Timing & trends

As I was walking through the shopping district of Kingston-on-Thames yesterday, I was wondering whether the locals had gotten the memo that the country remained on “High Alert” in light of the Manchester bombings. Here I was in the middle of an historic “village,” walking across the Clattern Bridge (built in 1293) along with thousands of British shoppers, laughing and joking, sitting in pubs, talking about the rugby matches and generally going about their regular daily business as if nothing had happened. If I could have drawn little “thought balloons” above each and every person I observed, there would be one simple image of a raised middle finger everywhere. It was a wonderful, beautiful thing to witness.

It should come as no surprise to anyone that knows British history that, as my father used to refer to it, this “little peanut of an island” ruled the world under the British Empire for most of the 19th century, ceding superpower status only after WWII to the U.S. and Russia after ruling the waves from the mid-1700s. It was in 1939 that the British government designed a poster (shown above) intended to prepare the citizenry by “shaping morale” for the imminent arrival of WWII with an increasingly bellicose Germany. While the poster was rarely displayed publicly, it epitomizes the “stiff upper lip” mentality of nation and explains a great deal of the majestic history of the country. Of course, I am talking up my book as all four grandparents were from England and many of my partner’s first cousins are showing us around. For someone raised in a country barely 150 years old, to walk through churches built in the 1300s is awe-inspiring to say the least and intimidating at its best.

So as I attempt to make sense of today’s markets with rampant interventions and blatant manipulations all designed to “shape morale” and keep the citizenry at once both complacent and behaved, it is as if the global banking cartel, working hand-in-glove with governments, are preparing for a cataclysm of sorts—a financial tempest that will make the “Blitz” of 1940-41 over London pale by comparison.

By intervening in the gold and silver markets, they have been able to eliminate their usual “canary-in-the-coal-mine” predictive natures and by propping up stocks, bonds and real estate, the public is now juggling multiple bubbles in a manner not unlike the Roaring Twenties or the Late Nineties. One by one, I see the “Big Money” (Warren Buffett, Paul Tudor Jones, Ray Dallio) exiting the stock and bond markets, and hedge funds managers galore returning capital to investors as opportunities shrink and risk escalates. When you think about the fact the CNBC’s favorite ratings magnet, Warren Buffett, has now horded more then $100 BILLION “looking for better entry points,” you have to ask yourselves why Facebook shares at $150 with a 38 P/E or Amazon at $995 trading with a 187 P/E are not finding themselves in the portfolio of Berkshire Hathaway. Can all of these very seasoned players in global markets be wrong at the same time?

The days of traditional fundamental analysis may have metamorphosed but they are by no means “different” in terms of outcomes. Just as surely as quantitative analysis has altered the technical aspects of securities analysis, all it has actually achieved is a temporary Band-Aid over a cancerous lesion. That cancerous lesion is the inability of corporations listed on the public markets to actually deliver earnings that can be paid out in the form of dividends over time. Algorithms that use pattern-recognition software to trade markets are specialists in rearranging Band-Aids over thousands of these hideous lesions but the time is rapidly approaching when events such as government default, social insurrection, recession, geopolitical upheaval including war, and/or natural disaster will wash away those Band-Aids, leaving multiple exposures of the ill health of the body.

As Paul Singer said recently: “We think that the low-volatility levitation magic act of stocks and bonds will exist until the disenchanting moment when it does not. And then all hell will break loose.” That is precisely what I have been writing about through most of the last nine years dealing with serial intervention by central banks with checkered and sporadic periods of success and failure always finding solid FUNDAMENTAL reasons for trying to buy volatility (“VIX”/UVXY-US”) or to buy puts on the S&P 500. Many such efforts occurred as recently as last November when I took out pre-election hedges to protect against a Trump victory. By 10:30 p.m. on the night of the election, I was clinking champagne glasses with my partner and dancing around the room with Fido the Dog as my hedges, had they opened right then and there, would have been ahead over tenfold. I went to bed with a wondrous array of sugar plums dancing in my head only to awake to the horror of stocks opening unchanged. Since then, I have refrained from trying to trade against the Cretins because it has become a mug’s game of chronic head-banging and repeated rebukes.

