Timing & trends

Here they are: the most important charts in the world.

We asked our favorite portfolio managers, strategists, analysts, and economists across the Street for the charts that they deem the most important right now, and this is what they sent us.

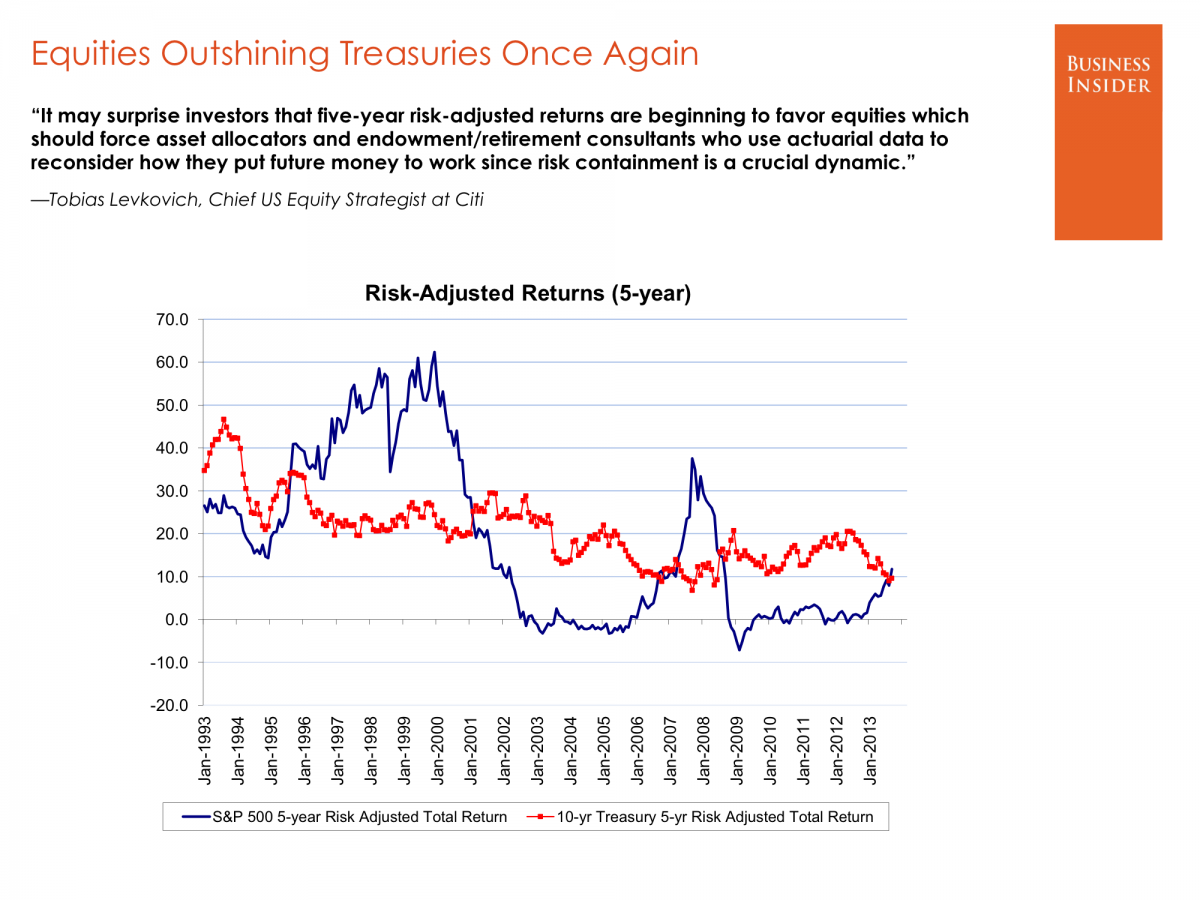

A lot of the focus is on the stock market, as many consider it to be at a critical juncture. The withdrawal of Federal Reserve stimulus and attendant normalization of interest rates is also a hot topic — as is the bloodbath in emerging markets — while many are coming around to the notion that the American economy just can’t grow like it used to anymore.

