Timing & trends

Ladies and gentlemen, our “All Clear” signal has officially been triggered!

On Monday, the VIX closed below 20. That’s been my boundary marker to consider the market’s recent unpleasantness to be behind us. That ended a run of 30 consecutive days in which the VIX closed above 20. It was longest such streak in more than three years.

Fortunately, the stock market has been behaving much better recently. The S&P 500 has rallied seven times in the past eight sessions. On Thursday, the index not only broke above 2,000 for the first time in seven weeks, but it also closed above its 50-day moving average, which is a key technical indicator.

But here’s a fact investors need to understand: the market’s recent uptick is quite different from what we’ve seen before. Lately, it’s been the cyclical stocks that have grabbed Wall Street’s attention. In this week’s CWS Market Review, we’ll take a closer look at what’s made traders so happy this week. I’ll also preview our first Buy List earnings report for the Q3 earnings season. Later on, I’ll bring you up to speed on our Buy List stocks. But first, let’s look at last week’s poor jobs report and how it vindicates Janet Yellen and the Federal Reserve.

Yes, the Fed Got It Right

Last Friday, the Labor Department released the September jobs report, and it wasn’t a good one. The U.S. economy created only 142,000 net new jobs last month, which was well below expectations.

For some context, the economy had been churning out an average of 200,000 jobs per month for the last few years. Not only was the September report bad, but the government also lowered the numbers for July and August by 59,000.

What’s more is that more folks are simply opting out of the jobs market entirely. Last month, the labor-force participation rate dropped down to 62.4%, which is a 38-year low. Some of the decline, but not all, is due to demographic factors like retiring Baby Boomers.

They key takeaway from this report is that it vindicates the Federal Reserve’s decision last month to hold off on raising interest rates. Honestly, it seems like a no-brainer. How can you argue that the economy’s overheating when job growth is so slow, and there’s no inflation in sight? In fact, the dominant global-economy story this year is massive commodity deflation. The Fed’s had rates at 0% for seven straight years, so what’s a few months more?

Now we have some more details on the Fed’s mindset. On Thursday, the Fed released the minutes from its September meeting, and it showed that members were concerned that the economy wasn’t strong enough for a rate hike. Broadly speaking, the Fed is still optimistic about the economy. I think they’re probably right. I don’t see a recession looming for us. Rather, the economy will likely experience more growth, but at a subdued pace.

Getting a rate increase is tricky. What’s interesting is that in 2010-11, several countries like Sweden, Norway, Australia and Israel went ahead with premature rate hikes, and then quickly backed off when the damage became apparent. What makes the story more interesting is that at the time, Stanley Fischer was head of the Bank of Israel. Now he’s the number 2 at the Fed. We also know from history that raising rates before the economy is ready can lead to trouble. In 1937, the Fed made a similar mistake when it incorrectly thought the Great Depression was behind it. Short version: it wasn’t.

For much of this summer, the Fed sent signals to investors to expect higher rates soon. I talked a lot about that in previous issues. Now we know that “soon” isn’t quite as soon as we thought. For its part, the market is quite pleased that 0% rates will be around for a bit longer. The futures market doesn’t see a rate hike coming until March, and a second hike may come next September. Just look at the bond market: three weeks ago, the six-month Treasury was yielding 0.27%. Today that’s down to 0.07%.

The Market’s Shift Towards Cyclicals

The stock market is also happy about lower rates. (Perhaps Carl Icahn’s warning from last week was a signal to buy.) The key fact about the market’s recovery is that’s it been led by cyclical stocks. By cyclicals, I mean businesses that are heavily tied to the business cycle. This would include areas like steel, cars and railroads.

