Timing & trends

The markets of late have been like watching paint dry.

I’ll address them in a few minutes.

But first, let me tell you about some reflective thoughts I had while watching the markets this past week.

Thoughts about what a mess the world is in. There’s a whole lot going on that I don’t like one bit at all.

I don’t like the fact that China is being very aggressive in the South China Sea, and that it is all but certain a war will break out there some day soon.

I don’t like the fact that Germany is now becoming the last shoe to drop in the European Union, with its GDP for the most recent quarter slumping badly.

I don’t like the rise of neo-Nazi and fascist groups all over Europe.

I don’t like the rise of neo-Nazi and fascist groups all over Europe.

Nor the very real chance Putin will invade Ukraine and other Eastern European countries and former Soviet Union satellites.

I am very worried too about the Middle East. I have absolutely no doubt that a wider war looms dead ahead, between several Middle Eastern countries.

Or that the Ebola virus could become the 21st century’s Black Death.

But these are just a few of the things I don’t like about the current state of the world.

I am extremely worried about what’s happening in my own country.

I am worried that our insane and arcane tax code is driving the rich to invest overseas and to even give up their citizenship.

And that there is now a rash of “corporate inversions” going on where some of our biggest and brightest companies are leaving our shores for lower-taxed homes in other countries.

Our tax code is precisely what our forefathers didn’t want. A direct tax on our labor that effectively turned our country into a socialist state by making us all slaves of a leviathan.

And by giving the government the right to intrude on your privacy by monitoring everything you make and do.

That’s what our income tax is. Our forefathers were against all forms of direct taxation, and were for indirect taxation instead, such as a national sales tax.

But now, we have the opposite — an income tax that has become so repressive that the IRS is now chasing down every penny it can find, even money you have or earn outside of the U.S. — making our country the only developed country in the world to have such a draconian tax system.

Yes, you are an economic slave to Washington.

I don’t like how our federal government wastes more money than one could do if they were stinking drunk, and though they could issue blank checks and promises to everyone.

And that behind closed doors in Washington, our leaders are actively considering the International Monetary Fund’s socialist answer to simply grab 10 percent of everyone’s wealth to help solve our debt problems …

And to further confiscate our wealth by requiring all retirement accounts to buy U.S. Treasuries.

I totally despise the fact that 200 million Americans now live completely without any constitutional rights, in a so-called “Constitution-free zone” where you can be stopped, searched and thrown in jail without a warrant or due cause.

The NSA spying, which continues unabated, has trampled on our right to privacy — another completely distasteful act our leaders are engaging in.

I also despise the fact that our country’s legal system has become such a farce that each and every one of us is guilty of committing as many as three felonies a day, according to research by Harvey Silverglate and Alan M. Dershowitz.

And the Department of Homeland Security (DHS)? Along with the IRS, it’s become the modern-day Gestapo — an internal standing Army intruding and trampling on your privacy and liberty.

And the Department of Homeland Security (DHS)? Along with the IRS, it’s become the modern-day Gestapo — an internal standing Army intruding and trampling on your privacy and liberty.

Arming and militarizing local police with military-grade armored vehicles and weapons, 1.8 billion hollow-point bullets and more.

Can you blame the people of Ferguson, Missouri? How would you react if militarized police paraded down your street loaded to the gills with all sorts of hardware you’d normally see only in a war-like situation?

And lest you think Ferguson is an extreme example of the American police state, think again. There are countless examples of heavily armed SWAT teams being used in America even for routine investigations and petty crimes.

Thing is, the war cycles ramp up all the way into late 2020. That means we have almost six years to go before there is any relief in sight.

Sure, there will be brief interludes between now and then. But in the months and years ahead you can expect …

More civil wars across the globe

More civil wars across the globe

Massive social and political unrest in the developed economies of Europe and the U.S.

Massive social and political unrest in the developed economies of Europe and the U.S.

Rising taxation and confiscatory wealth measures

Rising taxation and confiscatory wealth measures

International wars

International wars

More international terrorism

More international terrorism

More invasions on your privacy

More invasions on your privacy

More Fergusons

More Fergusons

And more, lots more geo-political unrest, the worst we have seen, according to my war cycle models, since the mid-1800s.

