Timing & trends

Perspective

The observation that European savers are being punished is not new, but the form is unique. That borrowers are being favoured is also not new, and the form is also unique.

Why?

Policymakers are still in the thrall of theories that have always been impractical. Credit expansion and currency depreciation remain the remedies for anything. Sheer audacity has carried them this far, but at some point, their fanaticism will fail. The curiosity is when do they realize their methods are unsupportable.

There are at least four items that will be alerts.

- The resumption of credit spread widening.

- The reversal in the Treasury curve to steepening.

- Resumption of weakening commodities.

- Resumption of a firming dollar.

Of these, the latter is underway.

This as well as the general heaviness out there reminds of the “Debt Bomb”. This was a satirical video written and performed by our London buddy – Dominic Frisby. The link to YouTube is: https://www.youtube.com/watch?v=GXcLVDhS8fM

The full realization interventionist policymaking has been a fantasy of generations of undisciplined intellectuals. It will take some time and not-impossible forces to wake them up. Reducing their monopoly on “Monopoly Money” will take a little longer.

The irony is that history provides reliable instruction on what works and what doesn’t. Since the inception of modern central banking in 1694, there are 300 years of specific instruction, and that is that throwing credit at a credit contraction won’t make it go away.

Stock Markets

With new stock issues soaring and exploding like rockets, we have been plodding along the path of a Rounding Top. During the Third Quarter history recorded Exuberance, Volatility and Divergence. This was repeated to last week’s high in the senior indexes. This has added an Up Thrust to our Rounding Top pattern on the NYSE comp.

The key high on the NYA was 11,108 set in September. After a correction to Springboard Buy in October the next high was 11,068 in November. Then there was the intense excitement in February that drove the big index up to 11,142 last Wednesday. This was a pop to a new high and the slump is indicating a Failed Up-Thrust”, which is likely to be followed by a correction. At least equivalent to the one that completed in October.

Somewhat more than a 10 percent correction would turn the Rounding Top pattern into a Rounded Top.

This would be the Resolution to the excesses of a cyclical bull market.

But let’s outline the steps on the way.

Taking out the 50-Day ma which is at 10,852 would be step one. Oddly enough, this is close to the level of the 40-Week ma, which provided magnificent support on all of the bull moves since 2009.

In the meantime, the old Dow Theory has been a guide that has been building a classic “Sell” signal. As the ChartWorks updated it on February 14th, the longer the non-confirmation of the DJIA high – the more significant the correction.

If the correction occurs within six weeks it is moderate. The Dow and the Transports both set highs on December 29 and Monday’s high for the Dow ran unconfirmed for ten (10) weeks.

The other count we had going was the stock rally that follows a collapse in crude oil prices. And this has been looking for a high in the March 6th to 13th window.

In the Sector Opportunities Department, the outstanding rally in the REITS (IYR) registered an Upside Exhaustion in early February. The high was 83.54 and by steps the decline took out the 50-Day a couple of weeks ago. That was at 80 and this week the moving average is providing overhead resistance.

The last time this was crossed was on the October correction when support was found at the 40-Week ma. It is now at 74, which is also support provided by the December correction level.

On the S&P, the Failed Up-Thrust, or False Breakout would be realised in taking out the base line. The index is at 2098 and taking this out would confirm the False Breakout.

Is this week’s decline a correction or the start of the Resolution to the excesses of a cyclical bull market?

Unprecedented speculation by central bankers makes this bubble more than just cyclically interesting.

Credit Markets

Do negative interest rates require the bond holder to restore coupons and then some to the certificate, rather than clipping them?

Just asking.

Where the stock market has been working on a False Breakout, credit spreads have had a significant correction in the widening trend. We were looking for a reversal to widening at around June and this was accomplished at 143 bps in June. The “wide” was 213 bps in January. So far the narrowing has made it to 177 bps.

In 2007 the reversal to widening was accomplished at 126 bps in June and initial move took the spread to 186 bps on September 15th. The correction was to 167 bps on Monday, October 15th. With this “joy” the S&P clocked its best percentage gain in a day. Up 11.7% on Friday the 12th.

That was a profound False Breakout.

The resumption of widening in the middle of October effectively ended the 2007 stock bull market.

This time around, spreads reversed to widening at 143 bps in June and the worse was 213 bps in January. Narrowing has made it to 177 bps yesterday.

