Timing & trends

Ed Note: the results will be approximately 11pm PST thursday night.

Ed Note: the results will be approximately 11pm PST thursday night.

Betfair says £40.5 million has so far been chanced on the result of the referendum to make it the biggest political betting event in British history.

Bookmakers said the frenzy of excitement over the looming vote has prompted some people to place bets for the first time. Which means it may be of more than passing significance that bookies are now saying they are very confident of a Remain vote and may even make the In camp still stronger favourites in the final run-up to the vote.

related:

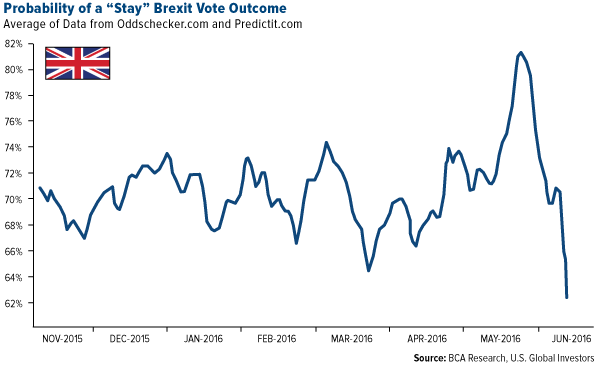

I want to continue the Brexit conversation from last week. With only three days left before U.K. voters head to the polls, expectations of which side might win are beginning to shift toward the “Brexiteers,” while betting markets are still putting money on the “stay” campaign. However, the probability of victory for those who favor keeping their European Union membership has weakened rather remarkably in the last month, falling from over 80 percent in mid-May to around 62 percent today, according to BCA Research.

One of the main grievances is the burden of EU regulations, which are decided by unelected officials in Brussels with little to no cost-benefit analysis. These rules, which regulate everything from the number of hours someone can work (48 hours) to vacuum cleaner power, ultimately stifle growth and innovation.

Consider the so-called FANG stocks—Facebook, Amazon, Netflix and Google. These four tech behemoths, not to mention Apple, rank among the most disruptive, transformative companies the world has ever seen. They also happen to be American. Nothing like them exists in Europe—or, for that matter, anywhere else across the globe.

|

When’s the last time a major scientific or technological breakthrough was made in France? In Germany? Where’s Europe’s answer to Silicon Valley?

It’s not that these countries lack capable thinkers and entrepreneurs. Far from it. Europe was once at the center of everything, from science to music to business. But now that Piketty-style “envy economics” reign supreme in the EU, innovation has increasingly shifted west toward the U.S.

And it doesn’t end there. EU officials continually try to make demands on how these companies conduct their business, whether that be regulating Amazon and Netflix’s original streaming content or suing Facebook over privacy issues.

These are among the questions and concerns Brexiteers and Eurosceptics are bringing to the fore. And no matter the referendum’s outcome, they’re not likely to go away any time soon. In fact, this could very well be the beginning and should serve as a wakeup call to EU policymakers. Just as American colonists protested taxation without representation over 240 years by dumping an entire shipment of English tea into Boston Harbor, many Brits today are staging their own taxpayers’ revolt by demanding control over their own economy, budgeting, immigration policies and more.

This is more broadly a debate over common law (the U.K.) and civil law (the Continent). Under common law, there’s greater protection of wealth and intellectual property. You’re presumed innocent until proven guilty. Why are real estate prices higher in London, New York City and Hong Kong than in Rome, Paris and Berlin? Common law.

Also at issue is the EU’s immigration and open borders policy, which has brought more than 600,000 asylum seekers into the U.K. in recent years.

I invite you to watch Brexit: The Movie, a Hollywood-caliber documentary that details many of the arguments in favor of the U.K. leaving the EU. When London financial markets were deregulated in the 1980s under Prime Minister Margaret Thatcher, it led to what is known as the “Big Bang,” named for the skyrocketing growth in market activity, and the same could very well happen to the U.K.’s economy post-Brexi.

