Timing & trends

Defying sentiment polls leading up to last week’s historic Brexit referendum, British voters said “thanks, but no thanks” to excessive EU taxation and regulation, choosing to take back Britain’s sovereignty in financing, budgeting, immigration policy and other areas essential to a nation’s self-identity. It was a momentous victory for the “leave” camp, led by former London mayor Boris Johnson and U.K. Independence Party leader Nigel Farage, who invoked the 1990s sci-fi action film “Independence Day” by declaring June 23 “our independence day” from foreign rule.

As I’ve been saying the last couple of weeks, British citizens and businesses have grown fed up with an avalanche of failed socialist rules and regulations from Brussels, responsible for bringing growth and innovation to a grinding halt. Even if the referendum had gone the other way, it should still have served as a wake-up call to the European Union’s unelected bureaucratic dictators. Euroscepticism and populist movements are gathering momentum in EU countries from Italy to France to Sweden, and the week before last, fiercely independent Switzerland, which voted against joining the EU in the 1990s, finally yanked its membership application for good.

American voters should be paying attention. Many have already pointed out the parallels between the Brexit movement and Donald Trump’s populist campaign for president. This connection was not lost on Trump, who tweeted early Friday morning: “They took their country back, just like we will take America back.”

Britain’s decision to leave exposes the fragility of trade right now and mounting apprehension toward globalization. The EU is mired in tepid growth, and the blame cannot be pinned on immigrants, as some have tried to do. Instead, Brussels’ policies are anti-growth. Moore’s Law says the number of transistors in a microchip doubles every two years. That’s just a fact. American entrepreneurs embrace and indeed push the limits of technological innovation, but “Eurocrats,” to a large extent, seem to be in open opposition to it. This is why many large, successful American tech firms such as Facebook and Google are treated with such hostility in Europe. The bureaucrats are so against growth and prosperity, it wouldn’t surprise me if they tried to do away with Moore’s Law.

A Legendary Day for Gold

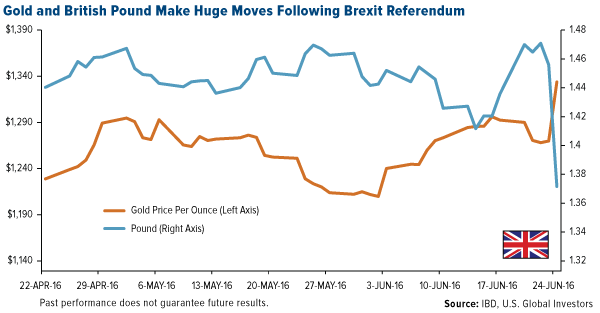

Immediately after results were announced, the British pound sterling, one of the world’s reserve currencies, collapsed spectacularly against the dollar, plunging to levels not seen since Margaret Thatcher’s administration. The euro, the world’s only fiat currency without a country, fell more than 2 percent.

Gold, meanwhile, screamed past $1,300 an ounce to hit a two-year high, proving again that the yellow metal is sound money and fervently sought by investors worldwide as a safe haven during times of economic and political uncertainty.

Uncertainty is indeed the order of the day. As the World Gold Council (WGC) put it on Friday, “It is difficult to find an event to compare this to.” Trading blocs have fractured before, but none as large and significant as the EU. As the world’s fourth most liquid currency, gold saw massive trading volumes. At the Shanghai Gold Exchange, an all-time record amount of gold was traded following the Brexit—the equivalent of 143 tonnes in all.

“We expect to see strong and sustained inflows into the gold market, driven by the intense market uncertainty that now faces the global markets,” the WGC wrote.

The Brexit lifted not just bullion but gold stocks as well, with many of them climbing to fresh highs. Shares of Barrick Gold shot up 10 percent in early-morning trading while Yamana Gold and Newmont Mining both saw gains of over 8 percent.

