Timing & trends

1. JIM ROGERS: The worst crash in our lifetime is coming

Rogers: I learned very early in my investing careers: I better not invest in what I want. I better invest in what’s happening in the world. Otherwise, I’ll be broke. Dead broke. Well, what’s going to happen is it’s going to continue. Some stocks in America are turning into a bubble. The bubble’s gonna come. Then it’s gonna collapse and you should be very worried.

2. Changes Coming Along With Higher Canadian Interest Rates

by Michael Campbell

The Fed moved interest rates higher thursday putting pressure on Canada to raise rates. With BOC Stephen Poloz saying low rates “have done their job”, and with Canadian growth outperforming the US recently it looks like higher rates are coming to Canada too. Will it be 1/4 of a percent, 1/2%….?..

3. Pop Goes The Housing Boom… In Canada

We’re headed for another housing bust. This time in Canada. And the key is China.

It’s no secret that Chinese investors, seeking asylum from the slow-motion credit bust underway there, have been dumping tons of cash into Canadian real estate.

But it looks like a number of events are coming together at the same time to blow up that market before the end of 2017.

In the sphere of thought, absurdity and perversity remain the masters of the world, and their dominion is suspended only for brief periods. Arthur Schopenhauer

The proverbial question for many years has always been; when will this stock market bull end? By every measure of logic and or common sense, this bull market should have crashed years ago. However, it hasn’t, and much to the angst of many professionals continued its march upwards against all the odds. We would like to stop here and state that this market is now very close to trading in the extremely overbought ranges. A market can trade in the overbought ranges for an extended period. In this instance, we analysed monthly charts, where each bar represents a month’s worth of data. Historically, a market has experienced a correction within 5-10 months from the occurrence of this event. As of yet, the markets are not trading in the extremely overbought ranges on the monthly charts, but they are very close to moving into this zone.

Why has this market defied the expectations of all the professionals?

One of the culprits could be the emotional state of the masses. There is something almost insane taking place in this bull market; the higher it trends, the more anxious individuals come. It almost does not make sense as the opposite of this is what normally takes place. Were we not experiencing this first hand, we would find it almost impossible to believe such an event could occur.

We update this gauge every two weeks, and the last reading shows that the masses are still firmly entrenched in the anxiety zone. Sadly history also indicates that bull markets never end on a note of fear or angst but on a note of extreme joy/euphoric. We don’t want anyone to lose that is not our desire; all we are doing is simply examining historical trends both from a price perspective and a mass psychology perspective. Thus it appears that this market will only crash when the majority finally decide to embrace this incredibly resilient bull market.

The BBC Global 30 Index provides a macroeconomic view of the global economy; the index is trading well above the main uptrend line, clearly indicating that the Central banker’s ploy is working. The idea was to flood the system with money and create the illusion that all is well. This strategy has paid off handsomely; the stock market took off and in doing so created the illusion that all is well. Now the Fed’s have taken it one step further and are raising rates after holding them down for so long to further cement the illusion that all is well. The Bond Market should have crashed, but appears to be trending upwards instead. Two reasons for this are; central bankers worldwide are still lowering rates or maintaining a low rate environment as their economies are still far from healthy. This makes our bond market look more attractive (safe-haven bet and higher rates), and this outside demand for bonds is overriding these effects of a rate hike. We will expand on this concept in a future article, but suffice to say; the Fed might be raising rates to give it more room to wiggle in the future. Two leading economic indicators continue to illustrate that the global economy is far from healthy. Either they are both wrong, or the Fed is lying.

Real factors illustrating the Global Economy is far from healthy

Copper and the Baltic Dry Index are performing miserably because there the global economy is a lot weaker than the rosy picture central bankers are painting. In fact, there is absolutely no reason for them to raise rates; the only reason they are doing this is to create the illusion that the economy is strong. This index could drop all the way down to 7400, and the outlook would remain bullish. There is a good layer of support in the 9000 ranges. A correction would probably end at this level.