Further widening would make us wonder if this week’s False Breakout is as profound as the one in 2007.

Using the Junk side of recent narrowing, the rally in JNK was impetuous enough to register a Daily Springboard Sell as well as a Weekly Upside Exhaustion. As noted last week, the latter has occurred only 7 times on a series back to 2008. Each was followed by a significant setback.

JNK has been a good guide to the action. Its plunge with crude into December registered a Springboard Buy.

We appreciate technical measures when they register at each end of a strong move.

Spreads are setting up for the next phase of widening. Since the cyclical turn was made in June, it has been on the path to distressed conditions.

We’ve been bullish on long-dated Treasuries since January 2014 and got out twelve months later. Our January 20th Special reviewed the whole bull market from 1981 and concluded that it was close to “Ending Action”. The February 2nd ChartWorks noted the rare Upside Exhaustion as the high was set at 152. The projected target is the 84-Week ma, at around 132.

European bonds have been interesting. Greek and Russian yields have declined a little. Perhaps just a correction on the road to ruin.

British and German yields seem to be trying to base.

Germany set a low of .30% at the end of January and increased to .39% on February 22nd. The next low was at .29% on February 25th. Now at .38%, rising above .39% would set a modest uptrend.

The action in UK bonds has made the turn to rising yields. The low was 1.33% at the end of January. This week’s rise to 1.88% has taken out the last high at 1.84% and sets a modest uptrend in interest rates.

In anticipation of the actual start of the ECB buying program, yields have declined today. Will UK bonds trade with Europe or with the US?

Since last summer we have been calling the action in all classes of bonds as being the biggest bubble in history. Being the biggest, its demise will not go unnoticed.

Currencies

The Dollar Index traded in a range at the 94 to 95 level from January until Tuesday. This was on either side of the 50-Day and in rising to 96.37 today it is breaking out. The last such breakout occurred in July. The resumption of the “sound money” trend may be perplexing to the establishment.

Let’s review our stance. In a post-bubble contraction the senior currency becomes chronically strong. Last June we advised that while the DX was overbought it could become superoverbought. That was reached on the zoom into January.

Has the sideways motion eased the overbought condition?

No, it is still relatively high, but that was the case following the commodity blow-off of 1980. The DX rallied from 95 to 164 (not seasonally adjusted). The rallies generated superoverbought conditions many times and corrections were modest.

The main uptrend can continue.

Commodities

Crude hit our timing target for the plunge to end in January. Then the bottoming process would last for many months. “V” bottoms have not followed oil crashes. Last week our concern was that this process could dither around into the start of the next recession.

Generally weakening commodities, as well as the crash in the Baltic shipping rate, are telling us that the global economy is slowing. Over the past few months many US business and economic numbers have turned from very positive to soft or down. There was a lengthy list of them, but in not immediately grabbing the story; it is gone.

However, history records that in a “New Financial Era” the stock market no longer leads the business cycle. We used this in 2007 to advise that the recession would start virtually with the bear market. And it did. Then it was used to note that once the panic ended in 2009, the recover would soon follow. The crash ended in March and the recession ended in that June.

A turn to disappointing numbers should accompany a resumption in weakening commodities – and – a weakening stock market.

Crude enjoyed a sharp jump from 43.50 in January to 54 in early February. It has been in a trading range. This week it has worked its way to above the 50-Day ma. So long as it stays above it is constructive.

Longer term, we have our doubts as relative to real measures such as gold or the PPI, there is further to go on crude’s full bear market.

In the meantime, gasoline became more oversold than it did in its post-2008 crash. And now it has exploded, setting a huge swing on the Daily RSI to very overbought. Also there is a significant gap in the chart. Gasoline needs a correction.

GKX (grains) joined the bounce in crude and made it from 295 to 316, just below the 50-Day. So far, the slide has been to 296. Taking out 295 will test support at the September low of 290, which was the low for the bear that started in 2011.

Over in base metals, the GYX set its low with the crude problems at 299 and bounced to 318 in early February. The next low was 305 a couple of weeks ago. The last rally attempt was turned back by the 50-Day ma. At 310 now, base metals remain in a trading range.