I’ve always advocated a 10 percent weighting in gold—5 percent in physical gold, 5 percent in gold stocks—with rebalancing done on a quarterly basis. Gold is now up at least one standard deviation for the 60-day period, meaning now might be a good time to take some profits and rebalance. It’s been a spectacular six months!

Learn how you can take advantage of rising gold equities.

So What Happens Now?

As I said, global growth is unstable, especially in the EU, and the Brexit will only add to the instability. This will likely continue to be the case in the short and intermediate terms as markets digest the implications of the U.K.’s historic exit.

It should be noted that the country will remain a member of the EU for two more years, during which time the nature of the relationship following the official divorce can be negotiated. These negotiations will take place without David Cameron, who unexpectedly announced early Friday morning that he was stepping down as prime minister.

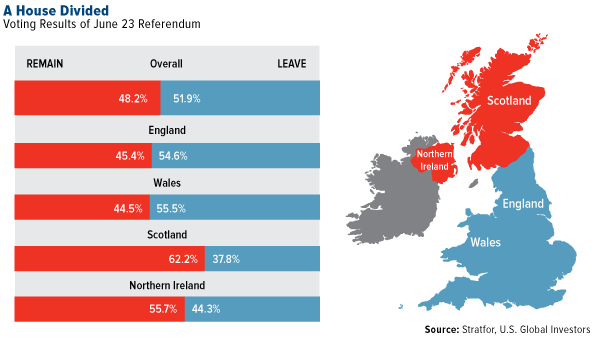

The results of the referendum also call into question the unity of the kingdom itself. England and Wales both voted to leave the European bloc while Scotland and Northern Ireland were aligned in their desire to remain members.

|

|

Reacting to the outcome, Nicola Sturgeon, the First Minister of Scotland and leader of the Scottish National Party, said the people of Scotland see their future “as part of the European Union.” A second attempt at pulling out of the U.K., then, seems likely. In September 2014, you might remember, a referendum to quit the United Kingdom failed. Northern Ireland will become the only part of the U.K. to share a land border with an EU country (the Republic of Ireland), and it’s unclear at the moment whether a physical border, complete with passport control checks, will need to be erected.

In the meantime, it’s important to “keep calm and invest on.” We should expect volatility in the short term, but the global selloff might be a good opportunity to nibble at stocks that could rally once the initial shock has subsided.

For investors looking to minimize the volatility, short-term, tax-free municipal bonds continue to be attractive on global negative interest rates and falling currencies. Muni bond funds have seen inflows of more than $30 billion this year alone, with the week ended June 22 seeing the highest inflows in over three years at $1.4 billion.

related:

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2016: Barrick Gold Corp., Yamana Gold Inc.

Signs of The Times

“The ‘Toxic Sludge’ Of The Investing World Is Back”

“Investors, Prepare Your Radiation Suits And Bio Hazard Gloves”

– Business Day. June 16.

“Toxic Sludge” means Subprime Mortgage-Backed Securities.

“Switzerland Withdraws Application To Join EU: Only ‘Lunatics Want To Join Now'”

– Zero Hedge, June 17.

“Queen asks guests to give her three reasons why Britain should remain in Europe”

– The Telegraph, June 21.

“Visium’s flagship fund was down 9.3% this year through May, while its competitors were up 0.2%.”

– Business Insider, June 18.

“Why We Can Expect Cripplingly Higher Oil Prices In The Near Future”

– OilPrice.com, June 20.

“Pimco Is Out With an Urgent Warning On US Commercial Real Estate”

– Business Insider, June 20.

Perspective

At one time, the term “cross currents” referred to the tidal transition from an expansion to a contraction. It was unsettling to the establishment. In economic jargon of the day, policymakers were “not rocking the boat” in attempting “to keep the recovery going”. All the while, of course “fighting inflation”.

You had to be there.

Now they are rocking the boats while trying to boost inflation because that will prompt a business expansion.

Weird!

Recently, Jeffery Grundlach commented that “Central banks are losing control”.