And on top of all that, you will see the baton of the largest economy in the world get passed from the U.S. to China.

As to the markets, there have been no changes since my column last week.

First, the U.S. broad equity markets, as expected, have bounced. But that’s all it is, a bounce. A 20 percent swoon in the Dow lies dead ahead.

Second, continue to avoid U.S. and European sovereign bonds. Though rallying a bit in price, the risk to owning them vastly outweighs the potential reward.

Third, gold and silver remain a bit lackluster, due to summer seasonal weakness.

But be sure to use that weakness to accumulate precious metals. The next phases of their long-term bull market are right around the corner.

Fourth, continue to steer clear of the euro currency. Instead, keep most of your money in dollar-based investments. As much as there is not to like about what’s happening to the U.S. — Europe and the Middle East are in worse shape, which is driving frightened capital directly into the dollar.

Fifth, consider investing in Asia, which is a bright spot in the world. I repeat my warning in my last column: According to all of my models, most Asian equity markets are now embarking upon new long-term bull markets, with China leading the way higher.

What is your view on all this? How do you see things developing in the near term? Feel free to add your comments to the discussion — click here to participate.

Stay tuned, stay safe and best wishes,

Larry

“Carpe diem. Seize the day, boys. Make your lives extraordinary.” – Dead Poets Society

“Carpe diem. Seize the day, boys. Make your lives extraordinary.” – Dead Poets Society

The stock market’s July swoon sure didn’t last long. From closing high to closing low (July 24 to August 7), the S&P 500 lost a grand total of 3.94%. That small bit of turbulence unnerved a lot of folks who should have known better. But since there’s been so little volatility of late, that minor dustup seemed larger than it truly was.

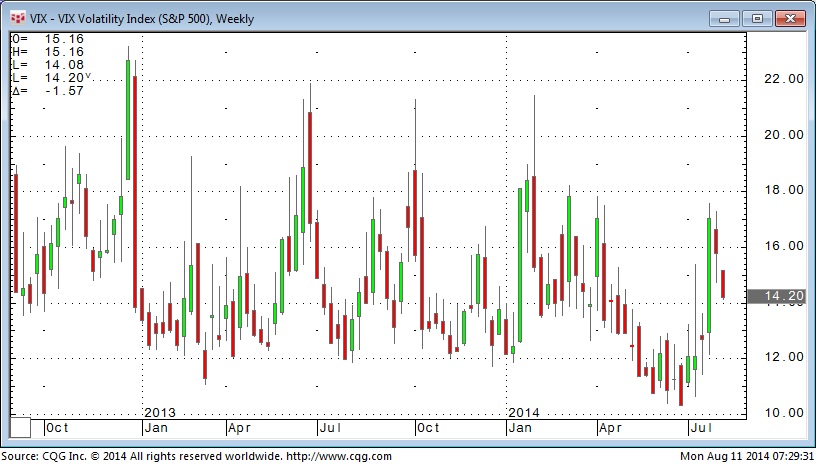

Last week, the Russian military called off some exercises near the Ukrainian border. I can’t say those exercises specifically caused the market’s tumble, but ever since they ended, the stock market has rallied. The S&P 500 has advanced in four of the last five sessions, and we’re not too far from another new high. Since August 7, the S&P 500 has gained 2.39%. Another sign that tensions have chilled out is that small-cap stocks have led the bounce-back rally, and the VIX is back down again.

Now that second-quarter earnings season is past us, this is a good time to run through all 20 stocks on our Buy List and review their prospects for the rest of the year. I’ll also take a look at the recent bond market rally. Long-term yields have been dropping, and I think the time has finally come for bonds to take a rest. We’ll also preview two Buy List earnings reports for next week. But first, let’s look at the stretched market for bonds.

It’s Time for Bonds to Sit Down

As well as the stock market’s done lately, the bond market has been a rock star this year. The yield on the 10-year Treasury closed at 2.40% on Thursday. That’s a 14-month low. If you had told me on New Years Day that the 10-year would go for 2.40% by August, I would have thought you were out of your mind. The yield has dropped more than 60 basis points since the start of the year.

