Timing & trends

Mike talks how Donald Trump and Bernie Saunders are part of the most pivotal trend impacting economics and finance. It’s the key to protecting the value of ones capital, or taking advantage of the market moves it will trigger…

related: In Live From The Trading Desk Victor elaborates on the sentiment shift that occurred last week, also spells out his specific positions on the CDN Dollar, Oil and Gold HERE

“It seems something is brewing for a major move”

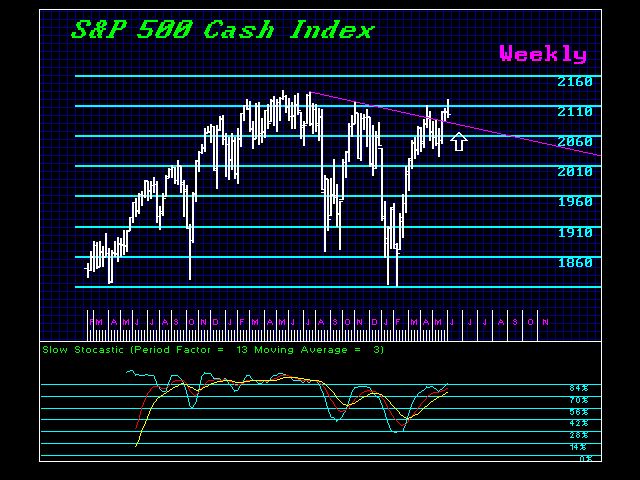

I have been warning that this has been the most sold rally perhaps in history. Between domestic buyers and net foreign investors, they are both approaching historical lows. This is the most shorted market ever. Yet the chart pattern defies all their selling. This is setting itself up for the pop to the upside because the selling has reach reach all time highs. The majority is clearly on the wrong side of the market yet the market defies their selling.

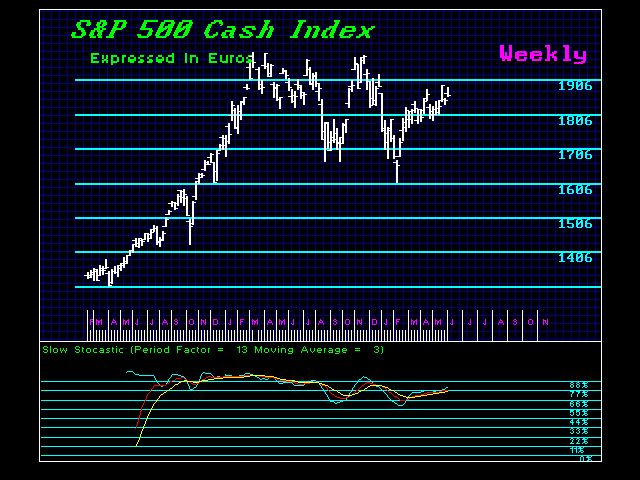

It seems something is brewing for a major move. We urge clients to what the reversals and the timing. Technically, we broke through the Downtrend Line and fell back to retest it. Holding that support level now is an indication of a coming pop to the upside. Pay attention to BREXIT. If Britain votes to leave and they cannot rig the election, we will start to see a contagion spread inside the EU members for a referendum to leave. The dollar can catch a bid on the initial capital crisis. When we look at the S&P500 in terms of Euro, the declines are far less due to the decline in the currency. The pattern is very flat and this is an indication also of a future breakout to much higher highs.

The net selling by foreign and domestic investors will lead to a complete reversal in their investment and that will fuel the rally.

more from Martin:

BREXIT Polls at 55% – Will the Euro Crash & Burn?

With its top two competitors – the euro and the yen – now mired in negative-yield absurdity, investors are fleeing to greener pastures where yields are still higher. And the greenest pasture of them all with the most liquid government bond market is the US.

With its top two competitors – the euro and the yen – now mired in negative-yield absurdity, investors are fleeing to greener pastures where yields are still higher. And the greenest pasture of them all with the most liquid government bond market is the US.

Foreign demand at the 10-year Treasury auction on Wednesday hit a record high of 73.6%, beating the prior all-time record of 73.5% in May. And they sold at a yield of 1.702%!

Why are investors – including central banks – so eager to buy this 10-year paper at this minuscule yield?

also:

Don’t miss ace analyst, Martin Murenbeld spelling out where gold’s going HERE

Ace analyst, Martin Murenbeld spells out where gold’s going. You may be very surprised how far he thinks gold is going to move given what he thinks is happening with interest rates, confidence in government and the US Dollar

Don’t miss Victor’s Live From The Trading Desk where he elaborates on the sentiment shift that occurred last week, also spells out his specific positions on the CDN Dollar, Oil and Gold

1. Time To Confront Economic Extremists

1. Time To Confront Economic Extremists

by Michael Campbell

Environment Canada has said that if the Oil Sands were completely shut down, carbon emissions would be cut by an infinitesimal 12/100th’s of 1 percent! Seems like a timely moment for a proper cost/benefit analysis of climate change action.

2. Jim Rogers: What’s coming will be ‘worse than anything we’ve seen in our lifetimes

Two thirds of the families in the US are now invested in the stock market compared to three percent in the great crash of 1929.

3. Gold Stocks: Be Prepared

by Rambus Chartology

There are two patterns I’m watching very closely in here on the HUI which will be a proxy for the rest of the PM stock indexes.