, Tim (I don’t pay my taxes) Geithner put out a sound bite stating he’s optimistic the government won’t trip over the so-called “fiscal cliff” because, “I also think you’re seeing people show more realism about what is necessary” to avoid a fiscal crisis. The markets seemed to like this. Separately, the Wall Street Journal’s Jon Hilsenrath reported to have a source which says the Fed will act as soon as next week to stimulate the US economy. This was a surprise and was most likely the force that took stock indices well off there lows in late trading today”.

“We all know the truth. They only have one weapon. It’s called the printing press (or perhaps an electronic printing press that automatically moves newly created ‘money’ into the checking accounts of targeted banks or corporations). More and more printing could be ignored by the market which is far more powerful than any central government. To the best of my knowledge the European Central Bank does not have the equivalent of a Plunge Protection Team or an Exchange Stabilization Fund allowing them to manipulate European stock markets. And, even so, money printing has been secretly going on behind the scenes for months and yet the financial crisis in Europe and the debt burden of U.S. cities, states and the U.S. government itself continues to grow and grow. This is primarily due to the reduced level of revenue from a slowing economy and from businesses who are reluctant to expand in an uncertain political and tax environment. I fear we could be looking at another ‘Flash Crash’ type scenario. I hope I am wrong and the traditional ‘seasonal’ tendency for another rally try into the U.S. Presidential election is still an option. I hope this because I stuck my neck out with the ‘BULL’ call into the election – one that I made late last year! In truth, the rally could have ended on April 2 and we’re now headed into oblivion. For this reason, I have limited our exposure to the markets to a few selected trades in our Current Portfolio. As I told you yesterday, the overall picture doesn’t appear very rosy with Spain, Italy and possibly France next ready to go over a financial cliff and the potential to see both the U.S. Dollar Index and the Euro both trade at par (100) in coming months cannot be discounted in this kind of environment.”

In short, Mark is very cautious here, I imagine it’s because he’s thinking what Greg Weldon is thinking. That “Never has there been been a more critical fiscal or political situation. No one can really debate the fact that the fiscal future of the US hangs in the balance”

The one big factor we can be sure will move the markets powerfully is the Fed coming forth with QE3. Marks comments about the “Plunge Protection Team” and the “Exchange Stabilization Fund” underscore what Greg Weldon told Mike. “That when push comes to shove, and we stare into that deflationary abyss, every central banker in the world will choose to reflate no matter what the cost because they think that they can deal with reflation better. In their minds its preferable to the pain of deflation. That’s the bottom line.

It sure will be an interesting next week, if as Mark Leibovit say’s above “the Wall Street Journal’s Jon Hilsenrath reported to have a source which says the Fed will act as soon as next week to stimulate the US economy”.

Hang on to your hats! At the time of this writing its 12:38 am PST and the S&P September Futures are trading down 2.25 points or the equivalent of 1336 on the cash S&P 500.

Mark Leibovit’s Gold Letter, # 1 Gold Timer for 10 year period & #2 Gold Timer for 2011

IF YOU HAVE NOT SIGNED UP FOR THE LEIBOVIT VR GOLD LETTER, HERE IS YOUR CHANCE. HERE IS THE LINK: WWW.VRGOLDLETTER.COM. YOU GET A 50% DISCOUNT FOR THE FIRST MONTH.

VRTRADER.COM Trial Signup:

THE RENEWAL OF YOUR SUBSCRIPTION IS AUTOMATIC. YOUR CREDIT CARD WILL CONTINUE TO BE BILLED UNLESS YOU NOTIFY VRtrader.com SEVEN DAYS PRIOR TO SUBSCRIPTION EXPIRATION EITHER VIA EMAIL POSTING THE WORD ‘UNSUBSCRIBE’ IN THE SUBJECT BOX OR TELEPHONE US AT (928) 282-1275 OF CANCELLATION. NO REFUNDS ARE AVAILABLE ON SILVER, PLATINUM OR VR FORECASTER (ANNUAL FORECAST MODEL) SUBSCRIPTIONS.