If you look at copper you can see that the market has been smashed; in all previous bull markets, copper trended upwards with the market. The picture painted by the Baltic Dry index is not any prettier; therefore, in reality, this recovery is nothing but an illusion. In 2008 this index was trading above 11,400, but today it trading at 855. This is what a crash looks for this index has dropped over 90% from its highs, yet hardly anyone focuses on it.

Now we could go on and on about how terrible things are for that is what the Naysayers love to do; focus on the negative for fear sells. But we won’t continue with this storyline for even though the data is valid; at least for now it is useless. The world has been sold a lovely story, and for the most part, they have bought it. One they will awaken and see that the emperor was never handsome and well dressed. Instead, he was an old fat man who was walking around practically naked.

There are other forces at play here, and the main one we stated at the onset appears to be sentiment. The majority are still very anxious, and it is hard to see how a market could crash when the crowd has not embraced it. A strong correction is more likely, but many individuals will confuse this correction for a crash, but that is a story for another day.

Conclusion

Logic dictates that this market should crash. Were it not for the Feds massive infusion of cash into the system; this stock market would have crashed a long time ago. However, as things stand, the sentiment is far from positive, and the global economy is far from strong. Most nations will continue to support a low rate environment in a bid to prevent further damage to their economies. This in turn will make our bond markets more attractive, and foreign money will continue to pour here, which in turn will most likely continue to curtail the effect of rate hikes. Eventually, the Fed will be forced to lower rates again as the economy starts to shown signs of impending weakness. If the global economy were healthy, then copper and the Dry Baltic Dry Index would be trending upwards.

All bull markets experience at least one very strong correction; this Bull Market is not going to be an exception. This market is more likely to experience a strong correction than a crash. Sadly, only when the sentiment moves to the euphoric zone, will this market be ready to put in a long term top.

In general, we prefer the term correction (mild, strong or back breaking) because a crash is meant to indicate the end of something, but almost every crash has proven to be the beginning of a new bull run. The best time to buy a stock is when the crowd is scared to death. This bull market will experience one very strong correction, but it will not mark the end of the bull, but the last leg of a very spectacular run. This spectacular run will end, and then we will experience meltdown that will eventually create another once in a “lifetime buying moment”.

Absurdity. A statement or belief manifestly inconsistent with one’s own opinion.

Ambrose Bierce

Last week investors shrugged off even more drama coming out of Washington. Stocks continued to rally and hit record highs, even as former FBI director James Comey testified that, in his opinion, President Donald Trump fired him in an attempt to lift the “cloud” of the Russia investigation.

If true, this suggests obstruction of justice, an impeachable offense. And if impeached, or in the event of a resignation, Trump’s political agenda would likely be derailed. The last (and only) time a U.S. president resigned, the Dow Jones Industrial Average lost up to 40 percent,as a recent article in TheStreet reminds us.

But markets paid no mind to Comey’s insinuations, underscoring investors’ confidence that tax reform and deregulation will proceed as planned. And sure enough, just hours after Comey testified, the House of Representatives voted to repeal key parts of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which has contributed to an alarming number of small bank closures since its passage in 2010.

So once again, the wisdom of crowds prevails. If you remember, markets were forecasting as far back ago as last summer that Trump would win the November election.

This doesn’t mean, however, that Trump’s problems are behind him.

Last week I was speaking with Mike Ward, a top publisher with Agora Financial, who compared Presidents Trump and Ronald Reagan. It was suggested that, despite Trump’s apparent affection for the 40th president, he has so far failed to live up to the Great Communicator’s memory of optimism and deep respect for the office.

Whereas Reagan wanted to “tear down this wall,” Trump wants to “put up that wall.” Whereas Reagan insisted it was “morning in America,” Trump insists it’s “American carnage.” Reagan succeeded in building coalitions and unifying our allies against the Soviet Union. Trump has already managed to destabilize many of those alliances.

