On the potential for another financial crisis in the US

On the potential for another financial crisis in the US

I’d bet that most International Man readers are familiar with Peter Schiff. He is a financial commentator and author, CEO of Euro Pacific Capital, and is known for accurately predicting the 2008 financial crisis.

He also has a very keen understanding of internationalization. Peter shares with me his strategies in this must-read discussion below that I am happy to bring exclusively toInternational Man readers. (If you are not already a member, you can join for free here.)

Nick Giambruno: Peter, do you see the potential for another financial crisis in the US playing out in the not-so-distant future?

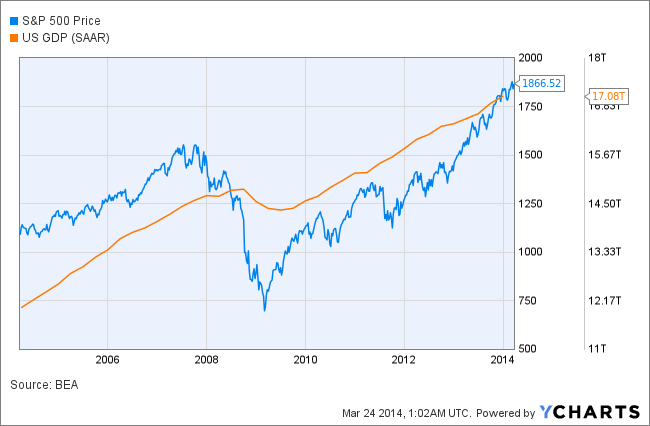

Peter Schiff: Unfortunately, yes. I mean, how soon is very difficult to tell. In fact, right now you’ve got a high level of complacency. The stock markets are rallying to new highs, nominal highs. People seem to be convinced that the worst is behind us, that the central banks of the world have solved their problems by papering them over. But, you know, I don’t think they’ve solved anything. I think they’ve compounded the underlying problems that caused the last crisis, and so now the next crisis will be that much worse because of what the central banks did, in particular the Federal Reserve.

The Fed is right now trying to prop the economy up, the housing market up with cheap money, and it is operating under the delusion that one day it can take that cheap money away and the economy and the housing market will just sustain on their own, but that’s not possible. The Fed is building an economy that is completely dependent on that cheap money. And so if you take it away, the economy implodes, but if you don’t take it away, then it’s worse.

Nick Giambruno: So what measures do you see coming into place—things such as capital controls?

Peter Schiff: Well, certainly as currencies depreciate, governments look to try to find ways to stop the bleeding. What’s really is going on with inflation is that you have a huge transfer of wealth from savers and lenders to debtors, and of course the US government is the world’s biggest debtor, but a lot of American voters are in debt too.

If you’re a saver and you don’t want to watch your assets confiscated through the printing press, then you’re going to try to protect yourself. You might do that by moving your dollars abroad, converting them to foreign currencies, trying to get out of harm’s way, and that’s when you have the government potentially coming in with capital controls.

Putting taxes on foreign currency transactions or maybe outright prohibiting them altogether, that will make it more difficult for you or more expensive to take protective measures. I think we’ve already got the beginnings of capital controls in the United States. The government is making it very difficult for Americans to do business abroad. Many foreign financial institutions, banks, and even bullion depositories are refusing to do business with American citizens for fear of retaliation by the IRS or other government agencies.

Nick Giambruno: So what can Americans and others living under a desperate government do to minimize this risk?

Peter Schiff: Well, the first thing that you could do is minimize your purchasing power risk. So you don’t have to get your money into a foreign bank or foreign brokerage account to get out of the dollar. I help Americans diversify globally within a US account, but their portfolio consists of foreign assets, whether it’s foreign bonds, government bonds, corporate bonds, foreign stocks, dividend-paying stocks, commodities, or precious metals. These are all things that will protect purchasing power in an inflationary time period, and things that the federal government—the Federal Reserve—can’t levy the inflation tax on.