Base metal miners (SPTMN) declined from 1599 in 2011 to 513 in January. The rebound made it to 739 last week. At the recent low it was not cyclically oversold. Miners are drifting down to test support at the 50-Day. We are not bullish on the longer term.

Lumber fell out of its wedge pattern and took the hot forestry stocks with it. WY set an Upside Exhaustion at 36.73 in early January. The initial slide was to 34.46 and the rebound made it to the 50-Day at 35.50. It is now at 34.16 and not oversold. Tree stocks are on an intermediate decline.

Earnings Heading South: Fast

- Note the reversal in EPS (red line) in 2007 and in 2000.

- Breaking below the zero line is critical.

Real Interest Rates: China

Link to March 6 Bob Hoye interview on TalkDigitalNetwork.com: http://talkdigitalnetwork.com/2015/03/dow-theory-working-and-its-not-pleasant

All I can say is WOW! China is on the move again, big time, with the new Silk Road already ramping up, part of an infrastructure investment that will total $1 TRILLION when all is said and done.

It’s all part of Beijing’s commitment to build out Western China, where the bulk of the population lives, including a whopping 30 million Chinese who actually live in caves.

They need power, food, education, health care, communication services, transportation infrastructure and more. Most are living not in the 21st century, or even the 20th, but in the 19th century.

So if you think China’s economic growth is going to slow much, think again. Fully 46 percent of mainland China’s population, or 629 million people, still live in rural China. That’s almost twice the entire population of the United States. And they are living on less than $1 a day.

Right now I’m in Yichang, one of the smaller cities in China with a population of roughly 4.5 million.

I arrived here after a three day cruise down the Yangtze River checking out small river coastal towns that are to be developed as part of the new Maritime Silk Road, which will use the Yangtze, through the Three Gorges Dam, to ship goods eastward and westward, then by rail south through Thailand, Malaysia and Indonesia.

There’s construction everywhere. Along the Yangtze, in small river towns, and right here in Yichang. All part of the build out of new Silk roads that will literally transform China into the largest economy in the world over the next few years.

There’s construction everywhere. Along the Yangtze, in small river towns, and right here in Yichang. All part of the build out of new Silk roads that will literally transform China into the largest economy in the world over the next few years.

The opportunities to profit are also literally boundless. German, American and French companies are forming joint ventures with Beijing to help the build out. Not to mention oodles of publicly traded Chinese companies.

From here I’ll be going to Xian by train, then to Lanzhou, two more very important stops along the new Silk Road. I’ll be collecting my observations, contacts and research and once I vet everything, will be issuing recommendations to my Real Wealth Report subscribers.

But right now, let’s turn to recent market action. All I can say again, is WOW. DEFLATION is now striking hard!

Consider the dollar, which, despite all the pundits claiming that its rally was over, soared like an eagle, precisely as I had forecast .

That dollar strength, driven largely by the rapidly disintegrating euro, is now beginning to accelerate the pace of deflation in the U.S. and in the dollar-denominated commodity markets, where almost every commodity is tanking.

Most noticeably, and again, precisely as I forecast, is gold and precious metals. Gold has now cratered back to the $1,168 level, and silver to below $16.

While short-term bounces are inevitable, the trends remain firmly negative for the precious metals (and miners), precisely as I have warned … and they will not bottom until you see gold below $1,000 and silver near $12.50.

Likewise, the price of oil and gas remain weak at the knees, as do food prices, corn, wheat, soybeans and more.

A while back I suggested inverse ETFs on gold and silver, and a bullish ETF on the dollar. I hope you acted on those suggestions. If you did, you’re making money hand over fist. Hold them, more gains are coming!

Now, let’s take a look at the stock market. Yes, I still maintain my view that the major U.S. and European stock indices are headed for some short-term trouble.

Granted, my timing here has been off, to say the least. But all of my indicators continue to strongly suggest that the stock markets’ next major move will be to the downside, not the upside.

In part, it will be a reaction to the deflation striking other sectors. It will also be largely technical in nature, as corrections are necessary to pave the way higher down the road.

The important points are this: Long-term, the equity markets remain very healthy, but short-term, danger is the byword.

I much prefer to stand aside a correction. The Dow will begin its ascent to Dow 31,000+ only after a steep, surprising correction unfolds.

So if you’re a savvy investor, you’ll stand aside most stocks, or invest conservatively, until that correction comes. Then, you’ll deploy your capital aggressively, when the blood starts running in the streets.