During the 1988 vice-presidential debate, Texas Senator Lloyd Bentsen famously ribbed then-Senator of Indiana Dan Quale for comparing himself favorably to John F. Kennedy. “I served with Jack Kennedy. I knew Jack Kennedy,” Bentsen said. “Senator, you’re no Jack Kennedy.”

Similarly, many observers are of the opinion that Trump is no Reagan.

Don’t get me wrong. I remain hopeful. President Trump wants to make America great again, and it’s still well within his power to do so—if he can practice some self-restraint and not get caught up in petty feuds. Voters support his vision. They gave him not only the Executive Branch but also Congress and most states’ governorships and legislatures.

You could say I’m hoping for the best but preparing for the worst. I advise investors to do the same. No one can say what the future holds, and it’s prudent to have a portion of your portfolio in gold, gold stocks and short-term, tax-free municipal bonds, all of which have a history of performing well in volatile times.

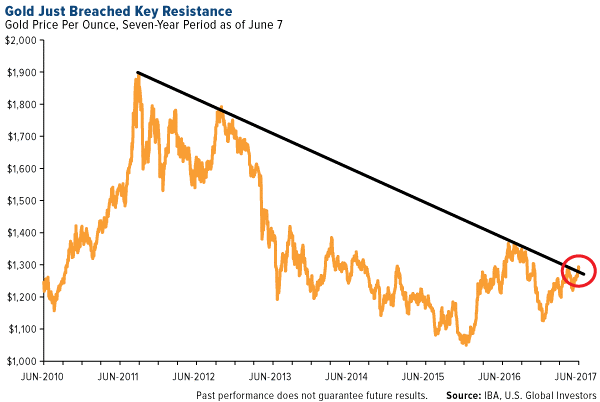

Gold Poised for a Breakout

Following bitcoin’s breathtaking ascent to fresh highs, gold rose to a seven-month high last week on safe-haven demand, stopping just short of the psychologically important $1,300 level. Supported by Fear Trade factors such as geopolitical turmoil—both in the U.S. and abroad—and low to negative government bond yields, gold’s move here can be seen as a bullish sign.

As others have pointed out, the yellow metal breached the downward trend of the past six years, possibly pointing to further gains.

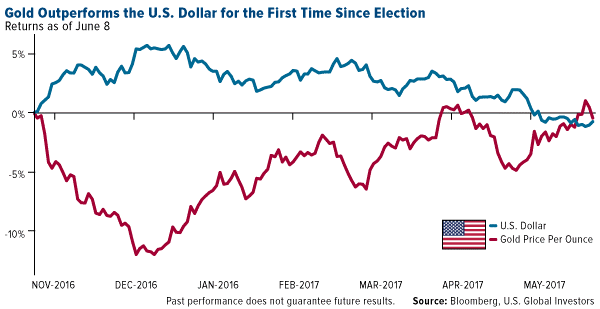

Under pressure from a beleaguered White House and stalled policy reform, the U.S. dollar continued to sink last week, with gold outperforming the greenback for the first time since the November election. Because gold is priced in dollars, its value increases when the dollar contracts.

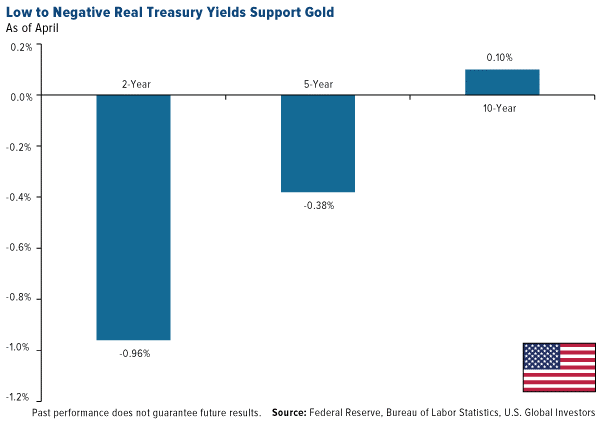

It’s also important for investors to remember that gold has often rallied when Treasuries yielded little or nothing. Why would investors knowingly lock in guaranteed losses for the next two or five years, or near-zero returns for the next 10 years? That’s precisely what Treasuries are offering, as you can see below:

Minus inflation, the two-year Treasury yielded negative 0.96 percent in April; the five-year, negative 0.38 percent; and the 10-year, a paltry 0.10 percent. (I’m using April data since May inflation data won’t be available until this Wednesday, but I expect results to look the same.)