Welcome and congratulations on choosing VRTrader.com as a source for your stock market commentary, information and analysis for the U.S. Stock Market. Needless to say we are very happy that you are joining us for AT LEAST the next 30 days days and look forward to providing you rewarding and inciteful information that will help you toward your goal of succeeding in the markets.

Here is the Special Trial Offer: Use this month to kick our tires. Pay 50% for the first 30 days (No refund) and sample our Silver or Platinum service and then decide what works best for you. If you aren’t 100% ready to move forward, simply email us to cancel one week before your 30 day 50% off trial subscription ends and it will be canceled and you will not be charged ANY FURTHER, no questions asked. Just send an email to mark.vrtrader@gmail.com” or call 928-282-1275 to cancel. You will receive an emailed confirmation of your cancellation at that time.

The 30 day trial is allowed one time only. By taking this 30 day 50% trial, you agree to be charged the full cost of the monthly Silver or Platinum service (choose one only) at the end of the 30 day trial subscription period, unless you cancel first. The regular Silver monthly rate is $49.40 and the Silver quarterly rate is $133.50. The regular Platinum monthly rate is $129.95 and the Platinum quarterly rate is $350.85. The special trial 50% off trial rates are listed below. Sign up today!

There are no refunds or pro-rata refunds offered at VRTrader.com for any subscription. You are being offered a 50% discount for trying our service for the first 30 days only!

Over the weekend, the Bond King “tweeted” twice…

His points were simple: You can’t make money in bonds. Real assets are the better bet now.

I agree with the Bond King. And I think one “real asset” looks like a great bet here.

Bill Gross is the “Bond King”… He earned this reputation from decades of outperforming his peers in bonds. And he runs the world’s biggest bond fund. But he doesn’t like bonds today.

A key reason he doesn’t like them is because after inflation, you’re actually losing money in bonds. You’re losing “purchasing power.”

The Bond King asked, “How will investors maintain purchasing power? Stocks maybe. Real assets are the better bet.”

“Real assets” typically means commodities and real estate. And between those two, there’s one clear winner for me.

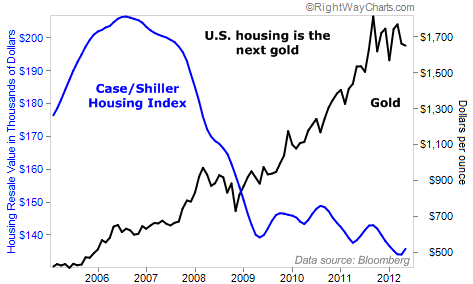

Take a look at the chart below, from the latest issue of my True Wealth newsletter. It shows real estate versus gold. To me, real estate looks like the place to be.

| The price of gold has gone up for 11 years straight. Meanwhile, real estate is dirt-cheap by any measure… It’s more affordable than ever (thanks to record-low mortgage rates)… And the uptrend is just beginning.

When even the Bond King says you don’t want bonds, you know it’s time to lighten your load in bonds and other paper assets (like cash in the bank). He says real assets are the better bet. Based on his track record, you should listen. Of the real assets out there, I believe real estate is the one that offers the least downside risk and solid upside potential. Listen to the Bond King. Get rid of some of your bonds (and other paper assets) and replace them with real assets. Real estate is my favorite real asset now… It’s what I’m doing with my own money… You should consider doing the same. Good investing, Steve

|

|

This week could be a huge one for stocks and commodities. This morning the dollar index is taking another run at our weekly chart resistance level. If it can break out and start to rally this week then a possible 4-6 week sell off in stocks and commodities may be just starting.

Watch the morning video or at least the last 4 minutes where I cover the SP500 intraday and daily chart which shows the main cycles and what we should be expecting within the coming days and weeks.

re- Market Analysis Points:

– Dollar index is making new highs this morning and if it can hold up into the close today then I would expect it to keep running higher for a few weeks.

– Oils has pulled back 5% from its high last Thursday and is now testing support and starting to bounce.