That these interventions have cost us all a great deal of financial, intellectual, and emotional capital is in no way a sop to the significance of their criminality. However, the irony is that it has not affected the youngsters trained in the Millennial art of entitlement and self-indulgence. “Old people suffer bear markets; WE buy corrections” is the mantra of the day for tens of thousands of fuzzy-cheeked, selfie-obsessed traders and investors born during the first decade of the DotComs and the last decade of world-class mineral discoveries. The maddening part of it all is that the science of financial engineering studied and now-perfected by the dozens upon dozens of academics manning the halls of the global central banks have not only failed to experience the rapture of meeting payroll, they have never fully understood the delicate balance between the “real” economy and the “financial” economy.

Sadly, the latter has now overtaken the former in its significance not so much in its effect upon the bricks-and-mortar portion but more so in how it has grown to absolutely dominate policy, both fiscal and monetary. To wit, all simulative efforts enacted by the policy-makers, whether central bankers or elected officials, are now targeted toward bank collateral with the primary reflationary target being real estate.

Now that home prices in America are now approaching and in some cases surpassing the pre-GFC (2008) levels, the risk to the banking cartel has been mitigated by way of the reparation of the valuations of their collateral Achilles’ Heel. Now that the risk of balance sheet implosion has been transferred from the banks to the consumers and by natural progression, the government, stock and bond prices are able to levitate and remain at bubble-like plateaus. An interesting question might be how gold and silver might have reacted since 2008 had the major portion of bank collateral been gold versus debt.

So as we plough forward into the spring of 2017, the model portfolio I constructed in 2001 and one which I actually bought in 2002 has surprised everyone by actually outperforming the S&P 500 by almost twofold but it should be emphasized that physical gold has been the premier performer while gold stocks have not done nearly as well. The fact that gold continues to be acquired by the Asian and European central banks is testimonial to the fragility of the currencies they are empowered to protect. As I sit here in the middle of England typing in an inn built in 941 A.D., it is easy to be intimidated by the sheer history of the establishment, of the village, of the region, and of the country. It is also easy to be intimidated by the constant and consistent bid in global equities in light of the slowing macro picture and looming interest rate hikes.

It is disheartening to watch gold and silver holdings sitting in limbo while stocks and crypto-currencies like Bitcoin are recording new all-time highs. It is depressing to watch bubble after bubble inflate while new ETFs are launching every day that lever up existing leveraged ETFs. It is frustrating to read emails from many seasoned long-term followers that are in full liquidation mode having been rendered powerless to any longer stomach the smug cockiness of the CNBC crowd. To sit on the crypto-currency sidelines while witnessing the manic elation of the Bitcoin Battalion is for me the ultimate in aggravation. All of my haranguing and whining and raging about the demise of the global currencies over the years was actually taken to heart by the master code-writers of the tech world, but instead of those massive tech profits migrating to gold and silver, they wound up CREATING their own alternative currency that has actually sucked capital AWAY from the precious metals because it was and is insulated from the grappling hooks of the interventionalists.

However, as glum as it may appear, it is never, EVER, truly “different” this time or any other time and all of the time-tested reasons for owning gold and silver are not only intact, they are more powerfully relevant today than ever before. I do not say this lightly; it took a trip to the birthplace of my forefathers in order to fully understand where we are in the bigger scheme. One of my lifelong heroes, Sir Winston Churchill, said “‘Tact’ is the ability to tell someone to ‘Go to Hell’ such that they actually look forward to the trip.” He was a wonderful writer and was a published author long before he became a politician or a statesman. He had the uncanny ability to deliver scathing commentary upon foolishness. In an encounter with Lady Astor, she said to him: “Mr. Churchill, I think you are drunk!” to which he replied, “M’Lady, it is true that I am drunk but it is also true that you are UGLY. In the morning, I shall be sober BUT in the morning, you shall still be UGLY.” Yet again, Churchill is accused of being a chauvinist pig with the following recontre: Lady Astor: “Oh, if you were my husband, I’d put poison in your tea.” “Madame,” Winston responded, “if I were your husband, I’d drink it.”

I bring these nuances of human brilliance to the attention of my readers because I truly love “wit and intellect” with a passion. When you are forced to sit back and grind your back teeth as others around you are celebrating the ownership of stocks at valuation levels surpassing the highs of 2001 and 2007 and 1987, you must have a “Fall Back” position in order to maintain sanity. As we are not yet able to hold up a mirror and prove to the world that we have solved the puzzle surrounding the global debasement of currency purchasing power, it can in no way be seen as an analytical failure of the precious metals. Alternatively, we have to think in the same manner as Sir Winston. We have to think as independently and as reconstructively as he did when he told the British people what they should expect in the event that they could rebuff the German Luftwaffe in 1940-41. We as gold and silver investors have to think as adaptably as did Churchill when he told the British people that this would be “their finest hour.”