If you’re more worried about political risk—about the US government seizing your assets—then you want to take the next step. This is not just getting out of the dollar, but getting your money out of the country. But again, the US government is making that more difficult right now.

I know personally. I set up a foreign brokerage firm as a subsidiary of my foreign bank, which I also set up, called Euro Pacific Bank. I did this predominantly for foreigners who were having trouble investing with my US brokerage firm. The securities rules and regulations are now so onerous that it almost caused me to view any foreigner as a terrorist. So if somebody in Australia wanted to open up an account with me, there was so much paperwork involved that oftentimes they would just give up halfway through the process. So what I did is I set up this foreign bank so that I wouldn’t have to operate under those confines, so I can be more competitive to a foreign investor, but I can’t offer these services to Americans.

My foreign bank is no different than many other foreign banks. In order to really protect the privacy of my foreign customers, I can’t accept American customers. And if I accepted American customers, my compliance cost would be so high that I would have to charge my foreign customers more for transactions to try to stay in business. So to mitigate all that regulation and the potential of having to share all the information on my foreign clients with the US government, I’m just not taking American customers with my foreign bank.

Nick Giambruno: So Euro Pacific Bank, where is it headquartered and why did you choose that jurisdiction?

Peter Schiff: It’s in St Vincent and the Grenadines (the Caribbean). I did it for a number of reasons: it’s close to me, but also because of the banking laws. You have secrecy, privacy, and you have no tax. They’re not going to impose any income tax on my company as an offshore bank, they’re also not going to impose any taxes, any withholding taxes on my bank’s customers’ interest income or their capital gains. And no one is going to pierce the wall of secrecy. You’re going to have to go in to a St. Vincent’s court and get a local court order to get any information from my bank.

The bank is regulated, but it’s not nearly as onerous as the type of regulations that I would face trying to do this business from the United States. In fact, some of the things we’re doing offshore might be completely impossible because they would no longer be economically viable if I tried to do them in America, but I can do them offshore because the government doesn’t impose these artificial barriers.

(Editor’s Note: You can find out more about Euro Pacific Bank here.)

Nick Giambruno: Generally speaking, which countries are you particularly bullish on?

Peter Schiff: It’s kind of like a monetary or economic triage; I’m always looking around the world to see which countries are in the least bad shape, which countries are the least reckless and the least irresponsible. You really can’t find any one country that’s doing it perfectly. You just have to find the ones that are making the fewest mistakes.

And I think high on that list are Singapore and Hong Kong. Those markets are relatively free of regulation, free of taxation. I mean, it’s not nonexistent, but on a relative basis you have a lot more freedom there, and so you have a lot more prosperity there. You have much better economic fundamentals. And not just in those two places, but in Southeast Asia in general, in a lot of the emerging economies, you’ll find a lot less government and a lot more freedom. People are working harder, they’re saving, they’re producing, and they’re exporting. You don’t have these trade deficits, budget deficits, and you don’t have armies of people looking to retire on government entitlements. In Europe, we still like Switzerland even though they are making mistakes tying their currency to the euro. I think eventually they will change that policy. Scandinavia, we have been investors in Norway, we’ve been investors in Sweden. Also Australia and New Zealand have been longtime favorites. We’ve been investing down there or even closer to home in Canada. We do have some investments in South America. We’re diversifying around the world trying to get into the right countries, the right currencies, the right asset classes.

Nick Giambruno: On a different note, we’ve seen the number of US citizens renouncing their citizenship sharply increase. We have also seen high-profile people like Tina Turner and Eduardo Saverin give up their US citizenship. Would Tina be eligible to use Euro Pacific Bank?

Peter Schiff: Yes, once you renounce your US citizenship. The only people who can’t bank with me are American citizens, or green card holders. So once you are no longer an American citizen, as long as you don’t reside in the United States, then you are welcome at the bank.