The High Cost of Indirect Taxation

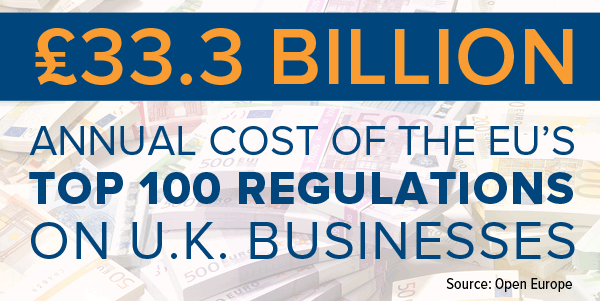

The U.K.’s EU club membership, so to speak, varies year-to-year, but it averages between 8 and 10 billion pounds—the equivalent of $11 billion and $14 billion—making the kingdom the third largest net contributor after Germany and France. But the costs don’t stop there. Towering above the contribution to the EU’s budget are costs associated with the bloc’s endless regulations—what I refer to as indirect taxation.

According to Open Europe, a nonpartisan European policy think tank, the top 100 most expensive EU regulations set the U.K. back an annual 33.3 billion pounds, equivalent to $49 billion. This amount exceeds what the U.K. Treasury collects in Council Tax (a tax on domestic property) on an annual basis.

And remember, that’s just the top 100. The “acquis communautaire,” the EU’s body of rules, directives and regulations, is a mammoth 170,000 pages long. Among the costliest regulations are the Renewable Energy Strategy (4.7 billion pounds a year), the Working Time Directive (4.2 billion a year) and the EU Climate and Energy Package (3.4 billion a year).

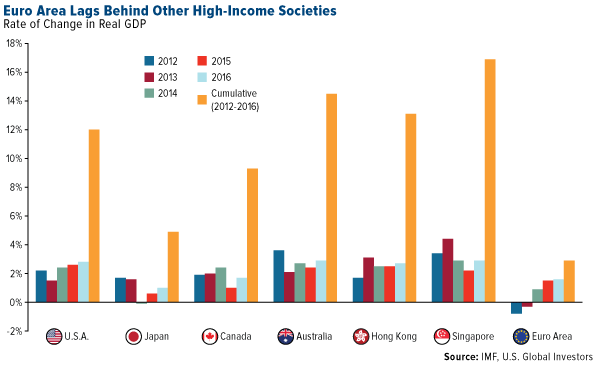

Tim Congdon, a prominent British economist and businessman, shows that such regulations—again, passed by unelected officials, similar to agencies here in the U.S.—have been a significant detriment to EU growth. Writing for the pro-leave group Economists for Brexit, he states: “It is obvious that the economies of EU member states are falling behind those of other high-income countries, falling behind consistently, and by a significant amount. Too much regulation must be the main explanation.”

Of course, these rules won’t disappear overnight if the U.K. chooses to leave. But it would be a step in the right direction toward repatriating a level of autonomy over the country’s own laws.

In the meantime, investors are bracing for the referendum with gold, which has rallied 7 percent this month, breaking above $1,300 an ounce . The yellow metal has historically been favored as a “safe haven” investment during times of political and economic uncertainty. Read my latest gold commentary on Forbes.

And with interest rates at near-zero or negative levels, droves of European fixed-income investors are abandoning government debt for American municipal bonds. The German 10-year government bond yield fell to subzero levels last week for the first time ever, spurring additional European flight into munis, which still offer attractive yields, relatively low volatility and diversification benefits.

Explore the $3.7 trillion muni market!

Let’s Not Forget to Clean House Here in the U.S.

