Timing & trends

1. The Capital Flood & All-Time Stock Market Highs

1. The Capital Flood & All-Time Stock Market Highs

by Michael Campbell:

A failed Turkish coup, Italian Banking crisis, Brexit surprise, bloody terrorist attacks & negative interest rates destabilizing Governments has money flooding from Europe seeking safety and some kind of a return. North American assets are the best looking nag in the glue factory and the torrent shoots Stocks to all-time highs. Meanwhile the big trigger looms….

2. “These are the danger signals and they are flashing now.”

Excerpts from this year’s (John) Templeton Prize recipient. A succinct and fantastic summation of WHY the West is in such decline and maybe, just maybe, how it might be great once again.

…..continue reading or listening HERE

3. The Terrifying $2 Quadrillion Monster Is Now Totally Out Of Control

The man who has become legendary for his predictions on QE, historic moves in currencies, and major global events, warns “The central banks are leading the world into a black hole and have no idea what a disaster they have created”

The entire global financial system is in jeopardy because citizens do not hold their political leaders to account. For the longest time, when the facts were uncomfortable societal leaders avoided them and citizens just shrugged and went along. Dangerously, that is a strategy that no longer works.

Michael lays out a good example where Politicians are going to do something to the CPP that will hurt a lot of people: Time For Concern

With the world in crisis, my email inbox is flooded. Especially so, since over four years ago, I forecast a period of rising domestic and international geopolitical tension, violence and even war.

With the world in crisis, my email inbox is flooded. Especially so, since over four years ago, I forecast a period of rising domestic and international geopolitical tension, violence and even war.

At the time, almost no one believed me. They even laughed. I even told them the Federal Reserve and other central banks would be meaningless going forward. As would interest rates. Everybody — and I mean everybody — thought I was nuts.

Even more so, when I told everyone that the geopolitical tensions would end up sending the Dow Industrials to new record highs near 31,000.

Well now, no one is laughing. To the contrary. The world, including the U.S., is crying. And now, everyone is asking me, “What the heck is going on?”

It’s not like I didn’t warn you. I warned you repeatedly starting in 2013 that the world would be breaking apart at the seams. That there would be new wars and new terrorist groups in the Middle East. And that the European Union would start to break apart like an eggshell.

And that, yes, major protests and divisiveness would even come to our own country.

What is this phenomenon that is driving such divisiveness in today’s world?

It’s the accumulation of deficit spending, poor corporate governance, poor political leadership, ignorance and more from the leaders of the world.

It’s all coming to a head through the cycles of war that I have previously written about. Those cycles do not crest until late 2020/early 2021.

Between now and then, you can expect more of what you have recently seen. More terrorist attacks in Europe and the United States. More domestic unrest on both continents. More political unrest. And ultimately, the entire collapse of the European Union.

The U.S. will fare better. It will have its terrorist attacks and its domestic unrest. And to be sure, a whole new set of crazy, insane leaders ignorant of history and how these things work.

But of all the places in the world, we will still be the prettiest, and capital will be attracted to our markets, especially the stock market.

So in the months and years ahead, when you see the world falling apart around you, don’t automatically assume the dollar will crash and so will the U.S stock market.

No. As bad as it will get here, from the rest of the world’s perspective, the U.S. will still be an island of safety for capital.

Get used to it. It will change everything you know. It will change everything you thought about economics. It will change everything you thought you knew about investing.

Accept it and you will protect and grow your money like never before. Ignore it and you will lose almost everything.

Best wishes and stay safe,

Larry

related:

For an example of how far we’ve fallen from the old days of free-range First World entitlement, consider the fact that investment analysts are now judging companies by how well they cater to the needs of the terrified:

Papa John’s upgraded on belief civil unrest is encouraging more pizza delivery

(MarketWatch) – Papa John’s International Inc. was upgraded to overweight from sector weight at KeyBanc Capital Markets with analysts expressing the surprising view that diners, concerned about political and civil unrest, are choosing to stay home for pizza delivery rather than head out for a meal.

“After speaking with several large operators and industry contacts, we believe the recent decline in casual dining restaurant segment fundamentals — traffic down 3% to 5% the past several weeks — may be the result of consumers eating more at home amid the current political/social backdrop, which we believe could last through the November election,” KeyBanc analysts wrote in a note published Tuesday.

Diners’ shift to a preference for convenience will benefit pizza delivery businesses like Papa John’s, according to KeyBanc.

Papa John’s shares, which jumped 3.8% Wednesday, are up 23.0% over the past three months. The S&P 500 is up 2.9% for the last three months.