In this era of invasive central planning and congenital bubble-blowing, it isn’t easy to invest as a contrarian. It is even more painful to watch friends and colleagues dismiss overvaluation arguments because “it’s working.” And it is almost surreal to watch naive and unsophisticated Canadian “investors” sitting with $3 million in mortgage debt, five rented properties and plans to “buy more” while attending seminars and conferences with paid actors revving up overexuberant crowds.

Sanity can only be kept by remembering the mistakes of the past; focusing on time-tested methods; and by remaining vigilant. To do otherwise would be folly of great impact and consequence. When investing in today’s hyperventilating markets, I will vow to “Keep Calm and Carry On.”

Now it’s off to the Emerald Isle.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

Bubbles come and go.

Silver and gold – 1980

Japanese Nikkei – 1990

NASDAQ – 2000

Mortgages and Real Estate – 2006

Bonds, Debt, Stocks, Real Estate – 2017

Examine the following graph of monthly data for 32 years of the NASDAQ 100 Index and Silver.

We saw the NASDAQ bubble in 1999-2000, a rapid rise for silver in 2010 – 2011 and a large rise in the NASDAQ 100 during 2009 – 2017.

Prices for both markets have often risen too far and too fast, and then corrected or crashed. The NASDAQ dropped more than 80% from 2000 to 2002. Silver dropped about 70% from 2011 to late 2015.

The NASDAQ 100 is likely to drop by a large percentage following its current run-up. Stay tuned – no correction yet.

Prices for stocks and silver rise, primarily because of currency devaluations. The two markets often offset each other, which suggests we should look at their sum. Examine 32 years of the NASDAQ 100 plus 175 times silver prices, which gives both markets roughly equal weight.

Over thirty years prices have risen exponentially as the dollar has purchased progressively less. Conclusion: Prices rise exponentially and probably will continue to rise as long as governments increase debt and central banks devalue their currencies.

Is the NASDAQ 100 high and is silver low?

Examine the ratio of 175 times the silver price divided by the NASDAQ 100. When the ratio is high – as in 2011 – silver is relatively high. When the ratio is low – as in 2017 – silver is undervalued compared to the NASDAQ 100 Index.

How long will the ratio stay this low? Probably not much longer …

When the NASDAQ 100 top will occur is important if you are riding the NASDAQ bull market. Now is a time for caution!

How much longer silver prices will stay low is important if you are stacking silver, as I hope you are. Take advantage of these low prices!

REVIEW – and then do your own due diligence:

- Prices for silver and the NASDAQ 100 rise exponentially as unbacked paper currencies are systematically devalued.

- Expect much higher silver prices because the silver to NASDAQ ratio is too low, along with dozens of other reasons.

- Consider taking profits out of the NASDAQ to buy silver. Don’t expect to hear this suggestion on Wall Street.

- Wall Street benefits from higher NASDAQ prices. Wall Street benefits little from higher silver prices, with the exception of JPM which, per Ted Butler’s data, has accumulated a massive hoard of silver bullion. Expect Wall Street to promote buying stocks and discourage acquisition of silver, as usual.

- Silver has been money and a store of value for thousands of years. The NASDAQ stocks have existed for a few decades. In the long term, trust silver. In the short term, the NASDAQ is over-valued and silver is inexpensive. Buy Silver!

Read Gold Moves Ahead of Silver

Read “House of Cards: Netflix is One of the Poster Children for Tech Bubble 2.0”

John Mauldin quoting Jim Mellon:

“And that makes it a bit like the markets – quiet at the moment, but the mayhem is just around the corner.

Assume the brace position.”

Gary Christenson

The Deviant Investor

It was a whirlwind week. After attending two big conferences, I landed in Vancouver Friday where I presented at the International Metal Writers Conference. Markets continued to close at record highs, even as political uncertainty remained and the threat of terrorism loomed large over Western nations. Last Monday, gold flashed a bullish signal we haven’t seen in over a year.

There’s much to talk about! Below are five things you need to know from the week now behind us.

1. Quants Now Control Wall Street

A special report by the Wall Street Journal last week confirmed what I’ve been saying for a while: Wall Street is now run by the quantitative analysts, or quants. Numbered are the days when traders and fund managers picked stocks on gut instinct. Today, a decision is made only after whole oceans of data have been processed using sophisticated algorithms.