It’s interesting how few people saw this big bond rally coming. Jeffrey Gundlach, the bond kingpin, was one of the few who got it right. There seems to be an insatiable appetite for all things bond. This week, the Treasury auctioned off some 30-year bonds, and yields were the lowest in more than a year.

Why the demand for fixed-income? I think this represents misplaced concerns about stock prices. Given where we are in the economy, it’s safe to say that the bond rally has run too far. The idea that investors are willing to lock in their capital for 10 years to get a measly 2.4% seems a bit crazy to me. That’s almost exactly what the stock market has gained in the last five years.

Several of our blue-chip Buy List stocks yield more than the 10-year, such as Wells Fargo(WFC), Ford (F) and Microsoft (MSFT). Not only do they yield more, but they’re also thriving businesses. As much as I love bonds, they just sit there.

You can really see the absurdity of the bond market by looking at the TIPs — the inflation-protected bonds. The 10-year TIP currently yields 0.2%. That’s down from 0.8% late last year. I understand why investors are nervous about stocks, but I don’t see why anyone would invest in a bond that barely beats inflation for the next 10 years. In 2012 and 2013, the 10-year TIPs turned negative, but the fear was more understandable, given the dramatic events in Europe. The 10-year Spanish bond now yields less than American bonds. In Germany, the 10-year bond dropped below 1%. The 1% Club is very exclusive; the only other members are Japan and Switzerland.

Thanks to improved economic numbers, we can expect long-term yields to drift higher as the year goes on. By this time next year, the Federal Reserve may have already started raising interest rates. Now let’s take a look at our Buy List.

Rundown of the Buy List

I was puzzled by the market’s negative reaction to AFLAC‘s (AFL) Q2 earnings report. I thought the earnings were fine. After all, they beat expectations by seven cents per share, but the shares fell as low as $58.50, and two weeks ago, I said the stock was an especially cheap buy below $60. The good news is that AFLAC ticked up above $60 per share on Thursday. AFLAC remains a good buy up to $66 per share.

Bed Bath & Beyond (BBBY) continues to recover, but unevenly. BBBY broke above $64 per share in late July. That’s nearly $10 more than its July low. Investors clearly overreacted to BBBY’s bad news. Remember that this is one of our off-cycle stocks, so they’ll report their Q2 earnings in about six weeks. They see Q2 earnings ranging between $1.08 and $1.16 per share. That’s not bad. Bed Bath & Beyond remains a good buy up to $65 per share.

Last week, I mentioned that CA Technologies (CA) was in danger of being knocked off next year’s Buy List. I’m free to change my mind before then, but I need to see more signs of improvement from CA. The part I really like is the generous yield. Going by Thursday’s close, CA yields 3.52%, but I’m not crazy about them. CA Technologies is a moderate buy up to $31 per share.

Cognizant Technology (CTSH) seemed to be our only bomb from last earnings season. Now that I’ve looked at the numbers, I’m not worried about CTSH at all. I apologize if you were caught in the sell-off, but the company is still doing well. If you don’t own CTSH, this is a good time to start a position, especially if you can get it below $45 per share. Cognizant Technology remains a good buy up to $48 per share.

CR Bard (BCR) is one of those quiet stocks that you tend to forget about because they’re so quiet. That’s unfair, because this is a solid company. Bard beat earnings last month and raised their full-year guidance. They now expect $8.25 to $8.35 per share for the full year. I held off on changing our Buy Below on Bard, but I think this is a good time for an increase. I’m raising our Buy Below on CR Bard to $160 per share.

I also mentioned DirecTV (DTV) last week as a possible deletion from next years’ Buy List. The difference is that I love DTV. It’s the AT&T deal that makes them less attractive as an investment. Their business continues to do well. I’ll let you know as we hear more about the AT&T deal. My decision will come down to how close the shares are to $95 by year’s end. There’s no point in holding on to a stock for a few more percent. Until then, DTV is a buy up to $95 per share.

eBay (EBAY) got knocked around for most of the spring. I’m pleased to see the shares are making their way back. They beat earnings by a penny per share last month, and the stock has continued to rally. eBay sees full-year earnings ranging between $2.95 and $3.00 per share. I’m going to keep a tight Buy Below for eBay at $55 per share.