This kind of mirco-fear is, not surprisingly, reflected in macro trends like defense stocks, which are now analyst favorites:

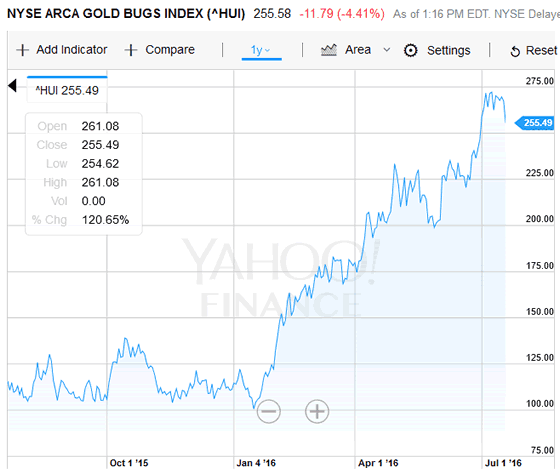

And of course gold and silver are always key parts of the chaos story. If we can’t trust the big systems to function safely or efficiently, and the biggest systems of all are fiat currency and fractional reserve banking, then opting out of paper money begins to make sense. Hence the monster run in precious metals miners during the first half of the year:

This breakdown of global civilization seems to baffle mainstream economists, leading to more or less random predictions:

IMF Called “Clowns” After Admitting They Fabricated Brexit Doom And Gloom

(Zero Hedge) – “The IMF has serious credibility problems. It has been seriously wrong for years. I hope that one of the things that the new government does is push to have some credible people running this institution… rather than the clowns currently running it,” exclaimed UKIP MP Douglas Carswell, pointing out Lagarde’s legion of fools flip-flop that the British economy will grow faster than Germany and France in the next two years – only weeks after its doom-laden warnings about Brexit.

As The Daily Mail reports, after saying that leaving the European Union could trigger a UK recession, the International Monetary Fund now expects the British economy to grow by 1.7 per cent this year and 1.3 per cent next year.

That is weaker than the 1.9 and 2.2 per cent growth forecasts before the referendum, but the UK is still set to be the second-fastest growing economy in the Group of Seven industrialised nations this year – behind the United States – and third-fastest next year, behind the US and Canada.

Of course, this is not the first time The IMF has unleashed comedic genius on the world…

But the new UK forecasts represent a climbdown for the global financial watchdog after it issued a string of doom-laden warnings over the damage Brexit would do.

Ahead of the referendum, IMF managing director Christine Lagarde, an ally of former chancellor George Osborne, said Brexit would be ‘pretty bad, to very, very bad’ for the UK.

But the latest forecasts – and an admission that a recession is now unlikely – suggest the outlook is not as bleak as the watchdog claimed.

And again, as The Mail notes, it is not the first time the IMF has had to row back from damaging comments about the UK economy. In April 2013, the fund’s then chief economist Olivier Blanchard said Britain was ‘playing with fire’ by pressing ahead with austerity at a time of ‘very low growth’. But the IMF was quickly forced into a dramatic volte face as the UK economy sprang into life, forcing Mrs Lagarde to admit ‘we got it wrong’.

The IMF’s new chief economist Maury Obstfeld said yesterday there were ‘promising signs’ for the global economy in the first half of 2016, but added: ‘Brexit has thrown a spanner in the works.’

And finally, here’s a short excerpt from a longer, must-read article titled The world is taking its revenge against elites. When will America’s wake up? by Thomas Frank, whose provocative work has been, um, discussed on DollarCollapse.com for many years.

The world of accepted ideas was coming apart, and no one caught the new mood better than the New York Times’s David Brooks, a man who has spent his career describing the inner lives of the nation’s prosperous white-collar elite. Ordinarily a dealer in witty aphorisms and upper-crust humor, Brooks now wrote a column entitled “Are We On the Path to National Ruin?” in which he speculated darkly about the possibility of fascism in America. “The crack of some abyss opened up for a moment by the end of last week,” he wrote. “It’s very easy to see this country on a nightmare trajectory.”

Brooks-in-despair is a pitiful sight, and one can’t help but sympathize. But what’s really remarkable about the response to these shocks of people like him has been their inability to acknowledge that their own satisfied white-collar class might be part of the problem. On this they are utterly in denial and whatever the disaster, the answer they give is always … more of the same. More “innovation”. More venture capital. More sharp young global Stanford entrepreneurs. There is no problem that more people like they themselves can’t solve.

It’s easy to see the problems presented by a cliquish elite when they happen elsewhere. In the countries of Old Europe, maybe, powerful politicians sell out grotesquely to Goldman Sachs; but when an idealistic American president announces that he wants to seek a career in venture capital, we have trouble saying much of anything. In Britain, maybe, they have an “establishment”; but what we have in America, we think, are talented people who deserve to be on top. One wonders what kind of a shock it will take to shake us out of this meritocratic complacency once and for all.

It’s important to understand that all of this, while seemingly coming out of left field for mainstream economists and politicians, was completely predictable for both Austrian School economists (who focus on a society’s balance sheet rather than irrelevancies like money supply or aggregate demand, and correctly see rising leverage as a sign of trouble) and pretty much anyone else with simple common sense.