And yet quants’ role has even further room to expand. As the WSJ reports, quant hedge funds now represent 27 percent of all U.S. stock trades by investors, up from 14 percent in 2013.

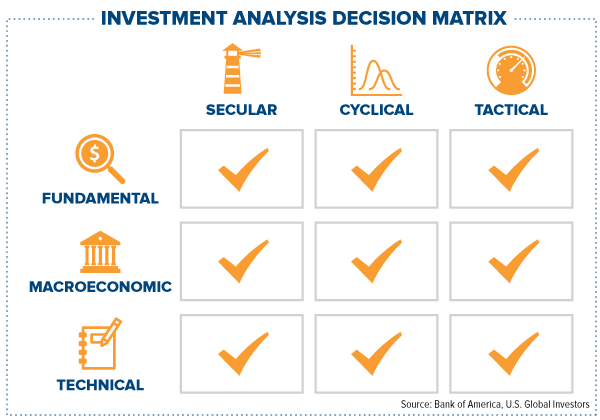

To get some idea of the type of analysis quants conduct, take a look at the matrix below. Of course, their methods are far more sophisticated, their data crunched in a matter of nanoseconds, but it’s helpful to see how they might codify many points of data.

We aspire to conduct the same sort of analysis, from technical to tactical, to make better, more strategic investment decisions.

2. Paul Singer Says It’s Time to Build Up Some Dry Powder

|

Last week at a Chief Executives Organization (CEO) event, I had the privilege of hearing billionaire hedge fund manager Paul Singer speak. His firm, Elliott Management, has one of the most impressive long-term track records, generating a compound annual growth rate (CAGR) of 13.5 percent since its inception in 1977, with only two down years.

Elliott Management currently manages close to $33 billion—not including the $5 billion it raised this month in as little as 24 hours. Yes, billion with a b. Singer, suggesting a potential investment opportunity in distressed stocks could soon open up, recently called on investors to commit a fresh infusion of cash. The resultant $5 billion in dry powder, the most ever raised in the firm’s history, is expected to be deployed at some later date.

Singer continues to be a huge advocate for gold. At the event, he mentioned that he still holds the yellow metal, noting its attractive diversification benefits. This is in line with what I frequently say: You’re unlikely to get rich investing in gold, but as a diversifier it helps to reduce some of the volatility in your portfolio. I like to recommend a 10 percent weighting in gold—5 percent in bars and coins, the other 5 percent in gold stocks—with annual rebalances.

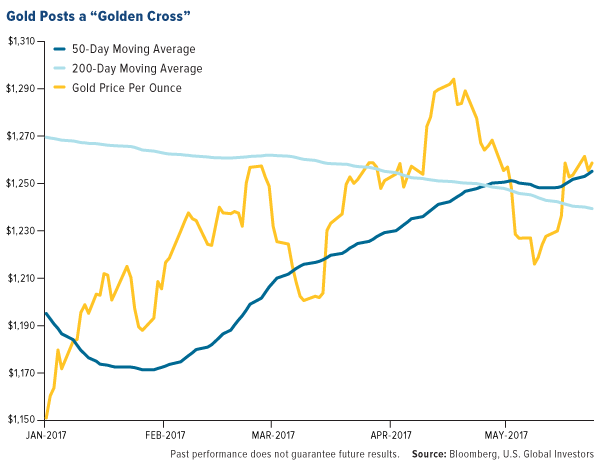

Gold posted a “golden cross” last week, which is what happens when the 50-day moving average climbs above the 200-day moving average, often seen as a bullish move.

The metal is up about 10 percent year-to-date on a weaker U.S. dollar, which has declined more than 5.5 percent over the same period.

3. BBH: Just Say No to Overdiversification

Diversification can sometimes help minimize volatility, but too much of it can lead to mediocre returns. That was the main theme of another speaker at the CEO event, this one from Brown Brothers Harriman (BBH), one of the largest private banks in the U.S. BBH research shows that, if your investment goal is to get rich, a highly-concentrated portfolio is the surest way to achieve it. An S&P 500 Index fund, while possibly delivering positive returns, is unlikely to make anyone a millionaire.

This is good to know, but the problem is that most investors can’t stomach the volatility inherent in a portfolio that holds only a few assets. With minimal diversification, daily swings can be dizzying. Professional money managers and investment banks such as BBH know how to use this volatility to their advantage, but for everyone else, it’s prudent to be diversified in gold, municipal bonds and other assets often seen as havens.

