Timing & trends

1. Marc Faber: Small investors have a huge opportunity to make money

1. Marc Faber: Small investors have a huge opportunity to make money

The bubble can last a long time, one just needs to increase the size of money printing continuously. As a result, asset prices – stocks and real estate – go up phenomenally….. The Dow Could Reach 100,000

2. Bond Bubble has Finally Reached its Apogee

by Michael Pento

The bond bubble has now reached epic proportions and its membrane has been stretched so thin that it has finally started to burst.

3. Is the World Political Economy Melting Down?

by Martin Armstrong

Many people have asked are we collapsing as did Rome? The answer is absolutely YES. Like Rome, the state always turns against its people as its need for money always expands. Like the Romans, we have lost our independence, our integrity, and our freedom.

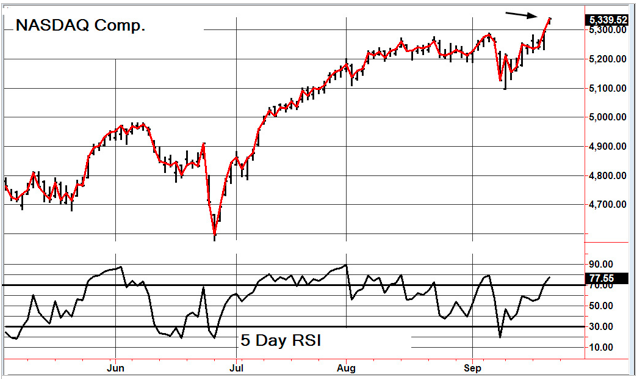

The current VIX Index (Volatility Index) chart is posted below going back to 2015.

Please note the following: The long term trend has been down with each successive peak being lower. (A lower VIX correlates with a higher stock market and a higher VIX with a lower stock market.)

The most recent peak that occurred breached the resistance line which is normally a not so good sign for later.

Yesterday (Sept. 20) the VIX closed above a long term fan line and so it will need to close below the fan line now in order for the market to get more adrenaline.

also:

The main U.S. stock market indexes gained 0.9-1.1% on Wednesday, as investors reacted to FOMCRate Decision announcement.

Stock Market Sentiment Improves Following Fed’s Rate Decision, Will The Uptrend Continue?

For Thursday September 22, 2016 3:00 P.M. PST

DOW + 99 on 1900 net advances

NASDAQ COMP + 44 on 1250 net advances

SHORT TERM TREND Bullish

INTERMEDIATE TERM TREND Bullish

STOCKS: A solid follow through to yesterday’s jump. Many analysts are wondering why the vault higher was so great.

The fact is, the market was ready to rally. We discussed this in the days leading up to the Fed decision. If the market had been overbought with a lot of call option buying on the day of the decision, the reaction would likely have been much more subdued.

GOLD: Gold rose another $9. Same story. No rate increase.

CHART: The NASDAQ Composite looks to have broken out of a congestion zone that lasted a bit over a month.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash. We’ll need a pull back.

System 8 We are in cash. Stay there.

News and fundamentals: Jobless claims came in at 252,000, less than the expected 21,000. Existing home sales were 5.33 million, less than the anticipated 5.44. On Friday we get the PMI mfg index flash.

Interesting Stuff: I would have liked to question Janet Yellen yesterday. I would have asked, “Interest rates have been near zero for almost 9 years and the economy is still too weak to raise rates? Doesn’t that mean that your policies have been an abject failure?”

TORONTO EXCHANGE: Toronto rose 86.

BONDS: Bonds were higher again.

THE REST: The dollar dropped again. Silver surged and crude oil jumped.

Bonds –Bullish as of Sept. 21.

U.S. dollar -Bullish as of August 30.

Euro — Bearish as of August 30.

Gold —-Bullish as of Sept. 21.

Silver—- Bullish as of Sept. 21.

Crude oil —- Bullish as of August 3.

Toronto Stock Exchange—- Bullish from January 22.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

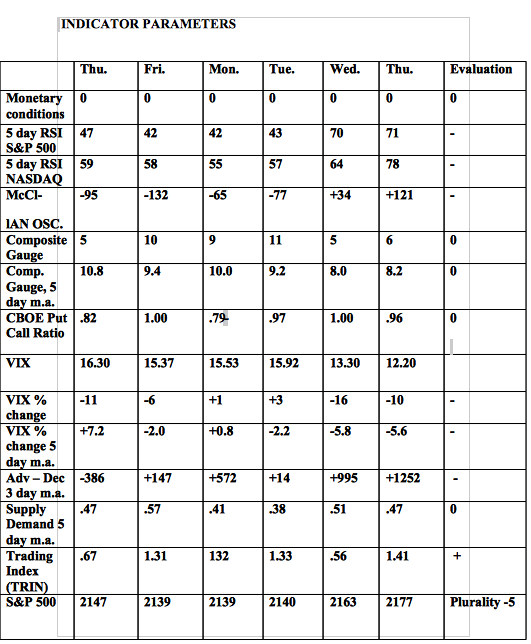

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

http://www.toddmarketforecast.com

….related:

Many people have asked are we collapsing as did Rome? The answer is absolutely YES. Like Rome, the state always turns against its people as its need for money always expands. Like the Romans, we have lost our independence, our integrity, and our freedom. The world political economy is melting down before our eyes as government constantly seeks more and more power. This desire for more power unfolds because they see that the free market is always going against them. To prevent the free market from winning, they always lash out and punish those who stand in their way. Government pretends to be benevolent, but the only tool they know is punishment.