It’s actually fairly simple: When you borrow too much money your life spins out of control. Individuals, families, and societies all live under the same set of economic laws, and suffer similar penalties for violating them.

The fact that this bit of kitchen-table wisdom is not apparent to the people in charge just reinforces the impression that they’re completely clueless, which in turn elevates the fear that the average person experiences when police are systematically killed and random assemblages are attacked with weapons ranging from assault rifles to tractor/trailers to axes. Or when interest rates fall to the point that retirement savings earn literally nothing while assets with unacceptable levels of risk (junk bonds, growth stocks, leveraged ETFs) are making fortunes for speculators.

Since the process of hyper-leveraging the world is shifting into an even higher gear as this is written, expect the mainstream to be surprised again – and regular people to even more terrified — by the result. Which means our future will include even more gold, missiles and pizza.

related:

Don’t miss Michael’s Mid-Week Update: The Capital Flood & All-Time Stock Market Highs

Yesterday, I discussed the importance of risk management and reviewed the 15-rules that drive my portfolio management discipline. I needed to lay that groundwork for today’s discussion of why those rules need to be implemented right now.

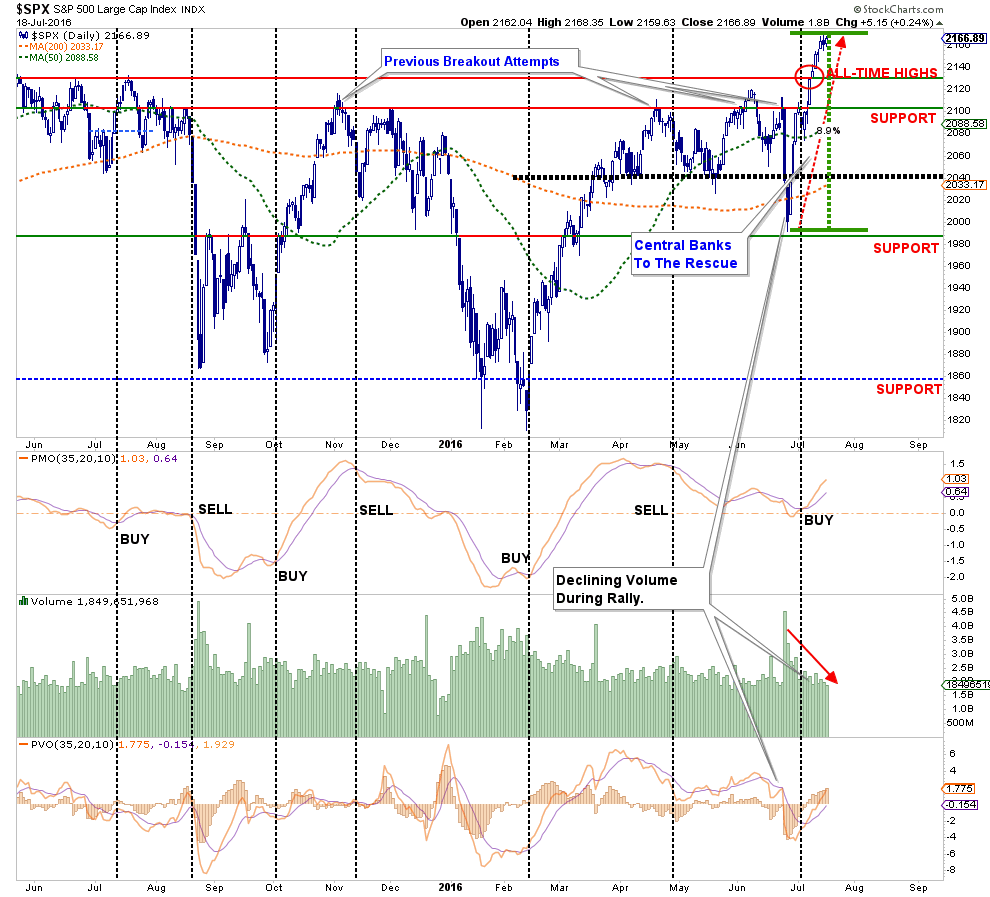

As shown in the chart below, the market has currently surged nearly 9% from the “Brexit” fear lows driven by a massive increase in Central Bank interventions.

The problem, as I have pointed out previously, continues to be that while prices are increasing, that increase in price is coming at the expense of declining volume. While volume is not a great timing indicator for trading purposes, it does provide insight to the “conviction” of participants to the advance of the market.

But do not be mistaken about the importance of the drivers behind the advance. As Doug Kass recently penned:

….continue reading and view larger charts HERE

also:

Don’t miss Michael Campbell’s Daily Comment – Time For Concern