The three key cyclical sectors I like to watch are the Industrials (XLI), the Materials (XLB) and Energy (XLE). In the last eight days, the S&P 500 has gained 6.997%, but over that same time, XLI is up 9%, XLB is up 13% and XLE is up more than 15% (see below). Of course, these were the sectors hit the hardest over the past few months, so what we’re seeing is a cyclical rebound. Once a cyclical trend gets established, it tends to run on for a long time. Of course, that’s why they’re called cyclicals. The difficulty is spotting the turning points, and we may have just seen one.

Some cyclical stocks on our Buy List would include Wabtec (WAB). In fact, I would say Wabtec is a classic cyclical. The company makes locomotives, brakes and other parts for the freight and passenger-rail industries. The shares are up 8.5% over the last eight days.

Another cyclical on our Buy List is Ford Motor (F). If you recall, the company recently announced its best September in 11 years. The shares have risen eight days in a row for a total gain of 14.2%. The stock closed Thursday one penny below $15 per share. The automaker hasn’t closed above $15 since July. I think we’ll see another solid earnings report from Ford later this month.

Another helpful sign for cyclicals is that some commodity prices have found their feet. Oil, for example, broke $50 per barrel for the first time since July. Only a few weeks ago, oil was less than $38 per barrel. The recent rise probably reflects the actions of the Russian military in Syria. While Syria isn’t a big deal in the global oil market, it’s located in a very important neighborhood.

Mirroring the leadership in cyclicals has been a somewhat tame performance from defensive sectors like consumer staples and utilities. The healthcare sector continues to be hurt by crumbling biotech shares. The biotech bubble has been bursting, and it’s not over.

I often say that true stock bubbles are quite rare. The problem is that market gurus love to proclaim bubbles. In reality, they don’t come along that often, and they’re usually focused in a sector.

Four years ago, right about this time, the Biotech ETF (IBB) was going for less than $88 per share. By this summer, it skyrocketed to $400 per share. Since then, it’s slowly deflated, and then Hillary’s Clinton’s tweet knocked the entire sector for a loop. Late last month, IBB dropped to $285 per share. It’s recovered a bit since then, but my advice is to stay away. This sector hasn’t hit bottom just yet.

When I say that we’ve hit our “All Clear” signal, I don’t mean to say that investors should expect a robust rally. Rather, I mean that we can expect reduced daily volatility. I doubt we’ll see as many 2% moves for the rest of the year, or the hyperactive intra-day swings that characterized the past six weeks.

The midpoint of the S&P 500’s high close (2,130.82 on May 20) and low close (1,867.61 on August 25) comes 1,999.215, and we just passed. In other words, we’ve made back half of what we lost. It took a few weeks, but we shaken off the late-summer story. Now we can focus on Q3 earnings season.

Wells Fargo Earnings Preview

Wells Fargo (WFC) is scheduled to report Q3 earnings before the market opens next Wednesday, October 14. This will be an interesting report for the big bank because the last report was decent but nothing great. Don’t be fooled—the bank is still very strong. The problem for Wells has been a weak mortgage market, and there’s not much they can do until that sector improves. For Q2, Wells’s mortgage-banking revenue fell by 1%. The bank’s net interest margin, which is a key metric for banks, has fallen below 3%. With ultra-low rates, that’s put the squeeze on all of their costs.

The stock got dinged up pretty hard in the August swoon. At one point, Wells dropped below $48 per share. The shares are still pretty cheap. Let’s look at some numbers. The bank should earn about $4.50 per share next year, give or take. If it can trade at 14 times that, which is hardly excessive, that translates to a price of $63 per share. Going by Thursday’s close, Wells would have to rally 20% to get there.

Wells has been one of the strongest large banks in the country. They’re also one of the few banks whose dividend is higher now than it was at the onset of the financial crisis. The dividend now yields 2.85%. That certainly beats 0% in short-term Treasuries. The consensus on Wall Street is for Wells to report Q3 earnings of $1.04 per share. That matches my numbers. By the way, if you want to know more about Wells Fargo, Jim Cramer recently had a good interview with John Stumpf, Wells’s CEO.