Express Scripts (ESRX) was our surprise star from last earnings season. The shares jumped 7.15% over two days. The pharmacy-benefits manager now expects full-year earnings of $4.84 to $4.92 per share. I also like that ESRX has a fairly clean balance sheet. I’m going to keep our Buy Below at $74 per share for now, but I may raise it soon.

After the market’s July slide, I was curious which Buy List stock would be the first to make a new high. I remember thinking that picking Fiserv (FISV) would be “too easy.” The stock rarely disappoints. On Thursday, Fiserv got as high as $62.47 per share, which is only 63 cents below the high from three weeks ago. This week, I’m raising our Buy Below on Fiserv to $66 per share.

You should never fall in love with a stock, but I have to admit that I have a serious crush onFord Motor (F). The stock had a strange sell-off that brought it below $17 for a few days. Don’t let that scare you. Things are going very well for Ford. I think we can expect another run at $18 per share. Ford currently yields 2.87%. Ford Motor is a buy up to $19 per share.

IBM (IBM) was the stock that everyone loved to hate. I think that’s softened a bit, but Big Blue has many problems ahead. Fortunately, the shares are pretty cheap here. I don’t know if they’ll hit their highly touted earnings target of $20 per share for next year. I’m assuming they will. The company has been spending enormous amounts of money buying back their own shares — $3.7 billion in Q2! I don’t think this is the wisest strategy. I’d rather see that money go back to shareholders. IBM is a buy up to $197 per share.

McDonald’s (MCD) is another stock that I listed last week as a candidate to stay home next year. I want to see signs from management that they get how serious the problems are. I don’t consider MCD to be a speculative play, since the dividend is quite solid at 3.46%. McDonald’s is a buy up to $101 per share.

Medtronic (MDT) is due to report on Tuesday, August 19. Wall Street currently expects earnings of 92 cents per share. My numbers say that’s about right. The medical-device maker is currently working through its big deal with Covidien. This is another stock that may not be back next year. Again, it’s not because I don’t like Medtronic, but the new company will be quite different. They see full-year earnings ranging between $4.00 and $4.10 for this year. Medtronic is a buy up to $67 per share.

Satya Nadella, Microsoft‘s (MSFT) new CEO, is still enjoying his honeymoon on Wall Street. Investors clearly love Steve Ballmer’s replacement. The irony is that much of the company’s recent success is due to Ballmer as much as to Nadella. If you recall, the stock fell in the after-hours market after the last earnings report came out. Then, once folks had a second to actually read what the company had to say, investors realized they had a good quarter. I think MSFT will make a run at their 52-week high soon. It’s our second-best performer this year. Microsoft continues to be a solid buy up to $48 per share.

Moog (MOG-A) is the final company I listed last week as a potential candidate to be culled from the Buy List. I didn’t like their recent guidance. I’m keeping a tight Buy Below at $71 per share.

Oracle‘s (ORCL) last two earnings reports were not particularly inspiring. But the more I look at the company, the more impressed I am. Thanks to the sell-off, I think Oracle is an especially good bargain here. Oracle will report fiscal Q1 earnings in mid-September. In June, they gave guidance of 62 to 66 cents per share. They should be able to get that easily. Oracle is a very good buy below $40. My Buy Below is at $44 per share.

Qualcomm (QCOM) got wrecked after its last earnings report, but here’s the hitch — the earnings were outstanding. Qualcomm also raised their full-year guidance, but investors were worried about their legal conflict with China. Unfortunately, there’s not much QCOM can do. I think they may wind up paying a hefty fine which may be the easiest route. Qualcomm remains a buy up to $79 per share.

Shares of Ross Stores (ROST) have not done well this year, but that’s mostly due to the lousy environment for retail, not with their performance. This week’s poor retail report also hurt the deep discounter. Ross is due to report fiscal Q2 earnings next Thursday, August 21. The company expects earnings between $1.05 and $1.09 per share. They also gave full-year guidance of $4.09 to $4.21 per share. If Ross can land in the upper end of that forecast, then the current share price is quite good. But I want to see next week’s results before I can say I’m more confident. Ross Stores is a buy up to $71 per share.