But there are a lot of other things going on as well.

Click Chart to see a larger view

Ed Note: This is #4 of 103 Great Charts and you can access the first one HERE

Ed Note: This above chart is #4 of 103 Great Charts and you can access the first one HERE

- I’ve been a long-time advocate on Gann Angles. This chart above and commentary expressed (click on this link) is where we stand on gold via Gann. “The Most Important Chart for Gold”

- But thank God there’s no rigging in gold and silver (even those apparently everything else there is).

- Sundown in America

- Text messaging liability – Now a two-way street

I know many readers continue to ask me about two Grandich clients (and personally my two largest holdings) Geologix Explorations and Sunridge Gold. Several have noted how little or no comment has come from someone “paid’ to open his mouth. Hopefully in the not-too-distant future, I will be able to do so.

Our Quick Pivot of August 22nd noted that the surge in Precious Metals had become speculative. The RSI on the silver/gold ratio had reached 79 when anything above 78 indicated “dangerous conditions”.

Our Quick Pivot of August 22nd noted that the surge in Precious Metals had become speculative. The RSI on the silver/gold ratio had reached 79 when anything above 78 indicated “dangerous conditions”.

The high for the RSI was 80 and the HUI set its high at 283 on August 27 and SSRI reached 10 on the same day. The advice was to take some money off the table and that nimble traders could play the short side of the silver market. Today’s low for the HUI has been 223 and for Silver Standard it’s been 5.95. While the move could generate lower momentum readings, nimble traders could cover shorts.

I love gold. I love its history. I love the role it’s had in many monetary systems. I love the beauty of gold. I love the versatile uses of gold.

I love gold coins. I love objects made of gold. I love gold’s role in new technologies.

But gold is not the end-all, be-all of the investment world. Nor is it the world’s savior. It is not even a very good hedge against inflation.

The hate mail will pour in again. I’m sure of it. But I have my reasons for giving you the truth, and nothing but the truth, about gold. As despised as I’ll be for the facts I give you today, you need to know the truth.

There are all too many myths and propaganda out there about gold, and if you get caught up in them, you most assuredly will lose the shirt off your back investing in gold.

The fact of the matter is that the chief reason promoted to invest in gold — inflation — is dead wrong.

The fact of the matter is that the chief reason promoted to invest in gold — inflation — is dead wrong.

Consider the following:

At the depths of the depression in 1929, an ounce of gold sold for $20. The Dow Industrials was at 40.

At the depths of the depression in 1929, an ounce of gold sold for $20. The Dow Industrials was at 40.

An ounce of gold today is roughly $1,300. It has increased 65 times over.

But the Dow Industrials stands at about 15,000. That’s 375 times more than it was in 1929.

And that means since 1930, the Dow has outperformed gold 5.8 times over.

In 1980, gold sold for $850 an ounce. The Dow Industrials was at 824.6. Since then, gold has increased 1.5 times over, and the Dow 18 times.

In 1980, gold sold for $850 an ounce. The Dow Industrials was at 824.6. Since then, gold has increased 1.5 times over, and the Dow 18 times.

In 1980, the average price of a single-family home in the U.S. was $68,700.

In 1980, the average price of a single-family home in the U.S. was $68,700.

Today it’s $223,222. It’s increased 3.3 times over (despite the real estate crash five years ago).

Gold’s up just over 50 percent since then.

Now, on the flip side of the coin, since the year 2000, gold’s gained more than 400 percent.

But the Dow Industrials are up a meager 29 percent.

So you see, overall, gold is not as great an inflation hedge as most would like to believe. Certainly not the gold promoters, who want you to buy gold at every twist and turn in the market, forever telling you that it’s the world’s best inflation hedge, when in reality, it is not.

The fact of the matter is this:

First, there are times when gold is a great inflation hedge, and there are times when it is not.

Second, there are times when gold goes up, and there are times when gold goes down, just like any other market or asset class.

Therefore, to maximize your profits in gold, you need to know when to be aggressively in gold, and when not to.

As a corollary, to also maximize your profits, you need to ignore the white noise about gold.