For more on how to deal with market volatility, download my whitepaper, “Managing Expectations.”

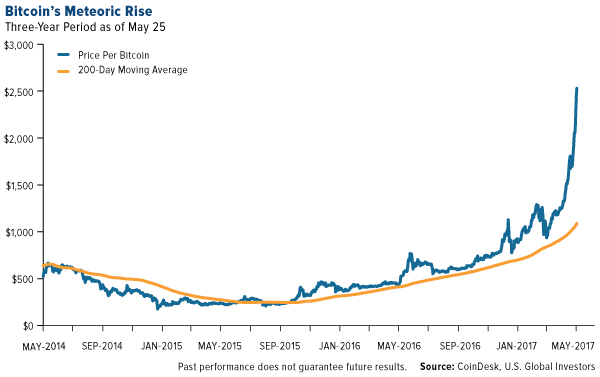

4. Want Volatility? Look No Further Than Bitcoin

Markets watched in amazement last week as bitcoin, the online-only currency, soared to a fresh high of $2,740, more than twice the value of an ounce of gold. On Thursday alone, it traded within a $510 range, underscoring the nearly 10-year-old cryptocurrency’s high levels of volatility and speculation.

Some bitcoin analysts forecast even higher gains, while others see the formation of a bubble they liken to the dotcom crash of the late 1990s and early 2000s. Since only March, when it surpassed gold, the digital currency has doubled in value.

These were among some of the discussions at Consensus, a bitcoin technology conference, which I also attended last week in New York. One of the highlights of the conference was hearing from Fidelity CEO Abigail Johnson, who surprised many attendees by embracing the digital currency and supporting its growth. I admire Johnson, head of a traditional financial firm, for recognizing the fact that bitcoin is already disrupting our industry and will likely continue to do so for some time. Not only does Fidelity now allow its workers to buy their lunches using bitcoin, but there are also plans to make it possible for clients to see and manage their bitcoin assets.

|

Fidelity isn’t the only firm trying to position itself as a bitcoin pioneer. Both Nasdaq and the Chicago Mercantile Exchange (CME) were sponsors of the conference, indicating cryptocurrencies’ gradual shift from fringe curiosity to legitimate speculative asset.

I was shocked to learn that there are now somewhere in the neighborhood of 700 cryptocurrencies, all of them locked in a race to see which ones will come out on top. They’re collectively up more than 400 percent so far this year, the market having risen from $17.6 million in January to $88 million today, according to cryptocurrency and blockchain technology news site CoinDesk.

To “mint” a new cryptocurrency, I learned, speculators raise capital not through conventional means but through crowdfunding, like a 21st century Gold Rush. All regulatory oversight and governance is therefore bypassed. The currency is then issued in an initial coin offering (ICO), after which it can be “mined” using powerful, energy-hogging computers. Naturally, the cheaper the electricity, the better. The hunt for the world’s cheapest kilowatt hour has taken “miners” all over the globe, from parts of Russia to Iceland to Finland to rural China.

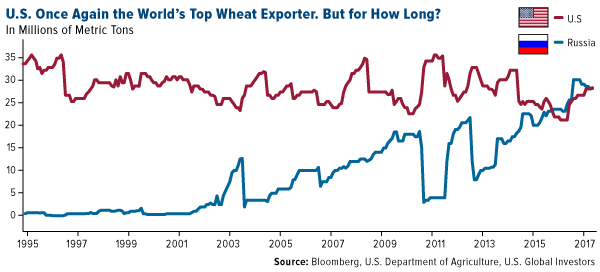

5. Make American Wheat Great Again

It looks as if wheat exporters are great again. After being displaced by Russia in August 2016, the U.S. has regained its title as the world’s top exporter of the grain—for now. Interestingly enough, the investigation into possible collusion between Donald Trump’s campaign and Russia has driven the U.S. dollar’s devaluation since the start of the year, which in turn has made U.S. exports cheaper for overseas buyers. Egypt, Algeria, Mexico and Japan all reportedly increased their purchase amounts of American wheat.

Two years ago, it was the Russian ruble’s weakness—prompted by the dramatic decline in oil prices and international sanctions following Russia’s occupation of Ukraine—that gave Russian exporters an edge. Coupled with a bumper crop, the country outpaced both the U.S. and European Union, then the leader.