Stryker (SYK) is one of those steady stocks that rarely surprises us. However, they surprised last month when they lowered guidance. Stryker lowered the top end of their full-year forecast by 10 cents per share. The shares pulled back from $86 at the beginning of July to $81 recently. Nevertheless, this isn’t one I worry about. Stryker remains a good buy up to $87 per share.

Wells Fargo (WFC) is simply the best-run big bank in the country. Wells is having a good year for us (+11%). The bank isn’t quite the bargain it used to be, but I hope to see another dividend increase soon. For now, earnings growth has slowed down, but Wells is also a much safer stock than it used to be. Wells Fargo remains a buy up to $54 per share.

That’s all for now. Next week should be another slow week. There’s not a lot of economic news or earnings reports due, so traders may be especially sensitive to headline risk. On Tuesday, the Labor Department reports on consumer inflation. The recent up trend has been very modest, and it may have peaked. On Wednesday, the Fed releases the minutes from its most recent meeting. I think it’s clear what path they’re on. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Named by CNN/Money as the best buy-and-hold blogger, Eddy Elfenbein is the editor of Crossing Wall Street. His free Buy List has beaten the S&P 500 for the last seven years in a row. This email was sent by Eddy Elfenbein through Crossing Wall Street

Axel Merk and Peter Schiff Talk GDP and US Growth. The US and EU expanded sanctions against Russia to punish Moscow. For the West, the big question now is whether these latest sanctions will make President Putin more cooperative or just prompt him to dig his heels even harder.

Axel Merk and Peter Schiff Talk GDP and US Growth. The US and EU expanded sanctions against Russia to punish Moscow. For the West, the big question now is whether these latest sanctions will make President Putin more cooperative or just prompt him to dig his heels even harder.

Erin takes a look and talks to Axel Merk, president and CEO of Merk Funds, about second quarter GDP numbers, real interest rates, inflation, and wages. After the break, Erin shifts gears to speak with Peter Schiff, CEO of Euro Pacific Capital, to get his take on the GDP numbers and the US recovery…click here or the image to watch

Last week Market Psychology was driven by rapidly escalating Geopolitical Stress (Ukraine, Gaza, Syria/Iraq) with the major stock indices hitting 2 month lows Thursday night as Russian troops massed on the Ukraine border and the US began air strikes in Northern Iraq….BUT…the market reversed sharply higher Friday on reports that the Russians were “standing down.”

For the past couple of months we’ve been warning that bullish Market Psychology was getting way overdone and that investors should get defensive…we’ve been expecting a shift from “Risk-On” to “Risk-off.” When asked, “What is the biggest mistake investors are making at this time?” We answered, “Reaching for yield!”

We thought the shift in risk attitudes would be caused by:

1) A realization that the Fed would raise interest rates more and faster than expected and/or

2) Increasing Geopolitical Stress.

We thought the “turn” in Market Psychology would cause:

1) A rising US Dollar: it traded at 2 year lows in early May…it rallied to 11 month highs last week,

2) Widening credit spreads: they began to widen at the beginning of July…then widened sharply the second half of the month,

3) A fall in the stock market: the DJIA and the S+P traded to all-time highs by mid-July…then fell ~5% to Thursday’s over-night lows.

Last week we used the term “Risk happens fast” to describe the sharp sell-off in the stock market. Another example of “Risk happens fast” is the huge move in the Vix…the Fear Index. In early July option volatility across markets was near All Time Lows with the VIX at 10.25%…2 weeks later it was over 17%…a 70% jump. (To put this in perspective the market isn’t “really scared” until this index is at 30% or more….during the panic of late 2008 the VIX traded at life-time highs above 90%.

CAPITAL FLOWS:

Top quality long-dated bonds have been a magnet for capital in 2014 even with yields near historical lows…Smart Money has been getting defensive, returning “to the center”…reducing leverage and looking for safety.

While the leading US stock market indices fell ~5% the DAX (the principle German Index) fell ~10%.