Gold is one of the most emotional markets on the planet, one of the world’s most recognized investments, all over the world.

Yet, it is also the market where the biggest lies are told, the biggest myths are perpetuated, and where the largest amount of misinformation is spread.

I tell you this only because it’s my job to help you protect your wealth. I have no vested interest in doing anything but that.

So bring on the gold investors — and especially the gold dealers and promoters — who will want my scalp for writing this column today. I don’t really give a hoot. All I care about is spreading the historical truth, not BS, propaganda or market myths.

That said, there will soon come a time when it is prudent to load up on gold, but we’re not there yet.

The simple reason is gold’s interim bear market is not yet over.

As you know from my previous columns, I expected a cycle low to form by Oct. 3. We got that low, right on cue at $1,276.90, one day early, on Oct. 2.

But that low did not break the prior low at $1,178. That means the interim bear market is not over yet, and that gold will likely bounce around in a tight trading range for the next few months, then do a swan dive heading into January of next year, where I expect gold will move below $1,178 — and likely bottom around the $1,035 level, or just slightly lower, under $1,000.

And then I will tell you to “back up the truck” on gold. For, you see, during gold’s ensuing new bull market leg higher — it will finally play catch-up with inflation, it will also rise as European and U.S. governments fall from their perches into a heap of rubble — and gold will begin an ascent that will take it to well over $5,000 an ounce.

Timing, in life and in the markets, is everything. Gold is not immune to that law. And it’s just not time for gold to shine again.

If you own gold from much lower levels, as I do and my subscribers do as well, then hold that gold. It’s great insurance. But don’t back up the truck on new purchases yet. Wait until I tell you to do so.

Best wishes, and stay tuned …

Larry

About Larry Edelson

With over three decades of experience in precious metals and natural resource markets, Larry Edelson has played a pivotal role in training Weiss Research staff and in guiding Weiss Research’s customers to prudent investments in these sectors.

His Power Portfolio and Real Wealth Report provide a continuing education on natural resource investments, with recommendations aiming for both profit and risk management. His team of technical analysts helps enhance the timing of investment recommendations with the aim of continually improving performance results for investors.

Mr. Edelson is also an accomplished analyst and writer, making substantial contributions to Weiss Research’s Safe Money Report andUncommon Wisdom.

He holds a B.A. degree from Columbia University. Mr. Edelson got his start on Wall Street in 1978. By 1980, he had his own firm active in international brokerage, financial analysis and money management.

In the mid-1980s, Mr. Edelson was one of the largest gold traders in the world, responsible for as much as $1.4 billion in daily gold trading volume on the Comex in New York, in today’s dollars. Mr. Edelson also managed several multi-million-dollar natural resource and commodity-based private investment funds.

Widely respected throughout the financial industry for his forecasts, Mr. Edelson has successfully called nearly all the major turning points in the world’s macro-economic trends, including …

-

The Stock Market Crash of 1987 and its subsequent rally to new highs by 1990.

-

The 21-year bear market in precious metals.

-

Major turning points in the currency markets, including the now multi-year-long decline in the dollar.

-

The peak of the stock market bubble in 2000.

-

The new bull market in natural resources that began in 2001.

-

One of the only analysts in the world to correctly identify in 2004 the start of the major bull markets in Asian economies and stocks.

Frequently quoted in international press, including Forbes, Bloomberg, CBS MarketWatch and more, Mr. Edelson travels extensively through Asia each year, bringing his followers first-hand analysis and accounts of the vibrant emerging economies.

I have been warning that there has been a “Club” that has been targeting market after market to make a quick buck. The LIBOR Scandal has caused the tide to turn as well as having to bail out the banks in 2008 that has fundamentally altered the course of everything. Now the Swiss regulators said they are investigating several Swiss financial institutions for possible manipulation of foreign-exchange markets, which is a dramatic expansion of the latest probe into potential rigging of widely used market benchmarks. The Swiss have come out and stated the they are now cooperating with authorities in other countries very closely. They have also stated publicly that “multiple banks around the world are potentially implicated.” The UNTOUCHABLES have started to lose their standing because they constantly blow themselves up and turn to government to save them whenever they lose money.