It will be much the same for commodities. Stay patient or outright bearish. Go back in only when you see mining companies, food processors and companies in the energy sector, going bust.

Best wishes, as always …

Larry

I have always argued that quantitative easing and zero percent interest rates were misguided policies to combat economic weakness. But as the years went on, misguided turned into irresponsible, which led to ridiculous, and then turned into dangerous. But lately, the only word that comes to mind is “surreal.” How should we react when central bankers begin to speak like Willie Wonka?

I have always argued that quantitative easing and zero percent interest rates were misguided policies to combat economic weakness. But as the years went on, misguided turned into irresponsible, which led to ridiculous, and then turned into dangerous. But lately, the only word that comes to mind is “surreal.” How should we react when central bankers begin to speak like Willie Wonka?

Contained in the latest release of the Minutes of the Federal Reserve’s Open Market Committee (Jan. 27-28, 2015) was a lively discussion of how to say something without anyone understanding what is being said. Although I have been critical of the Fed for many years, I never imagined that it would provide me with material that bordered on the metaphysical.

As Fed policies have become ever more critical to our economic health and stock market performance (see our 2015 Outlook piece in our latest newsletter), the degree to which investors and journalists dissect every public statement and utterance by Fed officials has increased remarkably. At present, one of the biggest points of contention is to find the true meaning and significance of the word “patient.”

Last year, as market watchers grew nervous with the Fed’s withdrawal of its quantitative easing purchases, many began to wonder how long it would be, after the program came to an end, for the Fed to actually raise interest rates, which had remained at zero since 2008. After all, this would shift the bank into a second, potentially more consequential, phase of monetary tightening. Investors wanted to know what to expect.

Initially the Fed let market participants know that it would hold rates at zero for a “considerable time” after the end of QE (9/13/12 press release), thereby creating a buffer zone between the end of QE and the beginning of rate increases. But, after a while, this also became too amorphous and static for investors who crave actionable information. So in December of 2014, in a bid to increase “transparency” (which is the central banking buzzword for “no surprises”), and to signal that the day of tightening had moved closer, the Fed replaced “considerable time” with the word “patient.” But this only deepened the mystery. Investors began to wonder what “patient” actually meant to the Fed. With potential fortunes riding on every word, the discussion was anything but academic.

When pressed for an answer at a Fed press conference, Yellen explained that the word “patient” in the FOMC statement indicated that it would be unlikely that the Fed would raise rates for at least “a couple” of meetings. She then conceded that “a couple” could be interpreted as “two.” Since the FOMC meets every six weeks, that seems to mean that a rate hike would not happen for at least three months after the word “patient” is removed from its statements. But she was also careful to say that removal of the word “patient” does not necessarily mean that the Fed would raise rates after two meetings, just that it’s possible. But this much transparency may have become too much for the Fed to handle.

With the economy now clearly losing steam, based on the drop in GDP from 3rd to 4th quarters, and general macro data coming in very weak (Zero Hedge, 2/18/15), I believe the Fed wants desperately to move those goalposts. But after a series of seemingly strong jobs reports, culminating with a strong 295,000 jobs in February, the market expects that “patient” will soon disappear from the statement. The Fed wants to comply, thereby signaling that everything is fine. But at the same time it doesn’t want the markets to conclude that rate hikes are imminent when it does.

In other words, they are searching for a way to drop the word “patient” without communicating a loss of patience. What? This is like a driver telling other drivers that she plans on engaging her turn signal before making a left, but then wonders how to hit the blinker without actually creating an expectation that a turn is imminent. This seems to be a question for psychologists not bankers. Perhaps it is looking for a new word to replace “patient”? Something that implies a slightly less patient outlook, but that certainly does not imply imminence. “Casual” or “nonchalance” may fit the bill. How would the markets react to a “nonchalant” Fed? Time for a focus group.

The recently released Minutes of the January 27-28 FOMC Meeting frames the difficulty:

“Many participants regarded dropping the “patient” language in the statement, whenever that might occur, as risking a shift in market expectations for the beginning of policy firming toward an unduly narrow range of dates. As a result, some expressed the concern that financial markets might overreact, resulting in undesirably tight financial conditions.”