When this happens, investors tend to shift into other safe-haven assets, including municipal bonds and gold.

Year-to-date, the yellow metal is up more than 9.7 percent, even as the stock market extends its rally. This runs counter to what we’ve seen in the past. As I’ve explained before, gold usually has a low correlation to other assets, including stocks and bonds, which is why investors all around the globe favor it as a diversifier.

So what gives?

Top Money Managers Sound the Warning Bell

One of the most compelling answers to this question, I believe, is that stocks appear to be overvalued right now, in turn boosting gold’s safe-haven investment case. This is the assessment of Bill Gross, the legendary bond guru who currently manages $2 billion with Janus Henderson.

Speaking at the Bloomberg Invest New York summit last week, the 73-year-old Gross said markets are now at their highest risk levels since before the 2008 financial crisis. Loose monetary policy has artificially inflated stock prices despite weak economic growth, he said, adding: “Instead of buying low and selling high, you’re buying high and crossing your fingers.”

Marc Faber, the Swiss investor often referred to as Dr. Doom, echoed Gross’ thoughts, telling CNBC last week that “everything” is in a bubble right now, similar to the days of the dotcom bust of the late 1990s. And when this bubble bursts, Marc said, investors could lose as much as half of their assets.

That stocks appear overvalued could be a driver of gold’s performance right now, with savvy investors, anticipating a possible market correction, loading up on assets that have historically held their value in times of economic crisis.

A cadre of other top money managers and analysts share Bill Gross and Marc’s less-than-rosy market view.

At the same Bloomberg event, billionaire hedge fund manager Paul Singer—whose firm, Elliott Management, recently raised $5 billion in as little as 24 hours—warned attendees that the U.S. was at risk of another debt shock.

“What we have today is a global financial system that’s just about as leveraged—and in many cases more leveraged—than before 2008, and I don’t think the financial system is more sound,” Singer said.

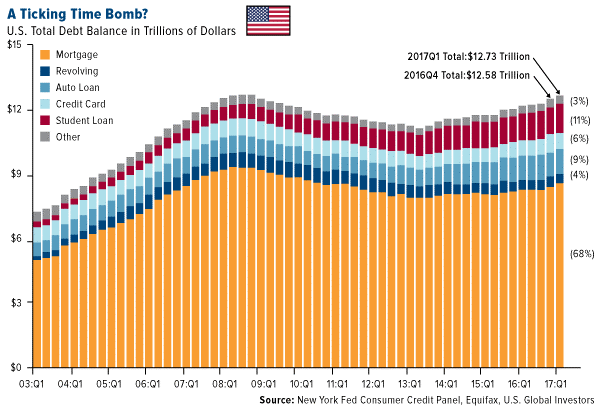

Indeed, U.S. debt levels are higher now than they’ve ever been, according to the Federal Reserve Bank of New York. In the first quarter of 2017, total U.S. household indebtedness reached a mind-boggling $12.73 trillion. That’s $150 billion more than the end of 2016 and $50 billion above the previous peak set in 2008.

Even more concerning is the fact that the number of delinquencies grew for the second straight quarter as more income-strapped Americans binged on credit. We could be headed for a massive hangover.

Cumulatively, these warnings stress the importance of hoping for the best while planning for the worst. In the past, there have been few ways as effective at preserving wealth as gold, gold stocks and tax-free, short-term munis.