Buy List Updates

Express Scripts (ESRX) said this week that it will cover two new cholesterol-lowering drugs, Praluent from Regeneron and Sanofi, and Repatha from Amgen. Both drugs were approved this summer, and both run about $14,000 per year.

Express Scripts said that next year, it will spend $750 million on these drugs. That’s probably too low, and a lot of folks on Wall Street said Express’s math doesn’t add up. They’re obviously getting a big discount. This week’s announcement will give a lift to ESRX’s business next year. I still think the shares are going for a good value at the current price. I like this stock. Look for another good earnings report later this month.

Shares of eBay (EBAY) got knocked for a 6% loss on Thursday. But the catalyst for the loss didn’t involve eBay. Instead, it was the news that Amazon (AMZN) is going to take on Etsy (ETSY). I think it’s interesting that eBay lost more than Etsy did on the news. Etsy is a site that lets artisans sell their wares over the Internet. Amazon may not make a lot of money, or probably lost more last quarter, but they’re the undisputed giant in online retail.

That’s all for now. Early earnings reports will start to flow in next week. It won’t take long before we get an idea of how well Corporate America did during Q3. There will also be some important economic reports. On Wednesday, the Census Bureau will report on retail sales for September. The CPI report comes on Thursday. This will be an interesting CPI report because the last one showed the lowest inflation all year. It was actually deflation. You can be sure bond traders will be eyeing next week’s CPI report closely. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Named by CNN/Money as the best buy-and-hold blogger, Eddy Elfenbein is the editor of Crossing Wall Street. His free Buy List has beaten the S&P 500 seven times in the last eight years. This email was sent by Eddy Elfenbein through Crossing Wall Street.

Named by CNN/Money as the best buy-and-hold blogger, Eddy Elfenbein is the editor of Crossing Wall Street. His free Buy List has beaten the S&P 500 seven times in the last eight years. This email was sent by Eddy Elfenbein through Crossing Wall Street.

Warren Buffett once referred to derivatives as “financial weapons of mass destruction“, and it was inevitable that they would begin to wreak havoc on our financial system at some point.

Warren Buffett once referred to derivatives as “financial weapons of mass destruction“, and it was inevitable that they would begin to wreak havoc on our financial system at some point.

While things may seem somewhat calm on Wall Street at the moment, the truth is that a great deal of trouble is bubbling just under the surface.

As you will see below, something happened in mid-September that required an unprecedented 405 billion dollar surge of Treasury collateral into the repo market.

I know – that sounds very complicated, so I will try to break it down more simply for you.

It appears that some very large institutions have started to get into a significant amount of trouble because of all the reckless betting that they have been doing.

This is something that I have warned would happen over and over again.

In fact, I have written about it so much that my regular readers are probably sick of hearing about it.

But this is what is going to cause the meltdown of our financial system…….continue reading HERE

Editor’s note: In this 7:40 minute Oct 6th interview with Bloomberg, Dr. Marc Faber discusses how low interest rates have helped to raised asset prices. Faber is well known for his “contrarian” investment approach. Watch the the video below:

ABOUT MARC FABER:

ABOUT MARC FABER:

Dr. Marc Faber is the editor of The Gloom, Boom and Doom Report. Dr. Faber has been headquartered in Hong Kong for nearly 20 years, during which time he has specialized in Asian markets and advised major clients seeking down-and-out bargains with deep hidden value–unknown to the average investing public–bargains with immense upside potential. A book on Dr Faber, “Riding the Millennial Storm”, by Nury Vittachi, was published in 1998. A regular speaker at various investment seminars, Dr Faber is well known for his “contrarian” investment approach.

Canada is no stranger in dealing with oil price collapses. The sharp fall in the price of crude in 2014 is not unprecedented. Over the past 30 years, there have been five major declines in the price of crude that have hit world markets—starting dates: June 1986, October, 1990, October 1997, May 2002 and June 2008. The plunge in prices has ranged from 25% to 60%. In all cases, Canada, as an oil-exporting country has had to bear the brunt of these precipitous and severe price declines, in terms of loss production, loss income and downward adjustments in its exchange rate and balance of trade.