Translated into English this means, “We hope the markets don’t actually believe what we tell them.” The Minutes continue:

“A number of participants noted that while forward guidance had been a very useful tool under the extraordinary conditions of recent years, as the start of normalization approaches, there would be limits to the specificity that the Committee could provide about its timing.”

To me this translates as “Transparency was great while we were loosening policy, or doing nothing, but it isn’t useful now that the markets expect us to tighten.” If you believe as I do, that the Fed has no intention of tightening anytime soon, its sudden aversion to clarity is understandable. Not surprisingly, the Committee appears to be in favor of shifting to a “data dependent” stance:

“…it was suggested that the Committee should communicate clearly that policy decisions will be data dependent, and that unanticipated economic developments could therefore warrant a path of the federal funds rate different from that currently expected by investors or policymakers.”

Of course the Fed won’t actually define exactly what type of data movements will translate into what specific policy actions. In that sense, a “data dependent” policy stance puts the Fed back into a “goalpost-free” environment where no one knows what it will do or when it will do it.

To underscore the absurdity of the situation, Chairman Yellen, at her semi-annual Senate testimony in February, offered this “full-throated” warning about pending policy normalization, saying that the Fed “will at some point begin considering an increase in the target range for the federal funds rate.” So this means that after some unspecified time of not even thinking about rate increases, the Fed will “begin” the process of getting itself to the point where it may “consider” (which is in itself an open-ended deliberation) an increase in its rate target (which does not even in itself imply an actual increase in rates). Yet despite this squishy language, the lead front page article on February 24th in the Wall Street Journal (that contained that quote), ran under the bold headline “Yellen Puts Fed on Path to Lift Rates.” Leave it to the media to carry the water that the Fed refuses to pick up.

So are we expected to believe that the Fed hasn’t even begun considering rate increases yet? Really? Isn’t that the biggest, most urgent, issue before it? The Fed is a central bank, what else is it supposed to consider? This is like a 16-year old boy saying that “at some point in the future I may begin thinking about girls.” Till then, should we expect him to think solely about homework and household chores?

Fed officials have warned that they are concerned about raising rates too quickly. Perhaps that fear may have been plausible a few years ago, before unemployment plummeted and the stock market soared. But how would a 25 basis point increase in rates seriously slow an economy that most people believe has fully recovered? And if the Fed is concerned now, why would it not be concerned next year? If anything, the longer it waits, the more vulnerable the recovery will be to higher rates.

The business cycle tells us that recoveries do lose momentum over time. The current recovery is already five years old, and is, statistically speaking, already well past its prime. And since low rates encourage the economy to take on more debt, the longer the Fed waits to raise rates, the more debt we will have when it does. This means that the debt will be more costly to service when rates rise, which will throw even more cold water on the “recovery.”

The Fed’s real predicament is not how to raise rates, but how to talk about raising interest rates without ever having to actually raise them. If we had a real recovery, the Fed would not need to couch its language so delicately. It would have just pulled the trigger already. But when its communications and its intentions are different, credibility becomes a very delicate asset.

The above is an abridged version of a longer article that appears in the Winter 2015 Euro Pacific Global Investor Newsletter

Best Selling author Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital. His podcasts are available on The Peter Schiff Channel on Youtube.

This past week, I penned a piece entitled “You Think Like A Bear But Invest Like A Bull?” that discussed the disconnect between my writings and the “Bullish” posture of the portfolio. To wit:

This past week, I penned a piece entitled “You Think Like A Bear But Invest Like A Bull?” that discussed the disconnect between my writings and the “Bullish” posture of the portfolio. To wit:

However, when that reversion process occurs is anyone’s guess.

Therefore, while the analysis suggests that portfolios should be heavily underweighted ‘risk,’ having done so would have led to substantial underperformance and subsequent career risk.

This is why a good portion of my investment management philosophy is focused on the control of ‘risk’ in portfolio allocation models through the lens of relative strength and momentum analysis.

The effect of momentum is arguably one of the most pervasive forces in the financial markets. Throughout history, there are episodes where markets rise or fall, further and faster than logic would dictate. However, this is the effect of the psychological, or behavioral, forces at work as ‘greed’ and ‘fear’ overtake logical analysis.