The US Dollar continues to rally. Mario Draghi (ECB head) appears to want a weaker Euro…the currency wars continue…in a deflationary environment there is a strong temptation to “gain market share” with a cheaper currency! The Euro fell to a 9 month low last week…but bounced Friday as the “relief rally” rippled across all markets.

Investors are fleeing high yield junk bond funds.

TRADING:

Is this another “Buy the Dip” opportunity? We think not…BUT…we covered our short S+P position very early Friday. We entered the trade in late July on “gut feel” that the market was ready to break…we took profits on the trade because our “gut feel” told us that the market wanted to bounce.

The 5 year rally off the 2009 lows has created tremendous buying momentum…traders have time-and-again been rewarded…BIG TIME…for buying the dip…BUT…we think the very rare July Monthly Key Reversal Down in the DJIA signaled a KEY turn in Market Psychology (reinforced by the rising US Dollar and widening credit spreads)…BUT…we wouldn’t be surprised to see a bounce from Thursday’s lows. From our short term trading perspective we’d look for that bounce to fail to make new highs…and then we’d look to re-establish short positions.

We’d also not be surprised to see the Friday rally as a “one day wonder” and the market continue to sell off if/when Geo-Political Stress escalates.

We remain long the US Dollar in our short term trading accounts. We expect European currencies to weaken sharply into year-end.

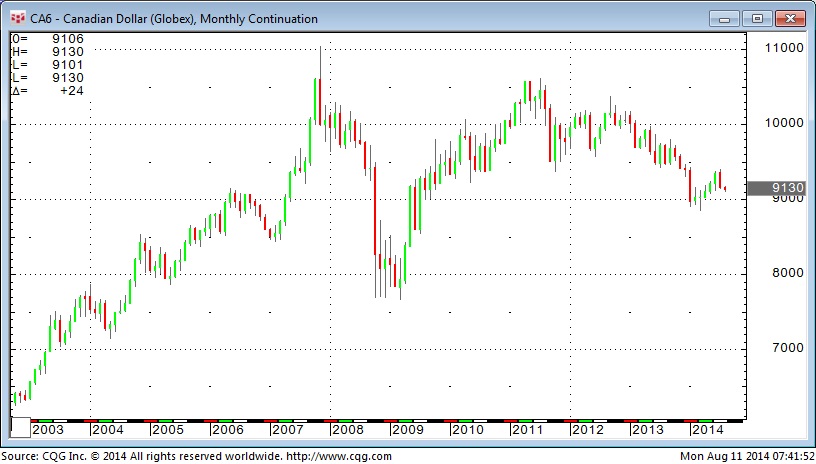

LONG TERM CURRENCY DIVERSIFICATION STRATEGY:

We continue to hold ~30% of our net worth in US Dollars as a long term currency diversification away from the Canadian Dollar. We were lucky to be “in the right place at the right time” when the Canadian Dollar rallied (actually when the US Dollar fell) from 2002 to 2008, and then again from 2009 to 2011. We decided to “take some money off the table” and converted ~30% of our net worth to US Dollars at an average of around par. We live and pay our bills in Canada so we have 70% of our net assets in CAD…BUT…we like the currency diversification idea.

What a mess the world is in. China, occupying the South China Sea, the Senkaku and Spratly Islands, hunting down oil and gas, ignoring territorial rights of others, ready to wage a war if need be.

Russia, arming itself to the teeth along Ukraine’s border, ready to invade. Scaring the dickens out of the people of Estonia, Latvia, Georgia, Poland – all of who think they are next on Putin’s list.

Trade wars (disguised as sanctions) erupting between Europe, the U.S. and Russia. Putin banning all food imports and more. Over $40 billion in U.S. company sales at risk for the likes of Boeing, PepsiCo, McDonald’s, Deere, Visa and MasterCard, DuPont.

Europe’s economy, already in a depression, to get worse, much worse.

Neo-Nazi groups rising in popularity throughout Europe. Eastern Europe worrying the Iron Curtain will rise again.

Argentina defaulting on its sovereign debt for the second time in 13 years.