– Natural gas is holding up well after Friday’s strong rally to new highs. It may be forming a bearish pattern with the three sharp surges to new highs pattern which I explain in the video.

– Gold and silver trader trading down 1+% and are likely to find a little support today as they test support levels. They are at risk of a major breakdown but currently they are still holding up.

– Bonds are reaching new highs this morning but looking ready for a 1-3 day pause. They are a little overbought.

– SP500 charts have been the most interesting the past couple months which is why I keep focusing on it.

If you did not read my special report and wave counts then do so here: http://www.thegoldandoilguy.com/articles/put-your-seatbelts-on-its-about-to-get-bumpy/

Watch Video Now: http://www.thetechnicaltraders.com/ETF-trading-videos/

The video clearly explains where the market seems to be trading in terms of cycles and what we should expect this week and in the coming month.

Chris Vermeulen

Tags: Market Cycle, market forecast, Stock Market Cycles, Stock Market Predictions

This entry was posted on Monday, July 23rd, 2012 at 8:56 am and is filed under Daily Market Trades, Market Forecast, Stock Market Predictions, Traders Buzz, Trading Videos. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

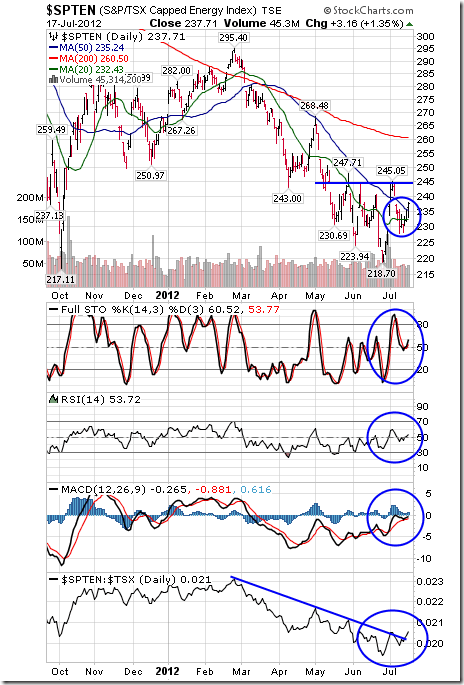

Ed Note: Josef Schachter has been suggesting since really early this year that oil was going down and that the markets in general are to take a hit. And oil will bottom some time in October.

He also suggests you buy the oil stocks, but unlike Vialoux wants to buy them 2 months later in October.

I think first of all investors must realize that the impact of a slowdown in the Chinese economy, which in my view is much larger than what the government has been reporting, the government says GDP has been growing at 7.8%, in my view it’s much lower because we have very reliable statistics.

The two countries where the exports were predominantly China-geared – Taiwan and South Korea and where the statistics are more reliable than what the Chinese announced in GDP growth, these countries have negative export growth on a year-on-year bases in the last month in June. If these countries have declining exports, it tells you something about the Chinese economy.

We have other reliable statistics like gaming revenues in Macau and so forth. The overall revenues are still up but the junkit turnover is down. These are middle men who bring the gamblers to Macau. Their growth rate has slowed down, luxury consumption has slowed down and electricity consumption is basically flat. Steel and cement production is up maximum 2-4% year-on year and so we have some reliable statistics.

Macdonalds just reported that their sales in Asia year-on-year is down more than 1%. Believe me if in a growth region, where markets are not yet saturated and where shops like MacDonalds are like prestige things for families to go and where their sales are down believe me – something is not quite right. I can see it with my own eyes. I don’t think that in Asia at the present time there is any economic growth.

When the Chinese economy was strong 2000-2008, it drove up commodity prices and that boosted growth rates in emerging economies such as Brazil, Argentina, and the oil-producing countries in the Middle East, and central Asia, Russia and of course also Africa and Australasia.

When the Chinese economy slumps, then obviously the demand for commodities goes down and these countries have less money and so they buy less and so it has a very strong multiplier effect on the global economy.

I think that the slowdown in the Chinese economy – and believe me, the Chinese economy did not grow in the second quarter by 7.8% – in my view, maximum 3%.