Gold Vaults a Sign of Increased Demand

The world’s two largest consumers of gold by far, China and India, are currently importing enormous amounts of the yellow metal on safe-haven demand. Bloomberg reports that China could boost its gold purchases from Hong Kong as much as 50 percent this year over concerns of currency devaluation, a slowing real estate market and shaky stocks. Imports could advance to 1,000 metric tons, which would be the most since 2013.

Meanwhile, India—whose affection for gold goes back millennia—saw its imports of the yellow metal rise fourfold in May compared to the same month last year as traders fear a higher tax rate on jewelry. Imports climbed to 126 tons, versus 31.5 tons last May.

As impressive as this news is, there’s no sign more compelling that investors have an insatiable appetite for gold right now than the growing demand for safety-deposit boxes.According to Bloomberg, companies in Europe are scrambling to meet customers’ needs for a safe, inexpensive place to store their bullion in the face of negative interest rates and rising inflation. Two firms in particular have plans to build additional facilities capable of holding 100 million euros ($112 million) each in bars and coins.

Daniel Marburger, CEO of European coin dealer CoinInvest, told Bloomberg that he had just finished working with a German customer whose bank account was charged negative interest rates. To prevent this from happening again, the customer converted his cash into gold and silver, which he sees as a more reliable store of value.

Negative rates are “definitely a driving factor and will lead to more sales and also more storage clients,” Marburger said.

Click here to learn how you can get exposure to gold!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

We increasingly see claims low volatility in the markets may be structural. Even as we agree that some of the analyses we see make good points, we are concerned we may be setting ourselves up for a major shock. Let me explain.

Before getting into the details about the current environment, let me make some general observations. In my experience, complacency, with its cousin low volatility, is the best bubble indicator I am aware of. Perceived safety gets investors to pile into investments that they later regret. When it happens on a massive scale, major market distortions may be created that can lead to financial crises. And as the tech bubble that burst in 2000 shows, even if there is no systemic risk, the unwinding can be most painful to investors. In 2008, however, the perception that home prices always had to rise had become engrained in highly levered, yet illiquid, financial instruments, causing the unwinding to bring the global financial system to its knees. In our assessment, however, make no mistake about it: assuming for a moment the next crash won’t take down a major bank, doesn’t imply it cannot wipe out much more of your wealth than you ever anticipated.

Indeed, lower bank leverage is given as an argument as to why volatility is lower these days. Except that the run-up to the financial crisis of 2008 – a period in which banks were extra-ordinarily levered – also showed low volatility in a variety of markets. It was the perceived safety, embodied by quasi-sophisticated value-at-risk (VAR) models that got risk managers at financial institutions to gear up. What could possibly go wrong, right?

A more convincing argument I hear as to why low volatility is structural may be that information nowadays gets absorbed more quickly. On the one hand, we have computers scan the news in milliseconds, often trading without human intervention. And we have more computing power, allowing for a more efficient implementation of any investment process. Market makers in exchange traded funds also help in the execution efficiency of markets, possibly exerting downward pressure on volatility. However, let’s not forget that volatility lowered in this fashion may have the same implication as low volatility in the building up of any bubble: it is the perceived risk that is lower, not actual risk. Machines are fantastic at certain aspects, be that keeping spreads tight in an exchange traded fund, or scanning Twitter for keywords. Trades initiated in this fashion provide liquidity to the markets, but that liquidity can evaporate rather quickly when the machines go off-line. Let there be a glitch in the markets for whatever reason (say, someone dumps a large number of derivatives in off hours), and today’s incarnation of automated traders tend to wait it out. In the meantime, stop loss orders of other market participants may be triggered, possibly causing flash crashes.

One argument is that low volatility is due to a lack of economic surprises. We get emotional about elections, but when the economy is stuck in a low growth environment with few deviations, it only makes sense for markets to be less volatile as well. That may be the case, but in our assessment won’t stop from investors pushing asset prices to unsustainable levels on that backdrop.