Many people have asked are we collapsing as did Rome? The answer is absolutely YES. Like Rome, the state always turns against its people as its need for money always expands. Like the Romans, we have lost our independence, our integrity, and our freedom. The world political economy is melting down before our eyes as government constantly seeks more and more power. This desire for more power unfolds because they see that the free market is always going against them. To prevent the free market from winning, they always lash out and punish those who stand in their way. Government pretends to be benevolent, but the only tool they know is punishment.

…speaking of meltdowns:

For the last several months, I’ve been putting up with some hate mail, as I forecast a severe decline in the precious metals. Questions came into my mailbag like …

– “Don’t you see the negative interest rates in Europe, surely they are bullish for gold?”

– “Don’t you see that George Soros and other big hedge fund managers are loading up on gold? What’s with you, Larry?!”

– “China and India are still buying gold so that must be bullish, no?”

– “One well-known analyst says the dollar is going to crash on September 30 so we must buy gold now, Larry!”

Let me address the above, and more, so you have a handle on why I’ve been bearish gold and silver — and correct!

FIRST, negative interest rates are not necessarily bullish for gold. Or silver. Why? Because you cannot spend gold and silver as if it’s real money. Hardly a soul will take it except an informed buyer, and in a barter situation.

The fact of the matter is this: People are hoarding cash in physical and digital form far more than they are hoarding gold and silver. They are doing so because …

A. It’s easier to hoard cash.

B. With deflation still ravaging Europe, that cash’s purchasing power is constantly increasing.

C. It IS easier to spend cash.

And more. So in a very real sense, gold is no longer money. A store of value? Yes, but only when governments’ backs are up against the wall. And that time is coming. But for now, gold and silver are simply commodities.

SECOND, don’t you see that George Soros and other big hedge fund managers are loading up on gold? What’s with you, Larry?! Sure I do, and I also saw them get KILLED when gold topped in September 2011 and they held on to their gold and incurred losses of 50% and more.

Just because they manage big money doesn’t mean they can’t get a trade wrong sometimes. In fact, they get them wrong far more often than you would imagine.

THIRD, China and India are still buying gold so that must be bullish, no? Yes, they are still buying, but so what?! Neither country has any intention of implementing a gold standard. They are simply diversifying their reserves a bit, just like you should be doing with your savings.

FOURTH, one well-known analyst says the dollar is going to crash on September 30 so we must buy gold now, Larry!

This one is total, unadulterated BS. This analyst has been wrong forever on the dollar and doesn’t have a clue how the world’s monetary system works or the global economy.

His theory is that the International Monetary Fund (IMF) is going to officially add the Chinese yuan to the IMF’s composition of its Special Depository Receipts, or SDRs, on September 30 and therefore, the dollar will crash.

Give me a break!

A. The yuan was approved by the IMF for inclusion in the SDRs a year ago. That means the dollar market has already had a year to digest it. And what has the dollar done since then? Appreciated against the Chinese yuan.

B. The yuan only accounts for about 4% of all of foreign exchange (forex) transactions today, which are well over $5 trillion a day. Meanwhile, the U.S. dollar accounts for as much as 85% of daily forex turnover.

How could the yuan even make a scratch in the dollar?

C. The yuan doesn’t have the liquidity or the market depth to dethrone the dollar. There are still capital controls in China on how much yuan can leave the country and it’s still largely a closed system.

C. The yuan doesn’t have the liquidity or the market depth to dethrone the dollar. There are still capital controls in China on how much yuan can leave the country and it’s still largely a closed system.

For instance, I have about $500 worth of yuan I forgot to change back to dollars the last time I was in China. I can change them to dollars in Southeast Asia, but due to a lack of liquidity, it will cost me as much as 20%.

And in the U.S? Forget it. Try converting yuan to dollars or vice versa. If you’re lucky, you might be able to do so at JFK, LAX or Chicago — but it will cost you a fortune.

D. Did this analyst even consider the fact that there’s plenty of legal and illegal Chinese money that wants to leave China, for diversification and whatever reason?

From what I can tell, no, he hasn’t. And that’s a big, biased mistake because there’s hundreds of billions of wealthy Chinese money that also wants to go abroad to invest, and mainly in the U.S. — buying businesses and real estate.

Bottom line: The U.S. dollar is NOT headed for any type of crash. To the contrary, my models show the dollar getting much stronger going forward — regardless of who takes the White House come November.

Why? Largely because Europe and the Middle East are such a mess. Anyone with any decent money would want to put it to work in the U.S., which means demand for dollars will continue to rise, even amongst the Chinese and Southeast Asians.

There really is no alternative at this time.

However, as I have also long maintained, the U.S. dollar cannot be the largely sole global reserve currency and the world’s reserve currency must change to a basket of currencies that is far more fair to the G-20.

That change will come by 2020, and it will involve the IMF or the World Bank. The new world reserve currency will be a composition of currencies of the G-20, it will be solely in electronic form, and it will be tied to a floating basket of commodity values.

That way, it will be not only transparent and fair but also subject to free market forces.

And by the time that transition comes, there may be some turmoil in the forex markets, but even then, the dollar will not crash.

Bottom line: Don’t fall for all the fear-mongering on the dollar. It’s coming from either inept analysts or fear-mongers trying to pick your pockets.

Lastly, keep your eyes on gold and silver now. Cycles still point lower into early October, they point higher for the dollar, and lower for stocks.

October is merely two weeks away, so stay very tuned in. My Real Wealth Report subscribers and trading service members are now starting to get very active with specific buy and sell signals for terrific profit opportunities.

Stay tuned and stay safe!

Best wishes,

Larry