I think a lot of people are doing this obviously for tax reasons, although they can’t necessarily claim it’s for tax reasons. You have to fill out a form if you want to renounce your citizenship—which, by the way, you can only get from a foreign embassy or consulate. Those forms used to be free. Now they’re $500 apiece. So think about that. If they can charge you $500 for that form, they could charge $5,000, they could charge $5,000,000. They could basically make it impossible for you to leave. And they’re trying to make it more difficult ever since Eduardo Saverin from Facebook went to Singapore. Now the government is trying to come up with all sorts of ways to punish Americans who try to give up their citizenship, and this really is the sign of a nation in decay. Fifty years ago, nobody would want to give up American citizenship. They would cherish it. The fact that so many people are paying tremendous amounts of money to get this albatross off their neck shows you how much times have changed, that an American passport is not an asset to be cherished but a liability that people are willing to pay to get rid of.

Nick Giambruno: And what about yourself? Do you believe you are adequately diversified internationally?

Peter Schiff: I think my investments are; I own a lot of foreign stocks. I have a lot of precious metals, I have a lot of mining shares. But I still live in the United States, so I’m obviously still vulnerable here. My family is here, so I haven’t done anything about a physical exit strategy. Although I do think I have financial resources that would afford me the ability to relocate, but I haven’t actually taken any steps other than setting up a foreign business. I have the foreign bank in the Caribbean. I have a brokerage firm Euro Pacific Canada, and so I’ve got offices up there. I’m also thinking about opening up an office in Singapore and trying to move more of my business—particularly my asset management business—to move it from the US. Not only because of favorable tax treatment outside the US, but because of the regulatory environment. If you want to be globally competitive, you need to be in an area where you can minimize these costs because if I have those costs and my competitors don’t, then I am at a disadvantage. And also because I think that over time people are going to be more and more hesitant about sending their money to the United States. So if I’m going to manage money, I might have to manage it offshore, because I think people will be worried about sending it here. They might be worried that the US government might take it.

If it ever gets really, really bad that you feel that you have to leave, by then it might be illegal to take any gold or silver out of the country. Right now you can take more than $10,000 worth of cash or cash equivalents—which would include gold bullion—out of the country as long as you tell the government that you’re taking it. And if you don’t tell them and they catch you, there’s a big fine and jail penalty. But one day it might not be the case. It might be that you are prohibited from taking any significant amount of money out of the country, and who knows what the penalty might be if they catch you. But if it’s already out of the country, then you don’t have to worry, because you’re leaving with nothing and the money is on the other side of the border waiting for you.

Nick Giambruno: So the idea is to preempt capital controls?

Peter Schiff: Yeah, well, you get out the window before they slam it shut. That’s the whole idea, and right now those windows are shutting all around as more and more offshore institutions are saying “no thank you” to an American customer. But the other reason that you want to act sooner too is if they impose exchange controls or fees on purchasing precious metals. They don’t ban them, but they have a big tax on the transaction or a big tax on the foreign exchange. If you want to buy Swiss francs, they can have a transaction tax. You want to get your money out of the dollar before those taxes are imposed, because if you wait until they’re imposed, then you can’t get as much money out, because a lot of it is being lost to taxes. In getting out of the dollar, you’re trying to avoid the inflation tax, but they’re hitting you with some other kind of tax in the process because that’s really what they are trying to do. A lot of people are worrying about the income tax or the estate tax and they go through elaborate means to try to minimize those taxes, but then they leave themselves vulnerable to what might be the biggest tax of all: and that’s the inflation tax. So you have to act to protect yourself before so many people are trying to protect themselves that the government makes it almost impossible to do so.

Editor’s Note: Internationalization is your ultimate insurance policy. Whether it’s with a second passport, offshore physical gold storage, or other measures, it is critically important that you dilute the amount of control the bureaucrats in your home country wield over you by diversifying your political risk. You can find Casey Research’s A-Z guide on internationalization by clicking here.

….read all Bob’s take on the

….read all Bob’s take on the

“Connecting bright, ambitious young people with wealthy individuals who want to invest in their futures.”

“Connecting bright, ambitious young people with wealthy individuals who want to invest in their futures.”