Parallels with 1985-86

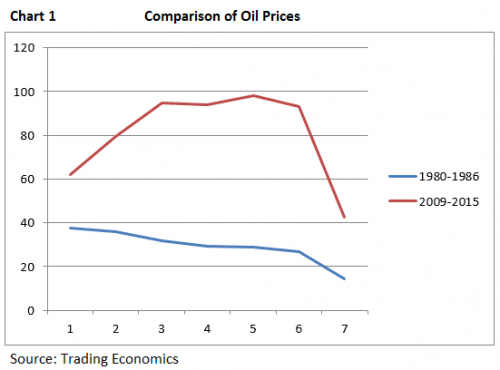

The current price collapse has significant parallels with that of 1985-86 (see Chart 1). In terms of the magnitude of the collapse, from peak to trough, prices fell by 59% in 1985-86 and by 56% in 2014-15. Both periods featured similar causes:

* A rapid and significant increase in supply; 1986 featured the full expansion from new fields in the Gulf of Mexico and in the North Sea; in 2014 the glut was caused by huge surge in production from unconventional sources such as oil shale in the U.S.

[Read: Canada Joins the Currency Wars]

* A major shift in OPEC policy. In 1985, OPEC abandoned price targets and stepped up production by about 30%, the resulting low price remained in effect for nearly two decades; OPEC took a similar position in November 2014 by increasing supply and dropping prices to stem further losses in its market share; no longer will OPEC abide by price targets.

* Worldwide a fall off in demand; in the early 1980s, the recession reduced demand and this contributed to lower oil prices. Today, oil demand has been slowing steadily since 2012, especially in the larger emerging markets.

…continue reading HERE

Two persistent myths convince gold bears that the price of gold will remain low – a looming series of interest rate hikes from the Federal Reserve and the fact that gold did not rally during the last round of quantitative easing. Peter Schiff explains why both of these myths are ready to die following Friday’s terrible job report. The silver price surged significantly higher on Friday’s news, and Peter thinks it won’t be long before gold also breaks out of its trading range. Investors are quickly running out of time to take advantage of these low prices.

Two persistent myths convince gold bears that the price of gold will remain low – a looming series of interest rate hikes from the Federal Reserve and the fact that gold did not rally during the last round of quantitative easing. Peter Schiff explains why both of these myths are ready to die following Friday’s terrible job report. The silver price surged significantly higher on Friday’s news, and Peter thinks it won’t be long before gold also breaks out of its trading range. Investors are quickly running out of time to take advantage of these low prices.

Stay tuned for a full transcript.

0:04 – Friday’s jobs data was much worse than the consensus forecast.

0:30 – Gold and silver rallied on the news, with silver trading at a 3-month high on Monday morning.

1:15 – Gold will follow silver’s lead and break out to new highs. Bearish speculators have been keeping the price down, because they believe higher interest rates are coming.

2:00 – Even if the Fed raised interest rates, there is no historical evidence that this would be bearish for gold.

3:00 – Janet Yellen’s rate hike pace would be even slower than the pace Alan Greenspan raised rates, which was very bullish for gold.

4:10 – Friday’s economic data will mark the beginning of the wake up call to gold bears that the Fed is not going to raise rates.

4:52 – Even though QE3 was not bullish for gold, QE4 would be a completely different situation.

5:44 – The dollar is not going to have all the support of emerging market economies like it did during previous rounds of QE.

7:03 – Goldman Sachs is now saying the Fed is more likely to raise rates in 2017.

7:28 – There’s a good chance that Q3 GDP could be negative, which means the United States could easily be in a recession by the end of 2015.

8:08 – The Fed has probably made the same mistake it did before the housing crash, overestimating the strength of the economy just as it was about to slip into a recession.