Veteran traders have always considered that central bankers have had little control over financial destiny. Cyclical changes in the yield curve and credit spreads occur regularly. Despite the best efforts of central bankers to prevent the change.

Now, cross currents in the credit markets are setting up a tidal change that again could be devastating. With this, the general public will finally realize that interventionist policymaking is a stupid waste of money.

Stock Markets

Reasonably good momentum was accomplished going into May. The limiter, so far, has been some key moving averages. On the positive side, there has been the “all-onemarket” thing. Crude up and dollar down makes the Fed feel good. Also helps the stock market.

The ChartWorks “Election Year Model” for this year, called for a correction focused upon June followed by a brief rally. This would be into a “Rolling Top”. The big “Rounded Peak” was accomplished last summer.

Crude oil soared to 51.71 two weeks ago when a correction began.

The DX set its low at 93.29 at the same time and has been stabilizing.

Both seem to be setting up for change.

In a punishingly volatile world, our objective is to look for change. This contrasts with policymakers who in pushing for constant growth, have exaggerated natural instability. In trying to prevent setbacks a massive positive feedback has been imposed. Negative feedback is always there to correct excess.

Usually discovered in the fall of the year.

As we have noted, central bankers are to financial markets as tornados are to trailer courts.

It is time to review some leading indicators.

Going into last year’s peak, the Transports provided the warning and in May it was that the bull market was over.

On this year’s outstanding rebound, the Trans have not confirmed the highs for the DJIA.

While the senior indexes are not quite as high as reached last year, the decline in real earnings takes the latest valuations to the moon.

Banks (XBD) led at the highs in 2007 and were coincidental in last year’s high.

On this index, the 50-Week ma has guided the play.

After providing support on the way up, it was taken out in July 2007. We used this as guidance and the equivalent take out occurred in August 2015.

And then there has been the second significant rally in the bear, which was turned back by the 50-Day in September 2008.

This has been used for this year’s rebound out of trashed conditions in January. The rally could make it to the 50-Week and that would limit the move.

The high for BKX was right at the 50-Week at 71 in April. In the middle of May it reached 71.53, which was little above the declining moving average. The subsequent low in June was below the May low, which makes the financial sector rather precarious.

For the Transports, the 50-Week provided support from 2010 to 2015. And it has been limiting the rebounds on the way down. As with the banks, TRAN has taken out the May low.

Poor action in leading sectors is not good for the rest of the market. The senior indexes have been inflated by financial engineering as well as by central bank buying.

Representing the broad market, the action in the NYA has been guided by the 65-Day ma. The failure in 2002, 2008 and in 2015 was marked by taking out the key moving average.

On the two previous bears, the second rebound was significant and turned back by the 65- Week ma. These were clocked in March 2002 and May 2008. On this one, the second rebound made it to the moving average in late April and the NYA has been trading above and below the declining moving average since.

The rebound high was 10468 in early June. At 10490 now, the May low was 10120. This level is both compelling and critical.

Now, what could turn it down?

A firmer dollar, weaker commodities, widening spreads and the resumption of curve flattening.

As with previous tidal changes, no alteration in Fed policy is needed.

Currencies

Brexit, Brexit, Brexit!

In two World Wars, England expended considerable blood and treasure in defeating European experiments in authoritarian government. With incredible irony, European authoritarians are taking over England. Albeit with less violence than when “William the Bastard” imposed feudalism in 1066.

The dollar is still building for a rally and once past the referendum it should turn up. We could change the above Swiss headline to “Only lunatics would want to stay in”.

Stock Market and Earnings

- Since January, stocks up and earnings down.

- Unusual.

- For how long can the divergence run?

Hong Kong House Prices

- The high was in August at 143.46.

- The March number at 125.42 was posted in June.

- The decline is now more impressive that the one in 2008.

“We’ve Defeated the Shale Revolution”

- Fracking is the technological revolution for crude.

