Timing & trends

1. Artificial Intelligence Confounds Its Creators

1. Artificial Intelligence Confounds Its Creators

Advanced artificial intelligence is far from that. Algorithms are constantly learning, often in unusual ways, and at an exponential rate. It’s one of the cornerstones of the New Gilded Age.

Unfortunately, nobody really knows how they learn. And that should scare you, a lot.

2. Canada’s 6-City Housing Prices & the Plunge-O-Meter

In March 2017 Canada’s big city metro SFD prices coiled about or slid off their near term highs except in Toronto where detached houses, town houses and condos fetched new peak prices; Vancouver strata prices also hit new highs as well. Strata is the new Canadian “can-do” “must-do” “will-do” affordability metric.

2. “The Donald” at Bat

Once again, the big man steps up to the plate.

Once again, he points his bat at the far bleachers.

This is going to be “bigger, I believe, than any tax cut in history.”

And once again, the fans go wild.

Wow… if he can pull this off

Todd Market Forecast for Thursday April 27, 2017 Available Mon- Friday after 6:00 P.M. Eastern, 3:00 Pacific.

DOW + 6 on flat breadth

NASDAQ COMP + 24 on 250 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS: The stock market keeps inching higher mainly on better than expected profits, but we didn’t like the internals. The NASDAQ was up nicely, but breadth was lacking.

Also, the S&P 500 is in a resistance zone. Let’s see how this pans out.

GOLD: Gold was flat. Not much to report here.

CHART The S&P 500 is hesitating near all time highs. I see no reason to issue a short term sell, but I really don’t want to recommend a trading position.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash stay on the sidelines for now.

System 8 We are in cash. Stay there.

System 9 We are in cash. Stay there.

NEWS AND FUNDAMENTALS: Not available

INTERESTING STUFF I can’t change the direction of the wind, but I can adjust my sails to always reach my destination. —–Jimmy Dean

TORONTO EXCHANGE: Toronto was down 143.

BONDS: Bonds were flat.

THE REST: The dollar almost unchanged. Silver was lower. Crude oil had a small bounce.

Bonds –Bullish as of April 3.

U.S. dollar -Change to bearish as of today April 25.

Euro — Change to bullish as of today April 25.

Gold —-Bearish as of April 19.

Silver—- Bearish as of April 19.

Crude oil —- Bearish as of April 18.

Toronto Stock Exchange—- Bullish from January 22, 2016

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

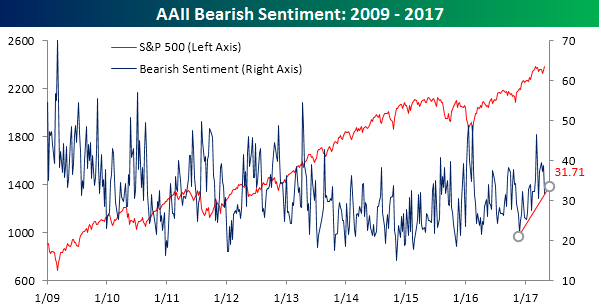

After dropping to its lowest level since the election, bullish sentiment on the part of individual investors surged by the most this week since the week after the election. According to the weekly survey from the American Association of Individual Investors (AAII), after just one-quarter of individual investors considered themselves bullish last week, more than 38% now put themselves in the bullish camp. So was it the French election that individual investors were so worried about (kidding)? Even with this week’s increase, a little perspective for this poll is in order, as it has now been 121 straight weeks since bulls were in the majority.

What we will be watching in this poll next week is what happens with bearish sentiment. In this week’s survey, bears decline from 38.7% down to 31.71%. Even after this week’s decline, the uptrend in bearish sentiment that has been in place since late last year remains in place (chart below). If that uptrend breaks, it could be a precursor for a move to a majority in the bullish camp.

Bob Moriarty the founder of 321gold and 321energy sits down with Maurice Jackson of Proven and Probable to discuss some very, very important topics affecting everyone. Bob addresses his concerns with the bifurcation between Candidate Trump and President Trump as he discusses the recent bombings on Syria and Afghanistan and the potential threat of war with North Korea and or Russia. Mr. Moriarty, discusses the big elephant in the room which is the U.S. Debt/Bond Market and the resolve, or lack thereof, for the government to create a solution. Bob shares with listeners the merits on stewardship of precious metals and which metals he is procuring at the moment and why. Listeners will also discover some truly spectacular junior mining companies that have offer a unique value proposition for investors.

Scroll Down for TRANSCRIPT:

Maurice: Welcome to Proven & Probable where we focus on Metals, Mining and More. I’m your host, Maurice Jackson. Joining us today is the founder of 321gold and 321energy.com and the author of two of my personal favorite books, The Art of Peace and Nobody Knows Anything. Bob Moriarty, thank you for joining us, sir.

Bob: Sure. It’s a pleasure to be here.

Maurice: You know, when it comes to putting a succinct picture together on the relationship with politics, geopolitics, and the value proposition it presents in the natural resource space, speculators turn to Bob Moriarty.

Bob, President Trump famously stated in 2017 that the United States is not the world’s police force, and within 45 days, bombs Syria and Afghanistan. What are the short-term and most important long-term implications regarding these actions?

Once again, the big man steps up to the plate.

Once again, the big man steps up to the plate.

Once again, he points his bat at the far bleachers.

This is going to be “bigger, I believe, than any tax cut in history.”

And once again, the fans go wild.