As I said earlier, the dollar has declined 5.5 percent year-to-date, helping to give American exporters an edge. According to Bloomberg, the U.S. is expected to ship more than 28 million metric tons of wheat this season, an increase of 34 percent compared to the same time last year.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Diversification does not protect an investor from market risks and does not assure a profit.

Strengths

- The best-performing precious metal for the week was palladium, up 4.18 percent. Bloomberg reports that rising automobile demand may be sending palladium futures toward the steepest rally since April 20.

- Bloomberg’s weekly poll of traders and analysts show the trending heading toward bullishness, with 10 bullish, five bearish and four neutral. Analysts point to concerns over terrorism, probes into President Donald Trump’s links to Russia and doubts that the Federal Reserve will raise rates in June, as factors that may spur investors to choose gold.

- China’s gold demand in 2017 is still the strongest in four years, reports Bloomberg. Although higher prices have deterred some buyers, dropping gold purchases from 15-month highs, the World Gold Council (WGC) sees demand growing to 900 to 1,000 metric tons for the full year.

Weaknesses

- The worst-performing metal for the week was gold, albeit still positive with a gain of 0.91 percent.

- The biggest gold miner ETF, the VanEck Vectors Gold Miners ETF, saw record outflows this week. On Wednesday, investors withdrew $662 million from the fund, making it the worst daily outflow since 2006. Similarly, the VanEck Vectors Junior Gold Miners ETF has had outflows of $804 million since March 31, after record inflows last quarter prompted the fund to change its portfolio structure. Bloomberg reports that the fund is now on track for the biggest quarterly outflow since the fund’s inception in 2009.

- A handful of gold mining stocks are experiencing challenges this week. Tragically, a fatal accident occurred at Torex Gold’s construction site at the El Limon Sur pit in Mexico. The ongoing ban on exports of mineral concentrate from Tanzania could cut Barrick Gold’s gold production by up to 6 percent this year, as Barrick’s equity interest in Acacia accounts for around 10 percent of its gold production. And Freeport-McMoRan has let go about 4,000 workers after a strike at the company’s Indonesian operations.

Opportunities

- Bank of America Merrill Lynch published a report this week on the company’s global mining conference in Barcelona. BofAML reports that most gold mining companies are in better condition than last year, due in great part to the better corporate discipline, with more focus on value over risk.

- Deutsche Bank published a special report on the global gold sector, stating “we feel investors should prepare for a flight to gold” in the uncertain global climate. The report also emphasizes the importance of looking for the gold stocks that offer better value, growth or leverage. Deutsche highlights the top global gold stocks as Newmont, Evolution Mining, St. Barbara Mining, Alacer Gold and Dacian Gold.

- Dacian CEO Rohan Williams told reporters that the recent deal between Eldorado and Integra signals the beginning of a cycle of mergers and acquisitions (M&A). More optimism for gold comes from Trump’s political troubles after Republicans criticized his budget. The gold price has risen, and gold’s open interest, a tally of outstanding contracts, has climbed to the highest since April 27. The chart below shows that the MACD (the gauge of price momentum) is above the “Sig,” or signal line, which is considered a bullish indicator. Yet another bullish indicator is that gold has experienced a golden cross, which happens when the 50-day moving average crosses above the 200-day moving average.

Threats

- Sibanye Gold recent acquisition of Stillwater Mining is under review in the courts. Some Stillwater investors contend that they were shortchanged with the purchase price of $18 per share. Sibanye is the U.S.’s only producer of platinum-group metals.

- South Africa is proposing to change the minimum black ownership of mining assets from 26 percent to 30 percent. Mines Minister Mosebenzi Zwane included this proposal in a mining charter. However, senior party policy officials said there may be negative consequences from such a measure, and that it may deter investment.

- Tanzanian Mines Minister Sospeter Muhongo was fired after an audit revealed that mineral exports had been understated. Acacia Mining has been investigated by a presidential committee, showing that Acacia reported certain containers held 26,000 ounces of gold, while the committee found those containers to hold 250,000 ounces. The magnitude of the discrepancy implies that the source mines, Bulyanhulu and Buzwagi, would actually be the world’s two largest gold producers. Those familiar with the events have called for an independent review. Acacia stock tumbled around 40 percent this week.

I’ll tell you when it’s time to buy miners and it’s not time yet. We need to generate some excessive bearish sentiment first. That will come only at the intermediate cycle bottom. And that’s not due until June.