I want you to take a close, hard look at this chart:

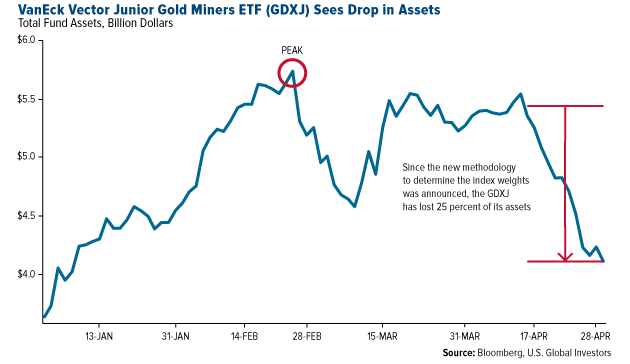

The GDXJ (VanEck Vectors Junior Gold Miners ETF) is the ETF that has become one of the world’s most popular investment vehicles for gold investors over the last decade.

The idea behind ETFs is luring many investors by allowing you to buy and sell broad baskets of stocks with a single trade.

It’s a one-click way to buy a basket of small-cap gold exploration, development and production companies, and from January 2010 to May 2017, the market capitalization of the GDXJ grew by 480%.

Since it became so popular, a technical challenge has emerged: by definition, junior gold stocks don’t have large market caps and their shares don’t have tremendous trading liquidity. The GDXJ grew in popularity so much that it had too much cash and not enough places to put it.

Here’s where this becomes interesting. I know many precious metal investors who are hurting big time right now because they missed the phenomenal move between January and August of 2016 and have been seeing nothing but a massacre ever since.

My gut and the research I’ve put together suggests that we are about to undergo a frenzy sell-off, something that will cause some gold investors (who have too much of their net worth weighting in gold-related stocks) to feel like puking, but for those who prepare, I am telling you that this is your “Bitcoin at $3” moment.

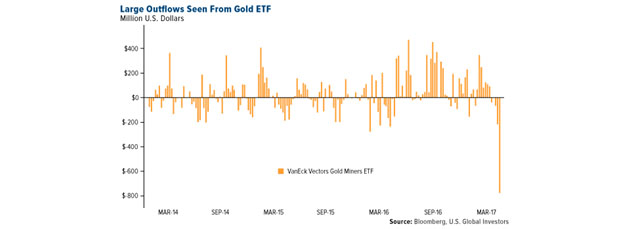

The sell-off has already begun, and it’s due to no fundamental reason at all—it is a “forced selling” based on technical issues.

Many junior gold stocks are Canadian. As soon as an entity owns more than 20% of a Canada-listed company, regulations restrict its trading ability and make holding the position a bureaucratic mess.

Because the ETF got so popular and the small-cap miners are truly a tightly knit group of companies that are not collectively worth that much, the ETF couldn’t find ways to deploy cash. As a result, it now has to rebalance its components.

This rebalancing is already underway, with hedge funds, short-selling funds and retail investors all looking for a way to either make a killing due to this selling avalanche or protect their holdings from further declines.

The rebalancing is set for June 16.

Between now and then, expect significant volatility in all the sub-$1 billion market cap junior and mid-tier gold companies. Shares of companies will be sold by the GDXJ so the new ETF can become a “large mid-tier to small major” gold ETF.

The Chain Reaction: Margin of Safety Will Be at All-Time High

Margin of Safety is the most important term in finance, according to Warren Buffett and his mentor, Benjamin Graham. Essentially, the idea is that no investment—and certainly no trade—are bulletproof, therefore the cheaper you can buy it, the better.

It goes deeper than that: a more effective use of Margin of Safety is contrarianism.

This means that you’re buying when assets are out of favor (and therefore cheap), with the certainty that demand will be increasing later.

But the most effective use of Margin of Safety is buying so cheap that the company actually trades at or below its liquidation value.

The GDXJ is going to dump close to $4 billion worth of junior mining shares—that’s a massive amount.

We all know how the market reinforces our most innate emotions, and as this forced regulatory selling commences, panic selling will ensue.

Gold stock investors will hit stop losses and dump shares, which will create more selling.

What may be in the cards here is a self-reinforcing cycle of forced, ignorant selling that will feed on itself and cause a panic in some of the world’s best small-cap gold stocks. It could be a chain reaction, and again, this is coming on June 16, right when the Federal Reserve next announces an interest rate decision.

Wealth Research Group’s Strategy

We follow a proprietary due-diligence process in order to sift through the hundreds of publicly traded companies.

We are currently reviewing all the companies that the GDXJ will be forced to sell. I can already tell you that I have personally taken profits on a number of dividend-paying stocks and liquidated a real estate holding in order to be cashed-up.

The reason I did this is because at the bottom, after some companies’ stock prices basically go back in time to levels lower than 2015’s historical lows, guys like my partners and I—or funds like Marin Katusa’s, or Sprott Asset Management and Peter Schiff’s Euro Pacific—and other legendary investors in the space will be making our most aggressive move yet.

Gold is not in a bubble, nor has it displayed any “bubble-like” golf stick-shaped chart.

Instead, it’s a highly depressed market where demand is high, but concentrated short positions by large funds who are long the S&P 500 are absolutely creating havoc for the retail investor. As I said last week, once the entire investment community begins taking profits after a nine-year bull market, the over-leveraged short positions they currently hold in mining shares will be liquidated, and you will most likely be among the rare breed of investors that get to experience a 100-fold move in a stock you own.

At the moment, a total of 52 companies are estimated to be under excessive liquidation by the GDXJ, and we’re preparing for this as we speak.

You need to make a decision—one that will define you regarding gold stocks from here on out. You need to be absolutely sure that you can stomach high volatility, which will test every fiber of your being, because buying when Margin of Safety is at an all-time high is not as easy as it sounds. It requires nerves of steel, and most of all, it entails forgetting all about the pain you endured (if you endured any) by mismanaging positions in the past or getting the timing wrong.

There’s no escaping this—it will get bloody before we get our chance to create dynasty money.

Now is the absolute ideal time to learn exactly how industry insiders are finding the best values.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Related Articles

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Wealth Research Group

The VIX, the volatility of the S&P 500, is sometimes touted as a “fear index.” Today is it extending its push below 10%, to fall to its lowest in nearly a quarter of a century.

The VIX, the volatility of the S&P 500, is sometimes touted as a “fear index.” Today is it extending its push below 10%, to fall to its lowest in nearly a quarter of a century.

1.

1.