- In the early 1900s, miners learned how to produce from low-grade copper porphyry deposits.

- In the 1960s and 1970s it was lower-grade Carlin gold and gold leaching.

- Technological improvements in oil production will continue.

- The headline is from The Times of June 19.

Listen to the Bob Hoye Podcast every Friday afternoon at TalkDigitalNetwork.com

also Bob Hoye with Michael Campbell in a 17 minute interview post the Brexit vote results:

It Was Incredible, Extraordinary, How To Take Advantage of Exciting Currency Volatility

Below is our daily list of the twenty best and twenty worst performing ETFs over the last five trading days. While most assets that took a hit over the last few sessions bounced, on a 5-day look back European ETFs continue to hurt, filling up the majority of our worst performer list. Banks and Capital Markets were the only non- regional/country based exposure or exchange to rank among the worst performers. As in prior days, gold and US treasuries and bonds were the winners, though gains were reversed to some degree on a one-day basis.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. Click here for a no-obligation free trial

related:

Traders need to be careful for the rest of the week. In a natural market the daily cycle should still have further to fall and after a bounce there should be one more leg down. But as I have warned over and over, we no longer have free markets. We have not had free markets since the SEC banned short sales on financials back in 2008. So it’s entirely possible the PPT intervened today and that’s all we are going to get for an intermediate cycle low.

This is why I don’t short stocks. You are fighting an opponent that has a printing press.

If support at 2040 is recovered tomorrow I would be inclined to assume the rest of the intermediate cycle decline has been prematurely aborted and go back into leveraged funds for the next leg up in this new 7 year cycle.

http://blog.smartmoneytrackerpremium.com/

related:

Brexit (or British Exit) is now a reality. Overnight, the UK voted to leave the European Union (EU). Final vote counts were 51.9% for the Leave camp and 48.1% for the Remain camp. Going into the vote, markets were betting on Remain, giving only a 25% chance to Brexit, but were proven wrong by voters. The anti-establishment movement as seen in other parts of the world continues. This unexpected and surprising outcome now creates much more uncertainly for the UK and the European region, although the UK does have two years to renegotiate trade deals.

Brexit is another example of a market tail-risk event, meaning it was a low probability event, but the possibility of such an outcome is real. In reaction, global markets are down this morning, with European markets being hit the hardest. Major European markets were lower by 6%-8%. TSX is off -1.5% and the S&P 500 is down -3%. The Nikkei was down -8%. The British Pound is down -8% against the U.S. Dollar, currently at 1.3621. It could trade down to 1.15-1.20, another 15% lower. We can expect more volatility and potential downside in the short term.

On the other hand, Gold is up 5%. The U.S. Dollar and Yen are rallying as safe haven currencies. The CAD is down -1.3% against the U.S. Dollar, trading at $0.7735.

The chance of a U.S. Fed rate hike has been pushed out as well. Futures predicting a zero chance out until Nov. 2016 and only a 13% chance in December 2016.

Neil’s Thoughts:

- Short term down draft in equity markets worldwide but inconsequential noise outside of Europe over the mid/long term. It justifies our large underweight in European equities.

- Positive for Gold which the model portfolios are overweight in.

- Positive for the U.S. Dollar and to a lesser extent the CAD. This is very good for our models.

- Positive for North American equities short/mid/longer term. This is very good for our models.

- Generally negative for European equities.

- Positive for the Pound Sterling vs the Euro in the long run.

- May result in a technical recession in Britain in the short term.

- Highly negative for the Euro as all the uncertainty is now on the Euro (the Pound’s future is known).

- Credit markets will not like this, but likely this will be short-term noise.

- Validates Trump politically to certain extent and increases the likelihood of continued anti-establishment political outcomes and a potential Trump victory.

Rest assured that your portfolios are well diversified and positioned to handle this Brexit outcome. Months ago we repositioned all our model portfolios with this risk in mind. This event proves the value of efficient diversification.

We’re always looking out for your best interest.