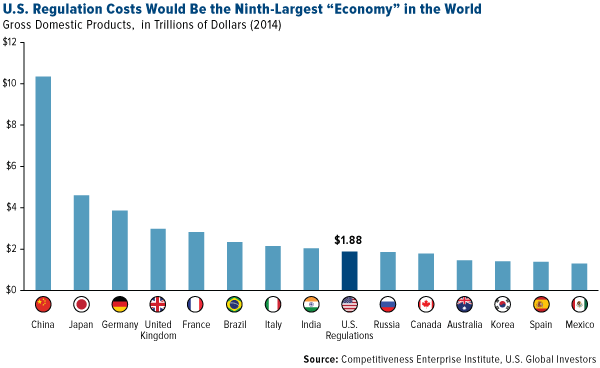

The EU is hardly the world’s only offender when it comes to passing onerous regulations. The U.S. government continues to add to the already-bloated Federal Registry, which now stands at 80,260 pages as of the end of 2015. That year, federal regulations cost U.S. businesses a staggering $1.885 trillion, or $15,000 per household, according to the Competitiveness Enterprise Institute (CEI). If U.S. regulations were its own economy, in fact, they would be the world’s ninth largest, sandwiched in between India and Russia.

This is something our next president will have no choice but to address. 2015 was a record year for adding new regulations. We can’t continue going down this path. The problem is that I haven’t seen either Donald Trump or Hillary Clinton make a serious commitment to streamlining rules and laws that affect businesses, especially small to medium-size businesses. According to a 2015 National Small Business Association (NSBA) survey, “regulatory burdens” was near the top of the list of challenges small business owners said threatened growth and the survival of their companies. I’m convinced that the candidate with the strongest economic and deregulatory plan has the best chance at winning the election in November.

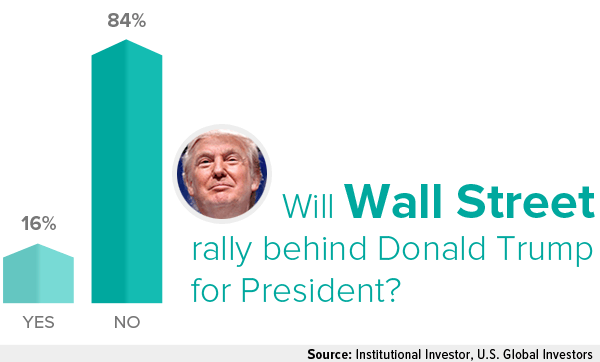

For whatever it’s worth, though, a poll in Institutional Investor found that large-scale investors appear to favor Clinton for president right now by a pretty wide margin. When asked if Wall Street will rally behind Trump, a whopping 84 percent said no.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2016: Apple Inc.

Diversification does not protect an investor from market risks and does not assure a profit.

related:

The Brexit vote is this Thursday, so nothing else matters until then. And polls, just to make it even more stressful, have it neck and neck. See Brexit poll tracker back to even at 44-44.

The Brexit vote is this Thursday, so nothing else matters until then. And polls, just to make it even more stressful, have it neck and neck. See Brexit poll tracker back to even at 44-44.

While we’re waiting, let’s consider some related questions:

Would leaving the EU be good or bad for Britain in the short run? A lot of definite-sounding opinion is being tossed around on this count — see ‘Negative and substantial’ impact on UK if it leaves EU: IMF — but it’s important to take such things with a grain of salt. No one has the slightest idea how such a divorce would go and if its immediate impact would be positive or negative.

Government agencies in particular view official statements as a tool for herding the masses in the proper direction. But they demonstrably suck at actual prediction. Go back through the history of Fed or IMF or ECB or Congressional Budget Office reports — here’s classic Bernanke on the previous decade’s housing bubble — and you’ll see that their predictions aren’t even random: Because their purpose is to shape public opinion rather than express truth, they’re right even less than half the time. So question number one can only be answered with a shrug and a “who knows?”