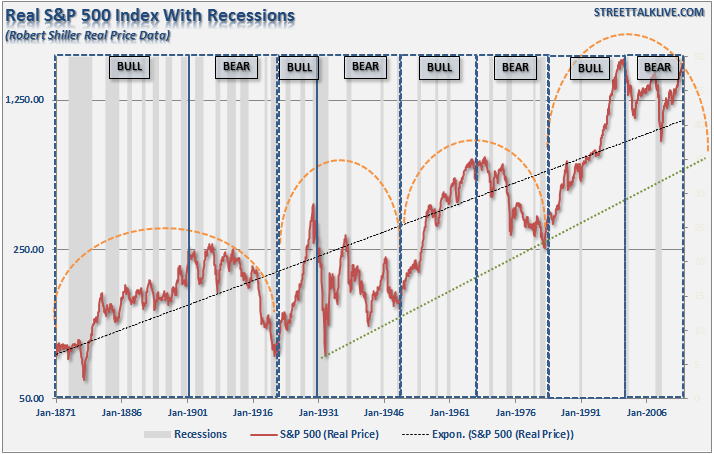

I have discussed the effect of ‘full market cycles previously as shown in the chart below”

A list of contents in this newsletter:

This will be about the weirdest thing you see today….

This will be about the weirdest thing you see today….

You know that we talk a lot about the insane level of government interference in our lives. About what we can and cannot put in our bodies. The amount of interest we’re entitled to receive on our savings. Etc.

But I’m noticing now even more ridiculous trends of governments wanting to get involved in people’s sex lives.

Last year the Danish government promoted an initiative called “Do it for Denmark”, encouraging Danes to travel abroad and have sex while on holidays. They even have a pretty racy Youtube video featuring a scantily clad gorgeous blonde waiting to do her duty for her country and procreate.

Singapore as well has a catchy jingle about going out and making babies, brought to you by the same guys who did the Mentos theme song.

The Swedish government actually spent taxpayer money on its new genitals song, so it can start indoctrinating children early on how they can make babies.

Here in Japan, which has one of the lowest birthrates in the world, the government is desperate to find solutions to what it calls its libido crisis.

According to their data, Japanese men aren’t terribly interested in sex and the women find sex to be bothersome.

Japanese being expert process engineers are coming up with a government solution to reengineer sexual desire in their country.

(I have to imagine that if this solution reached US soil, the government option would include the smooth sounds of Barack Obama whispering some pillow talk: “C’mon, lemme give you this big tax cut, baby…”)

Easily the most ridiculous solution they came up with is to impose a ‘handsome tax’ on attractive men. I thought this was a headline from the Onion, the greatest news source in the world, but it turned out to be true.

The idea being that if you tax handsome men, then less attractive men would have more money and hence be able to attract women.

Zerohedge covered this in fantastic detail—I encourage you to check it out. This is not a joke.

The thing that many of these countries have in common, Japan, Denmark, etc., is a rapidly declining birthrate.

A declining birthrate is disastrous for an economy, particularly for an ageing place like Japan.

Ironically, the oldest person in the world turned 117 years old yesterday—and no surprise that she’s Japanese. In fact, Japan is home to one of the oldest populations in the world and has one of the longest life expectancies.

Curiously they also have one of the largest pension programs in the world. You put all that together and you have fewer and fewer young people paying more and more of their income to support a disproportionately large population of retirees who are living for decades after they stop working.

Each one of these governments is trying to find a solution to fix this unsustainable fiscal problem.

In Denmark they seem to think that people aren’t going on vacation enough. In Japan they think it’s a problem of sexual desire. But in actuality it has everything to do with cost of living.

Month to month, year to year, it’s hard to notice the subtle changes in costs of living and standards of living, but after a long period of time it’s easy to look back and remember how things used to be.

You used to be able to support a family on a single income. You used to be able to afford medical care and higher education.

It’s often said that the greatest expense that someone will have in their life is his or her home. That’s total nonsense.

Now, I’m not saying it’s not worth it, but the biggest expense most people will have is family, and particularly children.

And after years and years of suffering through pitiful, destructive policies that have chronically made people less prosperous, it’s no surprise that they’re coming to the conclusion—you know, we can’t really afford to have a child right now.

There are consequences to conjuring money out of thin air. There are consequences to destructive policies.

So destructive in fact that central bankers and politicians even have the power to make a population disappear.

How ironic that they try to fix their own problem by trying to introduce themselves into our bedrooms.