The Dow shot up 216 points yesterday as investors dreamed of a home run.

Corporate taxes would be reduced to 15%, it was rumored. Personal rates would go down to 33%, 25%, and 12% in three simple brackets.

And the economy would boom… just like it did when the last “biggest tax cut ever” was rolled out by the first Reagan administration.

Colorful Player

From the cheap seats to the skybox heavies, Mr. Trump always gets the fans excited.

He is a colorful player who gets his mug in the press regularly. He talks big. He swings hard. But he has a hard time connecting with the little ball.

In his first two times at bat since joining the major leagues, he has struck out.

The first time, the pitcher lobbed an easy O’care reform right over the plate. But with the fans cheering him on… and his whole team supposedly behind him… “The Donald” just couldn’t get on base.

Then there’s America’s foreign policy.

Yes, it was a confusing situation. “The Donald” had given sports lovers hope that he might bring a change. But the president saw a curve ball coming his way and… taking a page out of Hillary’s campaign promises… he couldn’t resist.

He swung wildly, sending a foul ball into the crowd, where it knocked out a hot-dog vendor.

“He had it coming,” the sports commentators agreed. “The hot dogs tasted terrible.”

Grand Slam

And now, Mr. Trump is up again.

This time, he’s promised a grand slam. Lower taxes. Higher stocks. More GDP growth.

Wow… if he can pull this off, we will eat every sour word we have written about the man. We will retract every criticism. We will withdraw every negative observation and sarcastic remark.

“No, Donald Trump is not a jackass,” we will declare… openly and with no tongue in either cheek.

“No, the president is not a scoundrel… not a brazen self-promoter… not a big-mouthed fool. We take it all back. We were mistaken. Our bad.”

But this declaration awaits its moment. And we suspect the moment is not now. Because there are reasons – both practical and structural – why real tax reform is extremely unlikely.

As we pointed out yesterday, real reform would mean dumping the present system. Not tinkering with it. Not switching winners and losers. Not cutting taxes in one place and replacing the revenue in others.

No, real reform would be dramatic. Bold. It would eliminate the loopholes, special favors, and crony giveaways.

It would cut tax collections, too; the feds don’t really need so much money to defend the country and operate the courts. Practically everything else they do is designed to reward the insiders.

And therein lies the reason why the tax system will not be fundamentally changed nor deeply cut…

If “The Donald” were to propose real reform, it would bring the whole Deep State down on his head with a ferocity never before seen in American politics.

Curious Amalgam

The tax is a curious amalgam – a blend of vote-buying… crony payoffs… subsidies… wishful thinking… social engineering… and outright corruption.

It is the bog in which the swamp critters slither.

Mr. Trump can fiddle with it – he can reward some cronies and punish others, for example. But he can’t deliver a genuinely big tax cut.

Tax revenues… and the curious way in which they are generated… are the Okefenokee of the Deep State system.

Eliminating all the juicy favors, insider plums, and Establishment subsidies is out of the question.

In a better world, the people would speak up. They would say, “We’re willing to spend 10% of our income on government, no more.”

Then their elected representatives would get out their knives. They’d check their tax revenues. And then they’d begin whittling away at their expenses until the two lined up.

The Pentagon’s “Teach Children to Waterboard” afterschool program might get the axe immediately.

“Whose idea was that?” they would ask each other, laughing.

Or maybe the DEA’s “Help Us Increase Drug Dealer Profit Margins” PR campaign would be scratched from the list.

Who knows? Maybe the “Subsidize Rich Kids’ Education” program… aka federal support for universities… might be trimmed back, too.

But that’s not going to happen.

Dull Knives

Each time the pols start to cut, their knife goes dull.

Every little whittle gets blunted by lobbyists, pressure groups, cronies, and campaign contributors.

Then the program is saved by the same principle that saves petty computer hackers.

An idiotic scheme might cost $1 billion… and could easily be eliminated. But the typical taxpayer says, “Why bother? It only costs me 5 cents.” It is not worth his while to think about it.

The politician who goes back to his district claiming to have eliminated $1 billion of spending in other districts might just as well claim to have swatted a fly. The voters won’t care.

He is much better off telling them that he brought a $1 boondoggle to his district. Every wasted dollar goes into someone’s pocket. And that someone will fight hard to keep it coming.

There is also a plain and immediate reason why a big tax cut is not possible: The feds already owe $20 trillion. Even with no cut to revenues, they’re on track for $30 trillion in 10 years.

A tax cut without corresponding cuts to spending (which aren’t going to happen) will just add more debt.

For now, there is no Republican majority that will pass a major tax cut. That will have to wait for a different moment.

When stocks crash and the economy goes into recession… it will be a whole new ballgame.

Then, in a moment of panic and desperation – whack… smack – “The Donald” may finally send the ball over the fence.

Then… spending even more money we don’t really have… on more things we don’t really need… whoopee!… we will go broke.

Regards,

Bill

Market Insight

BY CHRIS LOWE, EDITOR AT LARGE, BONNER & PARTNERS

Argentina isn’t all about cattle wrangling and ranching…

This year, the country’s stock market has been on an absolute tear.

This follows the election of pro-market and pro-business President Mauricio Macri at the end of 2015.

As you can see from today’s chart, the Merval Index (MAR), Argentina’s main stock market index, is up 25% in local currency terms.

|

That compares with a gain of just 6% for the S&P 500.

— Chris Lowe