Would Brexit be a big deal in the long run? Here it’s easier to speculate, because market forces come into play. If one country leaves the EU then several more might do so in short order, and that might unravel the whole organization. This would produce ongoing chaos as each new election risks installing an anti-EU government and the Brexit drama is repeated continuously — though with new names like Frexit and Sprexit. The resulting uncertainty would be bad for the value of financial assets that depend on faith in governments and central banks. All those negative interest rate bonds would behave like junk, dropping to 70 cents on the dollar as buyers demand some return to go with their risk. Equities, which trade in part with reference to bond yields, would probably also behave like junk, falling in response to uncertainty instead of rising on the expectation of central bank salvation. So bad in the long run for the current irredeemably corrupt financial system — which is to say probably good for most regular people.

Will the Brexit vote count be fair? Almost certainly not. This is not a gratuitous jab the honesty of today’s officials but a recognition of historical fact. When elections are tight, they tend to be stolen by the side with the most efficiently-corrupt machine. JFK’s win over Nixon in 1960 thanks to suspiciously favorable results from Mayor Daley’s Chicago is still hotly debated. In Robert Caro’s biography of LBJ the author asserts (with copious attribution) that Johnson stole literally all his elections prior to the presidency (in his only losing run his opponent simply stole more votes). The recent Austrian election in which a barely-acceptable-to-the-establishment Green beat a totally-unacceptable nationalist is currently in court over allegations of fraud.

With the advent of electronic voting machines that — get this — leave no paper trail and so can’t be verified, it’s possible that there will never again be a completely fair election. And with Brexit, which European elites really, really don’t want to see happen, it would be a shock if they go down without a very dirty fight.

Will Bexit matter to the euro? However the UK vote goes, the genii is out of the bottle. Other nationalist parties are gaining strength on the continent and will demand exit votes of their own. Especially in countries having trouble living with a relatively strong euro, this is a given in the next few years. How will the EU head this off? Only one way: devalue the euro aggressively to make life easier for Italy, Portugal, Spain, Greece, et al.

But how, when most EU interest rates are near or below zero and governments have already accumulated record amounts of debt (and when populations are aging out of the workforce and immigrants cause more problems than they solve) does the ECB devalue the euro? Now we’ve arrived at the heart of the matter, which is the shape of the next stage of experimental monetary policy. Something amazing this way comes.

Would a plunging euro equal a soaring dollar? Maybe. Since in a fiat currency world national currencies are valued against each other, when one plunges others by definition go up. This might cause US stocks, bonds, and real estate to rise for a while, but at a huge cost. The too-strong dollar has already pushed domestic corporations into an earnings recession. An even stronger dollar would crush corporate profitability, and there’s no historical instance of a healthy economy in which the private sector is making less money each year.

So Bexit and its aftermath are just symptoms of a deeper problem. To paraphrase an old saying about inflation, today’s political turmoil is always and everywhere a monetary phenomenon. We’ve borrowed too much money and now nothing works any more. Electoral turmoil is simply what you get at the tail end of an epic debt binge. In that sense it doesn’t matter (within reason) who ends up being prime minister, president, or premier unless they figure out a solution for their balance sheets. And that — assuming it’s even possible — won’t be quick or easy.

also: Victor Adair and Michael Campbell on the Brexit Vote HERE

Bob Hoye on how the Central Banks have gone absolutely mad and created and environment where there are 3 levels of speculation, all leading to instability as waves of capital are sweeping the world looking for safety…

Don’t miss Victor Adair on Crude Oil Hits Its Peak

Bob Hoye believes after the message we can take from the Federal Reserve keeping U.S. interest rates unchanged last Wednesday is that “the Fed is finally being seen as ineffective”. “So anyone sitting there thinking the Fed knows what is going on, thats improbable. That they can make an effective policy thats also improbable.”

Bob Hoye believes after the message we can take from the Federal Reserve keeping U.S. interest rates unchanged last Wednesday is that “the Fed is finally being seen as ineffective”. “So anyone sitting there thinking the Fed knows what is going on, thats improbable. That they can make an effective policy thats also improbable.”

Interview Synopsis (Youtube Below)