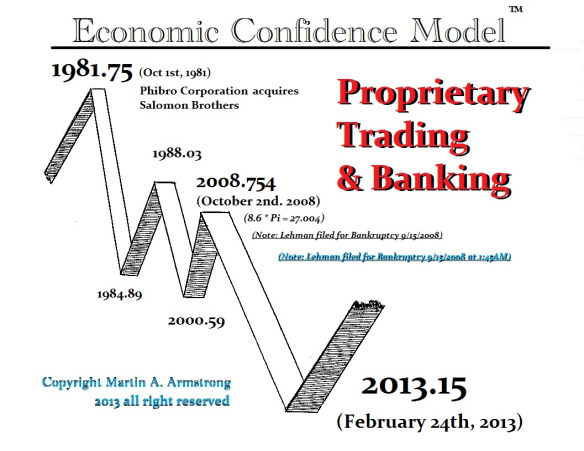

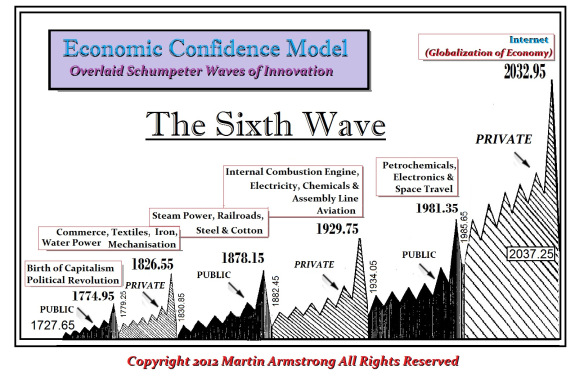

Our models on this issue of “The Club” have been spot on. The crisis came in 2008, which was 8.6 x Pi or 27.004 years from the date that Phibro took-over Salomon Brothers. That is the start date when the aggressive commodity trading culture infiltrated Wall Street. The full cycle for how long that would last should have been 31.4 years and that is when this trend came to an end idealized on February 24th, 2013. From here on out, the banks have pushed the envelope too far. We are starting to see J.P. Morgan charged criminally. When this ECM turns down again after 2015.75, the bankers will find that they are the escape-goats for politicians and will most likely be imprisoned.

The Year 1981 was truly monumental. It was the major peak on the 1981.35 Public Wave of the Economic Confidence Model. On January 20th, 1981, Ronald Reagan was sworn in as the 40th President. Iran freed the 52 hostages taken in 1979 on January 25th. By March 30th, 1981, Reagan was shot by a gunman in an attempted assassination along with his press secretary. On May 14th, 1981 Pope John Paul II was shot in an attempted assassination. On October 6th, 1981, Anwar el-Sadat was assassinated by Islamic extremists during a military parade in Cairo. Then, on December 14th, 1981, Israel annexed the disputed Golan Heights.

In 1981, seeking a larger and more permanent source of capital, Salomon Brothers agreed to its sale to Phibro for $554 million. Phibro was then one of the world’s largest commodities traders. John H. Gutfreund of Salomon Brothers became its chairman of the Salomon Brothers subsidiary and co-chief executive (along with the Philipp Brothers chairman, David Tendler) forming a new holding company, Phibro-Salomon Inc.

On September 28th, 1987, Warren E. Buffett, agreed to pay $700 million for a 12 percent stake in Salomon Inc., the parent company of Salomon Brothers Inc., Wall Street’s largest investment banking-house. That is how Buffett got into trading commodities instigated by Phibro.

This aggressive trading culture has led the world into all sorts of trading scandals and manipulations with numerous fine only prosecutions of the major players. This time, however, the LIBOR Scandal took place in London and the bankers do not control the Europeans as they do the Americans. This aggressive manipulating culture has now run its course and the cycle has changed direction.

….more from Martin Armstrong:

Manipulations & Exceptions – One-Dimensional Thinking

Death of the Euro?

France Makes it Illegal to Close Your Company