I have little doubt that a substantial driver of low volatility may be central banks. Low interest rates and quantitative easing (QE) compress risk premia; in plain English, this means not only that junk bonds trade at a lower premium over Treasuries, but that perceived risk is reduced in all markets, including equities, causing volatility to be lower. When central bankers “do whatever it takes,” it is no surprise that investors chase yield without being concerned about negative consequences.

But when central bankers “taper” their purchases, odds are that volatility comes back as taper tantrums have shown. The same should be the case when the Fed raises interest rates or “normalizes” its balance sheet. But wait: this hasn’t happened, emboldening those who argue we have a structural change. With all due respect, I believe this is the wrong conclusion: in 2016, the Fed was hostage of the markets. Eager to raise rates, the folks at the FOMC realized they could only raise rates if the market let them. Any Fed official will tell you they won’t be held back from raising rates simply because equity prices might fall. Indeed, any incoming Fed chair (and we will have a newbie early next year) will take the job with the best of intentions, not be bossed around by the markets. Except that falling equity prices are often associated with expanding risk premia, i.e. plunging junk bonds; that is, they are associated with deteriorating financial conditions. And the Fed is always ready to respond to “deteriorating financial conditions.” You tell me what the difference is in an era of elevated asset prices.

Still, the market appeared to present the rate hike earlier this year on a silver platter. Just as a bull market makes investors feel very smart, a rate hike where the wheels don’t fall off the markets makes the guardians at the Fed feel like they are doing their job properly. Maybe so. I have a more somber interpretation: in hesitating so long to raise rates, the Fed has fallen ever more behind the curve. Sure, the Fed may raise nominal rates, but real rates may continue to be low to negative. Federal Funds futures currently price in 2.5 more rate hikes until the end of 2018, including the one we are expecting today (we write this analysis before the June FOMC decision). How is that possible with an economy that is allegedly booming, where wage pressures, albeit not severe, are gradually creeping higher? As such, my sanguine interpretation is that the reason the market is not spooked is that it thinks the Fed is going to stay “behind the curve.”

As a word of caution, with a new Fed chair coming next year, I would not count on the market being complacent; the new chair may well try to assert himself or herself, causing risk premia to rise. The pressure cooker may well try to release steam once again, until the Fed chair then reacts to what may well be deteriorating financial conditions.

This implies the Fed won’t be able to normalize its balance sheet, but is more likely to be heading towards QE again. Indeed, my interpretation of FOMC talk is that many members believe more QE is not a question of whether, but of when.

If my analysis is correct, it suggests low rates for a very long time. And that, in turn, may of course mean that risk premia will ultimately be compressed yet again. So, maybe, it is different this time?

Let’s look at equity investors. The brilliant minds (brilliant because they have made lots of money in recent years, please take this reference as being cynical) know that central banks will come to the rescue. So why not buy the dips? And stock prices always go up, don’t they? You can’t possibly be smarter than the masses (the index), and the index is going up, so buy, buy, buy. And we hear that this is different from the dot com bubble as, according to some metrics, stocks aren’t terribly overvalued and could no up another 20%; let’s make that 50%.

I hear arguments for buying bitcoin, as it could go up tenfold or more, but it can only go down 100%, so the risk/reward must surely be worth it.

Indeed, I agree that it is extremely difficult to identify the top in a bubble.

The question, in my view, is whether it’s better to be early or to be late in taking chips off the table. It clearly depends on the risk profile of investors, but I would like to caution that those who don’t prepare early may well be late, terribly late. Fear not, as the government might bail you out. Except that they may not this time around, as banks aren’t over-levered this time around. In our assessment, you ain’t getting a bailout unless a systemically important institution is at risk.