Nigeria’s extremist Boko Haram still running amuck, raping, kidnapping and killing thousands.

The Islamic State of Syria and Iran (ISIS) killing scores more, running over sovereign states as if they were mere speed bumps along the road to creating an extremist Islamic caliphate based on terror and a twisted view of Islam.

Israel and Gaza at each other’s throats again, and despite the recent truce, my sources in Israel tell me there is no real end in sight and they expect the conflict to get worse, much worse in the weeks ahead.

Time to batten down the hatches, as I stated in my column on July 28?

You can bet your bottom dollar it is. And realize this:

First, the war cycles that I first warned you about two years ago are ramping up with an intensity that even I find surprising. So much so that I now believe that, yes, World War III may be right around the corner.

Second, international conflict is only one part of the war cycles. As I’ve also pointed out in the past, the domestic war cycles are also ramping up at the same time as the international war cycles are …

Second, international conflict is only one part of the war cycles. As I’ve also pointed out in the past, the domestic war cycles are also ramping up at the same time as the international war cycles are …

Meaning you can also expect rising civil unrest and rebellions. Their chief cause? When governments are bankrupt — like the U.S. and Europe are today — historically they turn first against their own citizens by raising taxes, by attacking the rich, by spying on them, by engaging in confiscatory measures, and more.

Hence the NSA spying, which continues unabated. The constitution-free zones of our nation’s borders, where 200 million Americans live, 60 percent of our country’s entire population …

And where the Fourth Amendment has been suspended, giving Washington extraordinary powers to stop, search and detain anyone without due process of law.

And more, much more draconian measures to come as Washington runs amuck, repeating the same old mistakes that have caused the decline of every major power throughout history.

So what is an investor to do?

Simple, realize this: With every crisis comes opportunity. So while it is time to batten down the hatches,it is NOT time to simply sit on the sidelines and stuff your money under a mattress.

Instead, it’s time to protect your wealth from the riskiest of investments, and look for opportunities in others!

That means …

First, steer clear of the riskiest investments. Those investments right now largely involve U.S. and European equity markets.

As I warned a couple of weeks ago, the U.S. broad equity markets are now in an interim bear market that could last anywhere from five to 10 months in duration, into December of this year, or worst case, May of next year.

I expect a 20 percent swoon in the Dow, and roughly the same in the S&P 500 and Nasdaq. Use any bounce of the recent lows to get out of all stocks except those recommended in my Real Wealth Report and those you may be trading on a short-term basis.

For longer-term holdings you cannot exit, for whatever reason, hedge via an inverse ETF such as the ProShares Short S&P 500 (SH).

And no matter what, steer clear of Europe’s equity markets as much as possible.

Second, also avoid U.S. and European sovereign bonds. Yes, bond prices are rallying of late, due to flight to safety capital. But the bond rally is not going to last. The downside to owning U.S. and European sovereign bonds is HUGE. Steer clear of them and keep your liquid safe-keeping money in shorter-term money markets.

Third, continue to accumulate precious metals. Gold is starting to finally lift its head, and as expected, is stronger than silver. But don’t rule out platinum and palladium, the next phases of their long-term bull markets are also shaping up nicely.

Fourth, steer clear of the euro currency! It’s a disaster in the making and has now confirmed on my models a major bear market that will see the euro lose as much as 28 percent of its value against the dollar over the next three years.

Not surprisingly, just as I’ve warned, the dollar is rallying (right along with gold). That’s because frightened capital pouring out of Europe and other parts of the world still see the dollar as the safest place to be during times of geo-political unrest.

This is precisely what happened in the 1930s, and it’s happening again.

Keep most of your funds in the U.S. dollar. Other currencies that should appreciate going forward include the Aussie and New Zealand dollars, and most Asian currencies.

Fifth, speaking of Asia — and to all those who say Asia’s stock markets cannot rally when Europe and the U.S. are falling — I say baloney.

According to all of my models, most Asian equity markets are now embarking upon new long-term bull markets, with China leading the way higher.

Bottom line: Consider putting some of your money to work in Asian equity markets via an ETF such as iShares Asia 50 (AIA).

Stay tuned, stay safe, and best wishes,

Larry