Without providing specific investment advice, my view is that the best short-term strategy may be a good long term strategy. That may mean to rebalance a portfolio, take chips off the table, when times are good. The problem is, where on earth does one put those chips? Historically, one would rebalance to fixed income, but in an era of extraordinarily low rates, investors are reaching for yield in the bucket that ought to be “safe.” You don’t need to be a doomsday forecaster to suggest that many investors may be over-exposed to risk assets as those higher yielding fixed income instruments may exhibit a high correlation to equities in a downturn. And when the masses all realize this – granted it may take considerable time as those ‘buying the dips’ won’t be rooted out overnight – the carnage in the markets may well be severe. Is the recent sell-off in the Nasdaq the canary in the coal mine? We think it is, but the buy-the-dip troopers may well prove us wrong. For a day. Or a week. Or longer. But maybe not.

So while the banks may not need a bailout, I’m not so sure about pension funds or individual investors. Yet, “needing a bailout” and actually getting one are different stories.

This analysis wouldn’t be complete without looking at another elephant in the room: Chinese banks. Credit growth in China has been breathtaking; financial institutions, in my assessment, carry too much leverage. Yet markets are well behaved. So if you are looking for a more traditional type of blow-up, China is a good candidate. Chinese banks are systemically important and, as such, candidates for bailouts. China is a perfect example in my view where you have a market that appears calm, yet is subject to underlying pressures that we believe are unsustainable. That doesn’t mean it is obvious how any unwinding may unfold. But if past shockwaves attributed to China are any indication, it may not bode well for risk assets.

All of this has led to a surge in index investing. The industry argues that the average investor cannot beat the index, especially after fees. Well, it’s a mathematical certainty given that the average cannot beat the average when you deduct fees. That doesn’t mean investors should throw risk management out of the window; it doesn’t mean buyers of tulips in 17th century Netherlands were right; it doesn’t mean buyers of tech stocks in the late 90s were right.

Mind you, there are so many indices one can track these days that one can hardly call it passive, but active management is dead, a dying breed; or is it merely in a cyclical low? Seemingly ever rising markets appear to have created a feedback loop. To me, this question is directly related to volatility: when risk premia are low, the dispersion of risk is low, making it difficult for active managers to shine. It doesn’t help that many active managers promote lower returns. Why would you embrace lower returns than you can attain by chasing high flying stocks? The answer, of course, is risk management: those high-flying stocks might come crashing down.

Should risk premia rise once again, i.e. should volatility move higher, we believe there should be a larger number of active managers standing out. As such, my take is that active management will be embraced once again. That said, we may need substantial carnage in the markets for investors to realize their need to hire an active manager once again. And tomorrow’s active manager may well be different from yesterday’s given how the industry has changed. Just a few years ago, one would have been hard pressed to find an active manager to switch to different ETFs depending on the market environment. Similarly, a new breed of systematic trading strategies has risen that were a rarity a few years ago. In between, there is a range of new tools available to traditional active managers that may well become popular again.

What it comes down to is constructing and managing a portfolio that suits the risk profile of the individual, the family office, the pension plan. It’s not about constructing a portfolio that suits fast money pundits or cocktail talk.

On a separate note on how to navigate these markets, please register for our June 22 Webinar entitled: “Invest in Yourself – What Your Advisor Doesn’t Tell You”. Make sure you subscribe to our free Merk Insights, if you haven’t already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

President & CIO, Merk Investments

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments LLC makes no representation regarding the advisability of investing in the products herein. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

Legendary investor Jim Rogers sat down with Business Insider CEO Henry Blodget on this week’s episode of The Bottom Line. Rogers predicts a market crash in the next few years. One that he says will rival anything he has seen in his lifetime. Following is a transcript of the video.

Rogers: I learned very early in my investing careers: I better not invest in what I want. I better invest in what’s happening in the world. Otherwise, I’ll be broke. Dead broke. Well, what’s going to happen is it’s going to continue. Some stocks in America are turning into a bubble. The bubble’s gonna come. Then it’s gonna collapse and you should be very worried. But Henry, this is good for you. Because someone has to report it. So you have job security. You’re a lucky soul.

Blodget: Well, yeah, TV ratings do seem to go up during crashes but then they completely disappear when everyone is obliterated, so no one is hoping for that. So when is this going to happen?